Securing your future against the potentially crippling costs of long-term care is a crucial financial decision. Understanding the intricacies of long-term care insurance premiums is paramount to making an informed choice. This guide delves into the factors that influence premium costs, providing a clear picture of what you can expect and how to navigate the complexities of this essential coverage.

From the impact of age and health status to the nuances of policy features and payment structures, we’ll explore the various elements that shape your premium. We’ll also compare offerings from different providers and offer strategies for managing your premiums effectively, ensuring you find a plan that aligns with your financial capabilities and long-term care needs.

Understanding Premium Payment Structures

Choosing a long-term care insurance policy involves careful consideration of various factors, and understanding the premium payment structure is paramount. The way you pay your premiums significantly impacts your overall cost and financial planning. This section clarifies the different options available and their implications.

Single-Pay versus Recurring Premiums

Single-pay premiums, as the name suggests, involve a one-time, lump-sum payment to cover the entire policy duration. Recurring premiums, on the other hand, are paid periodically, usually monthly, quarterly, semi-annually, or annually. Single-pay options offer the advantage of eliminating future premium obligations, providing peace of mind. However, they require a significant upfront investment. Recurring premiums offer flexibility and spread the cost over time, making them more manageable for many individuals. The choice depends largely on your financial situation and risk tolerance.

Level versus Tiered Premium Structures

Long-term care insurance premiums can follow either a level or a tiered structure. A level premium policy maintains a consistent premium amount throughout the policy’s duration. This predictability makes budgeting easier. A tiered premium policy, conversely, features premiums that increase over time, often in stages or according to a predetermined schedule. While initial premiums might be lower, they escalate, potentially becoming a significant burden in later years. The choice depends on your long-term financial outlook and your comfort level with potential future premium increases.

Scenarios Leading to Premium Increases

Several factors can trigger premium increases in long-term care insurance policies. These include higher-than-anticipated claims costs experienced by the insurer, changes in the insured’s health status (though this is less common in established policies), and adjustments to reflect updated mortality and morbidity data. For example, if the insurer experiences a higher-than-expected number of claims due to an unforeseen increase in the prevalence of certain conditions, premiums may need to be adjusted across the board to maintain the insurer’s solvency.

Premium Payment Frequency and Overall Cost

The frequency of premium payments influences the overall cost, although the total annual premium remains relatively consistent regardless of payment schedule. Paying annually generally offers a slight discount compared to more frequent payments due to reduced administrative costs for the insurer. For instance, paying $2400 annually might be slightly cheaper than paying $200 monthly, even though the total cost remains the same. This is because the insurer saves on processing and administrative fees associated with more frequent payments.

Factors Insurers Consider When Setting Premium Schedules

Insurers employ actuarial models to determine premium schedules. These models consider various factors, including the insured’s age, health status, policy benefits, inflation expectations, anticipated claims costs, and the insurer’s operating expenses. For example, a younger, healthier individual will typically pay lower premiums than an older person with pre-existing conditions seeking the same level of coverage. The insurer aims to balance the risk and cost associated with providing coverage while maintaining financial stability.

Comparing Premiums Across Different Providers

Choosing long-term care insurance involves careful consideration of premiums, and comparing offers from different providers is crucial. This section analyzes premium structures from three major insurers, highlighting key differences in benefits and costs to help you make an informed decision. We will focus on hypothetical examples for illustrative purposes, as specific premiums vary significantly based on individual factors.

Premium Structure Comparison: Three Major Insurers

Let’s compare hypothetical premium structures for a 60-year-old individual seeking a standard long-term care policy with a $150,000 benefit maximum and a 3-year benefit period. We’ll examine “Insurer A,” “Insurer B,” and “Insurer C.” Note that these are illustrative examples and do not represent actual insurer offerings. Actual quotes should be obtained directly from the insurers.

Insurer A might offer a level premium structure, meaning the monthly premium remains consistent throughout the policy term. Insurer B may utilize a tiered structure with premiums increasing at set intervals (e.g., every 5 years). Insurer C might offer a combination approach, with an initial level period followed by increases. The differences in the underlying actuarial models and risk assessments of each insurer influence these varying approaches.

Benefit Differences at Similar Premium Levels

Even at similar initial premium levels, significant differences in benefits can exist between providers. For instance, Insurer A’s policy at a hypothetical $300 monthly premium might include inflation protection, while Insurer B’s comparable policy might not, leading to a reduced benefit value over time. Insurer C, at a similar premium, could offer a broader range of covered services, such as home healthcare or adult day care, compared to the other two. These variations underscore the importance of carefully reviewing the policy documents to understand the scope of coverage.

Comparison of Premium Costs Based on Benefit Packages

The following table illustrates how premium costs vary across different benefit packages offered by the three hypothetical insurers. These figures are illustrative and should not be interpreted as actual quotes. Always obtain personalized quotes from the insurers based on your specific circumstances.

| Insurer | Benefit Package | Monthly Premium (Hypothetical) | Inflation Protection | Benefit Period (Years) |

|---|---|---|---|---|

| Insurer A | Standard | $300 | Yes | 3 |

| Insurer A | Enhanced | $450 | Yes | 5 |

| Insurer B | Standard | $280 | No | 3 |

| Insurer B | Comprehensive | $500 | Yes | 5 |

| Insurer C | Basic | $250 | No | 3 |

| Insurer C | Premium | $400 | Yes | 5 |

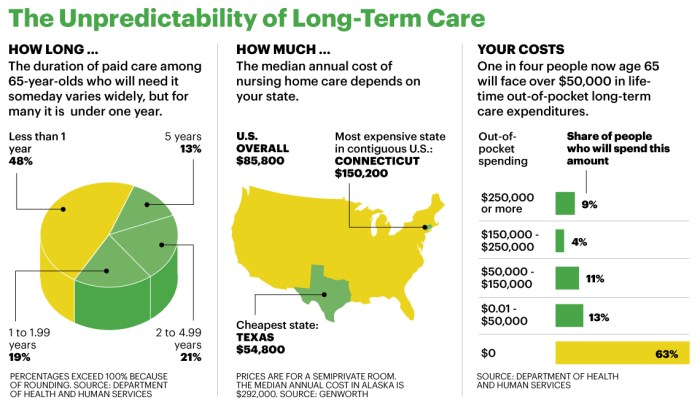

Premium Rate Variations Based on Location

Geographical location significantly impacts long-term care insurance premiums. Factors such as the average cost of care in a particular state or region influence the pricing. The following table demonstrates hypothetical premium variations for the “Standard” benefit package from our three insurers across three different states. These are for illustrative purposes only.

| Insurer | State A | State B | State C |

|---|---|---|---|

| Insurer A (Standard) | $300 | $350 | $275 |

| Insurer B (Standard) | $280 | $320 | $260 |

| Insurer C (Basic) | $250 | $300 | $225 |

Closing Notes

Navigating the world of long-term care insurance premiums can feel daunting, but with a thorough understanding of the factors at play, you can make a confident decision. By carefully considering your age, health, desired benefit levels, and payment options, you can secure a policy that provides the necessary protection without undue financial strain. Remember to compare offerings from different providers and utilize strategies for managing costs to find the best fit for your individual circumstances. Proactive planning is key to ensuring peace of mind for your future.

Questions and Answers

What happens if my health deteriorates after I purchase a policy?

Most policies won’t increase premiums due to worsening health after the policy is issued, but pre-existing conditions can impact initial premium pricing.

Can I change my policy’s benefit level later?

Many policies allow for adjustments to benefit levels, which typically results in a change to your premium. Consult your policy details or your insurer for specific options.

Are long-term care insurance premiums tax-deductible?

Tax deductibility depends on your individual circumstances and tax laws. Consult a tax professional for personalized advice.

What if I can no longer afford my premiums?

Some policies offer options like reduced benefits or premium waivers under certain circumstances. Contact your insurer to discuss available options if you face financial difficulties.