Navigating the world of health insurance can feel like deciphering a complex code. Premiums, the monthly payments for coverage, vary wildly, leaving many wondering what constitutes “normal.” This guide demystifies health insurance premiums, exploring the factors that influence their cost and providing practical strategies for managing expenses. We’ll delve into the intricacies of plan types, the impact of individual choices, and the role of external forces in shaping the overall cost of health insurance.

From understanding the components of your premium to navigating marketplace options, we aim to equip you with the knowledge to make informed decisions about your health insurance coverage. We’ll examine how age, location, health status, and lifestyle choices contribute to premium variations, offering clear explanations and illustrative examples to clarify the often-confusing landscape of health insurance pricing.

Defining “Normal” Health Insurance Premiums

Defining a “normal” health insurance premium is challenging due to the significant variability inherent in the system. There’s no single, universally applicable figure. Premiums are highly personalized, reflecting a complex interplay of individual circumstances and broader market forces. Understanding what constitutes a “normal” premium requires considering several key factors.

Premiums vary considerably based on age, geographic location, and individual health status. Younger, healthier individuals generally pay less than older individuals with pre-existing conditions. Location also plays a significant role, as healthcare costs and provider networks differ across regions. A “normal” premium in a rural area with limited healthcare options may be considerably lower than in a major metropolitan area with a high concentration of specialists and advanced medical facilities.

Factors Influencing Premium Perception

Several factors influence what an individual perceives as a “normal” premium. Personal financial resources significantly impact this perception. A premium that seems reasonable to a high-income earner might be prohibitive for someone with a lower income. Marketing and advertising also shape perceptions; insurance companies often present premiums in ways that highlight affordability, potentially influencing what consumers consider “normal.” Furthermore, the level of coverage offered (e.g., bronze, silver, gold, platinum plans) greatly impacts the premium cost, making direct comparisons between plans difficult without careful consideration of benefits. Finally, the perceived value of the insurance itself—the peace of mind it provides—influences the willingness to pay a specific premium.

Average Premiums Across Demographic Groups

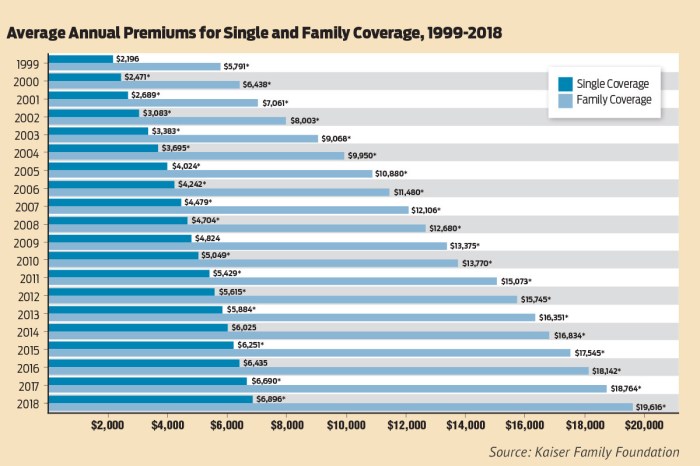

The following table provides a simplified illustration of how average premiums might vary across different demographic groups. Note that these figures are hypothetical examples for illustrative purposes only and do not represent actual premiums. Actual premiums vary significantly based on the specific plan, insurer, and individual circumstances. Data from reliable sources like the Kaiser Family Foundation and the Centers for Medicare & Medicaid Services would be necessary to obtain precise average premium information for a given year and location.

| Demographic Group | Age Range | Location (Example) | Average Monthly Premium (Hypothetical) |

|---|---|---|---|

| Young Adult (Single) | 25-34 | Rural Midwest | $300 |

| Young Adult (Single) | 25-34 | Urban Coast | $450 |

| Family with Children | 35-44 | Suburban South | $1200 |

| Senior Citizen (Single) | 65+ | Urban Northeast | $800 |

Factors Affecting Premium Costs

Several interconnected factors influence the cost of individual health insurance premiums. Understanding these factors empowers consumers to make informed decisions and potentially lower their overall healthcare expenses. These factors range from personal characteristics to the specific design of the insurance plan itself.

Individual health insurance premiums are a complex calculation, reflecting a multitude of variables. Age, location, and health status are key determinants, but lifestyle choices and the type of plan selected also play significant roles. The interplay of these factors creates a wide range of premium costs, highlighting the importance of careful consideration before selecting a policy.

Age and Health Status

Age is a significant factor in premium calculations. Generally, older individuals tend to have higher premiums due to a statistically higher likelihood of needing more extensive healthcare services. Pre-existing conditions also significantly impact premium costs. Individuals with chronic illnesses or conditions requiring ongoing treatment will typically face higher premiums than those in good health. For example, someone with diabetes might see a substantially higher premium than someone with no pre-existing conditions, reflecting the anticipated higher cost of managing their condition.

Geographic Location

The cost of healthcare varies geographically. Premiums are higher in areas with higher healthcare costs, such as major metropolitan areas with high-cost hospitals and specialists. Rural areas, conversely, may have lower premiums but potentially limited access to specialized care. For instance, a premium in New York City will likely be higher than one in a rural area of Nebraska, reflecting differences in the overall cost of medical services and provider fees.

Lifestyle Choices

Lifestyle choices directly impact health and, consequently, insurance premiums. Smoking, excessive alcohol consumption, and a lack of physical activity increase the risk of developing various health problems. Insurers consider these factors when calculating premiums, often charging higher rates for individuals engaging in risky behaviors. For example, a smoker might pay significantly more than a non-smoker due to the increased risk of lung cancer, heart disease, and other smoking-related illnesses. Similarly, individuals with a Body Mass Index (BMI) indicating obesity may also face higher premiums.

Type of Health Insurance Plan

Different types of health insurance plans offer varying levels of coverage and cost-sharing. This directly impacts the premium amount. HMOs (Health Maintenance Organizations), PPOs (Preferred Provider Organizations), and POS (Point of Service) plans represent common choices, each with a unique cost structure.

| Plan Type | Premium Cost | Copay/Deductible | Network Restrictions |

|---|---|---|---|

| HMO | Generally lower | Typically lower | Strict; must see in-network providers |

| PPO | Generally higher | Typically higher | More flexible; can see out-of-network providers (at a higher cost) |

| POS | Moderate | Moderate | Combination; in-network preferred but out-of-network options available (at a higher cost) |

Impact of External Factors on Premiums

Health insurance premiums aren’t set in isolation; they’re significantly influenced by a range of external factors that fluctuate over time. Understanding these influences is crucial for both insurers and consumers to anticipate and adapt to changes in the cost of health coverage. These external pressures can dramatically alter the affordability and accessibility of healthcare, impacting individuals and the overall economy.

Economic conditions exert a powerful influence on health insurance premium costs. During periods of economic growth, individuals generally have higher disposable incomes, potentially leading to increased demand for healthcare services and higher utilization rates. Conversely, economic downturns can lead to reduced healthcare spending as individuals postpone non-essential care or lose their employer-sponsored health insurance. This fluctuating demand, coupled with the rising costs of medical care, directly impacts insurers’ expenses and consequently, premiums. For example, during the 2008 recession, we saw a temporary decrease in healthcare utilization, but this was often followed by a subsequent surge in demand as individuals sought deferred care, putting upward pressure on premiums in the following years. Inflation also plays a significant role; rising costs for pharmaceuticals, medical devices, and hospital services inevitably translate into higher premiums.

Economic Conditions and Premium Costs

The relationship between economic conditions and health insurance premiums is complex and multifaceted. Strong economic growth often correlates with higher healthcare utilization, driving up costs for insurers. Conversely, economic recessions can lead to reduced utilization, but this may be followed by a surge in demand as individuals address postponed care, creating cost pressures in the long term. Government economic policies, such as tax credits or subsidies for health insurance, also play a role in moderating premium increases, particularly for low-income individuals and families. Furthermore, unemployment rates directly impact the number of individuals relying on government-sponsored health insurance programs, adding to the overall financial burden.

Healthcare Legislation and Regulations

Healthcare legislation and regulations significantly shape the health insurance market and premium pricing. The Affordable Care Act (ACA) in the United States, for instance, introduced regulations aimed at expanding health insurance coverage and protecting consumers from unfair practices. While it broadened access to insurance, it also impacted premium costs through mandates like essential health benefits coverage and restrictions on pre-existing condition exclusions. State-level regulations also vary, influencing the competitive landscape and the costs of insurance within specific geographic areas. Regulations concerning medical malpractice, provider reimbursement rates, and the approval of new drugs and medical technologies all influence the overall cost of healthcare and subsequently, the premiums charged by insurers.

Technological Advancements and Premium Costs

Technological advancements in healthcare have a dual impact on premiums. While some innovations, like telehealth and remote patient monitoring, offer the potential for cost savings by increasing efficiency and accessibility, others, such as advanced diagnostic imaging and sophisticated treatments, can drive up costs. The introduction of new pharmaceuticals and medical devices, while often improving health outcomes, frequently comes with high development and manufacturing costs, leading to higher prices for consumers and impacting insurance premiums. The long-term effects of these technological changes are complex and often unpredictable, requiring careful evaluation to assess their overall impact on the affordability and sustainability of health insurance. For example, while gene therapy offers groundbreaking potential for treating previously incurable diseases, its high initial cost significantly impacts insurance premiums until widespread adoption lowers the price through economies of scale.

Last Recap

Ultimately, understanding your health insurance premium isn’t just about the monthly cost; it’s about securing your financial well-being and access to vital healthcare services. By understanding the factors influencing premium costs and employing effective management strategies, you can navigate the complexities of health insurance with confidence and make choices that best align with your individual needs and budget. Remember, proactive planning and informed decision-making are key to managing your health insurance expenses effectively.

User Queries

What is a deductible, and how does it affect my premium?

A deductible is the amount you pay out-of-pocket for covered healthcare services before your insurance begins to pay. Higher deductibles generally result in lower premiums, and vice-versa.

How often do health insurance premiums change?

Premiums typically change annually, often reflecting changes in healthcare costs, utilization rates, and regulatory adjustments. Some plans may also adjust premiums mid-year under specific circumstances.

Can I change my health insurance plan outside of open enrollment?

Generally, you can only change plans during open enrollment periods, unless you experience a qualifying life event (e.g., marriage, job loss) that allows for a special enrollment period.

What is a copay, and how is it different from a coinsurance?

A copay is a fixed amount you pay for a covered healthcare service (like a doctor’s visit). Coinsurance is a percentage of the cost you pay after you’ve met your deductible.

What is the role of my credit score in determining my health insurance premium?

In most states, credit scores are no longer used to determine health insurance premiums. However, there may be exceptions depending on the state and specific circumstances.