Navigating the complex world of tax deductions can be daunting, especially when it comes to personal finances. One area that often sparks confusion is the deductibility of life insurance premiums. While the general rule is that personal life insurance premiums are not deductible, there are exceptions and nuances depending on the type of policy, your circumstances, and your location. This exploration will delve into the intricacies of these rules, providing clarity and insights into when you might be eligible for a deduction.

We will examine the key distinctions between business and personal life insurance policies concerning tax implications, explore the deductibility rules across various countries, and highlight the impact of different policy types (term life, whole life, universal life, etc.) on your potential tax savings. By understanding these factors, you can make informed decisions about your life insurance coverage and optimize your tax strategy.

Tax Deductibility of Life Insurance Premiums

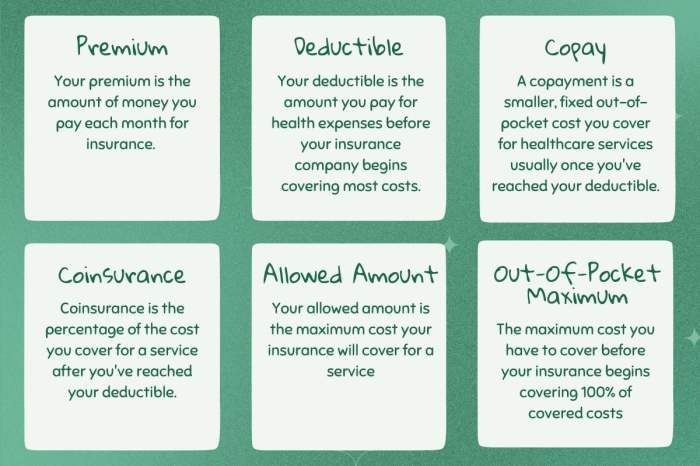

The deductibility of life insurance premiums varies significantly depending on the tax jurisdiction and the specific type of policy. Generally, premiums are not considered deductible as a business expense unless they meet specific criteria related to business purposes. However, certain exceptions exist, making it crucial to understand the relevant tax laws in your country or region.

Deductibility Rules in Different Tax Jurisdictions

The rules surrounding the deductibility of life insurance premiums differ substantially across countries. Some countries allow deductions for specific types of policies used for business purposes, while others offer no deductions at all. Understanding these differences is critical for accurate tax reporting.

| Country | Type of Policy | Deductibility Rules | Limitations |

|---|---|---|---|

| United States | Business-related life insurance (e.g., Key Person Insurance) | Premiums may be deductible as a business expense if the policy benefits the business. | Deduction is limited to the amount of the policy’s cash value. Specific requirements regarding ownership and beneficiary designation must be met. |

| Canada | Business-related life insurance | Premiums may be deductible as a business expense under specific circumstances. | Strict rules govern deductibility, often requiring the policy to be owned by the business and the beneficiary to be the business or a designated beneficiary. Deductibility may be restricted if the policy has significant investment components. |

| United Kingdom | Generally not deductible | Life insurance premiums are typically not deductible for income tax purposes. | N/A |

| Australia | Generally not deductible | Life insurance premiums are generally not deductible, except in limited circumstances related to specific business activities. | Exceptions are rare and require specific documentation and evidence of a direct business relationship. |

Situations Where Life Insurance Premiums Are Deductible

One common scenario where premiums might be deductible is when the life insurance policy is used for business purposes, such as Key Person insurance. In this case, the policy protects the business from financial losses resulting from the death of a key employee. The premiums paid for this type of policy can often be claimed as a business expense, reducing the business’s overall tax liability. Another example could involve a life insurance policy taken out as part of a business loan agreement; depending on the specific arrangement, the premium payments may be tax-deductible. The exact rules and regulations vary significantly between tax jurisdictions.

Situations Where Life Insurance Premiums Are Not Deductible

Most individual life insurance policies purchased for personal reasons do not qualify for premium deductions. This includes policies taken out to protect family members from financial hardship in the event of the policyholder’s death. Premiums for these types of policies are considered personal expenses and are not deductible for tax purposes in most jurisdictions. Similarly, the investment components of certain life insurance policies, such as universal life insurance, may not be tax-deductible.

Types of Life Insurance Policies That May Qualify for Premium Deductions

Generally, policies directly linked to business operations have a higher likelihood of qualifying for premium deductions. Key Person insurance, as previously mentioned, is a prime example. Other policies might qualify if they’re integral to a business’s financial structure, such as those used as collateral for a loan. However, the specifics depend heavily on the tax laws of the relevant jurisdiction and the precise nature of the policy and its relationship to the business.

Closing Summary

Successfully navigating the tax implications of life insurance requires a thorough understanding of the specific rules and regulations applicable to your situation. While personal life insurance premiums are generally not deductible, the exceptions and nuances discussed here highlight the importance of careful planning and potentially seeking professional tax advice. By considering the type of policy, your employment status, and the specific requirements of your tax jurisdiction, you can maximize the potential tax benefits associated with your life insurance coverage and ensure compliance with tax laws. Remember, the information provided here is for general guidance and should not be considered as professional financial or tax advice.

Question Bank

Can I deduct premiums for a policy on my spouse?

Generally, no. Premiums paid for a policy on your spouse are considered personal expenses and are not deductible.

What documentation do I need to claim a deduction?

You’ll typically need your insurance policy documentation showing premium payments, and possibly supporting documentation depending on the specific circumstances (e.g., proof of business ownership for business life insurance).

Are there penalties for incorrectly claiming a deduction?

Yes, incorrectly claiming a deduction can result in penalties, including interest and potential audits. It’s crucial to ensure accuracy.

Where can I find more specific information for my country?

Consult your country’s tax authority website or a qualified tax professional for details specific to your tax jurisdiction.