Navigating the world of life insurance can feel overwhelming, especially when faced with the diverse range of policies available. One key factor to consider is premium flexibility – the ability to adjust your payments over time. This guide explores the different types of life insurance that offer this crucial adaptability, empowering you to make informed decisions aligned with your evolving financial circumstances.

Understanding premium flexibility is paramount for securing your financial future. Whether you’re anticipating periods of fluctuating income or seeking greater control over your insurance costs, flexible premium options provide a degree of financial maneuverability that fixed-premium policies often lack. We’ll delve into the mechanics of these policies, comparing their advantages and disadvantages to help you choose the best fit for your individual needs.

Introduction to Life Insurance Premium Flexibility

Life insurance with flexible premiums offers policyholders the ability to adjust their premium payments over time, providing greater control and adaptability to changing financial circumstances. Unlike fixed premium policies where payments remain constant throughout the policy’s duration, flexible premium options allow for higher or lower payments within specified limits, depending on the policy’s terms and the insurer’s guidelines. This flexibility can be a valuable tool for managing personal finances and ensuring life insurance coverage remains in place even during periods of financial strain.

Flexible premium life insurance policies typically allow for adjustments to premium payments within a range defined by the policy. This range is usually determined by factors such as the policy’s cash value, the death benefit, and the policyholder’s age. For example, a policyholder might be able to pay a higher premium in years of higher income to build up cash value more quickly, or reduce premiums during times of financial difficulty, potentially impacting the policy’s cash value accumulation and the length of time the policy remains in force.

Benefits of Flexible Premium Life Insurance

Flexible premium life insurance offers several advantages compared to its fixed-premium counterpart. The primary benefit is the adaptability to changing financial situations. During periods of financial prosperity, policyholders can contribute higher premiums to accelerate cash value growth, potentially leading to higher future payouts or a longer period of coverage. Conversely, during leaner times, they can lower their premiums to align with their reduced income, maintaining some coverage even if they can’t afford the standard fixed premium. This adaptability reduces the risk of policy lapse due to unforeseen financial hardships. Furthermore, the ability to adjust premiums can offer increased financial flexibility for other goals and priorities.

Drawbacks of Flexible Premium Life Insurance

While offering considerable flexibility, flexible premium life insurance also presents certain disadvantages. The primary concern is the potential for insufficient premium payments. If premiums are consistently lower than the minimum required to maintain the policy, the cash value may decline, and the policy could lapse. This outcome would mean a loss of coverage. Furthermore, while flexibility exists, it’s usually bounded by policy terms and insurer regulations, so adjustments are not unlimited. The potential for lower cash value accumulation compared to consistently high premium payments is another factor to consider. Finally, flexible premium policies often have higher fees and charges compared to fixed premium policies, partially offsetting some of the potential benefits of flexible premium payment.

Situations Where Flexible Premiums Are Beneficial

Flexible premiums are particularly advantageous in situations where income fluctuates significantly, such as self-employment or commission-based work. For example, a freelancer experiencing a particularly successful quarter might opt to pay a higher premium to bolster their policy’s cash value. Conversely, if business slows down, they can adjust their premium payments downward to avoid policy lapse. Similarly, individuals experiencing unexpected financial challenges, such as job loss or medical expenses, can temporarily reduce their premium payments to manage their cash flow while still retaining some level of insurance coverage. This flexibility offers a crucial safety net during periods of financial uncertainty.

Types of Life Insurance with Flexible Premiums

Life insurance policies offering flexible premium structures provide policyholders with greater control over their payments, allowing them to adjust contributions based on their financial circumstances. This flexibility can be particularly beneficial during periods of financial uncertainty or when unexpected expenses arise. Understanding the nuances of these policies is crucial for making informed decisions about financial security.

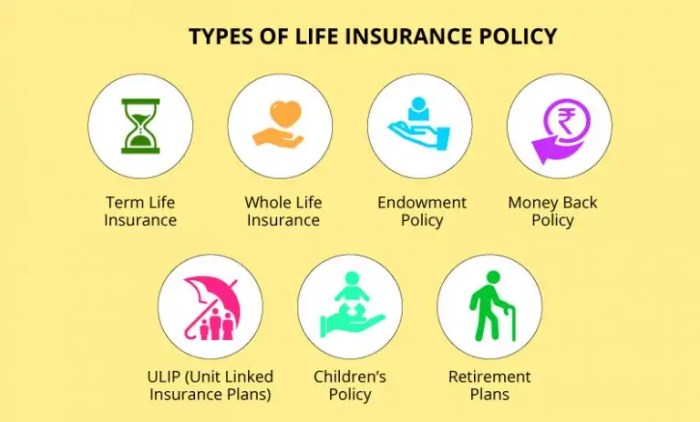

Several types of life insurance allow for flexible premium payments. The most prominent are universal life (UL), variable universal life (VUL), and indexed universal life (IUL) insurance. Each offers varying degrees of flexibility and investment options.

Universal Life (UL) Insurance and Premium Flexibility

Universal life insurance provides a death benefit alongside a cash value component that grows tax-deferred. A key feature of UL policies is the ability to adjust premiums within certain limits, usually specified in the policy contract. Policyholders can increase or decrease their premiums, provided they maintain a minimum premium to keep the policy active and the death benefit in force. This flexibility allows for greater financial adaptability, although failing to meet the minimum premium requirements can lead to policy lapse or reduced death benefit. The cash value component of the policy fluctuates based on the insurer’s declared interest rate, which is generally tied to current market conditions, but is typically lower than market returns.

Variable Universal Life (VUL) Insurance and Premium Flexibility

Variable universal life insurance shares the flexible premium structure of UL policies but introduces an investment component. Policyholders can allocate their premiums among various sub-accounts, typically investing in mutual funds with different levels of risk and potential return. This allows for greater control over the growth of the cash value, but it also carries greater investment risk. Premiums can be adjusted similarly to UL policies, with a minimum premium requirement to maintain the policy’s active status. However, fluctuations in market performance directly impact the cash value growth, which can affect the death benefit depending on the policy structure. The higher potential returns are balanced by a higher level of risk compared to UL policies.

Indexed Universal Life (IUL) Insurance and Adjustable Premiums

Indexed universal life insurance combines the flexible premium structure of UL policies with an investment component linked to a market index, such as the S&P 500. This approach aims to provide growth potential tied to market performance while limiting downside risk. Premiums are adjustable, similar to UL and VUL policies, with a minimum premium required to keep the policy active. The cash value growth is typically capped at a predetermined rate, protecting against significant losses while still offering participation in market gains. This approach offers a balance between the risk and return characteristics of UL and VUL policies. For example, an IUL policy might offer a participation rate of 90% of the index’s growth, meaning if the index increases by 10%, the cash value would grow by 9%.

Other Life Insurance Products with Premium Flexibility

While UL, VUL, and IUL are the most common types with flexible premiums, some other life insurance products may offer limited flexibility. Certain whole life policies, for instance, might allow for premium adjustments within a defined range or under specific circumstances, such as a temporary decrease due to unforeseen hardship. However, the level of flexibility is generally more restricted compared to the policies discussed above. Always review the specific policy contract to understand the extent of premium adjustment allowed.

Factors Affecting Premium Flexibility

The level of flexibility offered in life insurance premiums isn’t uniform; it depends on a complex interplay of factors related to both the insured individual and the insurance company’s policies. Understanding these factors is crucial for making informed decisions about choosing a policy that aligns with your financial circumstances and risk profile. This section will explore the key elements influencing premium flexibility.

The interplay between the insured’s characteristics and the insurer’s guidelines significantly shapes the degree of premium adjustment available. This interaction determines the scope for modifying premium payments over the policy’s lifespan, allowing for greater financial adaptability.

Insured’s Age, Health, and Financial Situation

An individual’s age, health status, and financial stability directly impact the insurer’s assessment of risk and, consequently, the flexibility offered in premium adjustments. Younger, healthier individuals typically present a lower risk profile, potentially enabling greater flexibility in premium payments. Conversely, older individuals or those with pre-existing health conditions might face stricter limitations on premium adjustments. Financial stability also plays a role; insurers might be more willing to offer flexibility to individuals demonstrating a consistent and reliable income stream. For example, a policyholder experiencing a temporary financial hardship might negotiate a reduced premium payment for a limited period, provided their long-term financial prospects remain sound. Conversely, a sudden, significant increase in income might allow for accelerated premium payments or an increase in coverage.

Insurance Company Underwriting Guidelines

Insurance companies employ underwriting guidelines to assess risk and determine the terms of insurance policies, including premium flexibility. These guidelines are based on actuarial data and risk models that consider factors like age, health, lifestyle, and occupation. Stricter underwriting guidelines may limit the extent to which premiums can be adjusted. For instance, a company with a conservative underwriting approach might offer less flexibility than one with a more lenient approach. The specific terms and conditions governing premium adjustments will be Artikeld in the policy document. These guidelines ensure the financial stability of the insurance company while providing a fair and consistent approach to premium adjustments across all policyholders.

Scenarios Requiring Premium Adjustments and Associated Implications

Understanding potential scenarios where premium adjustments might be necessary is vital. These adjustments can significantly impact both the policyholder and the insurance company.

- Job Loss or Reduced Income: A significant decrease in income might necessitate a temporary reduction in premium payments. This could involve negotiating a lower payment amount or temporarily suspending payments, potentially leading to a decrease in coverage or policy lapse if not managed properly.

- Unexpected Medical Expenses: Significant medical expenses can strain finances, potentially requiring a temporary reduction in premium payments. Similar to job loss, this could impact coverage or lead to policy lapse without proper communication and negotiation with the insurer.

- Significant Financial Gains: An increase in income might allow for increased premium payments, potentially accelerating the policy’s cash value growth or increasing the death benefit. This could lead to greater financial security and faster accumulation of policy benefits.

- Changes in Health Status: A significant change in health, such as developing a pre-existing condition, might affect future premium adjustments. The insurer might reassess the risk and adjust premiums accordingly, potentially increasing them or limiting flexibility in future adjustments.

Closing Notes

Choosing the right life insurance policy is a significant financial decision, and understanding premium flexibility is a critical component of that process. While flexible premium options offer valuable adaptability, it’s crucial to carefully weigh the potential benefits against the inherent risks associated with variable payments. By understanding the mechanics of different policy types, considering your personal financial situation, and engaging in thorough discussions with your insurance agent, you can confidently select a policy that provides the security and flexibility you need.

FAQ

What happens if I consistently pay lower than the minimum premium on a flexible premium policy?

Consistent underpayment may lead to a reduction in your policy’s cash value, potentially impacting the death benefit or even causing the policy to lapse.

Can I increase my premiums at any time on a flexible premium policy?

Generally, yes, but there may be limits on how much you can increase at once. Check your policy’s specific terms and conditions.

Are there tax implications associated with flexible premium life insurance?

Yes, the tax implications can be complex and vary depending on the policy type and how you utilize its features. Consult a tax professional for personalized advice.

What are the potential downsides of choosing a flexible premium life insurance policy?

The main downside is the risk of underpaying premiums and causing the policy to lapse. It also requires more diligent financial planning and monitoring.