Navigating the complexities of tax season can feel daunting, but understanding how to leverage deductions can significantly impact your financial well-being. This guide delves into the often-overlooked world of insurance premium deduction, explaining how various insurance premiums can reduce your taxable income and ultimately boost your savings. We’ll explore eligibility criteria, documentation requirements, and common pitfalls to ensure you’re maximizing your tax benefits.

From health and life insurance to other eligible types, we’ll clarify which premiums qualify for deduction and how to correctly claim them. We aim to demystify the process, providing clear examples and practical strategies to help you confidently navigate the tax landscape and secure your rightful deductions.

Tax Benefits of Insurance Premium Deduction

Insurance premium deductions offer significant tax advantages by reducing your taxable income. This ultimately lowers your overall tax liability, putting more money back in your pocket. The extent of these savings depends on several factors, including your tax bracket and the types of insurance premiums you’re deducting.

The fundamental principle is that eligible insurance premiums paid are considered allowable deductions. This means they are subtracted from your gross income before your taxable income is calculated. The lower your taxable income, the lower your tax bill. This benefit is particularly advantageous for individuals in higher tax brackets, as the tax savings are proportionally greater.

Examples of Insurance Premium Deductions Reducing Taxable Income

Let’s illustrate with a couple of scenarios. Assume a taxpayer in the 22% tax bracket pays $2,000 annually in health insurance premiums. This $2,000 deduction reduces their taxable income by the same amount. If their tax liability without the deduction was $5,000, their new tax liability would be $5,000 – ($2,000 * 0.22) = $4,560. This represents a $440 tax saving. For a taxpayer in the 32% tax bracket with the same premium, the savings would be $640 ($2,000 * 0.32). This clearly shows the higher the tax bracket, the greater the tax benefit. Another example could involve life insurance premiums, where deductibility may be limited to certain situations, such as those linked to business purposes. The specific rules vary by jurisdiction and insurance type.

Tax Benefits Across Different Tax Brackets

The tax savings from insurance premium deductions are directly proportional to the taxpayer’s marginal tax rate. A higher tax bracket means a larger percentage of the deduction is saved in taxes. Consider the following table illustrating this:

| Tax Bracket | Marginal Tax Rate | $2,000 Premium Deduction Savings |

|---|---|---|

| 10% | 10% | $200 |

| 12% | 12% | $240 |

| 22% | 22% | $440 |

| 32% | 32% | $640 |

This table demonstrates that the tax benefit increases linearly with the tax bracket. It’s crucial to remember that these are simplified examples and the actual tax savings may vary based on individual circumstances and applicable tax laws.

Step-by-Step Guide to Claiming Insurance Premium Deductions

Claiming your insurance premium deductions involves a straightforward process.

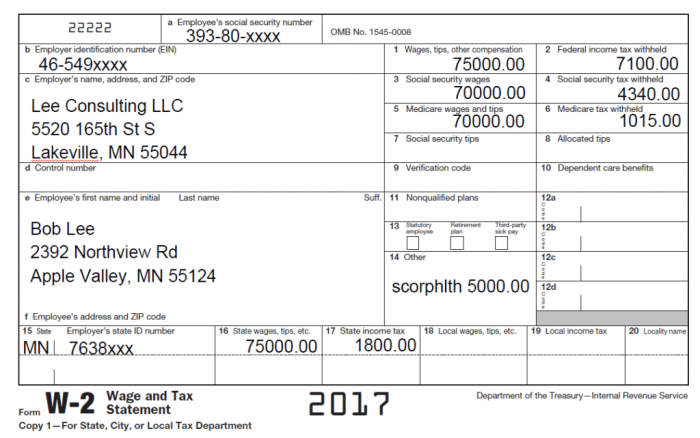

- Gather necessary documentation: Collect all your insurance premium payment receipts, statements, and policy details for the tax year.

- Identify eligible premiums: Determine which insurance premiums are deductible according to your tax jurisdiction’s rules. Not all insurance premiums qualify for deduction.

- Complete your tax return: Input the total amount of your eligible insurance premium deductions on the relevant section of your tax form. The specific form and section will vary depending on your location and the type of insurance.

- Review and file: Carefully review your completed tax return before submitting it to ensure accuracy. Filing deadlines must be adhered to.

Remember to consult with a tax professional if you have any questions or uncertainties about claiming your insurance premium deductions. They can provide personalized guidance based on your specific circumstances.

Types of Insurance Covered Under Deduction

Understanding which insurance premiums qualify for tax deductions is crucial for maximizing your tax savings. The eligibility and limitations vary depending on the type of insurance and the specific tax laws of your jurisdiction. Always consult the relevant tax regulations and potentially a tax professional for personalized guidance.

The following sections detail the common types of insurance premiums that may be eligible for tax deductions, along with their associated limitations and potential disallowances.

Health Insurance Premiums

Health insurance premiums are often deductible, offering significant tax relief for individuals and families. However, the deductibility depends on factors like the type of plan (e.g., employer-sponsored, self-employed), the applicable tax laws, and whether you itemize or take the standard deduction. For example, self-employed individuals may be able to deduct the full amount of their health insurance premiums, while those with employer-sponsored plans might have different rules based on their employer’s contribution. Deductions may be limited by the adjusted gross income (AGI) thresholds set by the tax authority. A situation where a deduction might be disallowed is if the premiums were paid for someone not considered a dependent as defined by tax law.

Life Insurance Premiums

Deductibility of life insurance premiums is generally limited. While premiums for life insurance policies are typically not deductible, there are exceptions. For instance, certain life insurance policies purchased as part of a business arrangement may have deductible premiums under specific circumstances. These circumstances are often complex and require careful examination of the policy’s terms and applicable tax regulations. For example, premiums paid on a key-person life insurance policy, which is designed to protect a business against the financial loss from the death of a key employee, might be deductible as a business expense. However, a deduction may be disallowed if the policy is primarily for personal benefit rather than a legitimate business purpose.

Disability Insurance Premiums

Premiums for disability insurance can often be deducted, but again, the rules vary. Self-employed individuals may be able to deduct the premiums paid for disability insurance as a business expense, similar to health insurance. However, deductibility might be limited depending on the type of disability insurance policy and the specific regulations. For example, if a disability policy is designed to replace lost income due to an injury incurred on the job, it might be treated differently than a policy covering disability from any cause. A deduction might be disallowed if the disability insurance policy is primarily a personal savings plan rather than true income replacement coverage.

Homeowner’s and Renter’s Insurance Premiums

These premiums are generally not deductible as itemized deductions on your tax return. However, certain types of losses covered by these policies may be deductible as casualty or theft losses if they meet specific requirements. For example, if your home suffers damage from a fire or other covered event, you may be able to deduct the unreimbursed losses. A deduction would be disallowed if the loss was due to normal wear and tear or a lack of proper maintenance.

Documentation and Proof Required

To successfully claim a deduction for insurance premiums, you must provide adequate documentation to support your claim. This documentation serves as proof of payment and eligibility for the deduction, ensuring the accuracy and legitimacy of your tax return. Failing to provide the necessary documentation or submitting inaccurate information can lead to delays in processing your return or even penalties.

Proper documentation and record-keeping are crucial for a smooth tax filing process. Maintaining organized records simplifies the process significantly and reduces the risk of errors or omissions. It’s essential to understand what documents are required and how to obtain and preserve them correctly.

Required Insurance Premium Documentation

The specific documents required may vary slightly depending on the type of insurance and the tax jurisdiction, but generally, you will need proof of payment and details of the insurance policy. This typically includes the insurance premium receipt, policy documents, and potentially other supporting evidence.

Obtaining and Maintaining Documentation

Obtain your insurance premium receipts immediately after making a payment. Keep all policy documents, including the insurance policy itself, in a safe and organized place. Consider using a filing system, either physical or digital, to maintain your documents. A well-organized system allows for easy retrieval when needed. For digital records, consider using cloud storage services or secure hard drives for backup purposes.

Consequences of Incomplete or Inaccurate Documentation

Submitting incomplete or inaccurate documentation can result in delays in processing your tax return. The tax authorities may request additional information, delaying your refund or potentially leading to an audit. In some cases, submitting fraudulent documentation can lead to significant penalties and legal repercussions. Accuracy and completeness are paramount.

Checklist of Required Documents

| Document Type | Description | Source | Notes |

|---|---|---|---|

| Insurance Premium Receipt | Proof of payment for the insurance premium. | Insurance company | Should clearly show the date of payment, amount paid, and policy number. |

| Insurance Policy | The official insurance policy document. | Insurance company | Contains details about coverage, policy terms, and the insured individual. |

| Form 16 | Tax deduction certificate issued by the insurance company (if applicable). | Insurance company | Provides details of the premium paid and eligible for deduction. |

| Bank Statement | Statement showing the payment of insurance premiums. | Bank | Useful as supporting evidence if receipts are unavailable. |

Concluding Remarks

Successfully claiming insurance premium deductions can lead to substantial long-term financial gains. By understanding the eligibility criteria, gathering necessary documentation, and avoiding common mistakes, you can effectively reduce your tax liability and improve your overall financial planning. Remember, proactive financial management is key, and this guide provides a solid foundation for maximizing your tax savings through insurance premium deductions. Take control of your finances and unlock the potential benefits today.

Frequently Asked Questions

What happens if I accidentally omit an insurance premium deduction on my tax return?

You can usually file an amended tax return to claim the deduction. However, there may be time limits, so it’s best to act promptly.

Are there any income limits for claiming insurance premium deductions?

Income limits vary depending on the type of insurance and your location. Consult your country’s tax regulations for specific details.

Can I deduct premiums for pet insurance?

Generally, pet insurance premiums are not deductible for federal income tax purposes in most countries.

What if my insurance provider doesn’t provide the necessary documentation?

Contact your insurance provider immediately to request the required documentation. Keep detailed records of your communication.