Navigating the complexities of tax deductions can feel daunting, but understanding how to leverage deductions on insurance premiums can significantly impact your financial well-being. This guide unravels the intricacies of claiming tax deductions for various insurance premiums, providing clarity on eligibility criteria, calculation methods, and reporting procedures. Whether you’re self-employed or an employee, we’ll equip you with the knowledge to confidently claim your rightful tax benefits.

From health and life insurance to long-term care, we’ll explore the specific types of insurance premiums eligible for tax deductions, highlighting the key requirements and limitations. We’ll delve into the differences between deductions for self-employed individuals and employees, offering practical examples and step-by-step calculations to ensure a clear understanding of the process. By the end of this guide, you’ll be empowered to maximize your tax savings and optimize your financial planning.

Calculating Tax Deductions on Insurance Premiums

Understanding how to calculate tax deductions for insurance premiums can significantly reduce your tax burden. This process involves identifying deductible premiums and applying the appropriate rules and limitations based on your individual circumstances and the type of insurance. Accurate calculation requires careful attention to detail and a clear understanding of applicable tax laws.

Deductible Premiums

Determining which insurance premiums are deductible is the first crucial step. Generally, premiums paid for health insurance, long-term care insurance, and self-employed health insurance are deductible, subject to certain limitations. However, life insurance premiums are typically not deductible, except in specific circumstances, such as those related to business life insurance. It’s essential to consult the relevant tax regulations and guidelines for the most up-to-date information on deductible insurance types.

Step-by-Step Calculation of Tax Deduction

The calculation of your tax deduction will vary depending on the type of insurance and your specific circumstances. However, a general approach involves these steps:

- Identify Deductible Premiums: Begin by compiling all your insurance premium receipts for the tax year. Separate the deductible premiums from those that are not deductible. For example, health insurance premiums paid are deductible, while life insurance premiums are generally not.

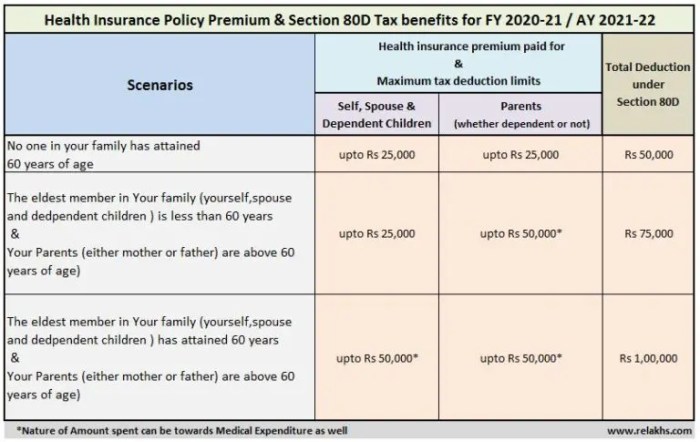

- Determine Applicable Limits: Tax laws often set limits on the amount of deductible premiums. These limits can vary depending on factors such as your income, filing status, and the type of insurance. For instance, there might be an income threshold above which the deduction is limited or phased out.

- Calculate the Deductible Amount: Subtract any reimbursements or credits you received for your insurance premiums from the total deductible premiums. This leaves you with the net amount of premiums you can deduct.

- Apply the Deduction: The method of applying the deduction depends on your tax filing status and other factors. You might be able to deduct it directly from your gross income or itemize it on Schedule A (Form 1040).

Illustrative Scenarios

Let’s consider a few hypothetical scenarios to illustrate the calculation:

| Scenario | Annual Income | Total Insurance Premiums | Deductible Premiums | Deductible Amount (after limitations, if any) | Tax Savings (assuming a 20% tax bracket) |

|---|---|---|---|---|---|

| Scenario 1: Self-Employed Individual | $60,000 | $7,000 (Health Insurance) | $7,000 | $7,000 (Assuming no limitations apply) | $1,400 (20% of $7,000) |

| Scenario 2: Employee with High Deductible Health Plan | $80,000 | $4,000 (Health Insurance) | $4,000 | $4,000 (Assuming no limitations apply) | $800 (20% of $4,000) |

| Scenario 3: Individual with Income Above Deduction Limit | $150,000 | $10,000 (Health Insurance) | $10,000 | $5,000 (Assuming a $5,000 limitation applies) | $1,000 (20% of $5,000) |

Note: These are simplified examples. Actual tax deductions depend on numerous factors, including specific tax laws, your individual circumstances, and the type of insurance. Always consult a tax professional for personalized advice.

Ultimate Conclusion

Successfully navigating the landscape of tax deductions on insurance premiums requires careful planning and a thorough understanding of the relevant regulations. This guide has provided a comprehensive overview of the key aspects, from eligibility criteria and calculation methods to reporting procedures and the distinctions between self-employed and employed individuals. By diligently following the guidelines Artikeld here and seeking professional advice when necessary, you can confidently claim your entitled deductions and minimize your tax burden, ultimately enhancing your financial security.

FAQ Corner

Can I deduct premiums for pet insurance?

Generally, no. Pet insurance premiums are not typically deductible for federal income tax purposes.

What if I overpaid my insurance premiums and received a refund?

The refund may impact your deductible amount. You should consult a tax professional to determine the correct adjustment.

Are there any penalties for incorrectly claiming insurance premium deductions?

Yes, inaccuracies can result in penalties, including interest and additional taxes. Accurate record-keeping is crucial.

Where can I find the relevant tax forms?

The IRS website (irs.gov) provides access to all necessary tax forms and publications.