Navigating the complexities of tax deductions can be daunting, particularly when it comes to healthcare expenses. Understanding whether your medical insurance premiums are tax deductible is crucial for maximizing your tax benefits and ensuring financial well-being. This guide provides a clear and concise overview of the rules and regulations surrounding the deductibility of medical insurance premiums, covering various employment situations and insurance plan types.

We’ll explore the eligibility criteria, necessary documentation, deduction limits, and the proper tax form procedures. We’ll also address common pitfalls and potential penalties for incorrect filing, ensuring you’re well-equipped to navigate this aspect of tax season with confidence. The information provided aims to clarify the process, making it more accessible for individuals and families.

Eligibility for Deduction

Determining whether your medical insurance premiums are tax-deductible hinges on several factors, primarily your employment status and the type of health insurance plan you possess. The rules differ significantly between those who are self-employed and those employed by a company. Understanding these nuances is crucial for accurately filing your taxes.

Deductibility Criteria for Medical Insurance Premiums

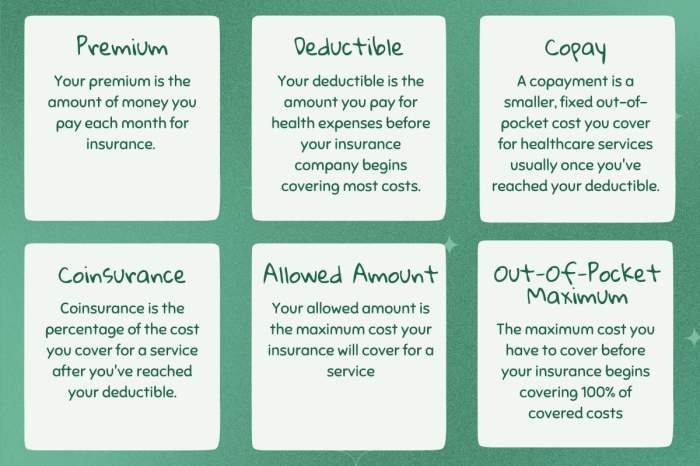

The Internal Revenue Service (IRS) in the United States, and similar tax authorities in other countries, have specific guidelines for deducting health insurance premiums. Generally, deductibility depends on whether the premiums are paid for self-employed health insurance or for health insurance offered through an employer. For self-employed individuals, premiums are often deductible as a business expense. However, for employed individuals, the deductibility of premiums is usually limited to situations involving specific health savings accounts (HSAs) or flexible spending accounts (FSAs).

Deductibility for Self-Employed Individuals

Self-employed individuals can often deduct the cost of health insurance premiums as a business expense on their tax return. This deduction reduces their taxable income, thus lowering their overall tax liability. To qualify, the individual must be self-employed, be actively engaged in a trade or business, and pay the premiums for health insurance covering themselves, their spouse, and/or their dependents. The premiums must be for a qualified health plan, which generally means it meets the minimum essential coverage requirements set by the Affordable Care Act (ACA).

Deductibility for Employed Individuals

For individuals employed by a company, the rules regarding the deductibility of health insurance premiums are more restrictive. Generally, premiums paid by the employer are not deductible by the employee. However, contributions made by the employee towards premiums through pre-tax deductions such as HSAs or FSAs can reduce taxable income. An HSA allows tax-advantaged savings for qualified medical expenses, while an FSA allows pre-tax contributions to cover eligible healthcare costs. The eligibility and contribution limits for both HSAs and FSAs are subject to IRS regulations.

Examples of Qualifying Medical Insurance Plans

Qualifying plans typically include plans purchased through the Health Insurance Marketplace (or equivalent in other countries), plans offered through an employer that meet minimum essential coverage requirements, and plans purchased directly from an insurance company that comply with relevant regulations. Specific plans that meet these requirements vary by location and regulations.

Instances Where Premiums Are NOT Deductible

Premiums are generally not deductible if they are: paid for insurance that does not meet minimum essential coverage requirements; paid for a plan that covers only long-term care; or paid after the tax year has ended. Furthermore, premiums paid through after-tax contributions to a health savings account are not deductible. Always refer to the current IRS guidelines for the most up-to-date information.

Eligibility Comparison Table

| Employment Status | Plan Type | Deductibility | Notes |

|---|---|---|---|

| Self-Employed | Individual Plan | Generally Deductible | Must meet minimum essential coverage |

| Self-Employed | Family Plan | Generally Deductible | Must meet minimum essential coverage; premiums for dependents are also deductible |

| Employed | Employer-Sponsored Plan (with pre-tax contributions via HSA/FSA) | Partially Deductible (pre-tax contributions) | Deduction limited to contributions made through HSA/FSA |

| Employed | Employer-Sponsored Plan (no pre-tax contributions) | Not Deductible | Premiums paid by the employer are not deductible by the employee. |

Potential Penalties for Incorrect Filing

Incorrectly claiming the medical insurance premium tax deduction can lead to significant consequences, ranging from financial penalties to potential legal repercussions. Understanding these potential penalties is crucial for ensuring accurate tax filing and avoiding unnecessary complications. This section Artikels the potential penalties and offers guidance on rectifying mistakes.

The Internal Revenue Service (IRS) takes tax inaccuracies seriously. Penalties for incorrectly claiming the medical insurance premium deduction can vary depending on the nature of the error and the taxpayer’s intent. Generally, penalties fall into two categories: those related to underreporting and those related to overreporting.

Penalties for Underreporting

Underreporting the deduction means claiming a lower amount than you are legally entitled to. While this might seem beneficial in the short term, it ultimately results in paying more taxes than necessary. The IRS may assess penalties for underreporting, including interest charges on the unpaid tax amount. The interest rate is typically adjusted periodically and is applied from the tax filing deadline until the tax liability is fully paid. In cases of intentional underreporting, additional penalties, potentially including civil or even criminal charges, could apply. The severity of the penalty depends on the magnitude of the underreporting and any evidence of fraudulent intent. For example, a small, unintentional discrepancy might only result in interest charges, while a large, deliberate misrepresentation could result in significant fines and potential legal action.

Penalties for Overreporting

Overreporting the deduction, on the other hand, involves claiming a higher amount than you are eligible for. This is equally problematic and can lead to penalties. The IRS may audit your return and disallow the excessive portion of the deduction. This means you will owe additional taxes, along with interest on the unpaid amount from the filing deadline. In cases where overreporting is deemed intentional, the penalties could be substantially higher, including potential fines and legal consequences. For example, claiming a deduction for premiums that were not actually paid, or exaggerating the amount paid, would constitute overreporting.

Common Mistakes to Avoid

Several common mistakes can lead to incorrect filing. Failing to maintain accurate records of premium payments is a frequent error. This makes it difficult to substantiate the claimed deduction during an audit. Another common mistake is misinterpreting the eligibility criteria for the deduction. Carefully reviewing the IRS guidelines and ensuring you meet all requirements is essential. Finally, incorrectly completing the relevant tax forms can also result in penalties. Using tax preparation software or consulting with a tax professional can help minimize these errors.

Rectifying Mistakes

If you discover a mistake in your tax return after filing, it’s crucial to take corrective action promptly. The IRS provides mechanisms for amending returns, typically using Form 1040-X, Amended U.S. Individual Income Tax Return. This form allows you to correct errors and report the correct amount of the medical insurance premium deduction. Filing an amended return as soon as possible is vital to minimize potential penalties and interest charges. It’s advisable to keep detailed records of the amendment process and any communication with the IRS. In complex situations, seeking professional tax advice is recommended.

Concluding Remarks

Successfully claiming the deduction for your medical insurance premiums hinges on understanding the specific requirements and meticulously maintaining accurate records. By adhering to the guidelines Artikeld in this guide, you can confidently navigate the tax process, ensuring you receive the appropriate tax benefits. Remember to consult with a tax professional for personalized advice, particularly if you encounter complex situations or have specific questions regarding your individual circumstances. Accurate record-keeping and careful attention to detail are paramount to avoiding penalties and maximizing your tax savings.

FAQ Section

What if I’m covered under both my employer’s plan and a supplemental plan?

The deductibility depends on the specifics of each plan and your employment status. Generally, premiums for employer-sponsored plans are not deductible, while premiums for supplemental plans might be, subject to certain limitations. Consult your tax advisor for clarification.

Can I deduct premiums paid for my dependents?

Yes, under certain circumstances. The eligibility depends on the dependent’s status and your tax filing status. Generally, you can claim the deduction if you are providing the majority of their financial support and they meet the IRS’s definition of a dependent.

What happens if I discover a mistake on my tax return after filing?

File an amended tax return using Form 1040-X. Provide clear documentation to support any corrections. The sooner you address the error, the better.

Where can I find more detailed information about state-specific regulations?

Consult your state’s tax department website or a qualified tax professional. State regulations can vary significantly, so seeking specific guidance is essential.