Securing a mortgage can be a complex process, and understanding all the associated costs is crucial for informed decision-making. One key element often overlooked by prospective homebuyers is the FHA upfront mortgage insurance premium (MIP). This premium, a one-time payment required for Federal Housing Administration-insured loans, significantly impacts the overall cost of your mortgage. This guide will demystify the FHA upfront MIP, explaining its calculation, payment options, and impact on your financial journey.

We will explore the differences between the upfront and annual MIP, delve into how your credit score and loan type influence the premium amount, and discuss the implications for refinancing. By the end, you’ll have a clear understanding of this important aspect of FHA mortgages and be better equipped to navigate the home-buying process.

FHA Upfront MIP Definition and Calculation

The FHA upfront mortgage insurance premium (MIP) is a one-time fee paid at the closing of an FHA-insured loan. It protects the lender against potential losses if the borrower defaults on the loan. Unlike the annual MIP, which is paid monthly, the upfront MIP is a lump sum payment. This upfront payment helps to mitigate risk for the lender and contributes to the FHA’s insurance fund.

The upfront MIP amount is calculated as a percentage of the base loan amount, and this percentage varies depending on the loan-to-value ratio (LTV). The LTV is the ratio of the loan amount to the appraised value of the property. A higher LTV generally results in a higher upfront MIP percentage. Other factors, while less directly influential, might indirectly affect the final amount, such as the type of property (single-family home, condo, etc.) and the borrower’s credit score. However, the LTV is the primary driver of the upfront MIP percentage.

Upfront MIP Calculation

The upfront MIP is typically calculated as a percentage of the base loan amount. The percentage varies depending on the loan-to-value ratio (LTV). For most loans, the upfront MIP is either 1.75% or 1.0% of the base loan amount. The choice between these percentages is dependent on the loan’s LTV ratio, and this is the main determining factor.

Factors Influencing Upfront MIP Amount

The primary factor influencing the upfront MIP amount is the loan-to-value ratio (LTV). A higher LTV indicates a greater risk for the lender, thus resulting in a higher upfront MIP percentage. For example, a loan with a higher LTV (e.g., 96.5%) might have a 1.75% upfront MIP, whereas a loan with a lower LTV (e.g., 80%) might have a 1.0% upfront MIP. In some cases, other factors such as the type of property or credit score may influence the final decision, but the LTV remains the key determining factor.

Example Upfront MIP Calculation

The following example illustrates how the upfront MIP is calculated. We will use a hypothetical loan with different LTV ratios to show the impact on the final upfront MIP amount.

| Loan Amount | Loan-to-Value Ratio (LTV) | Upfront MIP Percentage | Upfront MIP Amount |

|---|---|---|---|

| $200,000 | 96.5% | 1.75% | $3,500 |

| $200,000 | 80% | 1.0% | $2,000 |

Upfront MIP Amount = Loan Amount x Upfront MIP Percentage

FHA Upfront MIP vs. Annual MIP

Understanding the differences between the FHA upfront Mortgage Insurance Premium (MIP) and the annual MIP is crucial for prospective homebuyers. Both contribute to the overall cost of an FHA-insured loan, but they differ significantly in their payment structure and long-term financial implications. Choosing between them can have a substantial impact on your monthly budget and overall loan expenses.

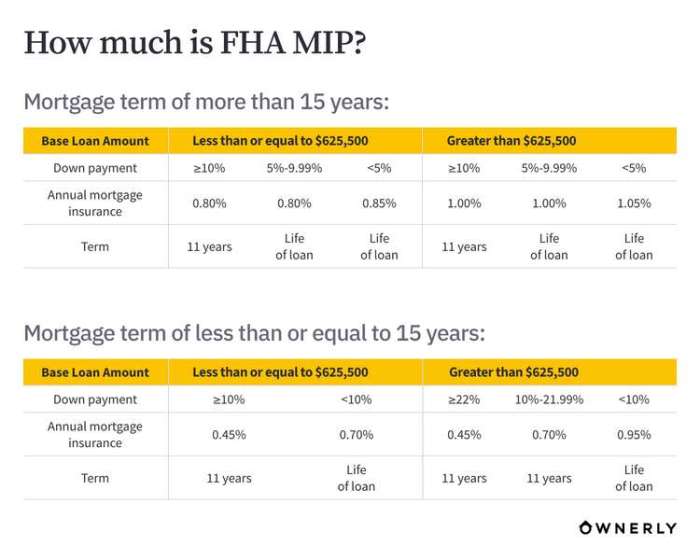

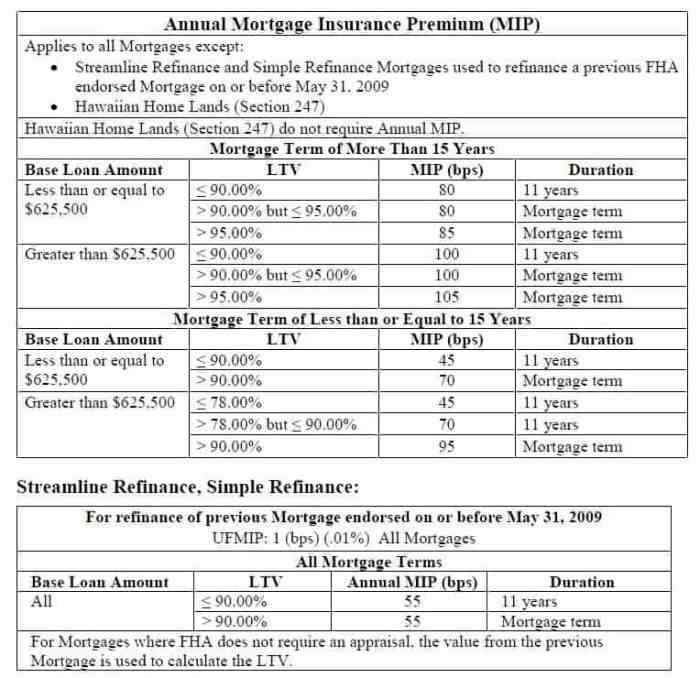

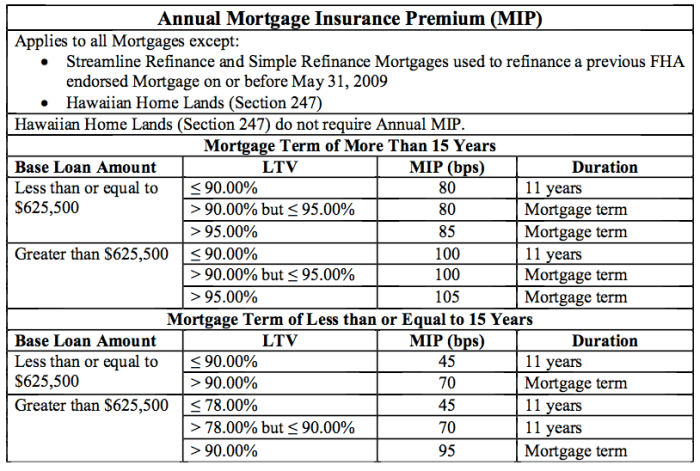

The key distinction lies in when and how the premiums are paid. The upfront MIP is a one-time payment made at closing, while the annual MIP is paid monthly as part of your mortgage payment. The upfront MIP is typically 1.75% of the loan amount, while the annual MIP rate varies depending on the loan-to-value ratio (LTV) and loan term. This difference in payment structure leads to contrasting impacts on your finances, both initially and over the long term.

Upfront MIP Payment Schedule and Total Cost

The upfront MIP is a lump sum paid at the loan closing. This can be rolled into the loan amount, increasing the principal balance, or paid directly from the borrower’s funds. While it might seem daunting to pay a significant amount upfront, the advantage lies in the reduced monthly payments, as the annual MIP is lower or absent (depending on the loan terms).

Annual MIP Payment Schedule and Total Cost

The annual MIP is a smaller, recurring payment added to your monthly mortgage payment. This makes for a higher monthly payment than a loan with only the upfront MIP. However, the total cost over the life of the loan may be higher or lower than the upfront MIP scenario depending on the loan’s terms and interest rates.

Comparison of Total Costs Over the Life of a Loan

Let’s consider an example: Suppose you’re taking out a $200,000 FHA loan. The upfront MIP would be $3,500 (1.75% of $200,000). Assuming an annual MIP rate of 0.8% and a 30-year loan term, the annual MIP would cost approximately $1,600 per year, or $133.33 per month. Over 30 years, the total annual MIP would amount to $48,000. In this scenario, the total cost of the annual MIP significantly outweighs the upfront MIP. However, if the annual MIP was lower, or the loan was paid off early, the total cost could be less than the upfront MIP.

Another example: A shorter-term loan (e.g., a 15-year mortgage) would result in lower overall annual MIP costs, potentially making the total cost closer to, or even less than, the upfront MIP paid at closing. The specific cost comparison depends heavily on the loan terms, interest rates, and the annual MIP rate applicable to the borrower’s specific circumstances.

Paying the FHA Upfront MIP

The FHA upfront Mortgage Insurance Premium (MIP) is a significant cost associated with obtaining an FHA-insured loan. Understanding your payment options is crucial for effective financial planning. Borrowers have several ways to cover this expense, each with its own set of advantages and disadvantages. Choosing the right method depends on your individual financial circumstances and long-term goals.

Paying the upfront MIP involves deciding whether to pay it in cash at closing or to finance it into the loan amount.

Methods for Paying the FHA Upfront MIP

Borrowers can typically pay the upfront MIP in one of two ways: paying it upfront in cash at closing or financing it into the loan amount. This decision impacts your immediate cash flow and the overall cost of the loan.

Financing the Upfront MIP versus Cash Payment

Financing the upfront MIP means adding the cost to the principal loan balance. This increases the total loan amount, resulting in higher monthly payments. However, it preserves your cash reserves at closing. Paying in cash reduces the overall loan amount, leading to lower monthly payments, but requires having the necessary funds available at closing.

Comparison of Payment Methods

| Feature | Financing the Upfront MIP | Paying Upfront in Cash |

|---|---|---|

| Initial Cash Outlay | Lower; only need funds for closing costs excluding MIP | Higher; requires funds for closing costs including MIP |

| Monthly Payments | Higher due to larger loan amount | Lower due to smaller loan amount |

| Total Interest Paid | Higher due to larger loan amount and longer repayment period | Lower due to smaller loan amount |

| Impact on Credit Score | Potentially lower if it impacts debt-to-income ratio negatively | No direct impact, unless other factors are affected |

| Cash Flow at Closing | Improved cash flow | Reduced cash flow |

| Long-Term Cost | Generally higher due to accumulated interest | Generally lower |

FHA Upfront MIP and Loan Refinancing

Refinancing an FHA loan can offer significant financial benefits, but the upfront Mortgage Insurance Premium (MIP) plays a crucial role in the decision-making process. Understanding how the upfront MIP interacts with refinancing is essential for homeowners considering this option. This section clarifies the impact of the upfront MIP on refinancing choices, detailing whether it’s refundable or transferable and providing examples of scenarios where refinancing may be advantageous or disadvantageous.

The upfront MIP, paid at closing, is a one-time fee calculated as a percentage of the loan amount. Unlike the annual MIP, which is paid monthly throughout the loan term, the upfront MIP is not typically refunded upon refinancing. However, the implications of this non-refundability depend heavily on the specific circumstances of the refinance.

Upfront MIP Non-Refundability and Refinancing Implications

The non-refundable nature of the upfront MIP means that it’s a sunk cost. This cost should be factored into the overall cost-benefit analysis of refinancing. While refinancing may lead to a lower interest rate or a shorter loan term, the inability to recoup the upfront MIP needs to be considered. A thorough comparison of the total costs associated with the existing loan versus the refinanced loan, including closing costs and interest payments over the life of the loan, is necessary to determine the financial viability of refinancing. A refinance that results in only a marginal reduction in monthly payments, after considering the upfront MIP, might not be financially beneficial.

Refinancing Scenarios: Advantageous and Disadvantageous

Consider two scenarios illustrating the impact of the upfront MIP on refinancing decisions.

Scenario 1: A homeowner has an FHA loan with a high interest rate (e.g., 6%). Interest rates have fallen significantly (e.g., to 4%). Refinancing to a lower interest rate could lead to substantial savings over the life of the loan, even after accounting for the non-refundable upfront MIP and closing costs. The savings from the reduced interest rate could outweigh the initial cost of the upfront MIP. This would represent an advantageous refinancing scenario.

Scenario 2: A homeowner has an FHA loan with a relatively low interest rate (e.g., 4.5%). Interest rates are slightly lower (e.g., 4%), but not significantly so. Refinancing in this case might not result in substantial savings, especially when considering the upfront MIP and closing costs. The minor reduction in monthly payments might not justify the added expenses. This would represent a less advantageous, or even disadvantageous, refinancing scenario. In this situation, the cost of refinancing, including the “lost” upfront MIP, might outweigh the benefits of a marginally lower interest rate.

Wrap-Up

Navigating the world of FHA mortgages requires a thorough understanding of the upfront mortgage insurance premium. While it represents an initial cost, careful consideration of payment options and the long-term implications can ensure a smooth and financially sound home-buying experience. By understanding the factors influencing the MIP amount and its impact on refinancing, borrowers can make informed decisions that align with their financial goals and secure their dream home with confidence.

Helpful Answers

What happens to the upfront MIP if I refinance my FHA loan?

Generally, the upfront MIP is not refunded upon refinancing. However, if you refinance into a conventional loan, you will no longer pay FHA MIP.

Can I deduct the FHA upfront MIP from my taxes?

No, the FHA upfront MIP is not tax-deductible.

Is the upfront MIP amount fixed or can it change?

The upfront MIP percentage is generally fixed based on your loan-to-value ratio (LTV) at the time of loan origination, but it can vary slightly depending on the specific FHA loan program.

What if I can’t afford to pay the upfront MIP in cash?

You can usually finance the upfront MIP, adding it to your loan amount. This will increase your overall loan balance and monthly payments.

How does a higher credit score affect the upfront MIP?

While a higher credit score doesn’t directly lower the *percentage* of the upfront MIP, a better credit score may make you eligible for a lower interest rate on the loan itself, potentially offsetting some of the overall cost.