Navigating the complexities of health insurance and taxes can feel like deciphering a foreign language. The question of whether your health insurance premiums are tax deductible is a common one, impacting your financial well-being significantly. This guide unravels the intricacies of premium deductibility, offering clarity for both the self-employed and employees, regardless of their insurance plan type. We’ll explore the nuances of deductions, comparing itemized deductions against the standard deduction, and examining the role of Health Savings Accounts (HSAs) in optimizing your tax strategy. Prepare to gain a comprehensive understanding of this often-misunderstood aspect of personal finance.

Understanding the tax implications of your health insurance is crucial for maximizing your financial resources. Whether you’re self-employed, employed by a company, or exploring options like HSAs, the rules surrounding deductible premiums vary. This guide provides a detailed examination of these differences, offering practical examples and step-by-step instructions to help you confidently navigate the tax landscape and ensure you’re claiming all eligible deductions.

Tax Deductibility Basics

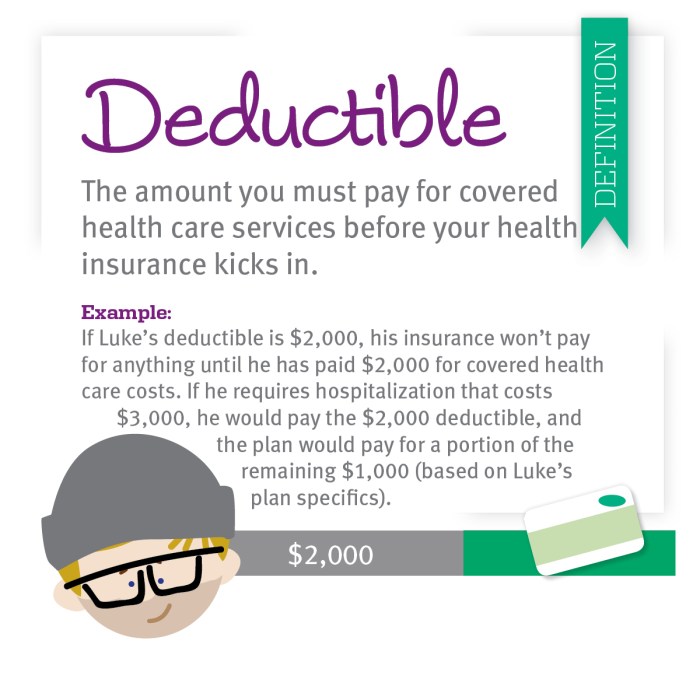

Understanding the tax deductibility of health insurance premiums hinges on your employment status and the type of plan you have. The rules can be complex, but this overview will clarify the key aspects. Generally, you can deduct premiums if you’re self-employed or if you’re paying for a plan that isn’t provided through your employer.

Types of Health Insurance Premiums

Health insurance premiums fall into several categories, each with different implications for tax deductibility. These include premiums for individual plans purchased on the marketplace, family plans, plans obtained through a spouse’s employer (sometimes), and premiums for plans covering self-employed individuals or their families. The specific type of premium significantly impacts whether it’s deductible.

Requirements for Deducting Health Insurance Premiums

To deduct health insurance premiums, you must meet certain criteria. Crucially, the premiums must be for medical insurance coverage. This means that the coverage must meet the minimum value requirements set by the Affordable Care Act (ACA). Further, you must itemize your deductions on your tax return, rather than using the standard deduction. For self-employed individuals, the premiums are deductible as an above-the-line deduction, meaning they reduce your adjusted gross income (AGI) before other deductions are considered. For those with employer-sponsored plans, the situation is different, as described below.

Examples of Deductible and Non-Deductible Premiums

Several scenarios illustrate when premiums are deductible and when they aren’t. For instance, a self-employed freelancer paying for their own health insurance can deduct the premiums. Similarly, a spouse who pays for a health insurance plan for themselves and their spouse, who is not employed and thus lacks access to employer-sponsored health insurance, may be able to deduct the premiums. Conversely, premiums paid for an employer-sponsored health insurance plan are typically not deductible by the employee, as the employer usually pays a portion, and the cost is factored into the employee’s overall compensation package. Premiums paid for long-term care insurance or other non-medical insurance are also generally not deductible.

Self-Employed vs. Employee Premium Deductibility

The deductibility of health insurance premiums varies significantly based on employment status.

| Feature | Self-Employed | Employee (with employer-sponsored plan) | Employee (without employer-sponsored plan) |

|---|---|---|---|

| Deductibility | Generally deductible as an above-the-line deduction. | Generally not deductible. | Potentially deductible if meeting specific criteria (similar to self-employed). |

| Tax Form | Schedule C (Profit or Loss from Business) or Schedule F (Profit or Loss from Farming) | W-2 (Wage and Tax Statement) – Premiums typically factored into compensation | 1040 (U.S. Individual Income Tax Return) – Itemized deductions required |

| AGI Impact | Reduces AGI before other deductions. | No direct impact on AGI. | Reduces AGI if itemized deductions exceed the standard deduction. |

| Additional Requirements | Must be self-employed and meet minimum value requirements of ACA. | N/A | Must meet minimum value requirements of ACA and itemize deductions. |

Self-Employed Individuals

Self-employed individuals, unlike those with traditional W-2 employment, have the responsibility of covering their own health insurance premiums. Fortunately, the IRS allows for a deduction to offset this cost, providing some tax relief for this significant business expense. This deduction can significantly reduce your tax liability, making it crucial to understand the process and requirements.

The self-employment tax deduction for health insurance premiums allows self-employed individuals to deduct the amount they paid for health insurance premiums for themselves, their spouse, and their dependents. This deduction is taken above the line, meaning it reduces your adjusted gross income (AGI) before other deductions are applied, resulting in a greater tax benefit. It’s important to note that the deduction is only available for health insurance premiums paid during the tax year, and specific requirements must be met.

IRS Form 1040, Schedule C

The primary IRS form used to claim the deduction for health insurance premiums paid by self-employed individuals is Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). This schedule is part of your overall Form 1040 tax return. You’ll report your business income and expenses, including your health insurance premiums, on this form. The health insurance premiums are reported as a business expense, reducing your net profit and consequently your self-employment tax liability. Remember to keep accurate records of all your premium payments throughout the year.

Claiming the Deduction: A Step-by-Step Guide

To successfully claim the deduction, follow these steps:

- Gather your documentation: Collect all your health insurance premium payment receipts or statements from the tax year. This documentation is essential for substantiating your deduction.

- Determine your eligible expenses: Ensure you only include premiums paid for yourself, your spouse, and your dependents. Premiums paid for ineligible individuals cannot be deducted.

- Complete Schedule C (Form 1040): Enter the total amount of health insurance premiums paid during the tax year in the appropriate section of Schedule C, typically under “Other Expenses.” Be sure to itemize these expenses clearly and accurately.

- File your Form 1040: Attach Schedule C to your Form 1040 and file your tax return by the applicable deadline. Submitting accurate and complete documentation is critical for a successful claim.

Common Mistakes to Avoid

Careful attention to detail is crucial when claiming this deduction. Here’s a list of common mistakes to avoid:

- Failing to keep accurate records: Maintain detailed records of all premium payments, including dates, amounts, and who the payment was for. Poor record-keeping can lead to delays or rejection of your claim.

- Including ineligible expenses: Only premiums for health insurance policies covering yourself, your spouse, and your dependents are deductible. Other types of insurance, like life insurance, are not eligible.

- Incorrectly reporting the deduction: Ensure you enter the amount correctly on Schedule C and attach all necessary supporting documentation. Errors in reporting can result in delays or penalties.

- Missing the filing deadline: File your tax return by the designated deadline to avoid penalties. Late filing can lead to additional tax liabilities.

Itemized Deductions vs. Standard Deduction

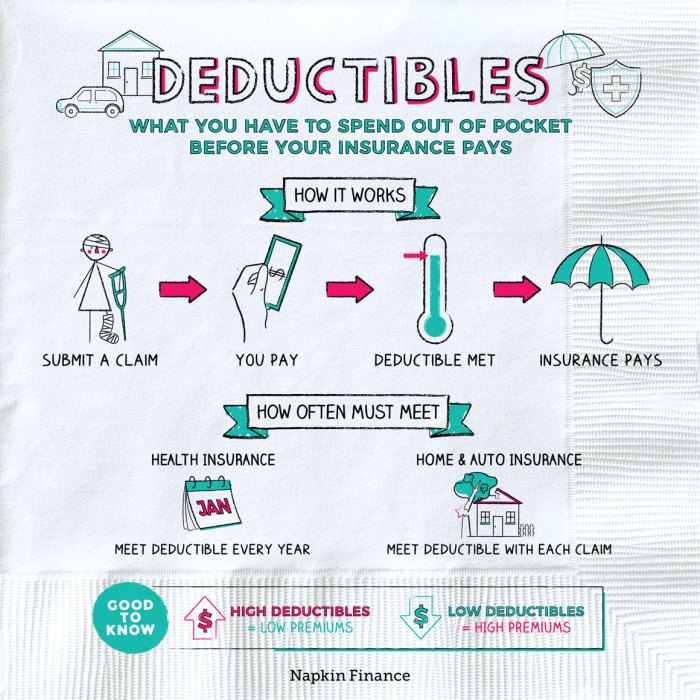

Choosing between itemizing deductions and taking the standard deduction is a crucial decision for taxpayers, significantly impacting their overall tax liability. The best choice depends on the individual’s specific financial circumstances, particularly the amount of deductible expenses they have incurred throughout the year. Understanding the differences between these two approaches is essential for optimizing your tax return.

The standard deduction is a fixed amount set by the IRS each year, varying based on filing status (single, married filing jointly, etc.). It provides a baseline deduction for all taxpayers, simplifying the tax preparation process. Itemized deductions, on the other hand, allow taxpayers to deduct specific expenses, such as medical expenses, charitable contributions, state and local taxes, and mortgage interest. The total amount of itemized deductions must exceed the standard deduction for itemizing to be beneficial.

Itemized Deductions and Health Insurance Premiums

For self-employed individuals, a significant itemized deduction can stem from health insurance premiums paid. These premiums are deductible as an above-the-line deduction, meaning they reduce your adjusted gross income (AGI) before calculating your taxable income. This deduction can be substantial, potentially making itemizing advantageous even if other itemized deductions are relatively low.

Examples Illustrating When Itemizing is Advantageous

Let’s consider two scenarios. In the first, Sarah, a self-employed consultant, paid $12,000 in health insurance premiums. Her standard deduction is $13,850. In this case, itemizing wouldn’t be beneficial because her health insurance premium deduction is less than her standard deduction. However, in the second scenario, John, a self-employed freelancer, paid $15,000 in health insurance premiums, along with $5,000 in unreimbursed medical expenses exceeding 7.5% of his AGI. His standard deduction is $13,850. The sum of his health insurance premium deduction and medical expense deduction exceeds his standard deduction, making itemizing the more advantageous strategy. This results in a lower taxable income and, consequently, lower tax liability.

Decision-Making Flowchart

A flowchart illustrating the decision-making process:

[Imagine a flowchart here. The flowchart would start with a box: “Calculate your standard deduction.” An arrow would lead to a decision box: “Total Itemized Deductions (including health insurance premiums) > Standard Deduction?”. If yes, an arrow leads to a box: “Itemize deductions.” If no, an arrow leads to a box: “Take the standard deduction.”]

The flowchart visually represents the core decision: if the sum of your itemized deductions surpasses your standard deduction, itemizing is beneficial; otherwise, taking the standard deduction is more advantageous. Remember to accurately calculate all itemized deductions to make an informed decision.

End of Discussion

Successfully navigating the world of health insurance premium tax deductibility requires a clear understanding of your individual circumstances and the applicable regulations. This guide has provided a comprehensive overview of the key considerations, from the differences between self-employment and employer-sponsored plans to the strategic use of itemized deductions and HSAs. Remember to consult with a tax professional for personalized advice tailored to your specific situation, ensuring you optimize your tax strategy and maximize your potential deductions. By carefully considering the information presented here, you can confidently approach tax season with a greater understanding of your rights and responsibilities.

Questions and Answers

Can I deduct health insurance premiums if I’m covered under my spouse’s plan?

Generally, no. Deductions typically apply to premiums you pay yourself, not those paid by your spouse or another family member.

What if I have both employer-sponsored insurance and a supplemental individual plan?

You may be able to deduct medical expenses exceeding a certain threshold, even with employer-sponsored coverage, but the deductibility of the individual plan premiums themselves is usually limited.

Are there penalties for claiming incorrect deductions?

Yes, inaccurately claiming deductions can result in penalties and interest from the IRS. Accurate record-keeping is essential.

Where can I find the specific forms needed to claim these deductions?

The IRS website (irs.gov) provides access to all necessary forms and publications. Form 1040, Schedule A, and Form 8889 are often relevant.