Securing substantial life insurance coverage often presents a financial hurdle. Life insurance premium financing offers a solution, enabling individuals to acquire larger policies than might otherwise be affordable through immediate cash outlay. This approach leverages a loan to pay premiums, allowing policyholders to build significant coverage while managing payments over time. Understanding the intricacies, however, is crucial to making informed decisions.

This comprehensive guide explores the mechanics of life insurance premium financing, delving into eligibility criteria, associated costs, potential risks, and alternative funding strategies. We’ll examine real-world scenarios, compare various financing options, and address common concerns to equip you with the knowledge necessary to navigate this financial tool effectively.

What is Life Insurance Premium Financing?

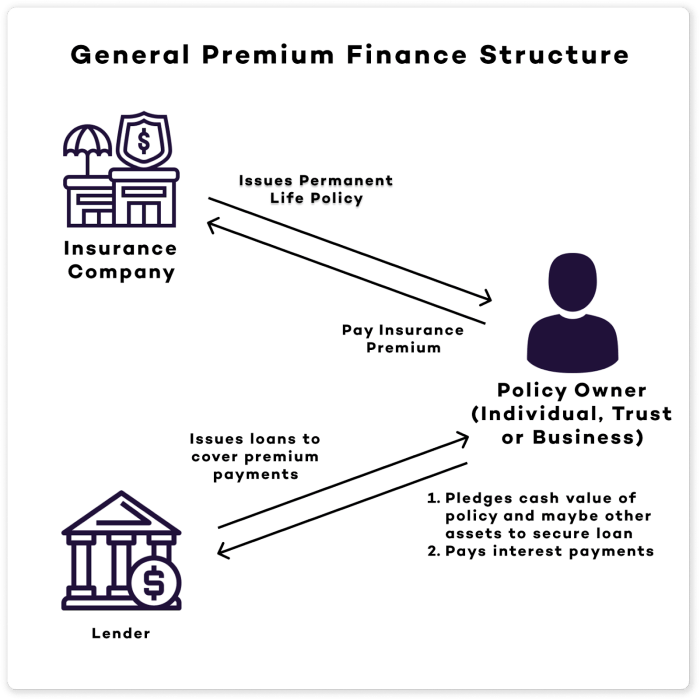

Life insurance premium financing is a financial strategy that allows individuals to purchase larger life insurance policies than they could otherwise afford by using a loan to pay the premiums. Essentially, you borrow money to pay your life insurance premiums, and the policy itself often serves as collateral. This allows you to secure significant life insurance coverage without having to immediately outlay a large sum of cash.

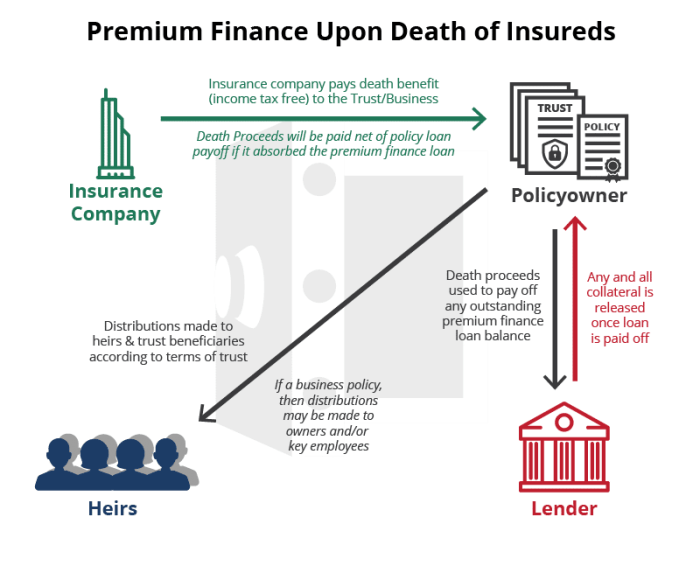

Premium financing works by securing a loan specifically designed to cover your life insurance premiums. The loan is typically repaid through regular payments, often structured to align with the insurance premium payment schedule. The life insurance policy acts as collateral for the loan, providing security for the lender. If you were to pass away, the death benefit from the policy would typically be used to repay the outstanding loan balance, with any remaining amount going to your beneficiaries.

Types of Premium Financing Arrangements

Several different types of premium financing arrangements exist, each with its own nuances and terms. These arrangements are often tailored to the individual’s financial situation and the specific needs of the life insurance policy.

Advantages and Disadvantages of Premium Financing

The decision to use premium financing involves careful consideration of both the potential benefits and drawbacks. Understanding these aspects is crucial for making an informed choice.

| Feature | Advantages | Disadvantages |

|---|---|---|

| Access to Larger Policies | Allows individuals to purchase larger life insurance policies than they could afford outright, providing greater coverage for their beneficiaries. | Increased overall cost due to interest payments on the loan. |

| Tax Implications | In some cases, interest paid on the loan may be tax-deductible, offering potential tax savings. (Consult a tax professional for specific advice). | The loan may impact your overall financial picture and credit score, potentially affecting your ability to secure other loans. |

| Collateral | The life insurance policy serves as collateral, reducing the risk for the lender. | If you fail to make loan payments, the lender could seize the policy, potentially leaving your beneficiaries with little or no coverage. |

| Flexibility | Various financing options are available, allowing for customization based on individual needs and financial situations. | Complexity of the arrangement; requires understanding of both insurance and loan terms. |

Eligibility and Qualification Criteria

Securing premium financing for your life insurance policy hinges on meeting specific eligibility criteria set by the lender. These criteria are designed to assess the risk involved in lending you the money to pay your premiums. Lenders carefully evaluate several factors to determine your suitability for a premium financing arrangement.

Lenders primarily consider a combination of factors to determine the applicant’s creditworthiness and ability to repay the loan. A thorough application review process helps mitigate potential risks associated with the premium financing arrangement.

Key Factors Considered by Lenders

Lenders use a multifaceted approach to assess applications, focusing on financial stability and risk management. This involves examining various aspects of the applicant’s financial profile to ensure responsible lending practices. The following factors are commonly considered:

- Credit Score and History: A strong credit history, reflected in a high credit score, is crucial. This demonstrates a history of responsible borrowing and repayment.

- Debt-to-Income Ratio (DTI): Lenders assess your existing debt obligations relative to your income. A lower DTI indicates a greater capacity to manage additional debt.

- Income and Employment Stability: Consistent income from a stable employment source is vital to demonstrate your ability to make loan repayments.

- Policy Details: The type and value of the life insurance policy being financed are evaluated. Policies with higher cash values might be viewed more favorably.

- Collateral: In some cases, the life insurance policy itself may serve as collateral for the loan.

Typical Eligibility Requirements

Meeting certain requirements is essential for approval. These requirements are standard across most premium financing providers. Failure to meet these requirements can lead to application rejection.

- Minimum Credit Score: Lenders often set a minimum credit score threshold, typically ranging from 660 to 700 or higher, depending on the lender and loan amount.

- Stable Income: Proof of consistent income from a reliable source, such as employment or self-employment, is generally required.

- Acceptable Debt-to-Income Ratio: Lenders usually prefer applicants with a DTI below a certain percentage, typically around 43%, but this can vary.

- Sufficient Policy Value: The value of the life insurance policy often needs to meet a minimum threshold to serve as adequate security for the loan.

Creditworthiness in Premium Financing

Creditworthiness is paramount in the premium financing process. It reflects your ability and willingness to repay borrowed funds. A positive credit history and strong financial standing significantly increase your chances of approval. A poor credit history may result in higher interest rates or even application denial.

Hypothetical Case Studies

To illustrate, let’s consider two hypothetical scenarios:

Successful Application

John, a 45-year-old with a stable income of $100,000 per year, a credit score of 750, and a low DTI of 25%, applies for premium financing for a $500,000 life insurance policy. His application is approved due to his strong financial profile and low risk.

Unsuccessful Application

Mary, a 30-year-old with a fluctuating income, a credit score of 580, and a high DTI of 60%, applies for premium financing for a $250,000 life insurance policy. Her application is rejected due to her poor credit history and high debt burden, indicating a higher risk of default to the lender.

Costs and Fees Associated with Premium Financing

Premium financing, while offering a convenient way to manage life insurance premiums, comes with associated costs. Understanding these fees is crucial for making an informed decision. These costs can significantly impact the overall expense of your life insurance policy, so careful consideration is necessary.

Several fees contribute to the total cost of premium financing. These fees vary depending on the lender, the amount financed, and the length of the financing agreement. It’s essential to compare offers from multiple providers to find the most competitive terms.

Interest Rates

Interest rates are a primary component of the cost of premium financing. These rates are typically higher than those found on other types of loans, reflecting the inherent risks associated with lending against a life insurance policy. Interest rates can be fixed or variable, depending on the lender and the specific loan agreement. Fixed rates offer predictability, while variable rates can fluctuate with market conditions. For example, a fixed-rate loan might charge 8% annual interest, while a variable-rate loan might start at 7% but could increase or decrease over time.

Origination Fees

Many premium financing providers charge an origination fee, a one-time payment to cover the administrative costs of setting up the loan. These fees are usually a percentage of the loan amount, typically ranging from 1% to 5%. A larger loan will therefore result in a higher origination fee. For instance, a 5% origination fee on a $10,000 loan would amount to $500.

Administration Costs

Ongoing administrative costs are also common. These may include annual fees or charges for servicing the loan. These fees are usually smaller than the origination fee but contribute to the overall cost over the life of the loan. These might be a fixed annual fee or a percentage of the outstanding loan balance.

Comparison of Interest Rates Across Providers

Interest rates can vary significantly between premium financing providers. It’s crucial to shop around and compare offers from several lenders before making a decision. The following table provides a hypothetical comparison:

| Provider | Interest Rate (Annual) | Origination Fee | Administration Fee (Annual) |

|---|---|---|---|

| Provider A | 8% Fixed | 2% of loan amount | $50 |

| Provider B | 7%-9% Variable | 1% of loan amount | $25 |

| Provider C | 8.5% Fixed | 3% of loan amount | $75 |

Hypothetical Example of Total Cost

Let’s consider a hypothetical example. Suppose you need to finance $20,000 in life insurance premiums over five years with Provider A from the table above.

* Loan Amount: $20,000

* Interest Rate: 8% fixed

* Origination Fee: 2% of $20,000 = $400

* Annual Administration Fee: $50

* Total Administration Fees (5 years): $50 x 5 = $250

To calculate the total interest paid, we can use a simple interest calculation (though in reality, most loans use compound interest, leading to a slightly higher total):

Total Interest ≈ (Loan Amount * Interest Rate * Loan Term) = $20,000 * 0.08 * 5 = $8,000

Therefore, the approximate total cost of financing with Provider A would be:

Total Cost ≈ Loan Amount + Origination Fee + Total Interest + Total Administration Fees = $20,000 + $400 + $8,000 + $250 = $28,650

This example illustrates how fees and interest can significantly increase the overall cost of premium financing. Always carefully review the terms and conditions of any premium financing agreement before proceeding.

Risks and Potential Drawbacks

Premium financing, while offering a convenient way to pay for life insurance premiums, carries inherent risks that potential users should carefully consider. Understanding these potential downsides is crucial to making an informed decision and avoiding unforeseen financial difficulties. Failure to do so could lead to significant financial strain and even the loss of your life insurance coverage.

High interest rates and the potential for accumulating substantial debt are the most significant risks. Premium financing essentially functions as a loan, and the interest charged can be considerable, significantly increasing the overall cost of your life insurance. This added expense can negate some of the financial benefits of the policy itself, especially if the policy’s cash value growth doesn’t outpace the interest accruing on the loan. Moreover, the longer the loan term, the more interest you’ll pay, potentially resulting in a much larger debt than the initial premium amount.

Consequences of Defaulting on Premium Financing Payments

Defaulting on premium financing payments can have severe consequences. The most immediate result is the lender reclaiming the policy. This means you lose your life insurance coverage, despite having made premium payments through the financing arrangement. Further, your credit score will suffer significantly, making it harder to secure loans or credit in the future. This negative impact on your credit history can affect various aspects of your financial life, from obtaining a mortgage to securing favorable interest rates on other loans. In some cases, depending on the terms of the loan agreement and applicable laws, you may face legal action from the lender to recover the outstanding debt.

Scenarios Where Premium Financing Might Not Be Suitable

Premium financing is not a universally beneficial financial tool. For individuals with limited financial resources or those facing financial instability, it can be exceptionally risky. For example, someone experiencing job insecurity or facing significant unexpected expenses should avoid premium financing. Similarly, individuals with a history of credit problems might find it difficult to secure a premium financing loan or might face higher interest rates, making the financing even more costly. Furthermore, if the primary purpose of purchasing life insurance is to leave a legacy for your dependents, the potential for losing the coverage due to defaulting on the loan significantly diminishes this intended benefit. Finally, if the premiums are significantly lower than your annual income, you might not need premium financing at all. Careful consideration of your financial situation and long-term goals is essential before pursuing this option.

Potential Risks and Mitigation Strategies

It’s crucial to understand the potential risks and actively implement mitigation strategies to protect yourself.

- Risk: High interest rates leading to significant debt accumulation.

- Mitigation: Shop around for the best interest rates and loan terms. Consider alternative financing options or paying premiums directly if possible.

- Risk: Defaulting on payments resulting in policy lapse and credit damage.

- Mitigation: Maintain a robust financial plan, including a sufficient emergency fund to cover unexpected expenses that could impact your ability to make payments. Ensure you have a clear understanding of the loan terms and payment schedule.

- Risk: The cost of financing outweighing the benefits of the life insurance policy.

- Mitigation: Carefully compare the total cost of the insurance policy, including financing charges, to the policy’s benefits and potential long-term returns. Consider whether the insurance coverage is necessary at all, given your financial circumstances.

- Risk: Inability to secure premium financing due to poor credit history.

- Mitigation: Improve your credit score before applying for premium financing. This may involve paying down existing debts and improving your credit management practices.

Alternative Funding Options

Choosing how to pay for your life insurance premiums is a crucial decision impacting your financial stability and the longevity of your policy. Several options exist beyond premium financing, each with its own set of advantages and disadvantages. Understanding these alternatives allows for a more informed choice tailored to individual circumstances.

This section compares premium financing with direct payment and using savings, highlighting situations where each method might be most suitable. We will analyze the pros and cons of each approach to facilitate a comprehensive understanding of your funding choices.

Direct Payment of Premiums

Direct payment involves paying your premiums directly from your existing funds, such as your checking or savings account. This method offers simplicity and transparency, eliminating the complexities and potential costs associated with other financing options.

Advantages include straightforward budgeting and the avoidance of additional fees or interest charges. Disadvantages, however, can include the need for a significant upfront capital outlay, potentially straining your current finances. This method is best suited for individuals with readily available funds and a consistent income stream capable of sustaining premium payments.

Using Savings for Premium Payments

Using savings to pay life insurance premiums is another common method. This approach allows you to utilize existing funds, avoiding external debt. It offers a degree of control and avoids the interest charges associated with loans.

The advantages include predictable cash flow and the avoidance of debt. However, the disadvantages include the depletion of savings, potentially limiting access to funds for other emergencies or investments. This option is ideal for individuals with sufficient savings and a willingness to temporarily reduce their liquid assets.

Comparison of Funding Options

| Funding Method | Advantages | Disadvantages | Best Suited For |

|---|---|---|---|

| Premium Financing | Access to larger policies, frees up cash flow | Interest charges, potential debt burden, risk of policy lapse | Individuals needing a large policy but lacking immediate funds, those prioritizing cash flow |

| Direct Payment | Simplicity, transparency, no additional fees | Requires significant upfront capital, potential financial strain | Individuals with readily available funds and consistent income |

| Using Savings | Predictable cash flow, avoids debt | Depletion of savings, limited access to funds for other needs | Individuals with sufficient savings and willingness to temporarily reduce liquid assets |

Illustrative Examples

Understanding the practical applications of life insurance premium financing requires examining scenarios where it proves beneficial and detrimental. This section will present such scenarios, along with a detailed example of a premium financing plan and an analysis of how varying interest rates impact the overall cost.

Beneficial Scenario: High-Net-Worth Individual

A high-net-worth individual, let’s call him Mr. Smith, requires a large life insurance policy to protect his substantial assets and provide for his family. He possesses significant liquid assets but prefers to keep a substantial portion invested for long-term growth rather than tying it up in a large insurance premium payment. Premium financing allows Mr. Smith to secure the necessary coverage immediately while maintaining his investment strategy. The interest paid on the loan is a tax-deductible expense, further enhancing the financial advantage. His assets continue to appreciate, and he secures the necessary insurance protection.

Detrimental Scenario: Individual with Fluctuating Income

Ms. Jones, a freelance graphic designer with fluctuating income, decides to use premium financing to purchase a large life insurance policy. While she can afford the initial payments, a period of reduced work dries up her income. She struggles to make the loan repayments, leading to potential penalties, default, and the risk of losing her policy. This scenario highlights the importance of carefully considering financial stability and the potential impact of unexpected income fluctuations before entering into a premium financing agreement.

Detailed Illustration of a Premium Financing Plan

Let’s consider a $1 million life insurance policy with an annual premium of $10,000. Ms. Brown secures a premium financing loan with a 6% annual interest rate over a 10-year term.

| Year | Premium Payment | Interest Payment | Total Payment | Loan Balance |

|---|---|---|---|---|

| 1 | $10,000 | $600 | $10,600 | $10,600 |

| 2 | $10,000 | $636 | $10,636 | $21,236 |

| 3 | $10,000 | $1274 | $11,274 | $32,510 |

| 4 | $10,000 | $1951 | $11,951 | $44,461 |

| 5 | $10,000 | $2668 | $12,668 | $57,129 |

| 6 | $10,000 | $3428 | $13,428 | $70,557 |

| 7 | $10,000 | $4233 | $14,233 | $84,790 |

| 8 | $10,000 | $5087 | $15,087 | $99,877 |

| 9 | $10,000 | $5993 | $15,993 | $115,870 |

| 10 | $10,000 | $6952 | $16,952 | $132,822 |

Note: This is a simplified illustration and does not include potential fees or charges. The actual interest payments will vary slightly depending on the compounding method used. The loan balance is the cumulative amount owed at the end of each year.

Impact of Different Interest Rates

The total cost of premium financing is significantly impacted by the interest rate. Using the same $10,000 annual premium example over 10 years, a 4% interest rate would result in a substantially lower total cost compared to the 6% example above. Conversely, an 8% interest rate would dramatically increase the total cost. A thorough comparison of interest rates from different lenders is crucial before committing to a premium financing plan. This highlights the need for careful consideration and comparison shopping.

Regulatory Considerations

Premium financing, while offering a convenient way to manage life insurance premiums, operates within a framework of regulations designed to protect both consumers and the financial system. Understanding these regulations is crucial for both lenders and borrowers to ensure fair and transparent practices. Failure to comply can lead to significant legal and financial consequences.

Relevant Regulations and Laws

The regulatory landscape for premium financing varies depending on jurisdiction. However, common themes include consumer protection laws, insurance regulations, and lending laws. Consumer protection laws often dictate disclosure requirements, ensuring borrowers understand the terms and costs associated with the financing agreement. Insurance regulations might address the suitability of premium financing for specific policyholders and the implications for insurance coverage. Lending laws typically govern aspects such as interest rates, fees, and the overall lending process. Specific examples of relevant legislation would include state-level insurance codes and consumer credit protection acts, varying significantly across jurisdictions. For example, the Dodd-Frank Act in the United States introduced stricter regulations on consumer lending, impacting some aspects of premium financing.

Role of Regulatory Bodies

Regulatory bodies play a vital role in overseeing premium financing practices. Their responsibilities include enforcing relevant laws, investigating complaints, and ensuring that lenders adhere to established standards. These bodies might include state insurance departments, consumer protection agencies, and banking regulators, depending on the specific nature of the financing arrangement. For instance, state insurance departments often have the authority to license and regulate premium finance companies, while consumer protection agencies focus on ensuring fair lending practices and preventing predatory lending. The precise role and responsibilities of these bodies differ across jurisdictions.

Implications of Non-Compliance

Non-compliance with premium financing regulations can result in severe consequences. Lenders may face penalties, fines, and even license revocation. Borrowers might be entitled to legal recourse, including the potential for loan cancellation or repayment of excessive fees. In addition, reputational damage can severely impact the lender’s business. For example, a lender found to have engaged in predatory lending practices could face significant fines and be subject to class-action lawsuits. This can also lead to a loss of consumer trust and damage to the company’s reputation.

Best Practices for Ensuring Compliance

Maintaining compliance with premium financing regulations requires a proactive approach. Lenders should implement robust compliance programs, including thorough due diligence on borrowers, clear and accurate disclosure of all terms and conditions, and regular internal audits to ensure adherence to relevant laws. Maintaining detailed records of all transactions and adhering to strict ethical lending practices are also essential. Regular training for staff on compliance requirements is another key aspect of best practice. This might include workshops and updates on changes in relevant legislation. Proactive engagement with regulatory bodies through open communication and prompt responses to inquiries can further enhance compliance.

Summary

Life insurance premium financing presents a powerful tool for securing substantial coverage, but careful consideration of its complexities is paramount. Weighing the advantages against potential drawbacks, including interest costs and debt accumulation, is essential. By understanding the eligibility requirements, associated fees, and alternative funding methods, individuals can make well-informed decisions aligned with their financial goals and risk tolerance. Remember to seek professional financial advice before embarking on any premium financing arrangement.

FAQ Corner

What happens if I can’t make my premium financing payments?

Failure to make payments can lead to loan default, resulting in the lender potentially seizing the life insurance policy. This could mean losing the policy’s cash value and coverage.

Can I refinance my premium financing loan?

Refinancing might be possible, depending on your financial situation and the lender’s policies. It could involve securing a new loan with potentially more favorable terms.

How does the tax treatment of premium financing work?

The tax implications of premium financing can be complex and vary depending on jurisdiction and specific circumstances. Consult a tax professional for personalized advice.

Are there any age restrictions for premium financing?

While there isn’t a universal age limit, lenders may have specific age requirements. Older applicants might face stricter eligibility criteria.

What types of life insurance policies are suitable for premium financing?

Permanent life insurance policies, such as whole life or universal life, are generally better suited for premium financing due to their cash value component.