Navigating the complexities of health insurance and tax deductions can feel like deciphering a secret code. Understanding whether your health insurance premiums are tax-deductible significantly impacts your overall tax liability. This guide unravels the intricacies of this often-confusing topic, exploring the various scenarios where deductions may apply, and highlighting situations where they may not. We’ll examine the impact of self-employment, employer-sponsored plans, the Affordable Care Act (ACA), and more, providing clear explanations and practical examples to help you better understand your tax obligations.

From the self-employed individual carefully reviewing their expenses to the employee enrolled in an employer-sponsored plan, the question of tax deductibility is crucial. This guide aims to clarify the rules and regulations surrounding this complex issue, offering a comprehensive overview that considers different employment statuses, healthcare plans, and filing statuses. We’ll explore both the federal and state-level implications, providing you with the knowledge you need to confidently manage your tax responsibilities related to health insurance.

Employer-Sponsored Plans and Deductibility

Employer-sponsored health insurance plans represent a significant portion of health coverage in the United States. Understanding the tax implications of these plans is crucial for both employees and employers. Generally, premiums paid by employers are not considered taxable income to the employee. However, the tax treatment of these plans and any associated contributions to health savings accounts (HSAs) can be nuanced and depend on various factors.

The tax advantages of employer-sponsored health insurance stem from the fact that the premiums paid by the employer are considered a non-taxable benefit. This means the employee avoids paying income tax on the value of the employer’s contribution. This significantly reduces the employee’s overall tax burden. However, this benefit is contingent upon the plan’s structure and the employee’s participation in any related accounts like HSAs.

Premiums Paid by Employers: Tax Implications

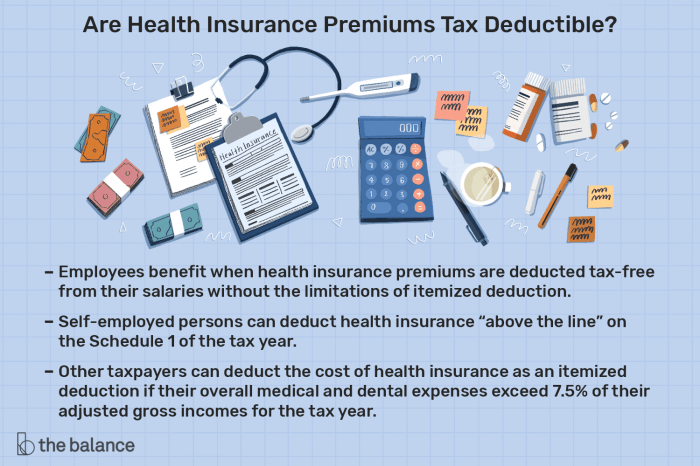

Premiums paid by an employer are generally excluded from an employee’s gross income and are therefore not subject to federal income tax, Social Security tax, or Medicare tax. This is a significant tax advantage for employees, as it effectively increases their disposable income. For example, if an employer pays $10,000 annually in health insurance premiums, the employee avoids paying taxes on that $10,000. The precise tax savings would vary based on the employee’s individual tax bracket. This exclusion applies even if the employee contributes a portion of the premium themselves.

Partial or Full Deductibility of Employee Contributions

While employer-paid premiums are generally tax-free, the situation changes when an employee makes additional contributions to their health insurance plan beyond the employer’s contribution. In some cases, these employee contributions might be deductible as a medical expense on their federal income tax return, but only to the extent that total medical expenses exceed 7.5% of their adjusted gross income (AGI). This threshold can make the deduction less beneficial for many taxpayers. For example, an individual with a high AGI might find that their employee health insurance contributions don’t exceed the 7.5% threshold, rendering them non-deductible.

After-Tax Contributions to Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) are tax-advantaged accounts available to individuals enrolled in high-deductible health plans (HDHPs). Contributions made to an HSA are made with after-tax dollars; however, these contributions are tax-deductible, and withdrawals for qualified medical expenses are tax-free. This provides a significant long-term savings and tax advantage for individuals who qualify. For example, if an individual contributes $3,850 to their HSA (the maximum contribution for 2023 for individuals under 55), they can deduct this amount from their taxable income, reducing their tax liability. Distributions for qualified medical expenses are then tax-free, providing a double tax benefit.

Scenarios Where Premiums Are Not Tax-Deductible

Even with employer-sponsored plans, there are instances where premiums aren’t tax-deductible. One key scenario is when the employer’s contribution is considered part of the employee’s compensation. While rare, this can occur if the plan is structured in a way that benefits the employer more than the employee. Additionally, premiums for plans that don’t meet the requirements of a qualified health plan under the Affordable Care Act (ACA) may not offer the same tax advantages. This is often the case with plans offered outside of a formal employer-sponsored program.

The Affordable Care Act (ACA) and Deductibility

The Affordable Care Act (ACA) significantly altered the landscape of health insurance in the United States, impacting not only access to coverage but also the tax deductibility of premiums. Prior to the ACA, deductibility largely depended on employer-sponsored plans and self-employment status. The ACA introduced new avenues for tax relief, primarily through tax credits and subsidies, making health insurance more affordable for many individuals and families.

The ACA’s impact on the deductibility of health insurance premiums is primarily indirect. While the ACA itself doesn’t directly create a new tax deduction for health insurance premiums, it fundamentally changed who can afford insurance and, consequently, who might itemize deductions related to medical expenses. Before the ACA, many individuals could not afford health insurance, thus limiting their ability to even consider medical expense deductions. The ACA expanded coverage, allowing more people to obtain insurance and potentially itemize medical expenses, including premiums, if they exceed a certain percentage of their adjusted gross income (AGI).

ACA Tax Credits and Subsidies

The ACA offers tax credits and subsidies to help individuals and families purchase health insurance through the Health Insurance Marketplaces (exchanges). These credits reduce the monthly cost of premiums, making coverage more accessible. Importantly, these credits are *not* themselves tax deductible. However, the reduced premium cost resulting from the credit can indirectly influence whether someone can afford to itemize medical expenses, potentially including premiums, if those expenses surpass the AGI threshold. For example, a family receiving a significant tax credit might find that their out-of-pocket medical expenses, including their (reduced) premiums, now exceed the 7.5% AGI threshold for itemized medical deductions.

Income Limitations and Eligibility Requirements for ACA Tax Credits

Eligibility for ACA tax credits is based on household income, as measured by modified adjusted gross income (MAGI). Income must fall within a specified range, generally between 100% and 400% of the federal poverty level (FPL). The amount of the credit is inversely proportional to income; those with lower incomes receive larger credits. Additional eligibility requirements include U.S. citizenship or legal residency, not being eligible for Medicare or Medicaid, and not being claimed as a dependent on someone else’s tax return. The specific income thresholds and eligibility criteria are updated annually.

Comparison of Tax Deductions: Pre- and Post-ACA

The following table compares the tax deduction landscape for health insurance premiums before and after the ACA’s implementation. Note that the primary difference lies not in direct deductibility of premiums but in the expanded access to affordable insurance facilitated by the ACA. The ability to itemize medical expenses, potentially including premiums, remains dependent on exceeding the AGI threshold.

| Feature | Pre-ACA | Post-ACA |

|---|---|---|

| Premium Deductibility | Generally only for self-employed individuals or through itemized deductions (if medical expenses exceeded 7.5% of AGI). | No direct change in deductibility; indirect impact through increased affordability via tax credits. |

| Tax Credits/Subsidies | None for health insurance purchases. | Available through Health Insurance Marketplaces based on income. |

| Access to Affordable Insurance | Limited for many individuals and families. | Significantly expanded through the Marketplaces and tax credits. |

| Itemized Medical Deductions | Subject to 7.5% AGI threshold. | Subject to 7.5% AGI threshold; increased likelihood of exceeding threshold due to increased access to insurance. |

Specific Deductible Expenses

Understanding which health-related expenses are deductible can significantly reduce your tax burden. It’s crucial to differentiate between paying for health insurance premiums and directly paying for medical care. While both relate to your health, they have distinct implications for tax deductions.

Many people confuse medical expenses with health insurance premiums. Medical expenses are the costs incurred for medical services like doctor visits, hospital stays, prescription drugs, and other healthcare treatments. Health insurance premiums, on the other hand, are the payments you make to maintain your health insurance coverage. While both can be relevant to tax deductions, they follow different rules and have different implications.

Deductible Health Insurance Premiums

Self-employed individuals and those not covered by employer-sponsored plans can often deduct the amount they paid in health insurance premiums. This deduction is taken on Schedule C (Profit or Loss from Business) or Schedule F (Profit or Loss from Farming), depending on your profession. However, eligibility requirements and limitations apply, often based on adjusted gross income (AGI).

Medical Expenses vs. Health Insurance Premiums

Medical expenses are out-of-pocket costs for healthcare services. These can include doctor visits, hospital bills, prescription medications, dental care, and vision care. Health insurance premiums, conversely, are the regular payments made to maintain health insurance coverage. The key difference is that medical expenses are direct costs of healthcare services, while premiums are payments for the *insurance* that covers those services. Only some medical expenses, exceeding a certain percentage of your AGI, are deductible. However, health insurance premiums may be deductible under specific circumstances, as mentioned above.

Documentation for Deductible Expenses

Maintaining meticulous records is vital for claiming deductions. For health insurance premium deductions, you’ll need Form 1095-B (or equivalent documentation) from your insurance provider, showing the premiums paid during the tax year. This form details the coverage dates and the total premiums paid. For medical expense deductions, detailed receipts or explanations of benefits (EOBs) from healthcare providers are required. These documents should clearly indicate the date of service, the provider’s name and address, and the amount paid for each service. If you paid for medical expenses through a health savings account (HSA), you will need documentation to support those transactions as well.

Calculating Deductible Amounts

Calculating the deductible amount depends on the type of expense. For health insurance premiums, the deductible amount is the total premiums paid during the tax year, subject to any applicable AGI limitations. For medical expenses, only expenses exceeding 7.5% of your adjusted gross income (AGI) are deductible.

Example: If your AGI is $60,000, then 7.5% of your AGI is $4,500 ($60,000 x 0.075 = $4,500). Only medical expenses exceeding $4,500 would be deductible. If your total medical expenses were $6,000, you could deduct $1,500 ($6,000 – $4,500 = $1,500).

This calculation applies to medical expenses only; the deduction for health insurance premiums is handled differently, as described previously. Consult a tax professional for personalized guidance based on your specific circumstances.

Tax Implications for Different Filing Statuses

Understanding your tax filing status is crucial when determining the deductibility of your health insurance premiums. The Internal Revenue Service (IRS) recognizes several filing statuses, each with its own set of rules and potential tax benefits. This section will explore how single, married filing jointly, and head of household statuses impact the deductibility of health insurance premiums.

The deductibility of health insurance premiums is primarily determined by whether the premiums are paid for self-employed individuals or through an employer-sponsored plan. For self-employed individuals, the deduction is typically taken as an above-the-line deduction, meaning it reduces your adjusted gross income (AGI) before calculating your taxable income. For those with employer-sponsored plans, the situation is more complex, often involving considerations of whether the plan is offered through a Flexible Spending Account (FSA) or Health Savings Account (HSA). The impact of filing status primarily affects the overall tax liability, influencing how much benefit you receive from any deduction.

Deductibility Based on Filing Status

The amount you can deduct for health insurance premiums doesn’t directly change based on your filing status. However, your overall tax liability does. A single filer with a lower income might see a larger percentage reduction in their tax burden from a premium deduction compared to a married couple filing jointly with a higher income. This is because tax brackets are progressive, meaning higher income earners pay a higher tax rate. Therefore, while the deduction amount remains the same, its *impact* on your final tax bill differs. For example, a single filer in a lower tax bracket might save $100 on their taxes from a $500 deduction, while a married couple in a higher tax bracket might only save $75.

Potential Tax Advantages and Disadvantages

Filing jointly generally offers the lowest tax rate compared to single or head of household statuses, for similar income levels. This means that a couple filing jointly could potentially realize a larger tax savings from the deduction than two individuals filing separately. However, head of household status provides a more favorable tax rate than single status for those who qualify (unmarried and paying more than half the cost of keeping up a home for a qualifying person). This can lead to slightly higher tax savings than a single filer with the same income and deductions. Conversely, filing as single might result in a smaller tax savings from the premium deduction compared to other filing statuses, but this is only relevant in a comparative context.

Maximum Deductible Amounts by Filing Status

The maximum deductible amount for health insurance premiums isn’t directly tied to your filing status. The limit is determined by other factors such as whether you are self-employed and the amount of your AGI. The following table illustrates this. Note that these are illustrative examples and may not reflect current IRS guidelines. Always consult the most up-to-date IRS publications for precise information.

| Filing Status | AGI Limit (Example) | Maximum Deductible Amount (Example) | Notes |

|---|---|---|---|

| Single | $75,000 | $5,000 | This is an example and is subject to change. |

| Married Filing Jointly | $150,000 | $10,000 | This is an example and is subject to change. |

| Head of Household | $112,500 | $7,500 | This is an example and is subject to change. |

Closing Summary

Determining the deductibility of your health insurance premiums requires a careful consideration of your individual circumstances. While the rules can seem intricate, understanding the key factors—employment status, type of health plan, and filing status—is crucial. This guide has provided a framework for navigating this complex landscape, equipping you with the knowledge to accurately assess your situation and potentially reduce your tax burden. Remember to consult with a qualified tax professional for personalized advice tailored to your specific circumstances and to ensure compliance with all applicable regulations.

FAQ Explained

Can I deduct health insurance premiums if I’m a freelancer and use a 1099 form?

Yes, self-employed individuals can generally deduct health insurance premiums. You’ll report these deductions on Schedule C (Profit or Loss from Business) or Schedule F (Profit or Loss from Farming).

What if my employer provides health insurance, but I also contribute?

Premiums paid by your employer are generally not taxable to you. However, if you make after-tax contributions to a health savings account (HSA), those contributions may be tax-deductible, depending on your eligibility.

Are there any penalties for claiming a deduction I’m not entitled to?

Yes, claiming incorrect deductions can result in penalties and interest charges from the IRS. It’s crucial to ensure you accurately report your deductions based on your specific circumstances and the applicable tax laws.

Where can I find more information about state-specific regulations?

Your state’s department of revenue or tax agency website is the best resource for state-specific rules regarding health insurance premium deductibility. You can usually find this information through a web search using “[Your State] health insurance tax deduction.”