Securing a mortgage is a significant financial undertaking, and understanding all associated costs is crucial. One often overlooked, yet potentially substantial, expense is mortgage insurance premium (MIP). This guide delves into the intricacies of estimating MIP, providing you with the knowledge to navigate this important aspect of homeownership confidently.

From the various types of MIP programs available to the key factors influencing their calculation, we’ll explore how down payments, credit scores, and loan-to-value ratios all impact the final premium. We’ll also examine different calculation methods, both manual and through readily available online tools, equipping you with the resources to accurately estimate your MIP costs.

Understanding Mortgage Insurance Premiums (MIP)

Mortgage insurance protects lenders against losses if a borrower defaults on their loan. It’s a crucial component of the mortgage process, particularly for borrowers with lower down payments. Understanding how MIP is calculated and the various programs available is essential for making informed financial decisions.

The Purpose of Mortgage Insurance

Mortgage insurance safeguards lenders by mitigating the risk associated with borrowers failing to repay their loans. If a borrower defaults, the insurance company compensates the lender for the outstanding loan balance, minimizing the lender’s financial losses. This protection allows lenders to offer mortgages to a broader range of borrowers, including those with smaller down payments or less-than-perfect credit scores. The presence of mortgage insurance, therefore, helps to stabilize the mortgage market and increase access to homeownership.

Factors Influencing MIP Calculation

Several key factors influence the calculation of mortgage insurance premiums. These include the loan-to-value ratio (LTV), the type of mortgage insurance program (e.g., FHA, PMI), the borrower’s credit score, the interest rate on the loan, and the loan term. A higher LTV generally results in a higher MIP, as it indicates a greater risk for the lender. Similarly, a lower credit score can also lead to a higher premium, reflecting a higher perceived risk of default. The specific formula used for MIP calculation varies depending on the insurance program. For example, FHA MIP is calculated based on a combination of the LTV and the loan amount, while PMI calculations are often more complex and vary among private insurers.

Types of MIP Programs

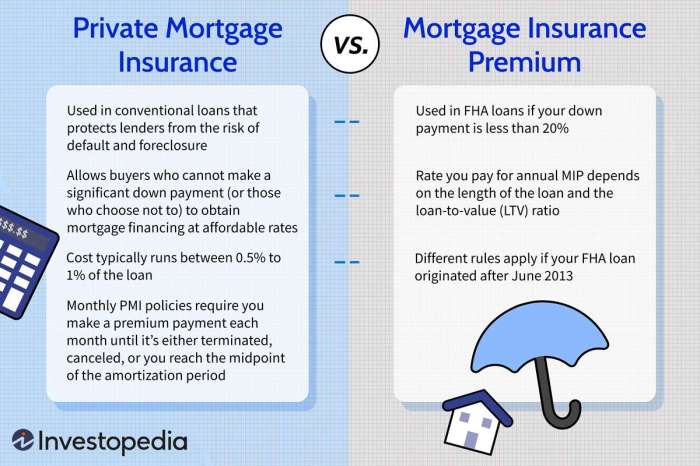

Various mortgage insurance programs exist, each with its own set of requirements and premium structures. Two prominent categories are government-backed insurance and private mortgage insurance.

Government-backed programs include the Federal Housing Administration (FHA) insurance, which insures loans made by FHA-approved lenders, and the Department of Veterans Affairs (VA) loan guarantee, which protects lenders against losses on loans to eligible veterans and service members. These programs often have lower upfront costs compared to private mortgage insurance but may involve ongoing premiums.

Private Mortgage Insurance (PMI) is offered by private companies and is typically required when a borrower makes a down payment of less than 20% of the home’s purchase price. PMI premiums are paid monthly and can be canceled once the borrower’s equity reaches 20% of the home’s value. Different private insurers may offer varying premium rates based on their risk assessment of the borrower and the loan.

Comparison of PMI and Government-Backed Mortgage Insurance

| Feature | Private Mortgage Insurance (PMI) | Government-Backed Mortgage Insurance (e.g., FHA) | VA Loan Guarantee |

|---|---|---|---|

| Insurer | Private Company | Government Agency (e.g., FHA) | Government Agency (VA) |

| Eligibility | Generally requires less than 20% down payment | Specific eligibility criteria; lower credit scores often acceptable | Eligibility restricted to veterans, service members, and eligible surviving spouses |

| Premium Payment | Usually monthly; can be canceled once 20% equity is reached | Usually upfront and monthly premiums | Funding fee at closing; no monthly premiums |

| Cost | Varies depending on risk assessment | Generally lower than PMI | Lower than PMI, but funding fee is a significant upfront cost |

Estimating MIP for Different Loan Types

Mortgage insurance premiums (MIP) vary significantly depending on several factors, most notably the type of loan and the size of the down payment. Understanding these variations is crucial for accurately budgeting for homeownership costs. This section will delve into the specifics of MIP calculations for different loan types and down payment scenarios.

Down Payment Amount and MIP

The down payment amount is inversely proportional to the MIP. A larger down payment generally results in a lower MIP, or even eliminates the requirement entirely. For example, conventional loans often require MIP only if the down payment is less than 20%. FHA loans, while designed for lower down payments, still have MIP requirements that are dependent on the loan-to-value ratio (LTV), which is calculated by subtracting the down payment from the loan amount and dividing the result by the loan amount. A higher LTV indicates a smaller down payment and thus a higher MIP. VA loans, while often requiring no down payment, may still involve a funding fee, which serves a similar purpose to MIP.

MIP Calculations for FHA, VA, and Conventional Loans

Each loan type employs a distinct MIP calculation method. Conventional loans typically have an upfront MIP paid at closing and an annual MIP paid throughout the loan term if the down payment is less than 20%. The upfront MIP is a percentage of the loan amount, while the annual MIP is calculated as a percentage of the outstanding loan balance. FHA loans usually have an upfront MIP and an annual MIP, both calculated as percentages of the loan amount, with the annual MIP potentially lasting the life of the loan depending on the loan terms. VA loans, instead of MIP, have funding fees that vary based on the veteran’s status and the down payment amount (or lack thereof). These funding fees can be paid upfront or financed into the loan.

MIP Calculation Methods for Fixed-Rate and Adjustable-Rate Mortgages

The calculation method for MIP remains largely consistent regardless of whether the mortgage is fixed-rate or adjustable-rate. The primary difference lies in the loan amount used in the calculation. For a fixed-rate mortgage, the loan amount remains constant throughout the loan term. However, with an adjustable-rate mortgage (ARM), the loan amount might change over time due to fluctuations in the interest rate, which can indirectly affect the annual MIP calculation if applicable, as the annual MIP is often a percentage of the outstanding loan balance. This means the annual MIP payment might adjust along with the interest rate changes in an ARM.

Hypothetical Scenario: Conventional Loan MIP Calculation

Let’s consider a hypothetical scenario: a home buyer is purchasing a house for $300,000 with a 10% down payment. This means a down payment of $30,000 ($300,000 x 0.10), leaving a loan amount of $270,000. For a conventional loan with less than 20% down, an upfront MIP might be around 0.5% to 1.75% of the loan amount, and an annual MIP might range from 0.5% to 1% of the outstanding loan balance. In this example, let’s assume an upfront MIP of 1% and an annual MIP of 0.75%. The upfront MIP would be $2,700 ($270,000 x 0.01). The annual MIP would be $2,025 ($270,000 x 0.0075) in the first year, and this amount would slightly decrease each year as the loan balance is paid down. These are estimates, and the actual rates would depend on the lender and specific loan terms.

Factors Affecting MIP Calculation

Several key factors influence the calculation of your estimated mortgage insurance premium (MIP). Understanding these factors allows for a more accurate prediction of your overall mortgage costs and helps you plan accordingly. The primary drivers are your credit score and your loan-to-value ratio (LTV), but other elements also play a significant role.

Credit Score Impact on MIP

Your credit score is a major determinant of your MIP. Lenders use your credit score to assess your risk. A higher credit score generally indicates a lower risk of default, resulting in a lower MIP. Conversely, a lower credit score signifies a higher risk, leading to a higher MIP. For example, a borrower with a credit score of 760 might qualify for a lower MIP rate compared to a borrower with a score of 660, even if both have similar loan amounts and LTV ratios. The difference can translate into hundreds or even thousands of dollars in additional premiums over the life of the loan. Specific rates vary by lender and program.

Loan-to-Value Ratio (LTV) Influence on MIP

The loan-to-value ratio (LTV) is the ratio of your loan amount to the appraised value of the property. A lower LTV signifies a smaller loan amount relative to the property’s value, indicating less risk for the lender. Therefore, a lower LTV generally results in a lower MIP. For instance, a borrower with a 20% down payment (resulting in an 80% LTV) will typically pay less in MIP than a borrower with a 5% down payment (resulting in a 95% LTV). The higher the LTV, the greater the risk for the lender, and the higher the MIP will likely be.

Other Factors Affecting MIP Cost

Several other factors can affect your MIP. These factors often interact with your credit score and LTV to determine your final premium.

- Loan Type: Different loan types (e.g., FHA, VA, conventional) have different MIP structures and requirements.

- Loan Term: Longer loan terms might lead to higher overall MIP costs, although the monthly payment may be lower.

- Down Payment Amount: As previously mentioned, a larger down payment reduces the LTV and therefore typically lowers the MIP.

- Property Type: The type of property (e.g., single-family home, condo, multi-family) can influence MIP calculations; some property types might carry higher risk assessments.

- Lender Fees and Charges: While not directly part of the MIP calculation itself, lenders may add their own fees and charges, which impact the overall cost.

MIP Calculation Methods and Tools

Accurately estimating your mortgage insurance premium (MIP) is crucial for budgeting your homeownership costs. While lenders handle the final calculation, understanding the process empowers you to make informed financial decisions. This section details manual calculation methods and explores readily available online tools for MIP estimation.

Several methods exist for calculating MIP, ranging from simplified estimations to complex formulas reflecting specific loan characteristics. The most accurate method depends on the loan type and the information available. Online calculators provide a convenient alternative to manual calculation, often offering more comprehensive results.

Manual MIP Calculation

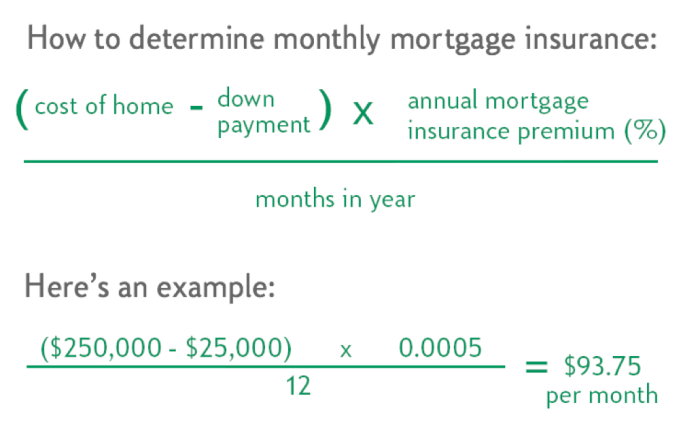

Calculating MIP manually requires understanding the specific formula used by your lender. While formulas can vary slightly, they generally involve the loan-to-value ratio (LTV), the loan amount, and the applicable MIP rate. A step-by-step process is usually as follows:

- Determine your Loan-to-Value Ratio (LTV): This is calculated by dividing your loan amount by the appraised value of the property. For example, a $300,000 loan on a $350,000 home results in an LTV of 85.7% (300,000/350,000).

- Identify the Applicable MIP Rate: The MIP rate depends on several factors, including your LTV and the type of loan (e.g., FHA, VA). These rates are usually published by the relevant government agency or can be obtained from your lender. Let’s assume an annual MIP rate of 0.5% for this example.

- Calculate the Annual MIP: Multiply your loan amount by the annual MIP rate. In our example, the annual MIP would be $1,500 (0.005 * $300,000).

- Determine the Monthly MIP: Divide the annual MIP by 12 to obtain the monthly payment. In this case, the monthly MIP would be $125 ($1,500 / 12).

Remember, this is a simplified example. Actual MIP calculations can be more complex, particularly for loans with varying interest rates or differing amortization schedules. Always consult your lender for the precise calculation based on your specific loan terms.

Online MIP Calculators

Numerous online mortgage calculators provide MIP estimations. These tools often incorporate various loan parameters, offering a more comprehensive estimate than manual calculations. Many websites dedicated to mortgages or financial planning provide these calculators.

These calculators typically require you to input information such as loan amount, down payment, property value, credit score, and loan type. The accuracy of the estimation depends on the accuracy of your inputs and the sophistication of the calculator’s algorithm. Some calculators may even factor in potential changes in interest rates over the loan term, adding a layer of complexity.

Accuracy Comparison of MIP Estimation Methods

Manual calculations, while providing a basic understanding, are less accurate than online calculators. Online calculators usually incorporate more variables and up-to-date MIP rates, leading to more precise estimations. However, even online calculators provide estimates, not definitive figures. The final MIP will be determined by your lender during the loan closing process.

The discrepancy between manual calculation and online calculator results stems from the simplified nature of manual methods. Online calculators often use more sophisticated algorithms that account for nuances in loan terms and current MIP rate adjustments, resulting in a more precise estimate.

Interpreting Online MIP Calculator Results

Online MIP calculators typically present the estimated MIP as a monthly amount added to your overall mortgage payment. Some calculators may also display the total MIP paid over the loan’s life. Always carefully review the calculator’s assumptions and the details of the estimate provided.

For example, a calculator might display a monthly MIP of $125 and a total MIP cost of $15,000 over a 30-year loan. This information allows you to accurately budget for your mortgage payments, including the MIP component. Remember that these are still estimates; your lender’s final calculation may vary slightly.

Outcome Summary

Accurately estimating your mortgage insurance premium is essential for responsible homeownership. By understanding the factors influencing MIP, utilizing available calculation tools, and planning for potential cancellation or refinancing scenarios, you can make informed financial decisions and avoid unexpected costs. This comprehensive guide provides a solid foundation for navigating the complexities of MIP and empowers you to take control of your home financing journey.

Key Questions Answered

What happens to my MIP if I refinance my mortgage?

Refinancing can impact your MIP. Depending on your new loan terms (loan-to-value ratio, loan type), you may need to pay a new MIP, continue paying the existing MIP, or potentially eliminate it altogether if you achieve a certain LTV.

Can I get an estimate of my MIP without providing personal financial information?

Many online calculators provide general MIP estimates based on loan amount, loan type, and down payment. However, for a precise estimate, you’ll likely need to provide more detailed financial information.

Is MIP tax deductible?

The deductibility of MIP depends on several factors, including your specific circumstances and tax laws. Consult a tax professional for personalized guidance.

How long do I typically pay MIP on a conventional loan?

For conventional loans, PMI is typically required until your loan-to-value ratio reaches 80%. This usually happens once you’ve built up sufficient equity in your home, either through paying down the principal or through home appreciation.