Choosing a health insurance plan can feel like deciphering a complex code. At the heart of this decision lies the often-confusing interplay between premiums and deductibles. Understanding the nuances of each is crucial to selecting a plan that aligns with your financial situation and healthcare needs. This guide will illuminate the key differences, helping you make an informed choice.

We’ll explore how premiums, the regular payments for your insurance, are influenced by factors like age, location, and health history. We’ll also examine deductibles, the amount you pay out-of-pocket before your insurance kicks in, and how they relate to overall costs. By the end, you’ll be equipped to compare plans effectively and choose the best fit for your circumstances.

Defining Premium and Deductible

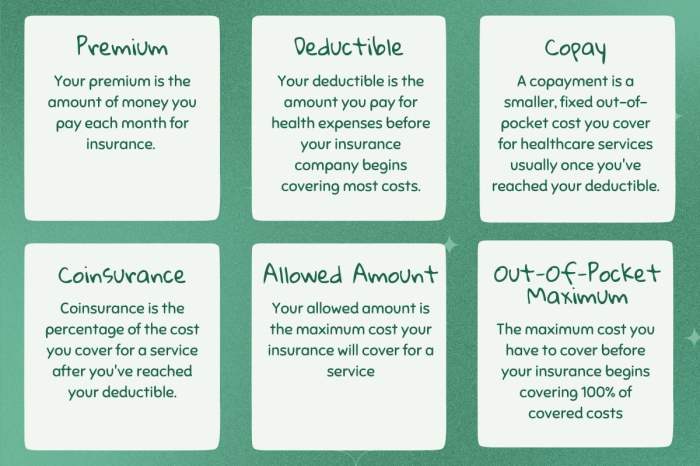

Understanding the terms “premium” and “deductible” is crucial for navigating the world of health insurance. These two components significantly impact your out-of-pocket costs and the level of coverage you receive. This section will clarify their meanings and how they interact.

Health Insurance Premiums Explained

A health insurance premium is the recurring payment you make to your insurance company to maintain your health insurance coverage. Think of it as your monthly membership fee. This payment guarantees access to the benefits Artikeld in your chosen plan. The amount you pay depends on several factors, including your plan’s coverage level, your location, your age, and the number of people covered under the plan.

Types of Health Insurance Premiums

Several factors influence premium costs, leading to variations in premium structures. These variations are not necessarily categorized into distinct “types,” but rather reflect the underlying cost drivers. For instance, individual premiums are typically different from family premiums, reflecting the increased cost of covering multiple individuals. Similarly, premiums for plans with more comprehensive coverage (like those with lower deductibles and co-pays) tend to be higher than those for plans with more limited coverage. Employer-sponsored plans often involve a shared cost between the employer and the employee, resulting in a lower premium for the employee than a comparable individually purchased plan.

Health Insurance Deductibles Explained

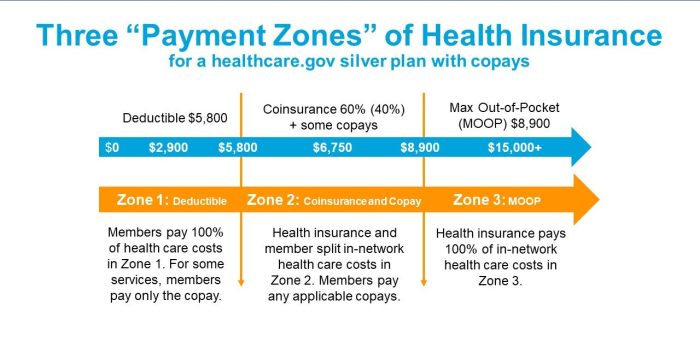

Your health insurance deductible is the amount of money you must pay out-of-pocket for covered healthcare services before your insurance company starts paying its share. Essentially, it’s the threshold you need to meet before your insurance benefits kick in. For example, if your deductible is $1,000, you’ll need to pay the first $1,000 of covered medical expenses yourself before your insurance company begins to cover the remaining costs. This deductible amount usually resets at the beginning of each policy year.

Deductibles and Out-of-Pocket Expenses

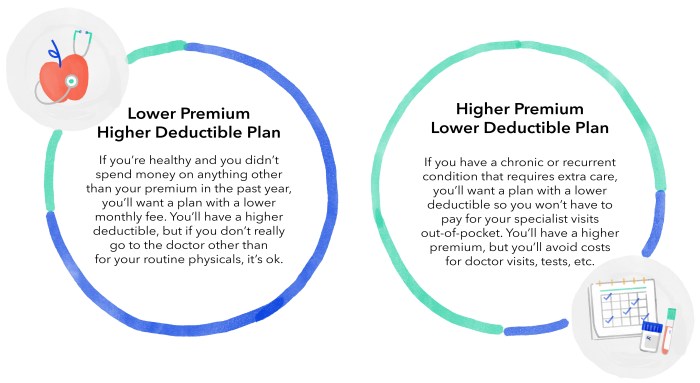

Deductibles directly influence your out-of-pocket expenses. The higher your deductible, the more money you’ll pay before your insurance coverage takes effect. However, plans with higher deductibles often come with lower premiums. Conversely, lower deductibles mean less upfront cost but usually come with higher premiums. Understanding this relationship is key to choosing a plan that aligns with your budget and risk tolerance. For instance, a young, healthy individual might opt for a high-deductible plan to save on premiums, while a family with pre-existing conditions might prefer a low-deductible plan for greater financial protection.

High-Deductible vs. Low-Deductible Plans: A Comparison

High-deductible health plans (HDHPs) require you to pay a larger amount out-of-pocket before your insurance coverage begins. They typically have lower premiums than low-deductible plans. Low-deductible health plans (LDHPs) have lower out-of-pocket expenses upfront, meaning you pay less before your insurance kicks in. However, these plans usually come with higher premiums. The best choice depends on your individual circumstances, financial stability, and health risks. Consider factors like your predicted healthcare utilization and your ability to manage a larger upfront cost. For example, someone with a chronic illness might find a low-deductible plan more financially manageable, despite the higher premium.

Factors Influencing Premium Costs

Several key factors contribute to the final cost of your health insurance premium. Understanding these factors can help you make informed decisions when choosing a plan. These factors interact in complex ways, so the overall cost is rarely simply the sum of its parts.

Age

Age is a significant factor in determining health insurance premiums. Older individuals generally have higher premiums than younger individuals. This is because the risk of developing health issues increases with age, leading to higher healthcare utilization and costs. Insurance companies use actuarial data to assess the likelihood of claims from different age groups, resulting in age-based pricing. For example, a 60-year-old individual is statistically more likely to require significant medical care than a 25-year-old, thus justifying a higher premium.

Geographic Location

Geographic location plays a crucial role in premium costs. Areas with higher costs of living, a higher concentration of specialists, and a greater prevalence of certain diseases often have higher premiums. For instance, premiums in major metropolitan areas with advanced medical facilities tend to be higher than those in rural areas with fewer healthcare resources. Competition among insurance providers in a given area also influences pricing.

Health History

An individual’s health history significantly impacts premium costs. Pre-existing conditions, such as diabetes or heart disease, can lead to higher premiums because these conditions increase the likelihood of future healthcare claims. Insurance companies assess the risk associated with an applicant’s medical history and adjust premiums accordingly. Individuals with a clean bill of health typically receive lower premiums than those with a history of significant medical issues.

Family Size

Family size also influences premium costs. Larger families generally have higher premiums than single individuals or smaller families. This is because the likelihood of multiple family members requiring medical care increases with family size, resulting in a higher potential for claims. Insurance companies account for this increased risk by adjusting premiums based on the number of individuals covered under the plan.

Premium Costs Across Different Age Groups

| Age Group | Individual Plan (Hypothetical Monthly Premium) | Family Plan (Hypothetical Monthly Premium) |

|---|---|---|

| 18-25 | $250 | $700 |

| 26-35 | $300 | $850 |

| 36-45 | $400 | $1000 |

| 46-55 | $550 | $1300 |

Illustrative Scenarios

Understanding the financial implications of choosing between high- and low-deductible health insurance plans is crucial for making an informed decision. The following scenarios illustrate the potential costs associated with each type of plan under different circumstances.

High-Deductible Plan and a Major Medical Event

Let’s imagine Sarah, a 35-year-old with a high-deductible health plan featuring a $10,000 deductible and a $6,000 out-of-pocket maximum. She experiences a serious car accident requiring hospitalization, surgery, and extensive physical therapy. Her total medical bills reach $50,000. With her high-deductible plan, Sarah is responsible for paying the entire $10,000 deductible before her insurance begins to cover costs. Even after meeting her deductible, she still faces significant out-of-pocket expenses until she reaches her out-of-pocket maximum of $6,000. In this scenario, Sarah would pay $10,000 (deductible) + ($50,000 – $10,000 – $6,000) = $34,000 out of pocket. This highlights the considerable financial risk associated with high-deductible plans when facing major medical emergencies. The savings in premiums might be offset significantly by a large unexpected medical expense.

Low-Deductible Plan and Routine Care

Consider John, a 40-year-old with a low-deductible plan featuring a $500 deductible and a $2,000 out-of-pocket maximum. Throughout the year, John has several routine checkups, experiences a minor respiratory infection requiring a doctor’s visit and prescription medication, and needs a dental cleaning. His total medical expenses for the year amount to $3,000. With his low-deductible plan, John’s out-of-pocket expenses are significantly lower. He pays his $500 deductible, and the remainder is covered by his insurance, resulting in a total out-of-pocket cost of approximately $500 + ($3,000 – $500) * (copay percentage, assuming a low percentage) = significantly less than $3000, likely under $1000 depending on his specific plan details. This demonstrates how a low-deductible plan can be more cost-effective for individuals with predictable, routine healthcare needs.

Visual Representation of Out-of-Pocket Expenses

Imagine two bar graphs side-by-side. The left bar represents a high-deductible plan, and the right bar a low-deductible plan. The y-axis represents out-of-pocket expenses in dollars, and the x-axis represents the months of the year. For the high-deductible plan, the bar remains relatively low for most of the year, reflecting low monthly premiums. However, a sudden, sharp spike occurs in one month, representing a significant medical event requiring a large out-of-pocket payment to meet the high deductible. The bar then plateaus at a higher level than the low-deductible plan, indicating ongoing cost-sharing even after the deductible is met. In contrast, the low-deductible plan’s bar shows consistent, low-level spending throughout the year, reflecting higher premiums but smaller out-of-pocket expenses for medical services. The overall height of the bar for the low-deductible plan is considerably shorter than the high-deductible plan’s peak expense, demonstrating lower total annual out-of-pocket costs despite the higher premiums.

Final Wrap-Up

Ultimately, the “best” health insurance plan is subjective, hinging on individual needs and financial realities. High-deductible plans offer lower premiums but require greater upfront cost absorption, while low-deductible plans provide more immediate coverage at a higher premium cost. Careful consideration of your health history, anticipated healthcare utilization, and budget is essential. By understanding the interplay between premiums and deductibles, you can confidently navigate the complexities of health insurance and select a plan that provides both financial protection and peace of mind.

Questions and Answers

What is a copay?

A copay is a fixed amount you pay for a covered healthcare service, such as a doctor’s visit, regardless of your deductible.

What is coinsurance?

Coinsurance is the percentage of costs you pay after you’ve met your deductible. For example, 80/20 coinsurance means your insurance pays 80% and you pay 20%.

What is an out-of-pocket maximum?

The out-of-pocket maximum is the most you’ll pay out-of-pocket in a year for covered services. Once you reach this limit, your insurance covers 100% of costs.

Can I change my health insurance plan during the year?

Generally, you can only change plans during open enrollment periods, unless you experience a qualifying life event (like marriage, job loss, or birth of a child).