Choosing the right insurance policy is a crucial financial decision, and understanding the concept of “premium insurance term” is key to making an informed choice. This term refers to the duration of your insurance coverage, ranging from short-term policies offering immediate protection to long-term plans providing sustained security. This guide explores the intricacies of premium insurance terms, analyzing their cost-effectiveness, impact on coverage, and relevance to individual circumstances.

We’ll delve into the factors that influence the length of your insurance term, including your age, health status, financial situation, and the type of insurance you need. We’ll also examine the potential benefits and drawbacks of opting for shorter or longer terms, helping you weigh the pros and cons to find the best fit for your unique needs. By understanding these nuances, you can make a confident decision that aligns with your personal and financial goals.

Defining “Premium Insurance Term”

The term “premium insurance term” refers to the length of time for which an insurance policy is active and premiums are paid. It’s a crucial aspect of understanding the cost and coverage provided by an insurance policy, varying significantly depending on the type of insurance and the specific policy details. Understanding the premium term is essential for budgeting and ensuring appropriate coverage.

The meaning of “premium insurance term” is straightforward: it’s the duration of the insurance contract. For example, a one-year premium term means the policy covers you for a year, after which renewal is required. Longer terms might be available, but they typically come with a slightly different pricing structure. This concept applies across various insurance types, impacting how you manage your risk and financial planning.

Types of Insurance and Premium Terms

The length of a premium insurance term varies considerably across different insurance products. Auto insurance, for instance, commonly offers terms of six months or one year. Homeowners insurance often follows a similar pattern, with annual terms being the most prevalent. Life insurance policies, however, can have significantly longer terms, sometimes extending for decades, with premiums paid regularly until the policy matures or the insured reaches a certain age. Health insurance policies, frequently tied to employer-sponsored plans or government programs, have their own unique term structures, often operating on a yearly renewal cycle.

Factors Influencing Premium Insurance Term Length

Several factors determine the length of a premium insurance term. The most prominent is the type of insurance; as mentioned previously, auto insurance is usually offered in shorter terms compared to life insurance. The insurer also plays a role; some companies may specialize in longer-term policies, while others focus on shorter-term options. Individual preferences and financial situations also influence the choice of term length. A person might prefer a shorter term for flexibility, while another might opt for a longer term for price stability and consistent coverage. Finally, the specific policy features, such as riders or add-ons, can sometimes affect the available term lengths. For example, a life insurance policy with a guaranteed cash value component might have a longer minimum term than a term life policy.

Cost and Value Analysis of Premium Insurance Terms

Choosing the right insurance term length is a crucial decision impacting both your immediate expenses and long-term financial security. Understanding the cost-effectiveness of various term lengths requires careful consideration of your individual circumstances and risk tolerance. This analysis explores the trade-offs between short-term affordability and the potential long-term savings of longer premium insurance terms.

Cost Comparison of Different Premium Insurance Term Lengths

The cost of premium insurance varies significantly depending on the chosen term length. Generally, shorter terms (e.g., 1-year) result in lower initial premiums. However, renewing these policies annually can lead to cumulative costs exceeding those of longer-term policies due to potential premium increases with age or changes in health status. Conversely, longer terms (e.g., 10-year, 20-year) offer lower average annual costs, providing predictability and potential savings over the long run, but require a larger upfront commitment. Medium-term options (e.g., 5-year) offer a compromise, balancing the benefits of both short-term and long-term plans.

Situations Where Longer Premium Insurance Terms Offer Better Value

Longer premium insurance terms frequently provide better value in situations where financial stability and long-term cost predictability are prioritized. For instance, individuals with stable incomes and a strong likelihood of maintaining good health might find a longer-term policy more cost-effective. Furthermore, individuals anticipating significant life events, such as marriage, homeownership, or starting a family, may benefit from the financial security and predictability of a longer-term policy, allowing them to budget effectively for their insurance costs. This is particularly true if they expect their health status to remain relatively stable during that period. The fixed premium ensures consistent costs, regardless of any potential future health changes that might otherwise increase premiums.

Risks and Benefits Associated with Different Premium Insurance Term Lengths

Choosing a short-term policy offers flexibility; you can adjust coverage as needed and potentially find a better deal if premiums decrease in subsequent years. However, this flexibility comes at the cost of potential premium increases upon renewal, especially if your health status changes. Longer-term policies provide cost predictability and potentially lower average annual costs, but lock you into a specific coverage level for an extended period, potentially limiting your ability to adapt to changing needs or benefit from lower premiums in the future. Medium-term options provide a balance, allowing some flexibility while still offering cost predictability over a longer period.

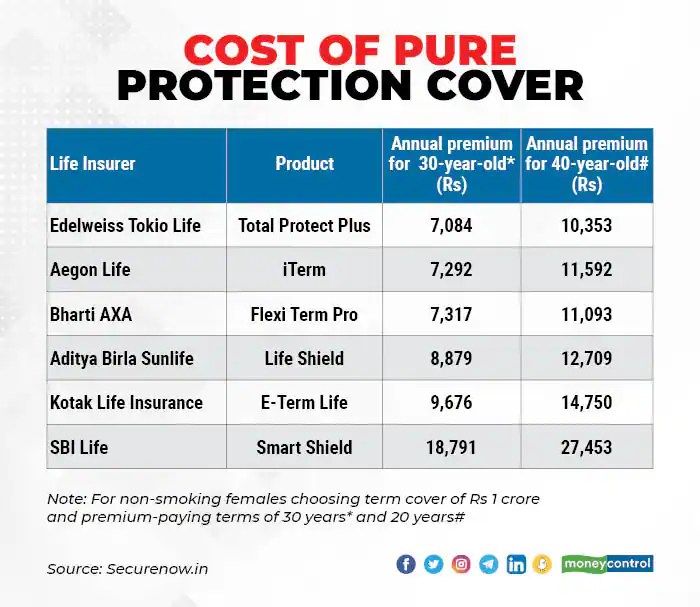

Comparative Table of Premium Insurance Costs

The following table illustrates hypothetical premium costs for a 35-year-old male, non-smoker, with standard coverage. Actual costs will vary significantly depending on factors such as age, health status, coverage level, location, and the specific insurer.

| Term Length | Annual Premium (USD) | Total Premium (USD) | Average Annual Premium (USD) |

|---|---|---|---|

| Short-term (1 year) | 1200 | 1200 | 1200 |

| Medium-term (5 years) | 1100 | 5500 | 1100 |

| Long-term (10 years) | 1000 | 10000 | 1000 |

Premium Insurance Term and Individual Circumstances

Choosing the right premium insurance term isn’t a one-size-fits-all proposition. Individual circumstances significantly impact the optimal term length and coverage amount, requiring careful consideration of personal factors and potential future needs. The interplay between age, health, financial stability, and life events necessitates a personalized approach to selecting a premium insurance term.

The selection of a premium insurance term is heavily influenced by individual circumstances. Age, health status, and financial stability all play crucial roles in determining the most suitable policy. Younger individuals with fewer financial obligations might opt for shorter-term policies, focusing on affordability. Conversely, those nearing retirement or with substantial financial responsibilities might favor longer-term policies offering more comprehensive coverage. Pre-existing health conditions can impact both eligibility and premiums, leading to a need for careful evaluation of different policy options.

Age and Health’s Influence on Premium Insurance Term Selection

Age is a primary factor influencing premium insurance term selection. Younger individuals typically enjoy lower premiums due to statistically lower risk. They may choose shorter-term policies to address immediate needs, such as covering a mortgage or providing for young children, and re-evaluate their coverage needs as their circumstances evolve. Older individuals, approaching retirement or with established families, might prefer longer-term policies for financial security and legacy planning, even if the premiums are higher. Health status also plays a critical role. Individuals with pre-existing conditions might find it challenging to secure coverage with certain insurers or may face higher premiums. This underscores the importance of seeking professional advice to find suitable coverage despite health challenges. For instance, a 30-year-old healthy individual might opt for a 10-year term, while a 55-year-old with a pre-existing condition might require a longer term with potentially higher premiums to ensure sufficient coverage until retirement.

Financial Stability and Life Events’ Impact on Premium Insurance Term Choices

Financial stability significantly influences the choice of a premium insurance term. Individuals with secure finances and substantial savings might be able to afford higher premiums for longer-term policies offering extensive coverage. Those with limited financial resources might prioritize affordability, opting for shorter-term policies with lower premiums. Life events such as marriage, childbirth, starting a business, or inheritance can also impact the decision. Marriage often necessitates a reassessment of insurance needs, possibly increasing coverage amounts or term lengths. Having children increases the financial responsibility, potentially prompting the need for higher coverage. Similarly, starting a business might require additional life insurance to protect the financial future of the business and family. An inheritance, on the other hand, could alter the financial landscape, potentially allowing for the selection of a more comprehensive policy.

Hypothetical Scenario Illustrating the Need for Premium Insurance Term Review

Consider Sarah, a 30-year-old single professional who purchased a 10-year term life insurance policy five years ago. At the time, her primary concern was securing a mortgage. Now, she’s married, expecting a child, and has started her own business. Her financial responsibilities and risk profile have significantly changed. This necessitates a review of her existing premium insurance term. She might need to increase her coverage amount to account for the additional financial burden of a family and a business. The 10-year term might no longer be sufficient, prompting her to consider extending the term or switching to a different policy that better aligns with her current circumstances. This scenario highlights the dynamic nature of life insurance needs and the importance of periodic reviews to ensure the policy continues to meet evolving personal and financial circumstances.

Conclusion

Ultimately, selecting the optimal premium insurance term requires careful consideration of your individual circumstances, financial stability, and risk tolerance. While longer terms often offer cost savings and comprehensive coverage, shorter terms provide flexibility and adaptability to changing life events. By thoroughly evaluating the costs, benefits, and potential risks associated with each option, you can make an informed decision that safeguards your future and provides the appropriate level of protection. Remember to regularly review your policy and adjust your premium insurance term as needed to ensure ongoing suitability.

Detailed FAQs

What happens if I need to cancel my policy before the premium insurance term ends?

Most insurance policies have clauses outlining cancellation procedures and potential penalties. These typically involve a refund of the unused portion of your premium, minus any applicable fees or charges.

Can I change my premium insurance term during the policy’s duration?

The possibility of changing your insurance term depends on your policy and the insurer. Some policies allow for adjustments, while others may require you to renew with a new term. Contact your insurer directly to inquire about this.

How does my credit score affect my premium insurance term and cost?

Your credit score can influence your insurance premium, particularly for certain types of insurance like auto or home insurance. A lower credit score might result in higher premiums.

What are the tax implications of my premium insurance term and payments?

Tax implications vary depending on your location and the type of insurance. Some insurance premiums may be tax-deductible, while others are not. Consult a tax professional for personalized advice.