Navigating the world of health insurance can feel like deciphering a complex code, especially when it comes to understanding your monthly premium. This seemingly simple number is actually a reflection of numerous factors, from your age and location to the specific features of your chosen plan. Understanding these factors is crucial for making informed decisions and securing the best possible coverage for your needs and budget.

This guide will unravel the mysteries behind health insurance monthly premiums, providing a clear and concise explanation of the key elements that influence their cost. We’ll explore the impact of individual choices, plan features, and external factors, empowering you to confidently navigate the healthcare marketplace and find a plan that suits your circumstances.

Factors Influencing Monthly Premiums

Understanding the cost of your health insurance is crucial for effective financial planning. Several key factors significantly impact your monthly premium, making it essential to understand how these elements interact to determine your overall cost. This section will delve into the primary factors that influence your monthly health insurance bill.

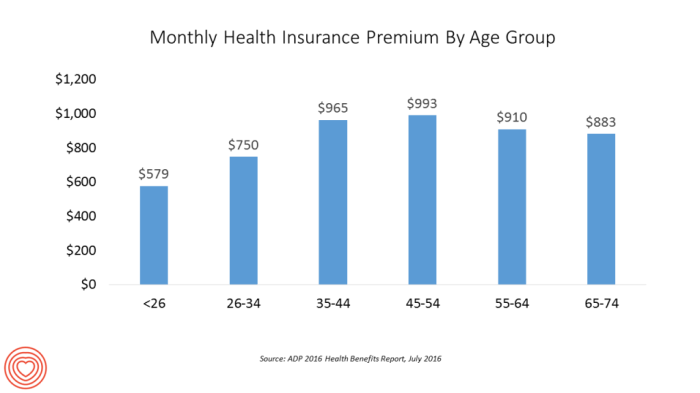

Age and Health Insurance Premiums

Age is a significant factor in determining health insurance premiums. Generally, older individuals tend to have higher premiums than younger individuals. This is because the likelihood of needing more extensive medical care increases with age. Insurance companies base their pricing models on actuarial data, which shows a strong correlation between age and healthcare utilization. For example, a 60-year-old might pay considerably more than a 30-year-old, reflecting the statistically higher risk of requiring more expensive treatments.

Geographic Location and Premium Costs

Your location plays a crucial role in determining your health insurance premium. The cost of healthcare varies considerably across different states and even within regions of a single state. Areas with a higher concentration of specialists, advanced medical facilities, and higher healthcare provider salaries tend to have higher premiums. For instance, someone living in a major metropolitan area with a high cost of living will likely pay more than someone living in a rural area with a lower cost of living. This disparity reflects the underlying expenses involved in providing healthcare services in different locations.

Comparison of Health Insurance Plan Premiums

Different types of health insurance plans, such as HMOs (Health Maintenance Organizations), PPOs (Preferred Provider Organizations), and POS (Point of Service) plans, offer varying levels of coverage and cost structures. HMO plans typically have lower premiums but require you to see doctors within their network. PPO plans generally offer higher premiums but provide more flexibility in choosing doctors, both in-network and out-of-network, albeit at a higher cost. POS plans offer a compromise, combining elements of both HMO and PPO plans. The specific premium for each plan type varies widely depending on the insurer, coverage level, and other factors. A comprehensive comparison of plans is crucial to find the best fit for individual needs and budget.

Pre-existing Conditions and Monthly Premiums

Under the Affordable Care Act (ACA), pre-existing conditions cannot be used to deny coverage or charge higher premiums. However, the impact of pre-existing conditions can still indirectly influence costs. While insurers cannot deny coverage, they may consider the severity and potential cost of managing a pre-existing condition when setting premiums for certain plans. For example, an individual with a chronic condition requiring ongoing medication and treatment might see a higher premium compared to someone without such conditions, although this is often factored into the broader risk pool and not directly based solely on the pre-existing condition itself.

Individual vs. Family Premium Costs

The following table compares average monthly premium costs for individual and family plans. Note that these are illustrative examples and actual costs vary significantly based on location, plan type, and other factors.

| Plan Type | Individual Premium (USD) | Family Premium (USD) | Difference (USD) |

|---|---|---|---|

| Bronze | 300 | 800 | 500 |

| Silver | 450 | 1200 | 750 |

| Gold | 600 | 1600 | 1000 |

| Platinum | 750 | 2000 | 1250 |

Understanding Plan Features and Costs

Choosing a health insurance plan involves understanding the intricate relationship between premiums and the plan’s features. The cost of your monthly premium is directly influenced by the level of coverage you select. This means making informed decisions about deductibles, co-pays, co-insurance, and out-of-pocket maximums is crucial to finding a plan that fits your budget and healthcare needs.

Deductible Amounts and Monthly Premiums

Higher deductibles generally correlate with lower monthly premiums. A deductible is the amount you pay out-of-pocket for covered healthcare services before your insurance begins to pay. For example, a plan with a $5,000 deductible means you’ll pay the first $5,000 of your medical expenses before your insurance coverage kicks in. Choosing a higher deductible shifts more of the financial responsibility to you upfront, resulting in lower monthly payments. Conversely, a lower deductible means a higher monthly premium but less out-of-pocket expense when you need care. The optimal balance depends on your individual risk tolerance and anticipated healthcare needs.

Co-pays, Co-insurance, and Out-of-Pocket Maximums

Co-pays are fixed amounts you pay for specific services, like doctor visits. Co-insurance is the percentage of costs you share with your insurer after you’ve met your deductible. The out-of-pocket maximum is the most you’ll pay out-of-pocket in a year; once this limit is reached, your insurance covers 100% of covered expenses. Plans with lower co-pays and co-insurance often have higher premiums. A high out-of-pocket maximum might mean lower premiums but potentially higher costs before your insurance fully covers expenses. For example, a plan with a low co-pay of $25 for a doctor’s visit but a high co-insurance of 40% after the deductible might result in higher overall costs compared to a plan with a higher co-pay but lower co-insurance. The out-of-pocket maximum provides a ceiling on your yearly healthcare expenses regardless of the co-pay and co-insurance percentages.

Prescription Drug Coverage and Premium Costs

Prescription drug coverage varies significantly between plans. Plans with comprehensive drug coverage, including access to brand-name medications and lower co-pays, typically come with higher premiums. Conversely, plans with limited formularies (lists of covered drugs) and higher co-pays for medications will usually have lower premiums. Consider your medication needs when selecting a plan. For instance, a person with multiple chronic conditions requiring expensive medications would likely benefit from a plan with extensive prescription drug coverage, even if it means a higher premium. Someone with minimal medication needs might find a plan with less comprehensive coverage more cost-effective.

Impact of Premium Plan Choices on Overall Healthcare Expenses

Choosing a higher premium plan often means lower out-of-pocket costs when you need care. A lower premium plan will result in lower monthly payments, but you may pay significantly more out-of-pocket if you require extensive healthcare services. For example, a healthy individual with minimal healthcare needs might prefer a high-deductible plan with a low premium, while someone with a chronic illness might find a higher-premium plan with lower out-of-pocket costs more beneficial. The best choice depends on individual circumstances, risk tolerance, and predicted healthcare utilization.

Strategies for Lowering Monthly Health Insurance Premiums

Lowering your monthly premiums often involves trade-offs. However, several strategies can help:

- Choose a higher deductible: Accepting more financial responsibility upfront reduces your monthly premium.

- Enroll in a plan with a higher co-pay or co-insurance: This shifts more cost-sharing to you in exchange for lower premiums.

- Consider a Health Savings Account (HSA): If eligible, contribute to an HSA to help pay for healthcare expenses tax-free and potentially lower your overall healthcare costs.

- Explore different plan networks: Plans with narrower networks (fewer doctors and hospitals) often have lower premiums.

- Compare plans carefully: Use online comparison tools and your employer’s benefits resources to find the best plan for your needs and budget.

Navigating the Health Insurance Marketplace

Finding the right health insurance plan can feel overwhelming, but understanding the process and available resources can make it significantly easier. This section guides you through navigating the health insurance marketplace to find a plan that suits your needs and budget.

Finding Affordable Health Insurance Plans

The key to finding affordable health insurance lies in a systematic approach. First, determine your eligibility for subsidies and tax credits (discussed in the next section). Then, utilize the HealthCare.gov website (or your state’s marketplace) to search for plans based on your location, income, and family size. Refine your search using filters for plan type (e.g., HMO, PPO), monthly premium, and deductible. Remember to compare plans from different providers, as prices and benefits can vary significantly. Finally, thoroughly review the details of each plan before making a selection.

The Role of Subsidies and Tax Credits

Subsidies and tax credits, offered through the Affordable Care Act (ACA), can significantly lower your monthly premium costs. Eligibility is based on your income and family size. These government programs help make health insurance more affordable for individuals and families who otherwise might struggle to afford coverage. The amount of financial assistance you receive is determined by a sliding scale, meaning higher incomes receive less assistance than lower incomes. For example, a family of four earning $60,000 annually might receive a substantial subsidy, reducing their monthly premium considerably, whereas a family earning $150,000 might receive little to no assistance. To determine your eligibility and the amount of financial assistance you may qualify for, use the online tools available on the HealthCare.gov website or your state’s marketplace.

Comparing Health Insurance Plans

Comparing plans involves more than just looking at the monthly premium. Consider the following factors: deductible (the amount you pay before insurance coverage begins), out-of-pocket maximum (the most you’ll pay out-of-pocket in a year), copay (the fixed amount you pay for a doctor’s visit), coinsurance (your share of costs after meeting your deductible), and the plan’s network of doctors and hospitals. Use the comparison tools provided by the marketplace to side-by-side compare plans based on these factors. Don’t hesitate to contact insurance providers directly with questions.

Understanding Plan Terms and Conditions

Health insurance plans use specific terminology. Understanding terms like “premium,” “deductible,” “copay,” “coinsurance,” “out-of-pocket maximum,” and “network” is crucial for making informed decisions. Each plan’s summary of benefits and coverage (SBC) provides a clear explanation of these terms and their implications for your costs. Review the SBC carefully and don’t hesitate to contact the insurance provider for clarification if needed. Paying attention to details like whether your preferred doctors are in-network is also vital.

Sample Health Insurance Plans

| Plan Name | Plan Type | Monthly Premium (Example Range) | Deductible (Example Range) |

|---|---|---|---|

| Silver Plan A | Silver | $300 – $500 | $3,000 – $6,000 |

| Bronze Plan B | Bronze | $200 – $400 | $6,000 – $12,000 |

| Gold Plan C | Gold | $400 – $700 | $1,500 – $3,000 |

| Catastrophic Plan D | Catastrophic | $150 – $300 | $7,900 – $8,150 |

*Note: These are example ranges and actual premiums will vary based on location, age, income, and other factors. Always check the marketplace for the most up-to-date information.*

Ultimate Conclusion

Ultimately, understanding your health insurance monthly premium isn’t just about the numbers; it’s about understanding your healthcare options and making financially responsible decisions. By carefully considering the factors discussed – age, location, plan type, coverage details, and employer contributions – you can effectively manage your healthcare costs and secure the best possible protection for yourself and your family. Remember to regularly review your plan and compare options to ensure you maintain optimal coverage while staying within your budget.

Commonly Asked Questions

What happens if I miss a health insurance premium payment?

Missing a payment can lead to your coverage being cancelled. Contact your insurer immediately if you anticipate difficulty making a payment to explore options like payment plans.

Can I change my health insurance plan during the year?

Generally, you can only change plans during open enrollment periods, unless you experience a qualifying life event (like marriage, job loss, or birth of a child).

How often do health insurance premiums change?

Premiums typically change annually, although they may adjust mid-year under certain circumstances, such as significant changes to your plan or health status.

What is a network provider?

A network provider is a doctor, hospital, or other healthcare facility that your health insurance plan has contracted with to provide services at a negotiated rate. Using in-network providers usually results in lower out-of-pocket costs.