Navigating the complexities of health insurance can feel like deciphering a foreign language. This guide aims to demystify the intricacies of health insurance premium programs, providing a clear understanding of how they function, what influences their cost, and how to navigate the enrollment process. Whether you’re an employer offering coverage, an individual seeking insurance, or simply curious about the system, this resource offers valuable insights into this crucial aspect of healthcare access.

From understanding the core components of a typical program and the factors driving premium costs, to exploring different program types and government regulations, we will cover the key aspects influencing your healthcare expenses. We’ll also delve into the impact these programs have on affordability and access, and look towards future trends and challenges within the industry.

Defining Health Insurance Premium Programs

Health insurance premium programs are systems designed to finance healthcare services. Individuals or groups pay regular payments (premiums) in exchange for coverage of medical expenses, reducing the financial burden of unexpected illnesses or injuries. Understanding these programs is crucial for navigating the complexities of healthcare financing and making informed decisions about your health coverage.

Core Components of Health Insurance Premium Programs

A typical health insurance premium program consists of several key components. These include the premium itself – the recurring payment for coverage; the deductible – the amount the insured must pay out-of-pocket before the insurance company starts covering expenses; the copay – a fixed amount paid by the insured for each medical visit; the coinsurance – the percentage of costs shared by the insured after the deductible is met; and the out-of-pocket maximum – the highest amount the insured will pay in a given year. The specific details of these components vary widely depending on the type of plan.

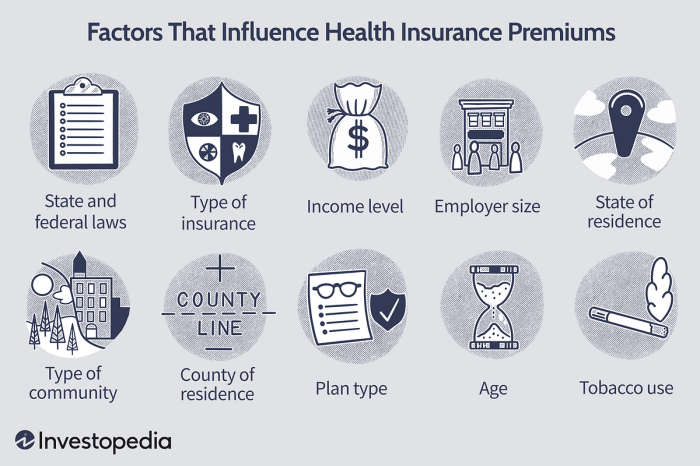

Factors Influencing Premium Costs

Several factors significantly impact the cost of health insurance premiums. Age is a major factor, with older individuals generally paying higher premiums due to increased healthcare needs. Geographic location plays a role, as healthcare costs vary considerably across regions. The type of plan chosen (e.g., HMO, PPO) also affects premiums, with plans offering greater flexibility often carrying higher costs. Individual health status, including pre-existing conditions, significantly impacts premiums, as individuals with pre-existing conditions may face higher costs. Finally, the level of coverage selected, including deductibles and co-pays, influences premium amounts; higher coverage typically translates to higher premiums.

Types of Health Insurance Premium Programs

Various models exist for health insurance premium programs. Employer-sponsored plans are offered by employers to their employees, often with employer contributions reducing the employee’s cost. The individual market allows individuals to purchase plans directly from insurance companies, with premiums based on individual factors. Government subsidies, such as those available through the Affordable Care Act (ACA) in the United States, help individuals and families with lower incomes afford health insurance by reducing their premium costs. Medicaid and Medicare are government-sponsored programs providing healthcare coverage to specific populations.

Comparison of Health Insurance Premium Program Models

| Program Type | Premium Cost | Coverage Level | Eligibility |

|---|---|---|---|

| Employer-Sponsored | Varies widely; often partially subsidized by employer | Varies widely depending on plan | Employees of participating employers |

| Individual Market | Varies widely based on age, location, health status, and plan type | Varies widely depending on plan | Individuals who purchase plans directly |

| Government Subsidized (e.g., ACA) | Reduced premiums based on income | Varies depending on plan and subsidy level | Individuals and families meeting income requirements |

Government Regulations and Subsidies

Government regulations and subsidies play a crucial role in shaping the landscape of health insurance premium programs. These interventions aim to ensure affordability, accessibility, and overall market stability within the healthcare system. Understanding the complexities of these regulations and the various subsidy programs available is vital for both individuals seeking coverage and policymakers striving for equitable healthcare access.

Key Government Regulations Impacting Health Insurance Premium Programs

Numerous regulations influence health insurance premium programs. These often involve mandates requiring insurers to cover specific services (e.g., essential health benefits in the Affordable Care Act), restrictions on pre-existing condition exclusions, and regulations concerning pricing and benefit design. For example, many countries have regulations limiting how much insurers can charge for specific procedures or medications. Other regulations focus on transparency, requiring insurers to publicly disclose their premium rates and benefit structures to allow for better consumer comparison and informed choices. Furthermore, regulations often govern the marketing and sales practices of insurance providers to prevent misleading advertising and ensure fair competition. Enforcement of these regulations typically falls under the purview of government agencies specializing in healthcare and insurance oversight.

Types of Subsidies or Tax Credits Available to Reduce Premium Costs

Governments employ various strategies to make health insurance more affordable. Subsidies, in the form of direct financial assistance or tax credits, are common tools. Direct subsidies typically involve government payments made directly to insurance companies to reduce the cost of premiums for eligible individuals or families. Tax credits, on the other hand, reduce an individual’s tax liability, effectively lowering their net premium cost. Eligibility for these subsidies is often determined by income levels and family size. For instance, the Affordable Care Act in the United States provides tax credits based on a sliding scale, making coverage more accessible to lower-income individuals. These subsidies can significantly impact the affordability of health insurance, allowing individuals to access necessary care without facing insurmountable financial burdens.

Comparison of Subsidy Programs in the United States and Switzerland

The United States and Switzerland offer contrasting approaches to health insurance subsidies. In the U.S., the Affordable Care Act (ACA) offers premium tax credits based on income and family size through the marketplace. Eligibility is determined by a percentage of the federal poverty level, with subsidies available to those earning between 100% and 400% of the poverty level. These credits are directly applied to reduce the cost of premiums purchased through the ACA marketplace. In contrast, Switzerland employs a system of mandatory health insurance with subsidies based on income. Individuals are required to purchase health insurance, but those with lower incomes receive government subsidies to help offset the cost of premiums. The Swiss system aims for universal coverage, with subsidies ensuring affordability for all citizens regardless of income level, though the level of subsidy varies based on individual income. While both systems aim to improve access to healthcare, they differ significantly in their implementation and eligibility criteria.

Benefits of Government Subsidies for Health Insurance Premiums

Government subsidies for health insurance premiums offer numerous benefits:

- Increased Access to Healthcare: Subsidies make health insurance more affordable, enabling more people to obtain necessary medical care.

- Improved Public Health Outcomes: Wider access to preventative and ongoing care leads to better health outcomes for the population as a whole.

- Reduced Healthcare Costs in the Long Run: Early intervention and preventative care facilitated by increased access often leads to lower overall healthcare costs over time.

- Economic Stability: Health insurance reduces the financial burden of unexpected medical expenses, preventing individuals from falling into financial hardship.

- Social Equity: Subsidies promote equity by ensuring access to healthcare for individuals across different socioeconomic backgrounds.

Future Trends and Challenges

The landscape of health insurance premium programs is constantly evolving, driven by technological advancements, shifting demographics, and ongoing debates about healthcare access and affordability. Understanding these emerging trends and the associated challenges is crucial for both individuals navigating the system and policymakers striving to create a more sustainable and equitable healthcare landscape.

Predicting the future of health insurance premiums requires considering several interacting factors, including technological innovation, regulatory changes, and demographic shifts. These factors will influence both the cost and accessibility of health insurance, posing significant challenges for individuals and the policymakers responsible for managing the system.

Emerging Trends in Health Insurance Premium Programs

Several key trends are reshaping health insurance premium programs. The rise of telehealth, for instance, offers potential cost savings by reducing the need for in-person visits. However, ensuring equitable access to telehealth services, particularly for individuals in rural areas or with limited technological literacy, presents a significant challenge. Another trend is the increasing adoption of value-based care models, which incentivize providers to focus on patient outcomes rather than simply the volume of services provided. While promising for cost control, the transition to value-based care requires significant investment in data infrastructure and changes in provider behavior. Finally, the increasing use of data analytics and artificial intelligence is enabling more personalized and predictive approaches to healthcare, potentially leading to more efficient and effective insurance programs. However, concerns about data privacy and security must be carefully addressed.

Challenges Faced by Individuals and Policymakers Regarding Premium Costs

The rising cost of health insurance premiums poses a significant challenge for both individuals and policymakers. For individuals, escalating premiums can lead to reduced access to necessary care, forcing difficult choices between healthcare and other essential needs. This is particularly acute for those with lower incomes or pre-existing conditions. Policymakers, meanwhile, face the challenge of balancing the need to control costs with the desire to ensure broad access to quality healthcare. The complexity of the healthcare system, coupled with the influence of powerful lobbying groups, makes finding effective solutions particularly difficult. For example, the ongoing debate surrounding drug pricing illustrates the complexities involved in controlling healthcare costs. The high cost of prescription drugs contributes significantly to rising premiums, and finding a balance between protecting pharmaceutical innovation and ensuring affordable access remains a major hurdle.

Potential Solutions to Address the Rising Cost of Health Insurance Premiums

Addressing the rising cost of health insurance premiums requires a multi-pronged approach. One key strategy is to promote preventative care and wellness programs. Investing in preventative measures can significantly reduce the need for expensive treatments later in life. Another approach involves increasing transparency and competition within the healthcare market. Making pricing information more readily available to consumers can empower them to make more informed decisions. Furthermore, promoting the development and adoption of cost-effective technologies, such as telehealth and remote patient monitoring, can help to contain costs. Finally, exploring alternative payment models, such as value-based care, can incentivize providers to focus on delivering high-quality care at a lower cost. For example, the expansion of accountable care organizations (ACOs) demonstrates a commitment to shifting from fee-for-service models towards models that reward providers for achieving better patient outcomes at lower costs.

A Scenario Outlining Potential Future Developments in Health Insurance Premium Programs

By 2030, we might see a landscape where personalized health insurance plans, based on individual genetic predispositions and lifestyle choices, are more common. These plans would offer preventative measures tailored to specific needs, leading to lower premiums for individuals who actively manage their health. However, concerns about genetic discrimination and data privacy would need careful consideration. Simultaneously, government regulation might focus on further incentivizing the adoption of value-based care models, potentially leading to a reduction in overall healthcare spending and, consequently, lower premiums. However, this transition would require significant investment in data infrastructure and workforce training. This scenario, while optimistic, highlights the ongoing tension between technological advancement, regulatory frameworks, and the fundamental need for affordable and accessible healthcare.

Last Word

Effectively managing healthcare costs requires a thorough understanding of health insurance premium programs. This guide has explored the multifaceted nature of these programs, highlighting the various factors influencing premiums, enrollment processes, and the role of government regulations. By understanding these key elements, individuals and employers can make informed decisions to secure affordable and comprehensive healthcare coverage. Proactive engagement with these programs is essential for ensuring access to quality healthcare in an increasingly complex landscape.

Q&A

What happens if I miss a premium payment?

Missing a premium payment can result in a lapse in coverage, meaning you’ll be responsible for all medical expenses until your payment is received and coverage is reinstated. Late fees may also apply.

Can I change my health insurance plan during the year?

Generally, you can only change your health insurance plan during the annual open enrollment period, unless you qualify for a special enrollment period due to a qualifying life event (e.g., marriage, job loss).

What types of documentation do I need to enroll?

Required documentation varies by program but typically includes proof of identity, income verification, and possibly proof of residency.

How are premiums calculated for families versus individuals?

Premiums for family plans are generally higher than individual plans, reflecting the increased coverage for multiple individuals. The exact calculation depends on the plan and the number of family members covered.