Securing your family’s financial future is a paramount concern, and life insurance plays a crucial role in achieving this. Understanding life insurance premiums, however, can feel like navigating a complex maze. This guide demystifies the process, providing a clear and concise explanation of what constitutes these premiums, the factors influencing their cost, and the various options available to you.

We’ll explore the different types of life insurance policies—term, whole, and universal—and how their features impact premium calculations. We’ll delve into the influence of age, health, lifestyle choices, and other factors on your premium. Finally, we’ll equip you with the knowledge to make informed decisions about your life insurance coverage and payment options.

Defining Life Insurance Premiums

Life insurance premiums are the regular payments you make to maintain your life insurance policy. These payments essentially purchase a promise from the insurance company to pay a death benefit to your beneficiaries upon your passing. Understanding the components and factors that influence these premiums is crucial for making informed decisions about your life insurance coverage.

Components of Life Insurance Premiums

Life insurance premiums are calculated using a complex formula that considers several key factors. These factors are combined to determine the overall risk the insurance company is taking in insuring your life. A significant component is the mortality rate, which is statistically determined based on age, gender, and health. Administrative costs, including salaries, marketing, and overhead, are also factored into the premium. Finally, the insurance company’s profit margin is incorporated to ensure the financial sustainability of the business. The interplay of these elements dictates the final premium amount.

Factors Influencing Premium Calculations

Several factors significantly impact the calculation of your life insurance premiums. Your age is a primary determinant, as older individuals statistically have a higher risk of mortality. Health status, including pre-existing conditions and lifestyle choices (such as smoking), plays a crucial role. The policy’s face value (the death benefit amount) directly correlates with premium cost; higher coverage necessitates higher premiums. The type of policy selected (term, whole, universal, etc.) also influences the premium, as different policies offer varying levels of coverage and cash value accumulation. Finally, your gender and occupation can influence premium calculations due to associated risk profiles.

How Different Policy Types Affect Premium Costs

Different types of life insurance policies come with varying premium structures. Term life insurance, offering coverage for a specific period, typically has lower premiums than permanent life insurance options like whole life or universal life. This is because term life insurance provides only death benefit coverage, without any cash value accumulation. Whole life insurance, on the other hand, offers lifelong coverage and builds cash value over time, resulting in higher premiums. Universal life insurance provides flexibility in premium payments and death benefit adjustments, with premiums fluctuating based on the policy’s performance and market conditions.

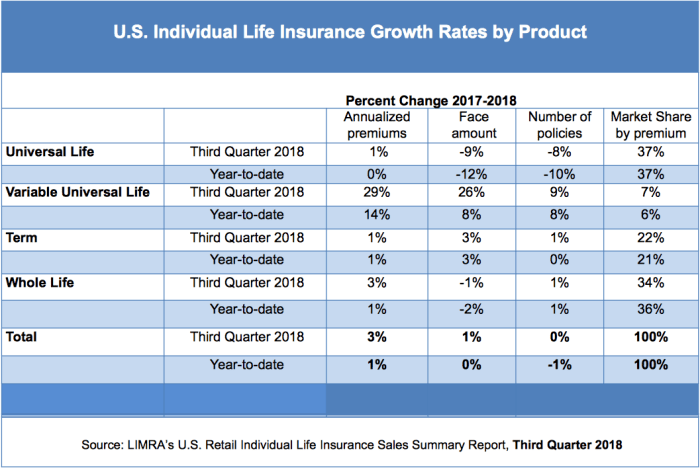

Premium Comparison Table

The following table provides estimated annual premiums for a healthy 35-year-old non-smoker, illustrating the premium differences between three common life insurance policy types. These are estimates only, and actual premiums will vary depending on individual circumstances and the specific insurance company.

| Age | Policy Type | Coverage Amount ($USD) | Estimated Annual Premium ($USD) |

|---|---|---|---|

| 35 | Term Life (20-year) | 500,000 | 1,000 |

| 35 | Whole Life | 500,000 | 2,500 |

| 35 | Universal Life | 500,000 | 1,500 – 2,000 (variable) |

Factors Affecting Premium Costs

Life insurance premiums aren’t a one-size-fits-all price. Several factors contribute to the final cost, influencing how much you’ll pay each month or year. Understanding these factors empowers you to make informed decisions when purchasing a policy. This section will delve into the key elements that determine your life insurance premium.

Age

Age is a significant factor in determining life insurance premiums. Statistically, the older you are, the higher your risk of death within the policy’s term. Insurance companies use actuarial tables—statistical data reflecting mortality rates—to assess risk. As you age, your risk increases, leading to higher premiums. A 30-year-old will generally pay considerably less than a 60-year-old for the same coverage amount. This reflects the increased probability of a claim being filed for the older individual.

Health Status

Your health status plays a crucial role in premium calculations. Applicants undergo a medical underwriting process, which involves providing medical history, undergoing medical examinations (sometimes), and potentially completing questionnaires. Individuals with pre-existing conditions, such as heart disease, diabetes, or cancer, typically face higher premiums due to the increased likelihood of a claim. Conversely, individuals in excellent health with no significant medical history will generally receive lower premiums. The severity and type of health condition significantly impact the premium amount.

Other Influencing Factors

Several other factors influence life insurance premium costs. These include:

- Smoking: Smokers face significantly higher premiums than non-smokers due to the increased risk of lung cancer, heart disease, and other smoking-related illnesses. The higher risk translates directly into a higher premium.

- Occupation: High-risk occupations, such as those involving hazardous materials or dangerous machinery, often result in higher premiums. Insurance companies assess the inherent risks associated with specific jobs when determining premiums.

- Family History: A family history of certain diseases, particularly those with a genetic component, can influence premium costs. If you have a family history of heart disease or cancer, for instance, your premiums might be higher.

Premium Differences Based on Health Conditions

The difference in premiums based on health conditions can be substantial. For example, a healthy, non-smoking 35-year-old might receive a significantly lower premium compared to a 35-year-old with a history of heart disease and a smoking habit. The specific premium difference varies greatly depending on the severity and type of health condition, as well as the insurer’s specific underwriting guidelines. Some insurers may even decline coverage for applicants with severe health issues.

Life Insurance Premium Calculation Process

The following flowchart illustrates a simplified version of the premium calculation process:

[Flowchart Description: The flowchart begins with “Applicant Information” (age, health status, lifestyle, etc.). This feeds into a “Risk Assessment” box, which considers factors like age, health history, occupation, and family history. The risk assessment results are then used in conjunction with “Actuarial Tables” (mortality rates) and “Company Profit Margins” to determine the final “Premium Amount”. The premium amount is then presented to the applicant.]

Life Insurance Premium Adjustments

Life insurance premiums, while initially set based on various factors at the policy’s inception, aren’t necessarily fixed for the policy’s entire duration. Insurance companies have mechanisms in place to adjust premiums, reflecting changes in the insured’s circumstances or the insurer’s risk assessment. Understanding these adjustments is crucial for policyholders to manage their financial planning effectively.

Premium adjustments in life insurance policies are primarily driven by changes in risk assessment and the underlying financial performance of the insurance company. These adjustments can manifest as either increases or decreases, and the process for implementing them varies depending on the type of policy and the specific circumstances. Transparency and clear communication from the insurance provider are key aspects of this process.

Premium Increase Circumstances

Premium increases are typically implemented due to factors related to the insured’s health, lifestyle, or the overall financial health of the insurance company. A significant health change, such as the development of a serious illness, could trigger a premium increase for certain types of policies. Similarly, a change in occupation to a higher-risk profession could also lead to a premium adjustment. Furthermore, unexpected increases in mortality rates or claims payouts might necessitate adjustments to premiums across the board to maintain the insurer’s solvency. For example, a major public health crisis could lead to increased mortality rates, prompting insurance companies to re-evaluate their pricing models. Finally, changes in the underlying investment performance of the insurance company’s assets might also necessitate premium adjustments.

Premium Decrease Circumstances

While less common than increases, premium decreases can occur under specific circumstances. A significant improvement in the insured’s health, demonstrably reducing their risk profile, might lead to a lower premium. This often involves providing updated medical information to the insurer. Furthermore, improvements in the insurer’s financial performance or a reduction in overall mortality rates could also result in premium reductions, although this is less frequent. A scenario where this might happen is if advancements in medical technology significantly reduce mortality rates for a specific age group, allowing the insurer to adjust premiums downwards.

Requesting a Premium Adjustment

The process for requesting a premium adjustment varies depending on the insurance company and the type of policy. Generally, it involves submitting a formal request to the insurer, usually in writing, providing supporting documentation relevant to the reason for the request. This might include updated medical records, proof of a change in occupation, or other relevant evidence. The insurer will then review the request and determine whether an adjustment is warranted based on their underwriting guidelines and risk assessment. Communication with the insurer throughout this process is crucial to understand the timeline and potential outcomes.

Premium Adjustment Scenario

Consider a scenario where John, a 40-year-old policyholder, initially purchased a term life insurance policy with a premium based on his healthy lifestyle and occupation as a software engineer. Five years later, John is diagnosed with a chronic condition that increases his risk profile. His insurance company, after reviewing his medical records, might adjust his premium upward to reflect the increased risk associated with his health condition. The increase would be communicated to John in writing, outlining the reasons for the adjustment and the new premium amount. John would then have the option to accept the new premium or explore alternative policy options.

Illustrating Premium Costs

Understanding the cost of life insurance can seem daunting, but with a clear understanding of policy types and influencing factors, it becomes manageable. This section provides examples to illustrate the potential premium costs for a 30-year-old healthy individual seeking $500,000 in coverage. Remember that these are illustrative examples, and actual premiums will vary based on individual circumstances and the insurer.

Premium costs for a 30-year-old healthy individual seeking $500,000 in coverage will vary significantly depending on the type of policy chosen. Term life insurance, which provides coverage for a specific period, generally offers lower premiums than permanent life insurance, which offers lifelong coverage. Within permanent insurance, whole life and universal life policies have differing cost structures.

Term Life Insurance Premiums

A 30-year-old healthy individual might expect to pay between $20 and $50 per month for a 20-year term life insurance policy with $500,000 in coverage. The exact cost will depend on factors such as gender, smoking status, health history, and the specific insurer. For example, a non-smoking male might secure a lower premium than a smoking female. A 10-year term policy would likely be cheaper, while a 30-year term policy would be more expensive. These premiums are generally fixed for the duration of the term.

Whole Life Insurance Premiums

Whole life insurance offers lifelong coverage and typically involves higher premiums than term life insurance. For a $500,000 policy, the monthly premium could range from $100 to $300 or more, depending on the factors mentioned above. Unlike term life insurance, whole life premiums are typically level for the policyholder’s entire life. The higher premiums reflect the ongoing coverage and the cash value component that builds over time.

Universal Life Insurance Premiums

Universal life insurance offers flexibility in premium payments and death benefit amounts. Premiums can be adjusted, within certain limits, to suit the policyholder’s financial situation. The initial premium for a $500,000 policy might be comparable to whole life, but it could potentially be lower or higher depending on the chosen premium payment schedule and the insurer’s specific terms. This flexibility comes with a degree of complexity in understanding the policy’s cash value growth and potential for adjustments.

Visual Representation of Premium Growth

To visualize premium growth, consider a graph charting the annual premium cost of a 20-year term life insurance policy over its 20-year term. The horizontal axis (x-axis) represents the year (from year 1 to year 20), and the vertical axis (y-axis) represents the annual premium cost in dollars. Since the premium for a term life insurance policy is typically fixed, the data points would form a horizontal line parallel to the x-axis. The line would be positioned at a height representing the fixed annual premium cost. The scale on the y-axis would depend on the actual premium amount, ensuring clear visualization of the unchanging cost. The graph would clearly illustrate the absence of premium increases throughout the policy’s duration.

Epilogue

Ultimately, understanding life insurance premiums is key to securing affordable and appropriate coverage for your needs. By carefully considering the factors influencing premium costs and exploring various payment options, you can choose a policy that provides the necessary financial protection for your loved ones without straining your budget. Remember, seeking professional advice from a qualified insurance agent can further assist in navigating this important decision.

FAQ Summary

What happens if I miss a premium payment?

Missing a premium payment can result in your policy lapsing, meaning your coverage ends. Most insurers offer grace periods, but it’s crucial to contact your insurer immediately if you anticipate a payment delay.

Can I change my premium payment frequency?

Yes, you can usually change your payment frequency (e.g., from monthly to annual) with your insurer’s approval. This may impact the overall cost; annual payments often result in lower overall costs due to reduced administrative fees.

How often are premiums reviewed and adjusted?

The frequency of premium reviews varies depending on the type of policy. Term life insurance premiums are generally fixed for the policy term, while whole life premiums may increase or decrease depending on the policy’s performance.

Does my life insurance premium ever decrease?

While unlikely with most term life insurance policies, some whole life policies may experience premium decreases under specific circumstances, such as policy performance exceeding expectations.