Navigating the complexities of medical insurance can feel like deciphering a foreign language. However, understanding your potential costs is crucial for effective financial planning. This guide demystifies the process by exploring the functionality of medical insurance premium calculators, empowering you to make informed decisions about your healthcare coverage.

We will delve into the factors influencing premium calculations, providing a clear understanding of how age, location, health status, and pre-existing conditions impact the final cost. Furthermore, we’ll equip you with the knowledge to effectively utilize online calculators, interpret their results, and compare quotes from different providers. Ultimately, this guide aims to simplify the process, making it easier for you to choose the healthcare plan that best suits your individual needs and budget.

Understanding Medical Insurance Premium Calculators

Medical insurance premium calculators are valuable tools designed to provide individuals with an estimate of their monthly or annual healthcare costs. They simplify the complex process of understanding insurance pricing by offering a quick and convenient way to explore different plan options and their associated premiums. This understanding empowers consumers to make informed decisions about their healthcare coverage.

Understanding how these calculators function is key to effectively utilizing them. They work by taking various factors into account, processing them through algorithms to generate a premium estimate. The accuracy of the estimate depends heavily on the completeness and accuracy of the information provided.

Types of Medical Insurance Plans Accommodated

Premium calculators typically handle a range of common medical insurance plan types. These include, but are not limited to, Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Point of Service (POS) plans, and High Deductible Health Plans (HDHPs) with or without Health Savings Accounts (HSAs). Each plan type differs significantly in terms of cost, coverage, and network access. The calculator will usually provide a breakdown of the estimated costs for each plan type based on the user’s input.

Input Variables Used in Premium Calculations

Several key variables are used to calculate medical insurance premiums. These variables are crucial because they influence the level of risk associated with insuring a particular individual. The more accurately these variables reflect an individual’s circumstances, the more accurate the premium estimate will be.

| Variable | Data Type | Description | Example |

|---|---|---|---|

| Age | Integer | Age of the insured individual. | 35 |

| Location | String (Zip Code or Address) | Geographic location of the insured individual, influencing healthcare costs in the area. | 90210 |

| Health Status | Categorical (e.g., Excellent, Good, Fair, Poor) or Boolean (e.g., Pre-existing conditions, Smoking status) | Self-reported health status or presence of pre-existing conditions that might impact healthcare utilization. | Good health, Non-smoker |

| Tobacco Use | Boolean (Yes/No) | Indicates whether the individual uses tobacco products. This significantly impacts premiums due to increased health risks. | No |

| Family Size | Integer | Number of individuals covered under the plan. | 4 |

| Desired Plan Type | Categorical (HMO, PPO, POS, HDHP) | The type of insurance plan the user is interested in. | PPO |

| Deductible | Currency | The amount the insured must pay out-of-pocket before the insurance coverage begins. | $1000 |

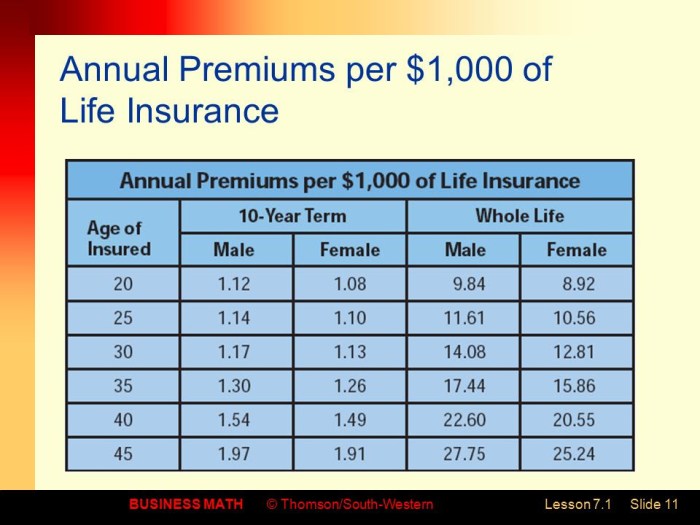

Visual Representation of Premium Costs

Understanding how medical insurance premiums are calculated is crucial for making informed decisions. A visual representation can significantly aid this understanding by clearly demonstrating the relationship between various factors and the resulting premium cost. Effective visualizations allow users to quickly grasp complex relationships, making the process of choosing a suitable plan more manageable.

Visual representations of premium costs often take the form of charts and graphs. These allow for a clear and concise depiction of how premiums change across different demographics and health profiles. The most effective visualizations utilize clear labeling and intuitive design to avoid confusion.

Scatter Plot Illustrating Premium Variation by Age and Health Status

A scatter plot is an ideal visual tool to demonstrate the interplay between age, health status, and premium costs. The horizontal axis (x-axis) would represent age, ranging from, for example, 18 to 65 years. The vertical axis (y-axis) would represent the annual premium cost, expressed in monetary units (e.g., US dollars). Each data point on the graph would represent an individual, with its horizontal position indicating the individual’s age and its vertical position indicating their annual premium. The size or color of the data point could further represent the individual’s self-reported health status (e.g., excellent, good, fair, poor), with larger or darker points indicating poorer health.

A clear trend is expected: a general upward trend in premium cost with increasing age, reflecting the higher risk of health issues associated with aging. Furthermore, individuals with poorer self-reported health status would likely be represented by data points higher on the y-axis, regardless of age, showcasing the impact of pre-existing conditions or health concerns on premium costs. The scatter plot would reveal the combined effect of age and health status on premium costs, potentially highlighting clusters of individuals with similar profiles and premium costs. A best-fit line or curve could be added to the scatter plot to visually represent the overall trend. A legend would clearly explain the meaning of point size or color in relation to health status. The title of the graph should be clear and concise, for example: “Impact of Age and Health Status on Annual Medical Insurance Premiums.”

Concluding Remarks

Securing affordable and comprehensive healthcare coverage is a significant financial decision. By understanding how medical insurance premium calculators work and the factors influencing premium costs, you can take control of your healthcare expenses. Remember, while these calculators offer valuable estimates, consulting with an insurance professional provides personalized guidance tailored to your unique circumstances, ensuring you make the best choice for your healthcare needs.

Essential FAQs

What happens if I enter inaccurate information into the calculator?

Inaccurate information will result in an inaccurate premium estimate. Ensure you provide accurate details for the most reliable results.

Can I use a medical insurance premium calculator if I have a pre-existing condition?

Yes, most calculators allow you to input information about pre-existing conditions, which will significantly affect your premium estimate.

Are the results from a medical insurance premium calculator guaranteed?

No, the results are estimates. The final premium may vary slightly depending on the specific insurer and policy details.

How often should I use a medical insurance premium calculator?

It’s advisable to use a calculator annually or whenever significant life changes occur (e.g., change in family size, job, or health status).