Premium finance insurance offers a unique approach to managing the cost of insurance premiums, particularly for larger policies. Instead of a single, potentially burdensome payment, it allows businesses and individuals to spread the cost over time through affordable installments. This method can significantly impact cash flow, providing financial flexibility for various insurance needs.

This guide delves into the intricacies of premium finance insurance, examining its benefits and drawbacks, the process of securing financing, and the regulatory landscape. We’ll explore real-world scenarios, highlighting both successful applications and potential pitfalls, to provide a comprehensive understanding of this increasingly popular financial tool.

What is Premium Finance Insurance?

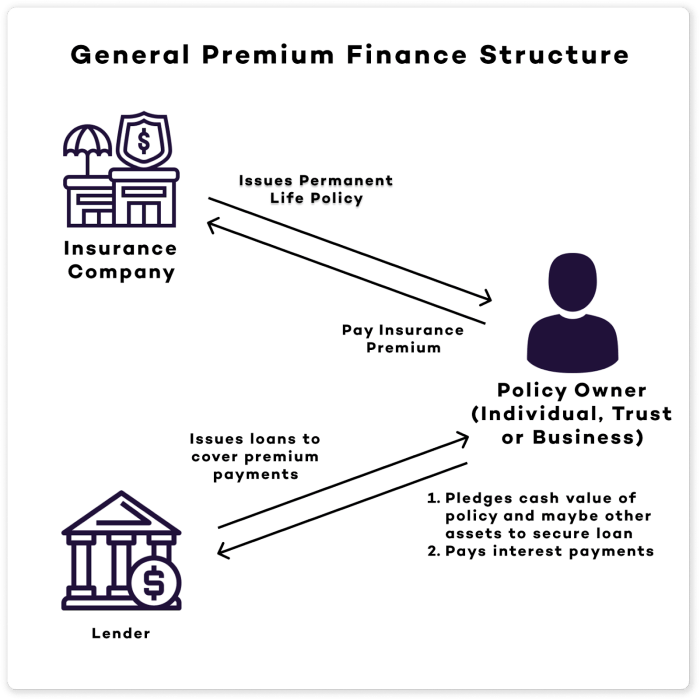

Premium finance is a financial service that allows businesses and individuals to pay for their insurance premiums over time, instead of making a single, large upfront payment. It essentially acts as a loan specifically designed to cover insurance costs, offering a more manageable payment schedule.

Premium finance differs from traditional insurance payment methods, such as paying annually, semi-annually, or quarterly, by providing a longer repayment term, typically broken down into monthly installments. Traditional methods require a significant upfront capital outlay, while premium finance spreads the cost over a period of time, making it more accessible for larger insurance policies.

Insurance Types Typically Financed

Premium finance is frequently used for various insurance types where premiums are substantial. This method is particularly common for larger commercial policies, but also applies to individual high-value insurance.

- Life Insurance: Large life insurance policies, often those with significant death benefits, are frequently financed through premium finance arrangements.

- Commercial Property Insurance: Businesses with extensive property holdings often utilize premium finance to manage the cost of their insurance premiums.

- Key Person Insurance: Businesses insuring key employees often opt for premium finance to handle the considerable premiums involved.

- Commercial Auto Insurance: Companies with large fleets of vehicles may find premium finance a beneficial option.

Securing Premium Finance: The Customer Process

The process of securing premium finance generally involves several key steps. First, the customer identifies their insurance needs and obtains a quote. Then, they apply for premium finance through a lender or broker specializing in this service. This application typically involves providing financial information and undergoing a credit check. Once approved, the lender pays the insurance premium directly to the insurance company, and the customer then makes regular payments to the lender according to the agreed-upon schedule. The repayment schedule, interest rates, and other terms are clearly Artikeld in the finance agreement. The entire process is streamlined to minimize inconvenience for the customer.

Benefits of Premium Finance Insurance

Premium finance offers a compelling solution for managing the cost of insurance premiums, providing significant advantages for both businesses and individuals. By spreading the cost over time, it improves cash flow and allows for the purchase of larger insurance policies that might otherwise be financially inaccessible. This section will explore the specific benefits for different user groups and compare premium finance to alternative payment methods.

Advantages for Businesses Using Premium Finance

Businesses often face significant upfront costs associated with various insurance policies, such as commercial property, liability, and workers’ compensation. Premium finance allows businesses to budget more effectively by spreading these substantial premium payments into manageable monthly installments. This reduces the strain on working capital, freeing up funds for other operational needs like inventory purchases, equipment upgrades, or marketing initiatives. For example, a small business needing $50,000 for annual liability insurance can avoid a large cash outflow by financing it through a premium finance plan, thus maintaining better liquidity. This consistent, predictable payment schedule improves financial forecasting and budgeting accuracy.

Advantages for Individuals Using Premium Finance

For individuals, premium finance can be particularly beneficial when purchasing large life insurance policies or other significant coverage. Instead of a substantial lump-sum payment, individuals can pay premiums in installments, making high-value insurance policies more attainable. This is especially relevant for individuals with fluctuating income or those aiming to secure significant life insurance coverage without impacting their immediate financial resources. For instance, someone planning for their family’s future can afford a larger life insurance policy through monthly payments rather than a single large payment, ensuring adequate coverage.

Comparison of Premium Finance to Other Payment Options

Compared to paying premiums in full upfront, premium finance offers the clear advantage of improved cash flow management. Unlike credit cards, which often accrue high interest rates, premium finance typically offers lower interest rates and predictable monthly payments. Furthermore, unlike personal loans, premium finance is specifically designed for insurance premiums, offering streamlined application processes and potentially more favorable terms. In situations where a business or individual might be unable to afford a large insurance premium upfront, premium finance presents a more manageable and affordable alternative.

Improved Cash Flow Management Using Premium Finance

The most significant benefit of premium finance is its ability to dramatically improve cash flow management. By spreading payments over time, businesses and individuals avoid large, potentially disruptive, outflows of cash. This predictability allows for better financial planning and reduces the risk of unexpected financial strain. For example, a seasonal business might experience fluctuating income throughout the year. Premium finance ensures consistent premium payments, regardless of monthly revenue variations, preventing cash flow disruptions and maintaining financial stability. This consistent and predictable approach minimizes financial risk and enhances overall business resilience.

Risks and Considerations of Premium Finance Insurance

Premium finance, while offering convenient payment options for insurance premiums, carries inherent risks for both businesses and individuals. Understanding these risks and the terms of the financing agreement is crucial to avoid potential financial hardship. Failure to do so can lead to significant consequences, impacting credit scores and potentially resulting in the loss of insurance coverage.

Risks for Businesses Using Premium Finance

Businesses utilizing premium finance should be aware of the potential financial strain caused by fluctuating cash flow. A sudden downturn in business performance could make premium payments difficult to manage, leading to default. Furthermore, the interest charges associated with premium finance can significantly increase the overall cost of insurance, impacting profitability. A thorough financial assessment before entering into a premium finance agreement is vital to ensure the business can comfortably meet its payment obligations. Failure to accurately assess cash flow and adequately plan for potential financial shortfalls could result in severe financial difficulties for the business.

Risks for Individuals Using Premium Finance

For individuals, the primary risk associated with premium finance is the potential for debt accumulation. Missed or late payments can lead to penalties, increased interest charges, and damage to credit scores. This can make it difficult to obtain credit in the future for other essential needs. The financial burden of premium finance payments, especially during periods of unemployment or unexpected expenses, can become overwhelming, potentially leading to default and the loss of insurance coverage. Careful consideration of personal finances and the ability to consistently meet payment obligations is paramount before opting for this type of financing.

Understanding Premium Finance Agreement Terms and Conditions

The terms and conditions of a premium finance agreement are legally binding and should be carefully reviewed before signing. This includes understanding the interest rates, payment schedules, late payment penalties, and the consequences of default. Clearly understanding the total cost of the insurance, including finance charges, is crucial for informed decision-making. Failure to fully grasp the agreement’s implications could lead to unforeseen financial difficulties. Seeking clarification from the lender on any unclear aspects of the agreement is highly recommended.

Implications of Defaulting on Premium Finance Payments

Defaulting on premium finance payments has serious repercussions. The lender may pursue legal action to recover the outstanding debt, potentially leading to wage garnishment or the seizure of assets. Furthermore, a default will negatively impact the individual’s or business’s credit score, making it harder to secure loans or other forms of credit in the future. Most importantly, default will typically result in the cancellation of the underlying insurance policy, leaving the individual or business without crucial protection. This could have severe financial and legal consequences depending on the type of insurance involved.

End of Discussion

Premium finance insurance presents a powerful tool for managing insurance costs, but careful consideration of its implications is crucial. Understanding the terms, potential risks, and available providers is paramount to making an informed decision. By weighing the benefits against potential drawbacks and selecting a reputable provider, businesses and individuals can leverage premium finance to optimize their financial strategies and safeguard against unforeseen circumstances.

Helpful Answers

What happens if I default on my premium finance payments?

Defaulting on payments can lead to repossession of the financed policy, impacting your insurance coverage. Late payment fees and damage to your credit score are also likely consequences.

Are there any hidden fees associated with premium finance insurance?

While the interest rates and payment schedule are generally transparent, carefully review the agreement for any additional fees, such as processing fees or early repayment penalties.

Can I use premium finance for all types of insurance?

Most premium finance providers cater to a range of insurance types, but specific policies and coverage limits may influence eligibility. It’s best to check with your provider directly.

How is the interest rate determined on premium finance agreements?

Interest rates are typically determined by several factors, including your creditworthiness, the length of the financing term, and prevailing market interest rates. These are usually disclosed upfront.