Navigating the complexities of health insurance can feel like deciphering a foreign language. However, understanding the Premium Tax Credit (PTC) is crucial for many Americans seeking affordable healthcare. This comprehensive guide unravels the mysteries surrounding the PTC, explaining its purpose, eligibility requirements, calculation methods, and the application process. We’ll explore how this vital credit impacts healthcare affordability and dispel common misconceptions, empowering you to make informed decisions about your health insurance.

The PTC isn’t just another government program; it’s a lifeline for millions, making quality healthcare accessible to individuals and families who might otherwise struggle to afford coverage. By understanding the nuances of the PTC, you can potentially save significant money on your monthly premiums and access the care you need without undue financial burden. This guide will provide you with the knowledge and resources to confidently navigate the PTC system.

Definition of Premium Tax Credit (PTC)

The Premium Tax Credit (PTC) is a government subsidy that helps individuals and families afford health insurance purchased through the Health Insurance Marketplace (also known as the Affordable Care Act or ACA marketplaces). It lowers the monthly cost of your health insurance premiums, making coverage more accessible.

The primary purpose of the PTC is to increase health insurance coverage among low- and moderate-income individuals and families. By reducing the financial burden of health insurance premiums, the PTC aims to ensure more people have access to necessary medical care and prevent financial hardship due to unexpected medical expenses. This aligns with the broader goals of the Affordable Care Act to expand access to affordable, quality healthcare.

Eligibility for the PTC is determined by several factors, primarily income. Generally, individuals and families whose income falls between 100% and 400% of the federal poverty level (FPL) may qualify. However, the specific eligibility criteria can vary slightly depending on the year and household size. Other factors, such as citizenship status and immigration status, may also play a role in determining eligibility. It’s important to note that eligibility isn’t guaranteed; it’s based on a complex calculation involving income, household size, and the cost of insurance plans in your area.

Comparison of the PTC to Other Health Insurance Subsidies

The PTC is one of several government programs designed to help people afford health insurance. It’s crucial to understand how it differs from other subsidies. The following table highlights some key distinctions:

| Subsidy | Primary Source | Eligibility Criteria | How it Works |

|---|---|---|---|

| Premium Tax Credit (PTC) | Affordable Care Act (ACA) Marketplaces | Income-based (100-400% FPL); Citizenship/Immigration Status | Direct reduction in monthly premium costs |

| Cost-Sharing Reductions (CSRs) | Affordable Care Act (ACA) Marketplaces (partially funded) | Income-based (below 250% FPL); plan selection | Lower out-of-pocket costs (deductibles, co-pays, etc.) |

| Medicaid | State and Federal Government | Income-based (generally below 138% FPL); Citizenship/Immigration Status; other factors | Government-funded health insurance coverage |

| CHIP (Children’s Health Insurance Program) | State and Federal Government | Income-based; Children under 19; Citizenship/Immigration Status | Government-funded health insurance coverage for children |

Eligibility Criteria for PTC

Eligibility for the Premium Tax Credit (PTC) hinges on several key factors, primarily focusing on income, household size, and citizenship or immigration status. Understanding these criteria is crucial for determining whether you qualify for financial assistance with your health insurance premiums. This section details the specific requirements and provides examples to illustrate how various life circumstances can affect eligibility.

Income Requirements for PTC Qualification

The amount of PTC you receive, or if you receive any at all, directly correlates to your household income. Your income is determined by your modified adjusted gross income (MAGI), which is your adjusted gross income (AGI) with certain adjustments. The IRS provides specific income thresholds that vary yearly and are adjusted based on your household size and location. If your MAGI falls below a certain percentage of the federal poverty level (FPL), you may be eligible for the full PTC. As your MAGI increases, the amount of PTC you receive decreases, eventually reaching a point where you no longer qualify. For example, a family of four in 2024 might qualify for a significant PTC if their MAGI is below 200% of the FPL, but receive a reduced credit if their MAGI is between 200% and 400% of the FPL. Above 400% of the FPL, they would likely not qualify for the PTC. It is important to consult the current IRS guidelines for the most up-to-date income thresholds.

Household Size and PTC Eligibility

Household size plays a significant role in determining PTC eligibility. The income thresholds used to calculate PTC eligibility are adjusted based on the number of people in your household. A larger household generally has higher income thresholds, reflecting the increased costs associated with supporting a larger family. For instance, a family of five will have higher income limits for PTC eligibility compared to a single individual. The IRS uses specific FPL guidelines that consider the number of individuals in the household, leading to different eligibility criteria depending on family size. This is because the cost of living and healthcare expenses generally increase with the number of people in a household.

Situations Impacting PTC Eligibility

Life events can significantly impact your PTC eligibility. Job loss, for example, can drastically reduce your income, potentially making you eligible for a PTC or increasing the amount of the credit you receive. Conversely, a substantial salary increase could render you ineligible. Changes in family status, such as marriage, divorce, or the birth or adoption of a child, will also affect your household size and income, thereby impacting your PTC eligibility. Similarly, a change in your immigration status may also affect your eligibility. It is crucial to report any significant life changes to the Marketplace promptly to ensure your PTC remains accurate and reflects your current circumstances. Failure to do so may result in penalties or require repayment of incorrectly received funds.

Impact of the PTC on Health Insurance Affordability

The Premium Tax Credit (PTC) significantly impacts the affordability of health insurance for many Americans. By lowering the cost of monthly premiums, it expands access to comprehensive health coverage, particularly for individuals and families with moderate incomes. The PTC’s effectiveness lies in its ability to bridge the gap between the cost of insurance and what individuals can realistically afford.

The PTC’s effect on access to health insurance is substantial. Before the Affordable Care Act (ACA) and the implementation of the PTC, many individuals and families found health insurance unaffordable, leading to a significant uninsured population. The PTC dramatically altered this landscape by making health insurance financially feasible for a larger segment of the population. This increased access translates to improved health outcomes, as individuals are more likely to seek preventative care and necessary treatment when insurance is within reach.

Cost Comparison: Health Insurance with and without the PTC

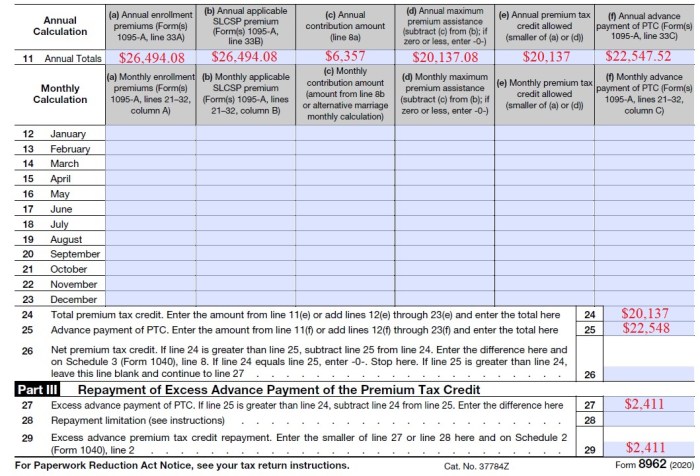

The difference in cost between health insurance with and without the PTC can be dramatic, depending on individual circumstances such as income, location, and the chosen health plan. For example, a family of four with an annual income of $60,000 might find a suitable health plan costing $1,200 per month without the PTC. With the PTC, however, their monthly premium might be reduced to $300, a difference of $900 per month or $10,800 annually. This substantial reduction makes the difference between unaffordable and manageable healthcare costs. The actual savings will vary based on individual income and the specifics of the chosen plan.

Effects of the PTC on Individuals and Families

The PTC’s positive effects ripple throughout individuals’ and families’ lives. Reduced healthcare costs translate to more financial stability, allowing families to prioritize other essential needs like housing, food, and education. The peace of mind provided by having health insurance allows individuals to focus on their work and family, rather than worrying about catastrophic medical expenses. This reduction in financial stress contributes to overall well-being and improved quality of life. For individuals facing pre-existing conditions, the PTC makes accessing necessary healthcare far more attainable, improving their health and overall outlook.

How the PTC Reduces Healthcare Costs

The PTC directly reduces healthcare costs by lowering monthly premiums. This impact is felt immediately and consistently. However, the long-term benefits extend beyond this initial cost reduction.

- Lower Monthly Premiums: The most direct benefit; the PTC subsidizes a portion of the monthly premium, making health insurance more affordable.

- Increased Access to Preventative Care: With affordable insurance, individuals are more likely to receive preventative care, reducing the likelihood of developing serious and costly health problems.

- Early Detection and Treatment: Early detection and treatment of illnesses are significantly less expensive than managing advanced stages of disease.

- Reduced Financial Burden from Unexpected Medical Expenses: The PTC helps individuals avoid the crippling financial burden associated with unexpected medical emergencies or chronic illnesses.

- Improved Overall Health and Well-being: Access to affordable healthcare leads to better health outcomes, reducing lost productivity due to illness and improving overall quality of life.

Resources for Further Information about the PTC

Finding reliable information about the Premium Tax Credit (PTC) is crucial for understanding your eligibility and maximizing its benefits. Several government agencies and non-profit organizations offer comprehensive resources to guide you through the process. This section details key sources and the type of information they provide.

Government Websites as Sources of PTC Information

The official government websites are the most authoritative sources for information on the PTC. These sites offer detailed explanations of eligibility requirements, application procedures, and frequently asked questions. Inaccuracies are minimized because the information comes directly from the source.

- Healthcare.gov: This website is the primary portal for enrolling in health insurance through the Affordable Care Act (ACA) marketplaces. It provides a wealth of information on the PTC, including eligibility calculators, step-by-step enrollment guides, and answers to frequently asked questions. You can find details on income limits, family size considerations, and plan selection based on your PTC eligibility.

- The Centers for Medicare & Medicaid Services (CMS): CMS is the federal agency responsible for administering the ACA. Their website offers detailed policy information, data on PTC usage, and reports on the program’s impact. This includes more in-depth analyses and explanations of the underlying regulations.

- Internal Revenue Service (IRS): The IRS website contains information about the tax implications of the PTC, including how it’s reported on your tax return and how any reconciliation affects your refund or payment. This resource is particularly helpful for understanding the tax aspects of the credit.

Non-Governmental Organizations Offering PTC Assistance

Many non-profit organizations offer assistance with navigating the PTC application process. These organizations provide valuable support, particularly for individuals who may find the process complex or overwhelming. Their services often include free counseling and guidance.

- The National Association of Insurance Commissioners (NAIC): While not directly involved in PTC administration, the NAIC offers resources to help consumers understand health insurance options and navigate the marketplace. They provide comparative information on plans and help to clarify consumer rights and responsibilities.

- Local Health Insurance Navigators and Assisters: Many states and communities have trained navigators and assisters who can provide personalized guidance on applying for the PTC and selecting a health insurance plan. These individuals are often found through local health departments or community organizations. They offer one-on-one support and can help simplify the process.

Visual Guide to Finding PTC Information Online

Imagine a flowchart. The starting point is a search bar, perhaps labeled “Find PTC Information.” The first branch leads to “Government Websites,” which then subdivides into Healthcare.gov, CMS.gov, and IRS.gov, each with a brief description of the type of information found there (e.g., Healthcare.gov: Enrollment, eligibility; CMS.gov: Policy details, data; IRS.gov: Tax implications). A second branch from the search bar leads to “Non-Governmental Organizations,” which further branches into the NAIC and “Local Navigators/Assisters,” each with a description of the services provided (e.g., NAIC: Consumer information, plan comparisons; Local Navigators/Assisters: Personalized guidance, application assistance). The flowchart emphasizes the different pathways to accessing information, highlighting the reliability and type of information offered by each source.

Final Summary

Securing affordable health insurance is paramount, and the Premium Tax Credit plays a pivotal role in making this a reality for many. By understanding the eligibility criteria, calculation process, and application procedures, individuals can effectively leverage the PTC to access quality healthcare without facing insurmountable financial obstacles. Remember to regularly review the program guidelines and seek assistance when needed to ensure you’re maximizing the benefits available to you. Taking control of your healthcare access starts with understanding the PTC.

Query Resolution

What happens if my income changes during the year?

You may need to report the change to the Marketplace. This could result in adjustments to your PTC or even termination of eligibility depending on the change in income.

Can I get the PTC if I’m already covered by an employer-sponsored plan?

Generally, no. The PTC is primarily for individuals and families purchasing insurance through the Marketplace. However, there may be exceptions in certain circumstances, so it’s best to check with the Marketplace.

What if I miss the deadline to enroll in the Marketplace?

There may be a special enrollment period available if you experience a qualifying life event (e.g., marriage, job loss). Check the Healthcare.gov website for details.

Is the PTC available in every state?

Yes, the PTC is a federal program available nationwide through the Health Insurance Marketplace.