Securing affordable car insurance is a crucial financial decision for most drivers. Understanding the factors that influence your premium is key to making informed choices and potentially saving money. This guide delves into the complexities of calculating the average 6-month car insurance premium, exploring the various elements that contribute to the final cost and offering strategies to potentially lower your expenses. We’ll examine everything from your driving history and vehicle type to the coverage levels you choose and the insurer you select.

This exploration will equip you with the knowledge necessary to navigate the often-confusing world of car insurance pricing, allowing you to confidently compare options and secure the best possible coverage at a price that fits your budget. We’ll provide practical advice, clear explanations, and insightful comparisons to help you make informed decisions about your car insurance.

Factors Influencing Average 6-Month Car Insurance Premiums

Several key factors interact to determine the cost of your six-month car insurance premium. Understanding these factors can help you make informed decisions and potentially save money. This analysis will explore the major influences on premium calculations.

Driver Age and Insurance Premiums

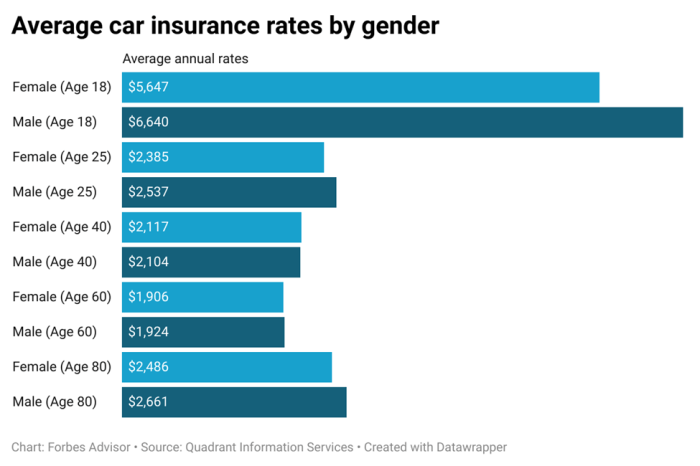

Younger drivers typically pay significantly higher premiums than older drivers. This is because statistically, younger drivers are involved in more accidents. Insurance companies assess risk based on historical data, and the higher accident rate among younger drivers translates to higher premiums. For example, a 16-year-old driver might pay three to four times more than a 30-year-old driver with a similar driving record and vehicle. As drivers age and gain experience, their premiums generally decrease, reaching their lowest point in the mid-to-late 50s before potentially rising slightly again in later years due to age-related health concerns.

Driving History’s Impact on Premiums

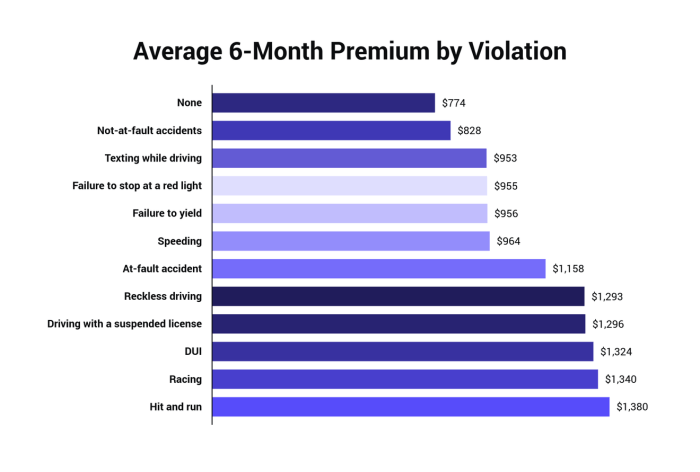

A clean driving record is crucial for maintaining low insurance premiums. Accidents and traffic violations significantly increase your risk profile in the eyes of insurance companies. A single at-fault accident can lead to a premium increase of 20-40%, while multiple accidents can result in even higher increases. Similarly, traffic violations like speeding tickets, reckless driving, or DUI convictions can dramatically raise your premiums. For instance, a DUI conviction can result in a premium increase of 50% or more, and may lead to difficulty obtaining insurance altogether.

Vehicle Type and Value’s Influence on Premiums

The type and value of your vehicle directly impact your insurance premium. More expensive vehicles generally cost more to insure due to higher repair costs and replacement value. The vehicle’s safety rating also plays a role; cars with better safety features may command lower premiums.

| Vehicle Type | Average 6-Month Premium (Example) | Factors Influencing Premium | Safety Rating Example |

|---|---|---|---|

| Sedan | $600 | Relatively low repair costs, common model | IIHS Top Safety Pick+ |

| SUV | $750 | Higher repair costs than sedans, larger size | IIHS Top Safety Pick |

| Truck | $850 | High repair costs, potential for higher accident risk | IIHS Top Safety Pick |

| Sports Car | $1200 | High repair costs, higher performance, higher risk | IIHS Top Safety Pick |

Geographic Location and Insurance Premiums

Insurance premiums vary significantly based on location, reflecting differences in accident rates, crime rates, and the cost of repairs in different regions. Urban areas with high traffic density and higher accident rates generally have higher premiums compared to rural areas. State regulations also influence premiums, with some states having stricter requirements and higher average costs. Even within a state, zip codes can influence premiums due to localized variations in risk factors. For example, coastal areas prone to hurricanes may have higher premiums than inland areas.

Coverage Levels and Premium Costs

The level of coverage you choose directly impacts your premium. Liability-only coverage is the cheapest, but it only protects others in case of an accident you cause. Adding collision and comprehensive coverage increases your premium but protects your vehicle against damage from accidents and other events like theft or vandalism.

- Liability Only: Lowest premium, but limited protection.

- Liability + Collision: Moderate premium, protects your vehicle in accidents.

- Liability + Collision + Comprehensive: Highest premium, full protection for various risks.

Comparison of Insurance Provider Premiums

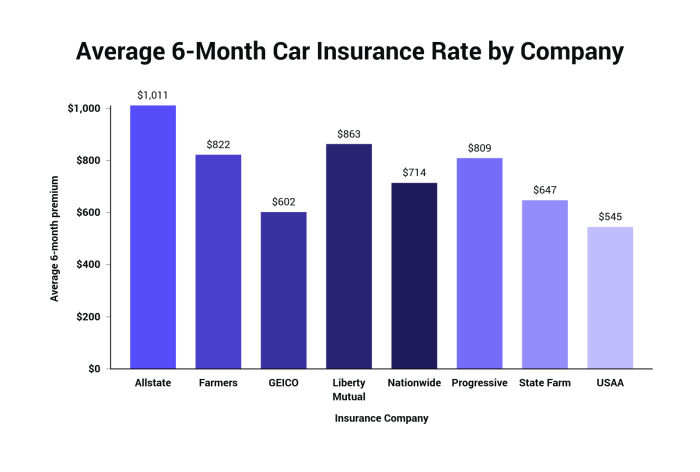

Choosing car insurance can feel overwhelming, with numerous providers offering various coverage options and price points. Understanding the differences in premiums and benefits offered by different insurers is crucial for making an informed decision. This section compares the average six-month premiums and coverage features of three major providers – fictionalized examples are used for illustrative purposes and do not represent actual quotes from specific companies. Remember that individual premiums vary greatly depending on numerous factors (discussed previously).

Average Six-Month Premium Comparison for Similar Driver Profiles

The following examples illustrate the potential variation in six-month premiums offered by three hypothetical insurance providers – Insurer A, Insurer B, and Insurer C – for a similar driver profile: a 35-year-old with a clean driving record, driving a mid-size sedan, living in a suburban area.

| Insurer | Coverage Type | Six-Month Premium (USD) | Deductible (USD) |

|---|---|---|---|

| Insurer A | Liability & Collision | $800 | $500 |

| Insurer B | Liability & Collision | $750 | $1000 |

| Insurer C | Liability & Collision | $900 | $250 |

Note that these are illustrative examples. Actual premiums will vary based on individual circumstances.

Coverage Options and Benefits for Similar Premiums

While Insurer A, B, and C offer similar premiums for basic liability and collision coverage, their specific coverage details and benefits may differ. For instance, Insurer A might offer roadside assistance as a standard feature, while Insurer B might include rental car reimbursement only as an add-on. Insurer C may have a more comprehensive coverage for specific types of damage, like hail damage, which may be an optional add-on for the others. Careful review of policy documents is essential to understand the nuances of coverage.

Discounts Offered by Different Providers

Many insurance providers offer discounts to incentivize safe driving and bundled services. The table below summarizes some common discounts offered by our hypothetical insurers.

| Insurer | Discount Type | Discount Percentage | Eligibility Requirements |

|---|---|---|---|

| Insurer A | Safe Driver | 15% | No accidents or violations in the past 3 years |

| Insurer A | Bundling (Home & Auto) | 10% | Bundling home and auto insurance |

| Insurer B | Safe Driver | 20% | No accidents or violations in the past 5 years |

| Insurer B | Good Student | 5% | Maintaining a high GPA |

| Insurer C | Anti-theft Device | 8% | Installation of an approved anti-theft device |

| Insurer C | Bundling (Home & Auto) | 12% | Bundling home and auto insurance |

Remember that specific discount eligibility criteria and percentages vary widely between providers and are subject to change. Always confirm details directly with the insurance provider.

Understanding Premium Calculation Methods

Car insurance premiums aren’t pulled from thin air; they’re the result of complex calculations based on a variety of factors. Insurance companies use sophisticated actuarial models to assess risk and determine the appropriate price for coverage. This process involves several key steps and considers a wide range of data.

Insurance companies employ several methods to calculate premiums, but a common approach involves a multi-step process that incorporates risk assessment and actuarial data. This process balances the need to cover potential payouts with the desire to offer competitive pricing.

Actuarial Data and Premium Setting

Actuarial data plays a crucial role in setting premiums. This data, collected and analyzed by actuaries, provides statistical insights into accident rates, claim costs, and other relevant factors. Specific data points significantly influence the final premium. For example, data on the frequency of accidents involving specific car models helps insurers assess the inherent risk associated with those vehicles. Similarly, data on the average cost of repairs for different types of damage informs the estimation of potential claim payouts. A higher accident rate for a particular demographic group (e.g., young drivers) will result in higher premiums for that group, reflecting the increased likelihood of claims. Data on geographic location, reflecting factors such as traffic density and crime rates, also contributes significantly to premium calculation. For instance, areas with high rates of theft will likely result in higher premiums due to the increased risk of stolen vehicle claims.

Risk Assessment and Premium Determination

Risk assessment is the core of premium calculation. Insurers use various factors to evaluate the risk associated with insuring a particular driver and vehicle. This involves analyzing a combination of factors, each contributing to the overall risk profile and, consequently, the premium. A text-based illustration can effectively represent this:

Imagine a pyramid. At the base are broad factors influencing many drivers, like location (urban areas often have higher premiums due to increased accident frequency) and vehicle type (sports cars often cost more to insure than sedans). The next level includes driver-specific factors like age (younger drivers statistically have more accidents), driving history (accidents and violations increase premiums), and credit score (a poor credit score can indicate higher risk). At the very top is a smaller section representing unique circumstances, such as the driver’s occupation (high-risk occupations might lead to higher premiums) or the specific coverage options chosen (more comprehensive coverage naturally costs more). The size of each section visually represents the weight of its influence on the final premium. A driver with many high-risk factors (large sections in the pyramid) will pay a significantly higher premium than a driver with fewer risk factors (smaller sections).

A Step-by-Step Premium Calculation Example

Let’s illustrate a simplified example. Assume a base premium of $500.

1. Base Rate: The insurer starts with a base rate reflecting the average cost of insuring a similar vehicle in a similar area.

2. Vehicle Factors: A sports car might add 20% ($100) to the base rate due to higher repair costs and theft risk.

3. Driver Factors: A young driver with a history of accidents could add another 30% ($150) due to increased risk.

4. Location Factors: Living in a high-crime area might add 10% ($50) to the premium.

5. Coverage Level: Choosing comprehensive coverage instead of liability-only might add 15% ($75).

6. Discounts: Good driving record discounts, bundled insurance discounts, or safe driver discounts might reduce the premium. Let’s assume a 5% discount ($37.50).

7. Final Premium: Adding all factors and subtracting the discount results in a final premium of $500 + $100 + $150 + $50 + $75 – $37.50 = $837.50. This is a simplified illustration, and actual calculations are far more complex, involving numerous variables and statistical models.

Strategies for Reducing 6-Month Car Insurance Premiums

Lowering your car insurance premiums can significantly impact your budget. Several effective strategies exist, allowing you to maintain adequate coverage while saving money. By understanding these strategies and actively implementing them, you can potentially reduce your six-month premium considerably.

Effective Strategies for Premium Reduction

Implementing specific lifestyle changes and making informed choices regarding your insurance policy can lead to significant savings. These strategies are not mutually exclusive; combining several can yield even greater reductions.

- Improve Your Driving Record: Maintaining a clean driving record is paramount. Avoid speeding tickets, accidents, and traffic violations. Insurance companies heavily weigh driving history when calculating premiums. A single accident can dramatically increase your rates for several years. Defensive driving courses can also sometimes result in discounts.

- Bundle Your Insurance Policies: Many insurance companies offer discounts for bundling multiple policies, such as home and auto insurance, under a single provider. This can lead to considerable savings compared to purchasing separate policies from different companies.

- Shop Around and Compare Quotes: Don’t settle for the first quote you receive. Compare quotes from multiple insurers to find the best rates for your needs. Utilize online comparison tools to streamline this process (discussed in the next section).

- Choose a Higher Deductible: Opting for a higher deductible means you pay more out-of-pocket in the event of a claim, but it will lower your premiums. Carefully weigh the potential cost of a higher deductible against the premium savings.

- Consider Less Comprehensive Coverage: Evaluate your coverage needs. If you have an older vehicle, dropping collision and comprehensive coverage might be a cost-effective option. Liability coverage remains essential, however.

- Maintain a Good Credit Score: In many states, your credit score influences your insurance premium. Improving your credit score can positively impact your rates. This is because insurance companies view a good credit score as an indicator of responsible behavior.

- Install Anti-theft Devices: Installing anti-theft devices, such as alarms or tracking systems, can qualify you for discounts with some insurers. These devices deter theft, reducing the insurer’s risk.

Comparison of Insurance Provider Premium Comparison Tools

Several online tools facilitate comparison shopping for car insurance. Each tool offers different features and levels of detail. Three popular options are:

- The Zebra: The Zebra aggregates quotes from numerous insurers, allowing for easy side-by-side comparisons. It provides a comprehensive overview of coverage options and pricing.

- NerdWallet: NerdWallet offers detailed reviews and comparisons of various insurance providers, along with tools to help you find the best rates. It goes beyond simple quote comparison, providing insightful analysis.

- Insurance.com: Insurance.com presents a straightforward comparison platform with a user-friendly interface. While not as feature-rich as some competitors, its simplicity is beneficial for those seeking a quick overview.

Cost-Benefit Analysis of Different Deductible Amounts

Increasing your deductible lowers your premium, but you pay more out-of-pocket if you file a claim. The following table illustrates a potential cost-benefit analysis:

| Deductible Amount | Estimated 6-Month Premium | Potential Out-of-Pocket Cost (Minor Accident) | Potential Out-of-Pocket Cost (Major Accident) |

|---|---|---|---|

| $250 | $800 | $250 | $250 + Repair Costs |

| $500 | $750 | $500 | $500 + Repair Costs |

| $1000 | $700 | $1000 | $1000 + Repair Costs |

| $2000 | $650 | $2000 | $2000 + Repair Costs |

Final Summary

Ultimately, determining your average 6-month car insurance premium involves a multifaceted assessment of risk and individual circumstances. By understanding the factors influencing premiums and employing effective cost-saving strategies, you can gain control over your insurance expenses. Remember that diligent comparison shopping and a thorough understanding of your policy’s coverage are essential for securing the best possible value for your investment. Proactive measures, such as maintaining a clean driving record and choosing appropriate coverage levels, can significantly contribute to long-term cost savings.

FAQ Insights

What is the average 6-month car insurance premium across the US?

There’s no single “average” due to significant regional and individual variations. Factors like age, driving record, vehicle type, and coverage levels heavily influence the final cost. However, estimates can range widely, from a few hundred to over a thousand dollars.

Can I pay my car insurance in installments?

Most insurers offer payment plans, allowing you to split your premium into monthly or quarterly installments. Check with your provider for specific options and any associated fees.

How often are car insurance premiums reviewed?

Premium reviews vary by insurer and policy type. Some insurers review annually, while others may do so more frequently based on factors like driving record changes or claims.

What happens if I move to a new state?

You’ll likely need to update your insurance policy to reflect your new address. Rates vary significantly by state, so expect a change in your premium. Contact your insurer to discuss this.