Understanding your W-2 form can be crucial for managing your finances, especially when it comes to employer-sponsored health insurance. While your W-2 doesn’t directly list your health insurance premiums in a single, easily identifiable spot, it provides key information that, when combined with other employer-provided documentation, allows you to understand your overall health insurance costs and tax implications. This guide will help you navigate the intricacies of locating and interpreting this information.

We’ll explore the relevant sections of your W-2, discuss where additional information might be found, and clarify how employer contributions and employee contributions are reflected. Furthermore, we’ll address the tax implications of employer-sponsored health insurance and offer practical examples to illuminate the process. By the end, you’ll possess a clearer understanding of how your health insurance premiums relate to your W-2 and overall financial picture.

Understanding W-2 Forms and Health Insurance Information

The W-2 form, officially titled “Wage and Tax Statement,” is a crucial document received by employees annually from their employers. While primarily focused on tax information, it can also provide insights into the employee’s employer-sponsored health insurance coverage. Understanding the relevant sections of the W-2 can help clarify the employee’s contribution to their health insurance premiums.

The W-2 form contains various boxes detailing different aspects of an employee’s compensation and withholdings. While it doesn’t directly list the premium amount for each month, specific boxes indicate the total amount contributed by both the employee and the employer towards health insurance premiums throughout the year. This information is crucial for tax purposes and also helps employees track their healthcare costs.

Employer-Sponsored Health Insurance Information on a W-2

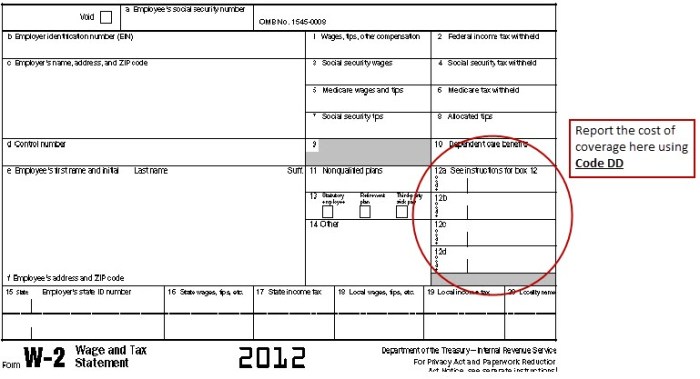

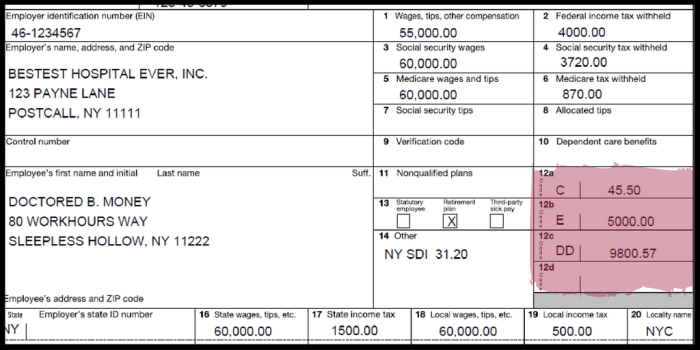

The most relevant section on a W-2 concerning health insurance is Box 12. This box displays various codes indicating different types of payments made to the employee. Code DD represents the amount of employer-sponsored health insurance premiums paid by the employee, and code W represents the amount paid by the employer. These codes provide a summary of the employee’s contribution to their health plan for the entire tax year. It’s important to note that the exact amount reflected will vary depending on the employee’s plan and contributions throughout the year. The W-2 does not show a breakdown of monthly premiums.

Reflecting Different Health Insurance Plans on a W-2

The type of health insurance plan (HMO, PPO, etc.) does not directly appear on the W-2 form. The W-2 only reflects the *total amount* contributed by the employee (Box 12, code DD) and the employer (Box 12, code W) toward the premiums. Whether the plan is an HMO, PPO, or another type is irrelevant to the information displayed on the W-2; that information would be found in separate plan documents provided by the insurance company or employer. The W-2 simply shows the financial contributions related to the plan, not the plan details themselves. For example, an employee with a high-deductible PPO might have a lower Box 12, code DD amount than an employee with a lower-deductible HMO, reflecting their different premium contributions.

W-2 Information and Health Insurance Premiums

The following table summarizes the relevant sections of a W-2 and their connection to health insurance premiums:

| W-2 Section | Description | Example Data | Relevance to Health Insurance Premiums |

|---|---|---|---|

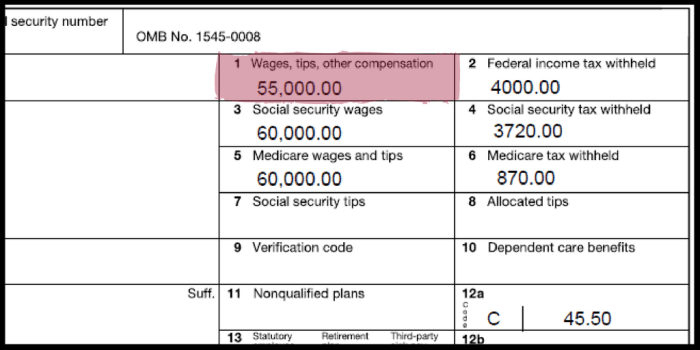

| Box 1 (Wages, tips, other compensation) | Total compensation received by the employee. | $60,000 | Indirectly relevant; helps determine the employee’s overall income, which might influence the employer’s contribution towards health insurance. |

| Box 12 (Various payments) | Includes codes representing different types of payments, including health insurance premiums. Code DD shows employee contributions, and Code W shows employer contributions. | Code DD: $2,400; Code W: $7,200 | Directly relevant; shows the total employee and employer contributions to health insurance premiums for the year. |

| Box 14 (Other | May contain additional information relevant to the employee’s compensation. | May include additional information related to health insurance, but not always. | Potentially relevant, depending on the information included. |

Locating Premium Information on the W-2 (If Applicable)

Your W-2 form primarily reports wages and taxes withheld from your paycheck. While it doesn’t directly detail your health insurance premiums in a dedicated line item like your gross pay, it might indirectly reflect your contributions or your employer’s. Understanding how this information might appear is crucial for accurate tax reporting and financial planning.

Information regarding health insurance premiums is often not explicitly found on the W-2 itself. The W-2 focuses on taxable wages and tax withholdings. However, the form *may* indirectly reflect the impact of your health insurance premiums. This depends on whether your employer pays any portion of your premiums, and how that contribution is handled. The absence of explicit premium information on the W-2 doesn’t necessarily mean your employer didn’t contribute.

Employer Contributions to Health Insurance

Employer contributions towards your health insurance premiums are generally not reported on your W-2. This is because these contributions are considered a non-taxable benefit provided by the employer. The amount of your employer’s contribution, therefore, does not affect your taxable income. However, if your employer contributes towards a health savings account (HSA), this contribution might be reflected on your W-2, usually in Box 12 with code W. This would represent your employer’s contribution to your HSA, not your premiums directly.

Employee Premium Contributions

Employee contributions to health insurance premiums are typically deducted pre-tax from your paycheck. These deductions reduce your gross income, which subsequently reduces the amount of taxes withheld from your paycheck. Consequently, you’ll see a lower amount of taxable wages (Box 1) on your W-2, reflecting the pre-tax deductions for your health insurance premiums. The W-2 itself doesn’t specify the exact amount contributed towards health insurance premiums; instead, it reflects the reduced taxable income resulting from these deductions.

Premium Information on Separate Documents

Your employer may provide a separate statement detailing your health insurance premiums paid throughout the year, both your contributions and those of your employer. This statement can be crucial for tax purposes and personal record-keeping. It will offer a clear breakdown of the costs, including the employee and employer shares. This separate document serves as a supplemental record to your W-2, providing a more complete picture of your health insurance costs and contributions.

Self-Employed Individuals

Self-employed individuals handle health insurance differently. They are responsible for the full cost of their health insurance premiums. These premiums are not deducted pre-tax from a paycheck, as in the case of employees. Instead, self-employed individuals can deduct their health insurance premiums from their business income when filing their taxes, using Schedule C (Profit or Loss from Business). This reduces their taxable income and, consequently, their tax liability. There is no reflection of these premiums on a W-2, as self-employed individuals do not receive a W-2.

Tax Implications of Health Insurance Premiums

Understanding the tax implications of health insurance premiums is crucial for both employers and employees. The tax treatment differs significantly depending on whether the premiums are paid by the employer, the employee, or a combination of both. This section will clarify these differences and illustrate how these premiums affect taxable income.

Employer-Paid Health Insurance Premiums are Tax-Advantaged

Employer-paid health insurance premiums are generally considered a non-taxable benefit for employees. This means the value of the employer’s contribution isn’t included in the employee’s gross income, thus reducing their taxable income. This is a significant tax advantage, as it effectively lowers the employee’s overall tax burden. The employer, however, can deduct the cost of the premiums as a business expense. This mutually beneficial arrangement incentivizes employers to offer health insurance benefits and reduces the overall cost of healthcare for employees.

Tax Implications for Employee Contributions

When employees contribute towards their health insurance premiums, the situation changes. Employee contributions are deducted pre-tax from their paychecks. This means the money used for premiums is not subject to income tax, Social Security tax, or Medicare tax. However, these contributions are not considered a tax deduction in the same way that employer contributions are for the employer. The employee receives a tax benefit through reduced payroll taxes, but not a direct reduction in taxable income like the employer’s contribution.

Comparison of Employer-Sponsored and Individual Health Insurance

Employer-sponsored health insurance offers substantial tax advantages compared to individual health insurance. With employer-sponsored plans, a portion (or sometimes all) of the premiums are paid by the employer, tax-free for the employee. Individual health insurance premiums, on the other hand, are typically paid entirely out-of-pocket by the individual, with no tax benefits beyond the potential tax deductions for medical expenses exceeding a certain percentage of adjusted gross income (AGI). The tax deduction for medical expenses is often not as significant as the tax savings from employer-sponsored plans.

Calculating Taxable Income with Employer Contributions

To calculate taxable income considering employer contributions to health insurance premiums, simply subtract the value of the employer’s contribution from the employee’s gross income before calculating taxes. For example, if an employee’s gross income is $60,000 and their employer contributes $5,000 towards their health insurance premiums, the employee’s taxable income is $55,000 ($60,000 – $5,000). This reduced taxable income directly translates to lower tax liability. It’s important to note that this calculation is simplified and doesn’t account for other deductions or credits that may apply. Consult a tax professional for a comprehensive calculation.

Final Summary

Successfully navigating the complexities of understanding health insurance premiums as they relate to your W-2 requires a multi-faceted approach. While the W-2 itself might not explicitly detail your premium costs, it provides essential data points that, when combined with supplementary information from your employer, paint a complete picture. By carefully reviewing your W-2, your benefits summary, and any related communications, you can gain a clear understanding of your health insurance costs and their tax implications. Remember to consult with a tax professional or your employer’s HR department if you require further assistance.

Essential FAQs

Q: My W-2 shows my employer contributed to my health insurance, but I don’t see a separate line for my contributions. Where are they?

A: Your employee contributions might be included in your total compensation, not as a separate line item. Check your employer’s benefits summary or pay stubs for a detailed breakdown of your premiums.

Q: I’m self-employed; where do I find information about my health insurance premiums for tax purposes?

A: Self-employed individuals typically deduct health insurance premiums on their tax returns using Schedule C or Schedule SE, depending on their business structure. Keep detailed records of your premium payments.

Q: What if my employer doesn’t provide a benefits summary?

A: Contact your employer’s HR department to request a detailed explanation of your health insurance plan and your contribution amounts. They are obligated to provide this information.

Q: Does the amount my employer contributes to my health insurance affect my taxable income?

A: Yes, employer contributions to your health insurance are generally considered non-taxable income for you, reducing your overall taxable income.