Securing your family’s financial future is paramount, and life insurance plays a crucial role in this planning. While traditional term life insurance offers affordable coverage for a specified period, a newer option, Return of Premium (ROP) term life insurance, adds an intriguing twist. This innovative policy not only provides the death benefit protection you need but also promises a unique return on your investment, refunding your premiums under specific conditions. This guide delves into the intricacies of ROP term life insurance, exploring its advantages, disadvantages, and suitability for various individuals.

We’ll unpack the mechanics of how premiums are returned, compare it to traditional term life insurance and other life insurance types, and help you determine if ROP is the right choice for your circumstances. Through clear explanations and illustrative examples, we aim to equip you with the knowledge necessary to make informed decisions about your life insurance needs.

Definition of Return of Premium Term Life Insurance

Return of Premium (ROP) term life insurance is a type of life insurance policy that offers a unique benefit: the return of your premiums at the end of the policy term, provided you haven’t made a death benefit claim. It combines the affordability and straightforward nature of traditional term life insurance with the added security of getting your money back. This makes it an attractive option for those seeking life insurance coverage but also wanting a potential financial return on their investment.

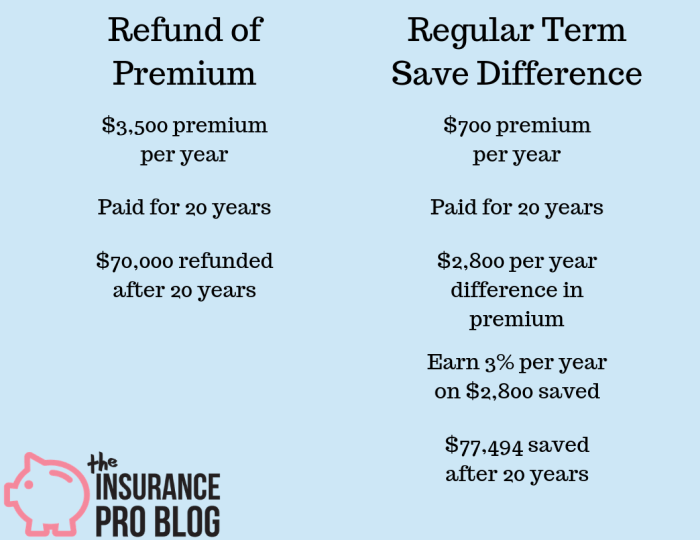

Return of Premium term life insurance differs from standard term life insurance primarily in its premium structure and payout. While traditional term life insurance only pays out a death benefit if the insured dies within the policy term, ROP policies guarantee the return of all premiums paid, assuming the insured survives the term. This means that while premiums for ROP policies are typically higher than those for comparable traditional term life insurance policies, the policyholder receives a significant financial return if they outlive the policy. Essentially, you’re paying a higher premium for the added security of premium repayment.

Key Features Differentiating Return of Premium Term Life Insurance from Traditional Term Life Insurance

The core difference lies in the premium structure and the ultimate payout. Traditional term life insurance offers a lower premium but only pays out a death benefit. Conversely, ROP term life insurance has a higher premium but guarantees the return of all premiums paid at the end of the term, if the insured is still alive. This additional benefit of premium return is the defining characteristic. Another key difference might be the length of the term; ROP policies may not be available for all term lengths offered by traditional policies. The availability and pricing of these policies vary among insurance providers.

Concise Definition for a Lay Audience

Return of Premium term life insurance is like a regular term life insurance policy, but with a twist: if you outlive the policy, you get all your premiums back. It costs more upfront, but you’re essentially betting on your longevity.

How Return of Premium Works

Return of Premium (ROP) term life insurance operates on a straightforward principle: you pay premiums, and if you outlive the policy term, you receive a refund of all your premiums paid, minus any applicable fees or deductions. This differs significantly from traditional term life insurance, where premiums are paid, and no monetary return is provided if the insured survives the policy term. The mechanism for this refund is built into the policy’s structure from the outset.

The mechanism through which premiums are returned involves the insurance company setting aside a portion of the premiums paid to build a cash value account for the policyholder. This account grows over the policy term, and upon successful completion of the term without a claim, the accumulated premiums (less any applicable charges) are returned to the insured. This is not an investment product in the traditional sense, as the returns are not tied to market performance; rather, the return is a contractual obligation stipulated within the policy.

Premium Refund Conditions

Receiving the premium refund is contingent upon fulfilling specific conditions Artikeld in the policy. These typically include maintaining the policy in good standing throughout the entire term, meaning all premiums must be paid on time. Any lapse in payments could jeopardize the return of premiums. Furthermore, the policyholder must survive the policy term; a death claim during the policy’s duration would negate the return of premiums, as the death benefit would be paid to the beneficiaries instead. Some policies may also include conditions related to specific policy riders or endorsements, which should be carefully reviewed before purchasing.

Return Scenarios

Let’s illustrate with a few examples. Imagine two individuals, both purchasing a 20-year ROP term life insurance policy with an annual premium of $1,000.

Scenario 1: John successfully completes the 20-year term without filing a claim. He receives a refund of $20,000 (20 years x $1,000), less any applicable fees. This could be a significant sum, offering a financial safety net after the policy term ends.

Scenario 2: Jane passes away during the 10th year of her policy. Her beneficiaries receive the death benefit as stipulated in the policy, but no premium refund is issued. The accumulated premiums earmarked for the refund are not returned in this case.

Scenario 3: Michael misses several premium payments during the policy term. This lapse could result in the policy being terminated, and he would forfeit the right to receive a premium refund.

ROP vs. Traditional Term Life Insurance

| Feature | Return of Premium (ROP) | Traditional Term Life Insurance |

|---|---|---|

| Premium Return | Full premium refund (less fees) if the insured survives the term. | No premium refund if the insured survives the term. |

| Cost | Generally higher premiums than traditional term life insurance. | Lower premiums than ROP policies. |

| Death Benefit | Pays a death benefit if the insured dies during the policy term. | Pays a death benefit if the insured dies during the policy term. |

| Overall Value | Offers a combination of life insurance coverage and a potential premium refund. | Provides life insurance coverage only. |

Who Should Consider Return of Premium Term Life Insurance?

Return of Premium (ROP) term life insurance isn’t the right fit for everyone. Its appeal lies in the guaranteed return of premiums, but this feature comes at a higher cost than standard term life insurance. Understanding your individual circumstances is key to determining if ROP is a worthwhile investment.

The ideal candidate for ROP term life insurance possesses a specific combination of financial security, risk aversion, and a need for life insurance coverage. Their age, financial situation, and risk tolerance all play significant roles in assessing suitability. Those with a strong financial foundation and a preference for guaranteed returns might find ROP particularly attractive.

Ideal Policyholder Profile

ROP term life insurance is most beneficial for individuals who value certainty and are comfortable paying a higher premium for the guarantee of receiving their premiums back at the end of the policy term. This approach prioritizes capital preservation and minimizing financial risk, rather than solely focusing on the lowest possible premium. It’s not a strategy for those prioritizing the most affordable coverage. Consideration should be given to other financial instruments and investment strategies that may offer similar risk mitigation.

Age and Financial Situation

Younger individuals with a longer time horizon and a higher earning potential may find ROP more appealing. They can afford the higher premiums and benefit from the potential return of premiums later in life. However, older individuals with limited time remaining until retirement might find the higher premiums less justifiable, as the return on investment might not outweigh the total cost of the policy. A stable financial situation is also crucial. Consistent income and sufficient savings are necessary to comfortably manage the higher premiums associated with ROP policies.

Risk Tolerance and Investment Strategies

Individuals with a low risk tolerance often find ROP attractive. The guaranteed return of premiums eliminates the uncertainty associated with other investment vehicles. However, it’s important to consider alternative investment strategies that may offer potentially higher returns but also carry greater risk. A comprehensive financial plan should account for all assets and liabilities, including the cost of the ROP policy and its potential return. For example, a high-net-worth individual with a diversified investment portfolio might find ROP a suitable addition for a portion of their life insurance needs, providing a guaranteed return alongside other higher-risk, higher-reward investments. Conversely, someone with limited savings and a need for affordable life insurance may find a standard term life insurance policy more appropriate.

Examples of Suitable Individuals and Families

A young professional with a stable income and a growing family might find ROP beneficial, offering peace of mind knowing that the premiums will be returned if they outlive the policy term. Similarly, a family with significant debt or substantial assets to protect might consider ROP as a way to ensure financial security for their loved ones while also securing a return of their investment. A self-employed individual with fluctuating income might prefer the certainty of ROP over the potential volatility of other investment options.

Comparison with Other Life Insurance Types

Return of Premium (ROP) term life insurance offers a unique blend of affordability and a guaranteed return of premiums, but it’s crucial to understand how it stacks up against other popular life insurance options like whole life and universal life insurance. Choosing the right policy depends heavily on individual financial goals and risk tolerance.

Return of Premium Term Life Insurance versus Whole Life Insurance

ROP term life insurance and whole life insurance represent distinct approaches to life insurance. ROP term life provides coverage for a specific period (the term), offering a death benefit if the insured passes away during that term. Crucially, it returns all premiums paid if the insured survives the term. Whole life insurance, conversely, offers lifelong coverage with a guaranteed death benefit, but premiums are typically higher and the policy also builds cash value over time. The cash value component can be borrowed against or withdrawn, providing a financial safety net. While whole life provides lifelong coverage, the higher premiums may not be suitable for everyone, particularly those prioritizing affordability during a specific life stage. ROP term life, while limited to a specific term, offers a compelling alternative for those seeking a balance between coverage and premium return.

Return of Premium Term Life Insurance versus Universal Life Insurance

Universal life insurance also provides lifelong coverage, but unlike whole life, it offers more flexibility in premium payments and death benefit adjustments. Premiums can fluctuate based on market performance and the policy’s cash value component grows based on the investment performance of the underlying accounts. ROP term life, on the other hand, has fixed premiums and a fixed term. The death benefit is also fixed. The key differentiator remains the return of premiums feature; universal life doesn’t typically offer this. While universal life provides flexibility and potential for cash value growth, it involves higher risk due to market fluctuations and may not guarantee a return of premiums. ROP term life, with its predictable premiums and guaranteed return, provides a more conservative approach for those seeking a defined period of coverage and a guaranteed return of their investment.

Key Differences Between Life Insurance Types

| Feature | Return of Premium Term Life | Whole Life Insurance | Universal Life Insurance |

|---|---|---|---|

| Coverage Period | Specific term (e.g., 10, 20, 30 years) | Lifelong | Lifelong |

| Premiums | Fixed, generally higher than term life without ROP | Fixed, generally higher than term life | Flexible, can fluctuate |

| Death Benefit | Fixed | Fixed | Adjustable, can increase or decrease |

| Cash Value | None | Builds over time | Builds over time, subject to market fluctuations |

| Premium Return | Guaranteed return of premiums if insured survives the term | No | No |

Illustrative Example

Let’s consider a hypothetical return of premium term life insurance policy to illustrate how it works. This example will showcase the premium payments, death benefit, and the eventual return of premiums under different policy durations. We will assume a healthy 35-year-old male applying for coverage.

This example uses simplified calculations for illustrative purposes; actual policies have more complex calculations and may include additional fees.

Policy Details and Premium Return Calculation

Imagine a 20-year term life insurance policy with a $500,000 death benefit. The annual premium is $1,000. This means the total premium paid over 20 years would be $20,000 ($1,000/year * 20 years). With a return of premium feature, the insurance company would return the full $20,000 to the policyholder if they survive the 20-year term.

Let’s explore what happens if the policyholder chooses a shorter term: If the policyholder opts for a 10-year term with the same death benefit and the annual premium remains the same, the total premium paid would be $10,000. If the policyholder survives the 10-year term, they would receive a $10,000 return of premium.

Visual Representation of Premium Payments and Return

Imagine a bar graph. The horizontal axis represents the years of the policy (0-20 for the 20-year policy, 0-10 for the 10-year policy). The vertical axis represents the monetary value in dollars. For the 20-year policy, you would see a series of 20 equally spaced bars, each representing an annual premium payment of $1,000. At the end of the 20th year, a significantly larger bar would represent the $20,000 return of premium. The total height of the bars for the premiums would be equal to the height of the final return of premium bar. For the 10-year policy, a similar graph would be shown but with only 10 premium bars and a final return of premium bar representing $10,000. The total height of the premium bars would again equal the height of the return of premium bar. This visually demonstrates the principle of the return of premium feature: all premiums paid are returned if the insured survives the policy term.

Conclusion

Return of Premium term life insurance presents a compelling alternative to traditional term life insurance, offering a potential return of premiums paid alongside the traditional death benefit. While the higher premiums are a key consideration, the financial security coupled with the possibility of a full premium refund makes it an attractive option for those who prioritize both protection and a potential financial return. By carefully weighing the benefits and drawbacks and considering your individual financial circumstances and risk tolerance, you can determine whether ROP term life insurance aligns with your long-term financial goals.

General Inquiries

What happens if I cancel my ROP policy early?

The terms for early cancellation vary by policy. Generally, you won’t receive the full premium refund, and the amount returned may be significantly less than what you’ve paid.

Is ROP insurance right for everyone?

No. ROP insurance is generally more expensive than traditional term life insurance. It’s most suitable for those who can afford the higher premiums and prioritize the potential for a premium refund.

Are there any tax implications with ROP insurance?

The tax implications of ROP insurance can be complex and depend on your specific circumstances. Consult a tax advisor for personalized advice.

How is the return of premium calculated?

The calculation method varies by insurer and policy. It typically involves a formula based on the premiums paid and the policy’s duration. The policy documents will clearly Artikel the calculation.