Securing your future well-being often involves navigating complex financial landscapes. Long-term care insurance, while crucial for protecting against the high costs of potential future care needs, presents a significant financial commitment. Understanding the factors that influence long-term care insurance premiums is therefore paramount. This guide will demystify the intricacies of premium calculations, payment options, and strategies for managing this essential expense, empowering you to make informed decisions.

From the impact of age and health status to the role of policy benefits and insurer stability, we’ll explore the key elements shaping your premium costs. We’ll also delve into various payment structures, including level versus step-rate premiums, and discuss strategies for minimizing premium increases over time. By the end, you’ll possess a clearer understanding of how to choose a policy that aligns with your financial situation and long-term care needs.

Factors Influencing Long-Term Care Insurance Premiums

Securing long-term care insurance involves careful consideration of various factors that significantly impact the cost of premiums. Understanding these factors allows for informed decision-making and the selection of a policy that aligns with individual needs and financial capabilities. This section will detail the key elements influencing premium calculations.

Age’s Impact on Long-Term Care Insurance Premiums

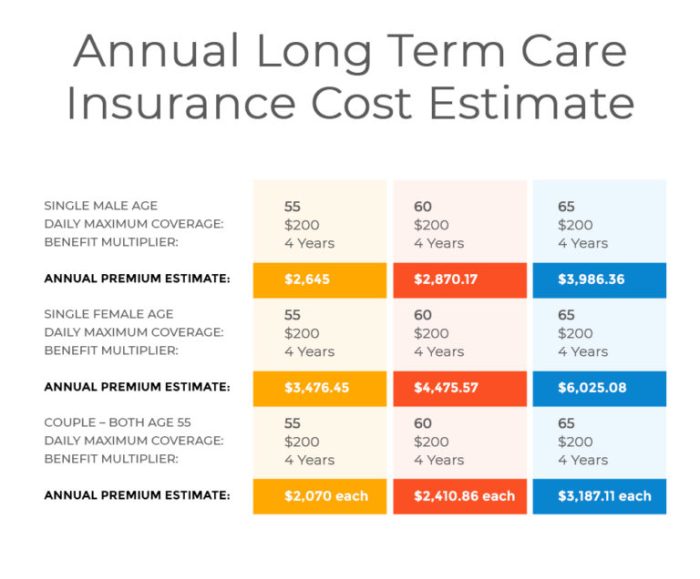

Age is a primary determinant of long-term care insurance premiums. The older an applicant is, the higher the likelihood of needing long-term care, leading to increased premiums. Younger applicants generally receive lower rates due to a reduced risk of needing care in the near future. The following table illustrates this relationship, presenting hypothetical premium examples for different age groups and risk profiles (Low, Medium, High). Note that these are illustrative examples and actual premiums vary significantly based on insurer and specific policy details.

| Age | Premium (Low) | Premium (Medium) | Premium (High) |

|---|---|---|---|

| 50 | $1,000 | $1,500 | $2,000 |

| 55 | $1,200 | $1,800 | $2,500 |

| 60 | $1,500 | $2,300 | $3,200 |

| 65 | $2,000 | $3,000 | $4,000 |

Health Status and Long-Term Care Insurance Premiums

An applicant’s health status significantly impacts premium calculations. Pre-existing conditions, current health issues, and family history of illnesses all influence the assessment of risk. For example, a history of diabetes or heart disease might result in higher premiums due to an increased likelihood of needing long-term care. Similarly, individuals with a family history of Alzheimer’s disease might face higher premiums because of the increased probability of developing this condition. Insurers conduct thorough medical underwriting to assess these risks.

Policy Benefits and Premium Costs

The level of benefits included in a long-term care insurance policy directly correlates with the premium cost. Higher coverage amounts, longer benefit periods, and more comprehensive benefits packages generally result in higher premiums.

- Lower Benefit Level: A policy with a lower daily benefit amount ($100/day) and a shorter benefit period (2 years) might cost significantly less, perhaps around $1,000 annually.

- Medium Benefit Level: Increasing the daily benefit to $200/day and extending the benefit period to 5 years would lead to a substantial increase, potentially reaching $2,500 annually.

- Higher Benefit Level: A comprehensive policy with a daily benefit of $300/day and a lifetime benefit period could cost considerably more, perhaps $4,000 or more annually.

Insurer Financial Strength and Premium Costs

The financial strength and rating of the insurance company offering the policy influence premiums. Insurers with strong financial ratings and a history of paying claims reliably may offer slightly higher premiums due to their greater stability and security. Conversely, insurers with weaker ratings might offer lower premiums but pose a higher risk of potential insolvency, impacting the future payout of benefits. It is crucial to research the insurer’s financial stability before purchasing a policy.

Premium Payment Options and Structures

Choosing a long-term care insurance policy involves understanding not only the coverage but also the various ways premiums can be paid and structured. This section details the available payment options and explains how different premium structures can significantly impact your overall cost. Careful consideration of these factors is crucial for securing affordable and sustainable long-term care coverage.

Payment Frequency Options

Long-term care insurance premiums can typically be paid on a monthly, quarterly, or annual basis. Monthly payments offer greater flexibility, allowing for easier budgeting and spreading the cost throughout the year. Quarterly payments provide a balance between convenience and cost savings, as fewer payments are made. Annual payments offer the lowest administrative costs and potentially lower overall premiums, but require a larger upfront payment. The choice depends on individual financial preferences and cash flow management strategies. Many insurers offer multiple options, allowing policyholders to select the payment schedule that best suits their needs.

Premium Payment Structures: Level vs. Step-Rate

Long-term care insurance premiums can be structured in two primary ways: level premiums and step-rate premiums. Understanding the differences is critical for projecting long-term costs.

Comparison of Level and Step-Rate Premiums

The following table illustrates the differences between level and step-rate premiums over a ten-year period. Note that these are illustrative examples, and actual premiums will vary based on insurer, policy features, and individual risk factors.

| Payment Structure | Initial Premium | Premium Increases | Total Cost over 10 years |

|---|---|---|---|

| Level Premium | $1500 | None | $15,000 |

| Step-Rate Premium (5% annual increase) | $1200 | 5% annually | $17,716 |

Inflation Protection Riders

Inflation protection riders help to mitigate the impact of rising healthcare costs over time. These riders increase the daily or monthly benefit amount of the policy at a predetermined rate, usually linked to an inflation index like the Consumer Price Index (CPI). While this protection ensures your benefits will maintain their purchasing power, it comes at an increased premium cost. For example, a policy with a 3% annual inflation protection rider will have higher premiums than a policy without this rider, but the benefits will be substantially higher in the future. The added cost is an investment in maintaining the value of your benefits in the long run.

Guaranteed Insurability Option

A guaranteed insurability option allows you to increase your coverage amount at predetermined intervals (e.g., every 3 years) without undergoing a new medical underwriting process. This is valuable as your health might change over time, potentially making it harder or impossible to obtain additional coverage later. While this offers flexibility and peace of mind, it typically increases your premiums over time. The additional premiums reflect the insurer’s acknowledgment of the increased risk associated with the guaranteed future coverage, irrespective of your health status at the time of the increase. This feature is particularly beneficial for individuals anticipating significant life changes or increased healthcare needs in the future.

Illustrative Examples of Premium Calculations

Understanding how long-term care insurance premiums are calculated can seem complex, but breaking down the process reveals the key factors at play. Several variables interact to determine your individual premium, and this section will illustrate this with a hypothetical example and a visual representation.

Hypothetical Premium Calculation Scenario

Let’s consider two individuals, both applying for a long-term care insurance policy at age 55. Individual A is a non-smoker with a family history of heart disease, while Individual B is a smoker with no significant family history of health issues. Both desire a daily benefit of $150, a 3-year benefit period, and a 5% inflation protection rider. Their premiums will differ significantly due to their health profiles and lifestyle choices.

Individual A’s premium might be calculated as follows (these are illustrative figures and not reflective of any specific insurer’s pricing): Base premium: $1,500 annually. Heart disease family history surcharge: +$200 annually. Total Annual Premium: $1,700.

Individual B’s premium, factoring in smoking: Base premium: $1,500 annually. Smoking surcharge: +$300 annually. Total Annual Premium: $1,800.

This simplified example demonstrates how health status and lifestyle significantly impact premiums. Other factors, such as age at application, benefit amount, and benefit period, would also contribute to the final premium. A more comprehensive calculation would involve actuarial models considering mortality rates, morbidity rates, and inflation projections.

Visual Representation of Age, Health, and Premium Cost

A three-dimensional bar graph could effectively illustrate the relationship between age, health status, and premium cost. The x-axis would represent age (ranging, for example, from 45 to 75), the y-axis would represent health status (categorized as excellent, good, fair, poor), and the z-axis would represent the annual premium cost. Each bar would represent a specific combination of age and health status, with the height of the bar indicating the premium cost. For instance, a 50-year-old with excellent health would have a shorter bar (lower premium) compared to a 65-year-old with poor health, which would have a much taller bar (higher premium). The graph would clearly show how premiums increase with age and deteriorate with health status.

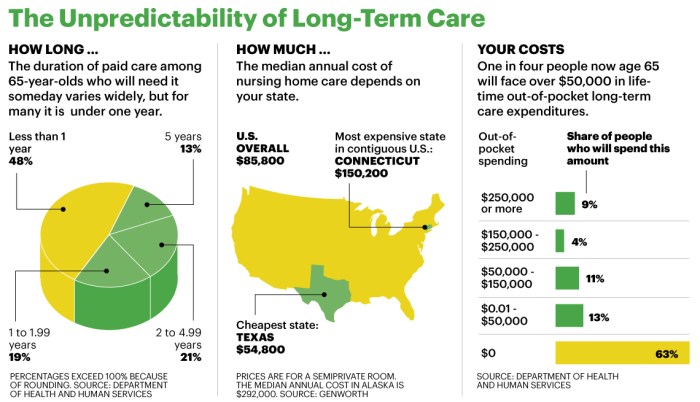

Impact of Different Benefit Periods on Total Policy Cost

The length of the benefit period—the duration for which benefits are paid—significantly influences the total cost of the policy over time. A longer benefit period provides greater financial protection but results in higher premiums. For example, a policy with a 2-year benefit period will have lower premiums than a policy with a 5-year benefit period, even if all other factors remain the same. However, the shorter benefit period offers less protection against long-term care needs that might exceed two years. The total cost over time will depend on the premium paid each year multiplied by the number of years the policy is in force. A longer benefit period, although more expensive initially, might prove more cost-effective if the individual requires long-term care for an extended duration. Conversely, a shorter benefit period could result in significant out-of-pocket expenses if care needs extend beyond the benefit period. This highlights the need to carefully weigh the trade-off between premium cost and the level of protection desired.

Ending Remarks

Planning for long-term care is a critical aspect of comprehensive financial security. While the complexities of long-term care insurance premiums can initially seem daunting, a thorough understanding of the factors influencing these costs, coupled with strategic planning, can lead to a more financially sound and secure future. By carefully considering your age, health, desired benefit levels, and the financial strength of the insurer, you can make informed decisions to protect yourself and your loved ones against the substantial financial burdens associated with long-term care.

General Inquiries

What happens if my health deteriorates after purchasing a policy?

Most policies will not increase premiums due to worsening health after the policy is issued, but pre-existing conditions might impact eligibility or initial premium.

Can I change my payment frequency?

Many insurers offer flexibility in payment frequency (monthly, quarterly, annually), but check your policy for specific terms and potential fees.

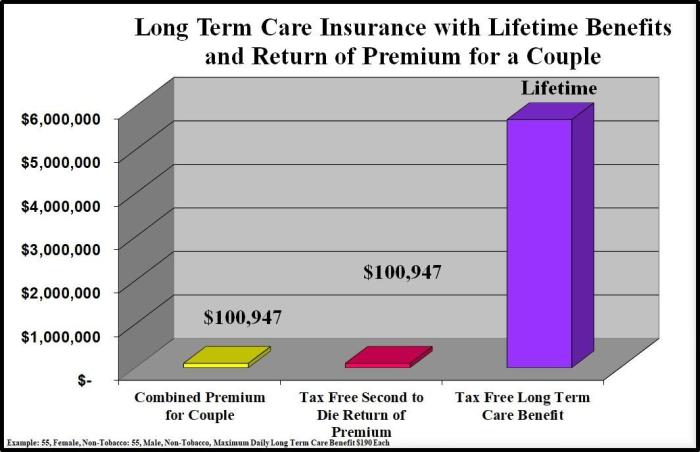

What are the tax implications of long-term care insurance?

Premiums are generally not tax-deductible, but benefits may be tax-free depending on your situation and how the benefits are structured. Consult a tax professional for personalized advice.

What if I can no longer afford the premiums?

Options include reducing coverage, adjusting benefit periods, or potentially surrendering the policy (though this may result in loss of premium payments). Consult your insurer to explore options.

How often are premiums reviewed and adjusted?

Premium adjustments vary by insurer and policy type. Some policies have level premiums, while others may increase periodically. Your policy will Artikel the specifics.