Navigating the world of health insurance can feel like deciphering a complex code. Premiums, the monthly payments for coverage, are a significant factor for many, influencing financial planning and healthcare access. This guide unravels the mysteries behind typical health insurance premiums, exploring the key factors that determine their cost and offering strategies to find affordable options.

From the impact of age and location to the nuances of different plan types and government subsidies, we’ll dissect the various elements that contribute to the final premium amount. We’ll also examine how deductibles, co-pays, and out-of-pocket maximums interact with premiums, providing a clearer picture of the overall cost of healthcare coverage.

Defining “Typical Health Insurance Premium”

A typical health insurance premium is the recurring payment an individual or group makes to a health insurance company in exchange for coverage of medical expenses. The amount of this payment varies significantly based on several interconnected factors, making a single “typical” premium difficult to define precisely. Instead, it’s more accurate to understand the range of premiums and the reasons for their variation.

Factors Influencing Premium Variations

Several key factors influence the cost of health insurance premiums. These factors are often intertwined and influence each other, creating a complex pricing structure. Understanding these factors helps individuals make informed choices about their health insurance plans.

Premium Components

A health insurance premium is comprised of several key components. These components reflect the costs associated with providing healthcare coverage and the insurer’s administrative expenses. The specific breakdown can vary depending on the insurance company and the plan’s structure, but generally includes:

- Claims Costs: This is the largest portion of the premium, representing the insurer’s expected payouts for medical services used by policyholders. This is influenced by factors such as the age and health status of the insured population, the types of medical services covered, and the cost of those services in the geographic area.

- Administrative Costs: These costs cover the insurer’s expenses related to managing the plan, including salaries, technology, marketing, and customer service. These costs are often a fixed percentage of the premium.

- Profit Margin: Insurance companies, like any business, need to make a profit. A portion of the premium contributes to the company’s overall profitability.

- Reserves: Insurers set aside funds as reserves to cover unexpected or unusually high claims costs. This helps ensure the financial stability of the plan.

Age’s Impact on Premiums

Age is a significant factor influencing premium costs. Older individuals generally pay higher premiums than younger individuals because they tend to have higher healthcare utilization rates and are more likely to require more expensive medical services. For example, a 60-year-old might pay significantly more than a 30-year-old for the same plan, reflecting the increased risk the insurer assumes.

Location’s Influence on Premiums

Geographic location plays a crucial role in premium pricing. Premiums are higher in areas with higher costs of living and healthcare services. For instance, premiums in major metropolitan areas with high-cost hospitals and specialists will generally be higher than premiums in rural areas with lower healthcare costs. The availability of healthcare providers and the competition among insurers within a region also impact pricing.

Health Status and Premiums

An individual’s health status significantly affects their premium. People with pre-existing conditions or a history of significant medical issues typically pay higher premiums because they represent a higher risk to the insurer. Insurers assess risk based on medical history, family history, and lifestyle factors to determine appropriate premium levels. For example, someone with a history of heart disease would likely pay more than someone with a clean bill of health.

Individual vs. Family Premiums

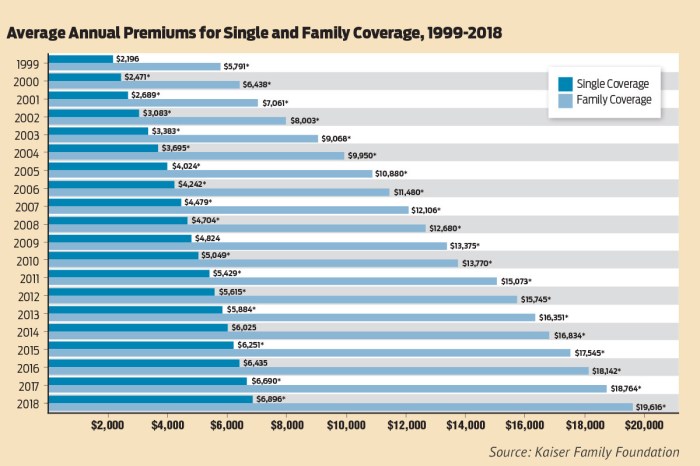

Individual health insurance premiums cover only one person, while family plans cover multiple individuals. Family plans typically cost more than individual plans because they cover a larger group of people, increasing the potential for higher claims costs. The exact cost difference depends on the number of people covered and their ages and health statuses. A family with several children and adults might pay significantly more than an individual purchasing a single plan.

Factors Affecting Premium Costs

Several key factors influence the cost of health insurance premiums. Understanding these factors can help individuals make informed decisions when choosing a plan. These factors interact in complex ways, so it’s crucial to consider them holistically rather than in isolation.

Deductibles, Co-pays, and Out-of-Pocket Maximums

The relationship between premiums and cost-sharing mechanisms like deductibles, co-pays, and out-of-pocket maximums is inverse. Higher deductibles, co-pays, and higher out-of-pocket maximums generally result in lower premiums. This is because the insurance company is assuming less risk upfront. For example, a plan with a $5,000 deductible will likely have a lower premium than a plan with a $1,000 deductible, as the insurer only pays after the deductible is met. Conversely, a plan with a lower out-of-pocket maximum offers greater protection against high medical costs but usually comes with a higher premium. The choice depends on an individual’s risk tolerance and expected healthcare utilization.

Premium Costs for Different Coverage Levels

Health insurance plans are often categorized by metal tiers: Bronze, Silver, Gold, and Platinum. These tiers represent the level of cost-sharing responsibility the insured individual bears. Bronze plans have the lowest premiums but the highest out-of-pocket costs; Platinum plans have the highest premiums but the lowest out-of-pocket costs. Silver and Gold plans fall between these extremes. For instance, a Bronze plan might require a higher deductible and higher co-pays, leading to lower monthly premiums, while a Platinum plan would likely have a lower deductible and lower co-pays, resulting in higher monthly premiums. The optimal tier depends on an individual’s health status, risk tolerance, and financial situation.

The Role of Pre-existing Conditions

Under the Affordable Care Act (ACA), insurers cannot deny coverage or charge higher premiums based solely on pre-existing conditions. However, this doesn’t mean pre-existing conditions have no impact on premiums. Individuals with pre-existing conditions might find that their overall healthcare costs are higher, potentially influencing the overall premium cost across the risk pool. While insurers cannot discriminate based solely on pre-existing conditions, they can still take into account the expected cost of care for the entire insured population.

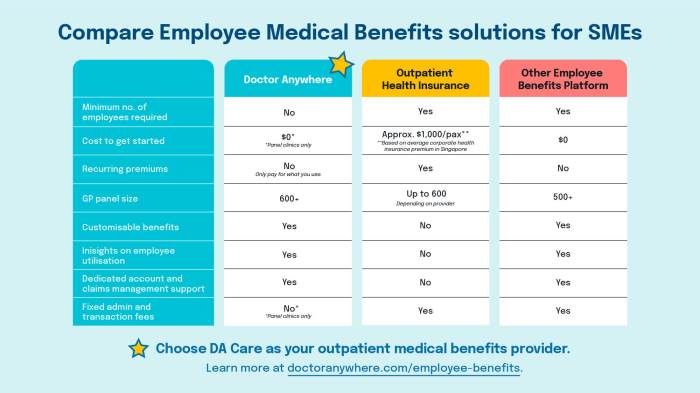

Employer-Sponsored vs. Individual Market Plans

Premiums for employer-sponsored plans are typically lower than those for individual market plans. This is primarily because employers often contribute a significant portion of the premium cost, and group plans benefit from economies of scale. Additionally, employer-sponsored plans may negotiate lower rates with insurance companies due to their larger pool of insured individuals. For example, a large company might secure a better rate than an individual purchasing a plan on the marketplace. The difference in cost can be substantial, often leading to significant savings for employees.

Average Premium Costs Across Demographics

Understanding the average cost of health insurance premiums is crucial for individuals and families to budget effectively and make informed decisions about their healthcare coverage. Several factors significantly influence these costs, leading to variations across different demographics and geographic locations. This section will explore these variations in more detail.

Premium costs are not uniform across the population. They vary considerably depending on several key factors, including age, family size, location, and income. Analyzing these variations allows for a better understanding of the accessibility and affordability of health insurance for different segments of the population.

Average Premium Costs by Age Group

The following table displays estimated average premium costs for individual and family health insurance plans, categorized by age range. Note that these are averages and actual costs can vary significantly based on plan type, location, and health status.

| Age Range | Average Individual Premium | Average Family Premium | Notes |

|---|---|---|---|

| 18-25 | $400 | $1200 | Premiums are generally lower for younger adults due to lower healthcare utilization. |

| 26-35 | $550 | $1600 | Premiums begin to increase as individuals age and healthcare needs potentially rise. |

| 36-45 | $700 | $2000 | This age group often faces higher premiums due to increased risk factors and potential family planning expenses. |

| 46-64 | $900 | $2500 | Premiums significantly increase as individuals approach retirement age and face higher healthcare risks. |

| 65+ | N/A (Medicare) | N/A (Medicare) | Individuals 65 and older are typically eligible for Medicare, a federally funded health insurance program. |

Geographic Variation in Average Premium Costs

A visual representation of average premium costs across different states could be depicted as a choropleth map. This map would use varying shades of color to represent the average premium cost in each state. States with higher average premiums would be represented by darker shades, while states with lower average premiums would be represented by lighter shades. For example, states with a high concentration of elderly individuals or higher healthcare utilization rates would likely show darker shades indicating higher average costs. Conversely, states with a younger population and lower healthcare utilization would display lighter shades indicating lower average costs. This map would provide a clear and concise visual comparison of premium costs across the United States, allowing for easy identification of states with the highest and lowest average costs. A legend would be included to indicate the range of premium costs represented by each color shade.

Income Level and Health Insurance Affordability

Affordability of health insurance premiums is directly linked to income level. Individuals and families with lower incomes often face a greater challenge in affording health insurance, even with subsidies. For example, a family earning $30,000 annually might find a $1,500 monthly family premium unaffordable, representing a significant portion of their monthly income. In contrast, a family earning $100,000 annually might find the same premium more manageable. This disparity highlights the need for government assistance programs and subsidies to help low-income families access affordable health insurance. The percentage of income spent on health insurance premiums is a key indicator of affordability, with higher percentages indicating reduced affordability. For instance, a family spending 10% of their income on premiums is generally considered more affordable than a family spending 20% or more.

Closing Summary

Understanding your typical health insurance premium is crucial for making informed decisions about your healthcare. By considering the factors influencing premium costs, comparing different plan options, and exploring available subsidies, you can secure comprehensive coverage that aligns with your budget and health needs. Remember, proactive planning and informed choices can significantly impact your overall healthcare expenses and peace of mind.

Detailed FAQs

What is a deductible?

A deductible is the amount you pay out-of-pocket for covered healthcare services before your insurance company starts paying.

How do pre-existing conditions affect premiums?

Under the Affordable Care Act (ACA), insurers cannot deny coverage or charge higher premiums based solely on pre-existing conditions. However, the conditions may influence the cost of coverage indirectly through higher risk assessment.

Can I change my health insurance plan during the year?

Generally, you can only change your health insurance plan during open enrollment periods, unless you qualify for a special enrollment period due to a qualifying life event (e.g., marriage, job loss).

What are the different metal tiers of health insurance plans (Bronze, Silver, Gold, Platinum)?

These tiers represent different levels of cost-sharing. Bronze plans have the lowest monthly premiums but higher out-of-pocket costs. Platinum plans have the highest monthly premiums but the lowest out-of-pocket costs. Silver and Gold fall in between.