Securing your personal assets through insurance is a crucial step in responsible financial planning. However, understanding the intricacies of premium payments can often feel overwhelming. This guide navigates the various methods, frequencies, and factors influencing the cost of premiums for personally owned insurance, aiming to demystify the process and empower you to make informed decisions.

From online payments to traditional mail, and from monthly installments to annual settlements, we’ll explore the diverse options available, highlighting their respective advantages and disadvantages. We will also delve into the factors that influence your premium costs, such as age, driving history (for auto insurance), and the level of coverage selected. Understanding these factors allows for more effective budgeting and planning.

Methods of Premium Payment

Paying insurance premiums for your personally owned assets is a crucial aspect of maintaining coverage. Understanding the various payment options available and their associated benefits and drawbacks allows for informed decision-making and efficient financial management. This section Artikels several common methods, their practical applications, and their respective advantages and disadvantages.

Available Payment Methods for Insurance Premiums

Individuals have several options for paying their insurance premiums, each with its own set of benefits and drawbacks. Choosing the right method often depends on personal preferences, financial habits, and technological comfort levels.

Online Payment

Online payment is a popular method, offering convenience and efficiency. It typically involves accessing the insurance company’s website, logging into your account, and selecting the “pay now” or similar option. You’ll usually need your policy number and payment information (credit card, debit card, or sometimes electronic bank transfer). Some companies may offer one-time payments or the option to set up recurring payments.

| Payment Method | Description | Advantages | Disadvantages |

|---|---|---|---|

| Online Payment | Paying premiums through the insurer’s website using credit/debit cards or electronic bank transfers. | Convenient, fast, secure (if using reputable sites), often allows for automated payments. | Requires internet access and a compatible device. Potential for fraud if not careful about website security. |

| Mail Payment | Sending a check or money order through the postal service. | Simple, accessible to everyone regardless of tech proficiency. | Slowest method, risk of lost mail, requires writing a check or obtaining a money order. |

| Automatic Payment | Recurring payments automatically deducted from a bank account or credit card. | Convenient, ensures on-time payments, avoids late fees. | Requires setting up the recurring payment, risk of insufficient funds leading to payment failure. |

| Payment by Phone | Paying premiums over the phone using a credit or debit card. | Convenient for those who prefer phone interactions. | May involve longer wait times, potentially less secure than online payment. |

Mail Payment

Traditional mail payment involves sending a check or money order payable to the insurance company. This method requires you to print and fill out the payment stub provided with your billing statement, or obtain the necessary information from your insurance company’s website. Include your policy number and clearly write your name and address on the check or money order. Mail it to the address specified on your billing statement.

Automatic Payment

Automatic payment provides a convenient and reliable way to ensure timely premium payments. You authorize the insurance company to automatically deduct payments from your bank account or credit card on your due date. This eliminates the need for manual payments and reduces the risk of late fees. The setup process usually involves providing your banking information or credit card details through a secure online portal.

Payment by Phone

Some insurance companies allow premium payments via phone. You will typically need to call their customer service number and provide your policy number and payment information. The agent will guide you through the payment process, usually using a credit or debit card. This method offers convenience for those who prefer phone interactions, but it may involve longer wait times compared to online payment.

Payment Frequency and Options

Choosing how often you pay your insurance premiums can significantly impact your budget and overall insurance costs. Understanding the available payment options and their implications is crucial for effective financial planning. This section Artikels the common payment frequencies and their associated advantages and disadvantages.

Payment frequency directly influences the total cost of your insurance. While most insurers don’t charge extra for paying annually, opting for more frequent payments, such as monthly or quarterly, often involves additional fees. These fees are designed to cover the administrative costs associated with processing more frequent transactions. The convenience of more frequent payments comes at a price.

Payment Frequency and Associated Costs

The most common payment frequencies are annual, semi-annual, quarterly, and monthly. Annual payments typically offer the lowest overall cost due to the absence of processing fees. Semi-annual payments represent a middle ground, offering a balance between cost and convenience. Quarterly and monthly payments offer greater flexibility but usually come with added administrative charges. For example, a policy with an annual premium of $1200 might incur a $20 processing fee per month when paid monthly, resulting in a total cost of $1440 ($120 x 12). The same policy paid annually would cost only $1200.

Examples of Beneficial Payment Frequencies

Several factors influence the optimal payment frequency. Individuals with tight monthly budgets might find monthly payments more manageable, despite the higher overall cost. This allows for better cash flow management and prevents a large lump-sum payment from disrupting their finances. Conversely, those with stable incomes and a preference for minimizing overall costs might prefer annual payments. Businesses often opt for annual or semi-annual payments for larger policies to streamline their accounting processes.

Comparison of Payment Schedules

The following table summarizes the pros and cons of different payment schedules:

| Payment Frequency | Pros | Cons |

|---|---|---|

| Annual | Lowest overall cost, simplifies budgeting | Requires a larger upfront payment |

| Semi-Annual | Balances cost and convenience, manageable payments | Higher overall cost than annual payments |

| Quarterly | More frequent payments than semi-annual, better cash flow management than annual | Higher overall cost than semi-annual payments, requires more frequent payments |

| Monthly | Most convenient, best for tight budgets, eases cash flow | Highest overall cost due to processing fees |

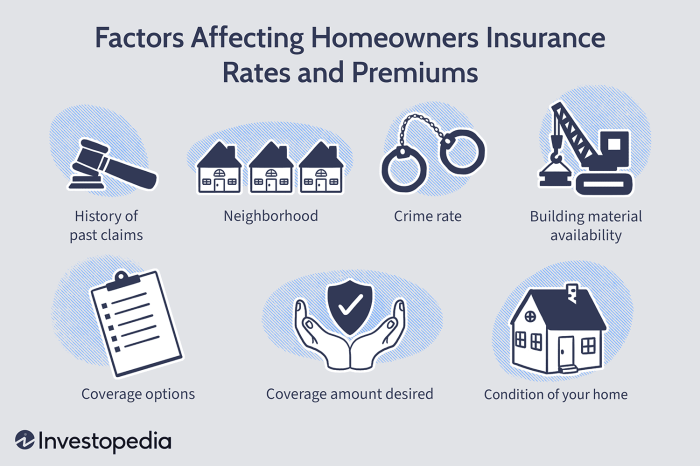

Factors Affecting Premium Costs

Several key factors influence the cost of premiums for personally owned insurance. Understanding these factors allows individuals to make informed decisions about their coverage and potentially reduce their premium costs. These factors interact in complex ways, and the impact of one factor can be modified by another.

Age of the Insured

Age is a significant factor influencing insurance premiums. Younger drivers, particularly those under 25, generally pay higher premiums due to statistically higher accident rates within this demographic. Insurance companies assess risk based on historical data, and younger drivers are often considered higher risk. As drivers age and accumulate a clean driving record, premiums typically decrease. This reflects the reduced likelihood of accidents associated with increased experience and maturity. Conversely, older drivers, particularly those over 65, might see a slight increase in premiums due to potential health concerns that could affect driving abilities. However, this increase is often less pronounced than the increase for young drivers.

Driving History

A driver’s history significantly impacts premium costs. A clean driving record, free of accidents and traffic violations, typically results in lower premiums. Conversely, accidents, speeding tickets, and other moving violations lead to increased premiums. The severity of the infraction directly correlates with the premium increase. For instance, a DUI conviction will result in a far greater premium increase than a minor speeding ticket. Insurance companies use a points system to track driving infractions, with each point adding to the overall risk assessment and premium calculation.

Coverage Level

The level of coverage chosen directly impacts the premium cost. Higher coverage limits, such as higher liability limits or comprehensive and collision coverage, result in higher premiums. This is because the insurer is assuming a greater financial responsibility in the event of an accident or loss. Conversely, choosing lower coverage limits, such as minimum liability coverage, will result in lower premiums but leaves the insured with greater personal financial exposure in the event of a significant claim. The trade-off between cost and protection is a crucial consideration when selecting coverage levels.

Type of Vehicle

The type of vehicle insured also affects premium costs. The make, model, and year of the vehicle influence the premium. Sports cars and high-performance vehicles generally have higher premiums due to their higher repair costs and greater potential for accidents. Vehicles with advanced safety features may qualify for discounts, reflecting the reduced risk associated with these features. Similarly, the vehicle’s safety rating, as determined by independent organizations, can influence premium costs.

Location

Geographic location plays a significant role in determining premium costs. Areas with higher rates of accidents, theft, or vandalism typically have higher premiums. Insurance companies analyze claims data for specific geographic regions to assess the risk associated with insuring vehicles in those areas. Urban areas often have higher premiums than rural areas due to increased traffic density and the higher likelihood of accidents and theft.

Scenario: Impact of Factors on Premium Costs

Let’s consider two drivers: Driver A is a 22-year-old with a clean driving record driving a new, fuel-efficient sedan in a rural area and Driver B is a 35-year-old with two speeding tickets in the past three years driving a sports car in a major city. Driver A will likely have a significantly lower premium than Driver B due to their age, driving record, vehicle type, and location.

Relationship Between Factors and Premium Costs

| Factor | Impact on Premium Cost |

|---|---|

| Age (Younger Drivers) | Higher |

| Age (Older Drivers) | Slightly Higher (potentially) |

| Clean Driving Record | Lower |

| Accidents/Violations | Higher |

| Higher Coverage Limits | Higher |

| Lower Coverage Limits | Lower |

| Fuel-Efficient Vehicle | Lower (potentially) |

| High-Performance Vehicle | Higher |

| Rural Location | Lower (potentially) |

| Urban Location | Higher (potentially) |

Payment Processing and Confirmation

Once you’ve chosen your payment method and submitted your premium payment, the process of verification and confirmation begins. This involves several steps, from the initial transaction to receiving final confirmation that your payment has been successfully processed and applied to your insurance policy. Understanding this process helps ensure a smooth and timely payment experience.

The typical process of premium payment processing involves several key stages. First, your payment is received by the insurer or their designated payment processor. This could be through an online portal, a direct bank transfer, a mailed check, or another accepted method. The payment details are then verified against the information provided during the policy application. This verification step ensures accuracy and prevents errors. Next, the payment is processed and recorded in the insurer’s system. This typically involves updating your policy status to reflect the payment. Finally, confirmation of the payment is sent to you, typically via email, mail, or through your online account. This confirmation serves as proof that your payment has been successfully received and applied.

Confirmation Methods

Several methods are used to confirm successful premium payments. Email confirmation is a common method, providing an immediate digital record of the transaction. This email usually contains the date of payment, the amount paid, and a transaction reference number. Mail confirmation, although slower, offers a physical record of the payment. This typically arrives within a few business days of the payment date and includes similar information to the email confirmation. Online portals offer real-time confirmation, allowing policyholders to instantly view their payment status and access transaction details. Many insurers provide access to online account management tools where the payment history can be viewed.

Proof of Payment

Proof of payment is crucial for resolving any potential payment disputes. Common forms of proof include the email confirmation, the mail confirmation, and online portal transaction history. Bank statements showing the transaction details, including the recipient’s name and the payment amount, also serve as valid proof. A canceled check, if paying by check, provides indisputable proof of payment. It’s advisable to retain all payment confirmation documentation for your records.

Addressing Payment Issues

If you encounter a payment issue or discrepancy, promptly contact your insurer’s customer service department. Provide them with your policy number, the date of payment, the payment method used, and the amount paid. If you have proof of payment, provide this documentation as well. The insurer will investigate the issue and provide an explanation and resolution. They might require additional information or documentation to verify the payment. Persistent issues should be addressed immediately to prevent any lapse in coverage.

Dispute Resolution for Payment Issues

Navigating insurance premium payments can sometimes present challenges. Understanding the process for resolving disputes is crucial for maintaining a positive relationship with your insurer and ensuring your coverage remains active. This section Artikels the steps to take when facing payment-related problems and clarifies the available resources for assistance.

Resolving payment disputes typically involves a straightforward process. First, promptly contact your insurance company’s customer service department. Clearly explain the nature of the problem, providing any relevant documentation such as payment confirmations, bank statements, or error messages. The insurer will then investigate the issue, potentially reviewing their records and your payment history. Depending on the complexity and nature of the dispute, resolution may involve adjustments to your account, refunds, or a revised payment plan. Maintaining clear and professional communication throughout the process is key to a successful outcome.

Common Payment Issues and Solutions

Several common payment-related issues can arise. These include incorrect payment amounts, delayed payments due to processing errors, and disputes over charges. For instance, if an incorrect amount was deducted, providing proof of the actual payment made (bank statement) will typically resolve the discrepancy. If a payment was delayed due to a technical glitch on the insurer’s end, documentation of the attempted payment and confirmation of the technical issue from the insurer may be necessary to avoid late payment fees. Disputes regarding specific charges often require reviewing the policy documents and the insurer’s explanation of the charges. In most cases, a clear and concise explanation from the insurer, supported by documentation, should suffice to resolve the matter.

Available Resources for Payment Assistance

Individuals facing payment difficulties often have access to several resources. Many insurance companies offer payment plans or extensions to assist policyholders experiencing temporary financial hardship. These options may involve spreading payments over several months or negotiating a reduced payment amount. It’s important to contact your insurer directly to discuss your specific situation and explore available options. Furthermore, independent consumer protection agencies or financial counselors can provide guidance and support in navigating payment disputes and exploring financial assistance programs. These agencies can offer valuable advice on your rights and responsibilities as a policyholder and help you effectively communicate with your insurance company. They can also assist in understanding and navigating complex insurance policies and regulations.

Ending Remarks

Effectively managing your insurance premiums involves a thoughtful consideration of payment methods, frequencies, and a keen awareness of factors affecting costs. By understanding the various options and their implications, you can optimize your payment strategy to align with your financial circumstances and ensure the uninterrupted coverage of your valuable assets. Remember to maintain accurate records and promptly address any payment issues to avoid potential penalties or policy lapses.

Answers to Common Questions

What happens if my payment is late?

Late payments typically incur penalties, which can vary among insurers. Repeated late payments may lead to policy cancellation.

Can I change my payment frequency?

Yes, most insurers allow you to adjust your payment frequency (monthly, quarterly, annually), but this may affect your overall premium cost.

What forms of payment are accepted?

Commonly accepted payment methods include credit cards, debit cards, electronic transfers, checks, and money orders. Check with your specific insurer for their accepted methods.

How can I prove I made a payment?

Keep records of your payment transactions, including confirmation emails, receipts, bank statements, or cancelled checks. Your insurer’s online portal may also provide payment confirmation.

What if I have a dispute regarding a premium payment?

Contact your insurer immediately to explain the situation and work towards a resolution. Review your policy and payment records carefully.