Navigating the complexities of US tax law can feel like traversing a maze, especially when it comes to healthcare costs. Understanding whether your health insurance premiums are tax deductible is crucial for maximizing your tax return and ensuring financial well-being. This guide unravels the intricacies of health insurance premium deductibility, offering clarity for both the self-employed and those employed by a company. We’ll explore the rules, exceptions, and potential benefits, helping you confidently navigate this important aspect of personal finance.

The deductibility of health insurance premiums hinges on several factors, including your employment status, whether you itemize deductions, and the specifics of your health insurance plan. The Affordable Care Act (ACA) also plays a significant role, introducing tax credits and subsidies that can further impact your tax liability. This guide will provide a detailed analysis of these factors, offering practical examples and step-by-step guidance to help you determine your eligibility and accurately claim any applicable deductions.

Tax Deductibility Basics

Understanding the tax deductibility of medical expenses, including health insurance premiums, can significantly reduce your tax burden. This section Artikels the general rules and requirements for claiming these deductions in the United States. It’s crucial to remember that tax laws are complex and subject to change, so consulting a tax professional is always recommended for personalized advice.

Itemizing vs. Standard Deduction

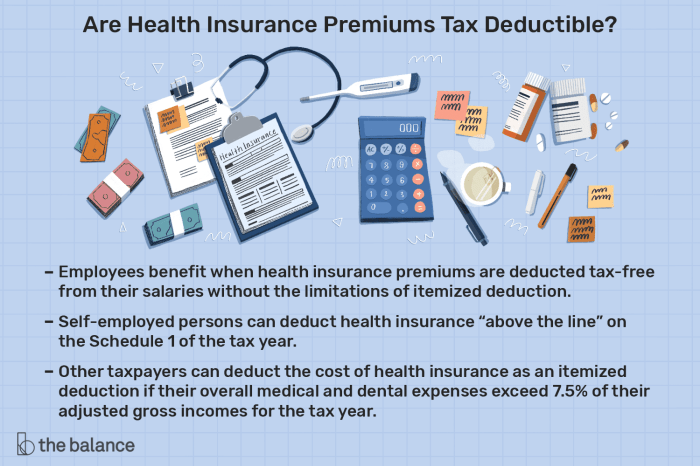

To deduct medical expenses, you must itemize on your tax return rather than taking the standard deduction. Itemizing means listing all your eligible deductions, including medical expenses, and subtracting the total from your gross income. If the total of your itemized deductions exceeds your standard deduction amount, itemizing will result in a lower taxable income. The standard deduction amount varies depending on your filing status and the tax year. You should compare the total of your itemized deductions, including medical expenses, against the standard deduction to determine the most advantageous approach.

Qualifying Medical Expenses

Beyond health insurance premiums, numerous other expenses qualify for medical deduction. These include doctor visits, hospital stays, prescription drugs, dental and vision care, and certain long-term care services. Specific requirements and limitations apply to each expense category. For example, deductible expenses generally include only amounts exceeding 7.5% of your adjusted gross income (AGI). This means you only deduct the portion of your medical expenses that surpass this 7.5% threshold. For instance, if your AGI is $50,000, you can only deduct medical expenses exceeding $3,750 ($50,000 x 0.075 = $3,750).

Tax Benefits: Self-Employed vs. Employed

Self-employed individuals and those employed by a company experience tax benefits differently concerning health insurance premiums. Self-employed individuals can deduct the entire amount of their health insurance premiums as a business expense, while employees can only deduct medical expenses, including premiums, if they itemize and exceed the 7.5% AGI threshold. This represents a significant tax advantage for the self-employed, as they can deduct the full cost regardless of the 7.5% AGI limitation.

Comparison of Tax Advantages Across Health Insurance Plans

The tax advantages of different health insurance plans vary based on several factors, including the plan’s cost and the individual’s income and medical expenses. The following table provides a simplified comparison:

| Health Insurance Plan Type | Premium Cost | Out-of-Pocket Maximum | Tax Deductibility (Self-Employed) | Tax Deductibility (Employed) |

|---|---|---|---|---|

| High Deductible Health Plan (HDHP) | Lower | Higher | Fully deductible | Partially deductible (above 7.5% AGI threshold) |

| Traditional Health Plan | Higher | Lower | Partially deductible (above 7.5% AGI threshold) | Partially deductible (above 7.5% AGI threshold) |

| Catastrophic Plan | Very Low | Very High | Partially deductible (above 7.5% AGI threshold) | Partially deductible (above 7.5% AGI threshold) |

Impact of the Affordable Care Act (ACA)

The Affordable Care Act (ACA), also known as Obamacare, significantly altered the landscape of health insurance in the United States, impacting not only access to coverage but also the tax implications for individuals and businesses. Its influence on the deductibility of health insurance premiums is a key area of change.

The ACA’s primary goal was to expand health insurance coverage. This expansion, however, had a complex interplay with existing tax laws concerning the deductibility of health insurance premiums. While the ACA didn’t directly change the *ability* to deduct premiums for self-employed individuals and those with employer-sponsored plans (in some cases), it introduced significant changes that indirectly affect the overall tax benefits.

ACA Tax Credits and Subsidies

The ACA introduced substantial tax credits and subsidies to make health insurance more affordable. These credits are based on income and are designed to lower the cost of monthly premiums for those who qualify. The availability of these credits, however, reduces the amount of premium expenses that are eligible for itemized deductions for those who itemize. This is because the tax credit effectively lowers the net cost of the insurance. For example, an individual receiving a $3,000 tax credit for health insurance premiums would only be able to deduct the remaining premium expense after the credit is applied.

ACA’s Impact on Tax Benefits Across Income Levels

The ACA’s influence on tax benefits varies significantly depending on income. High-income individuals generally won’t qualify for ACA subsidies and might continue to deduct premiums as they did before the ACA, subject to the limitations on itemized deductions. However, those with lower to moderate incomes, who benefit from substantial tax credits, will see a reduced deduction, if any, due to the credit already reducing their net premium costs. A family making $50,000 annually and receiving a large tax credit might find that their remaining out-of-pocket premium cost is too low to significantly impact their overall tax liability through itemization. In contrast, a family making $200,000 might see a similar tax benefit to pre-ACA scenarios.

ACA Implications for Self-Employed Individuals and Small Business Owners

Self-employed individuals and small business owners can often deduct the cost of their health insurance premiums. The ACA didn’t fundamentally alter this deduction, but it introduced the possibility of receiving tax credits through the health insurance marketplaces. This means that, similar to employees, the tax credit reduces the net cost of the insurance, potentially reducing the amount deductible. For example, a self-employed plumber paying $10,000 annually for health insurance and receiving a $2,000 tax credit can only deduct $8,000. The impact depends on the size of the tax credit they receive relative to their total premium costs.

Key ACA Provisions Related to Health Insurance Tax Deductions

| Provision | Description | Impact on Deductibility | Example |

|---|---|---|---|

| Tax Credits/Subsidies | Financial assistance to lower premium costs | Reduces deductible amount | $5,000 credit reduces $10,000 premium to $5,000 deductible amount. |

| Health Insurance Marketplaces | Online platforms for purchasing subsidized insurance | Indirect impact through subsidies | Access to subsidies changes the net cost of insurance, impacting deductibility. |

| Employer-Sponsored Insurance | Deductibility remains largely unchanged | Minimal direct impact | Employees can continue to deduct premiums, if applicable, under pre-ACA rules. |

| Self-Employed Deduction | Deduction for self-employed individuals’ health insurance premiums | Indirect impact through subsidies | Self-employed individuals can still deduct, but the amount is affected by received subsidies. |

Final Conclusion

Successfully navigating the landscape of health insurance premium deductibility requires careful consideration of your individual circumstances and a thorough understanding of applicable tax laws. While the process may seem intricate, this guide has provided a framework for understanding the key elements involved. By carefully reviewing your situation in light of the information presented, you can confidently assess your eligibility for deductions and accurately report your healthcare expenses on your tax return, potentially saving you money and reducing your overall tax burden. Remember to consult with a tax professional for personalized advice tailored to your specific situation.

FAQs

Can I deduct health insurance premiums if I’m covered under my spouse’s plan?

Generally, no. Deductions typically apply to premiums you pay directly.

What if I itemize but my medical expenses are less than the threshold for itemizing?

You cannot deduct health insurance premiums if your total medical expenses (including premiums) are less than the standard deduction amount.

Are dental and vision insurance premiums deductible?

Generally, these are considered medical expenses and may be deductible as part of your total medical expenses if you itemize, but not as a separate deduction for the premiums themselves.

Do I need to keep records of my health insurance premium payments?

Yes, absolutely. Maintain accurate records of premium payments as proof for tax purposes.

What form do I use to claim the self-employed health insurance deduction?

Form 1040, Schedule 1 (Additional Income and Adjustments to Income) and Form 8889 (Health Savings Accounts (HSAs)).