Insurance premiums: the price we pay for peace of mind. But what exactly are they, and why do they vary so dramatically? Understanding insurance premiums is crucial for making informed decisions about your financial protection. This guide delves into the intricacies of premiums, exploring the factors that influence their cost, the various payment methods, and how adjustments are made. We’ll unravel the mystery behind these seemingly complex numbers, empowering you to navigate the world of insurance with confidence.

From the fundamental concept of transferring risk to the intricate calculations behind premium determination, we’ll cover everything from the basics to more advanced aspects. We’ll examine how different insurance types (like car, health, and home insurance) impact premium costs and explore the role of risk assessment in setting those prices. By the end, you’ll have a clearer picture of how insurance premiums work and how to find the best coverage for your needs.

Defining Insurance Premiums

Insurance premiums are essentially the recurring payments you make to an insurance company in exchange for financial protection against unforeseen events. Think of it as a pre-emptive investment in safeguarding yourself against potential losses. The more extensive the coverage and the higher the likelihood of a claim, the higher the premium will generally be.

Insurance premiums are calculated based on a variety of factors specific to the type of insurance and the individual or entity being insured. These factors are carefully assessed by actuaries to determine the risk involved. The company uses this assessment to set a price that covers their anticipated payouts, administrative costs, and profit margin.

Types of Insurance Premiums and Their Variations

Different types of insurance carry different premium structures. For instance, health insurance premiums often vary based on factors like age, location, chosen plan (e.g., bronze, silver, gold), and pre-existing conditions. Auto insurance premiums are influenced by factors such as driving history (accidents, tickets), vehicle type, location (urban areas generally have higher rates), and the level of coverage selected (liability only, comprehensive, collision). Homeowners insurance premiums are largely determined by the value of the property, its location, the level of coverage, and the presence of security features. Life insurance premiums, conversely, are largely based on age, health status, and the amount of coverage selected. These variations reflect the differing levels of risk associated with each type of insurance.

Premium Comparison Across Insurance Providers

To illustrate how premiums can differ across providers, let’s consider a hypothetical scenario: car insurance for a 30-year-old driver with a clean driving record in a medium-sized city. The following table compares premiums from four different hypothetical insurance providers. Note that these are illustrative examples and actual premiums will vary widely based on specific circumstances and provider offerings.

| Insurance Provider | Premium Amount (Annual) | Coverage Details | Deductible |

|---|---|---|---|

| InsureAll | $1200 | Liability, Collision, Comprehensive | $500 |

| SafeDrive | $1000 | Liability, Collision | $1000 |

| AutoGuard | $1500 | Liability, Collision, Comprehensive, Uninsured Motorist | $250 |

| RoadMaster | $1300 | Liability, Collision, Comprehensive | $750 |

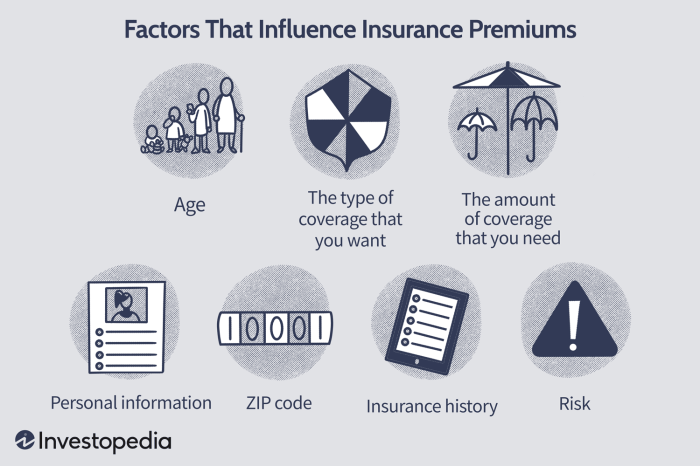

Factors Influencing Premium Costs

Insurance premiums, the price you pay for coverage, aren’t arbitrarily set. Numerous factors contribute to the final cost, reflecting the insurer’s assessment of risk. Understanding these factors can empower you to make informed decisions about your insurance choices and potentially lower your premiums.

Several key elements influence the calculation of insurance premiums. These factors are carefully weighed by insurance companies to accurately reflect the likelihood and potential cost of claims. The more risk an insurer perceives, the higher the premium will be.

Age

Age is a significant factor in many types of insurance. In car insurance, younger drivers, particularly those with less driving experience, are statistically more likely to be involved in accidents. This higher risk translates to higher premiums. Conversely, older drivers, while potentially facing health-related driving challenges, often have better driving records and thus may receive lower premiums, although this can vary based on specific circumstances and insurer policies. In health insurance, age also plays a role, with older individuals generally facing higher premiums due to the increased likelihood of needing more extensive medical care. This is often mitigated by government subsidies and programs designed to make healthcare more affordable for seniors.

Driving History (Car Insurance)

A clean driving record is a significant factor in determining car insurance premiums. Drivers with multiple accidents, traffic violations, or DUI convictions will face significantly higher premiums. Insurers view these events as indicators of higher risk and therefore charge more to compensate for the increased likelihood of future claims. Conversely, a driver with a long history of safe driving and no accidents will likely qualify for lower premiums, reflecting their lower risk profile. Many insurers offer discounts for drivers who complete defensive driving courses, further demonstrating the impact of driving history on premiums.

Health Status (Health Insurance)

Pre-existing conditions and overall health significantly influence health insurance premiums. Individuals with pre-existing conditions or a history of serious illnesses often face higher premiums because they are statistically more likely to require expensive medical treatments. Insurers assess the potential cost of caring for individuals with different health profiles, incorporating this assessment into the premium calculation. However, regulations in many countries aim to prevent discrimination based solely on pre-existing conditions, often mandating coverage regardless of health status. The impact of health status on premiums is a complex issue, influenced by both individual health and broader healthcare policy.

Location

Geographic location significantly impacts insurance premiums, particularly for home and auto insurance. Areas with higher crime rates, a greater frequency of natural disasters (e.g., hurricanes, earthquakes, wildfires), or higher rates of car theft will generally have higher premiums. Insurers consider the statistical likelihood of claims in different regions when setting rates. For example, someone living in a high-crime urban area might pay significantly more for homeowners insurance than someone living in a rural area with lower crime rates. Similarly, someone living in a coastal area prone to hurricanes will likely pay more for home and auto insurance than someone living inland.

Coverage Levels

The level of coverage chosen directly impacts premium costs. Higher liability limits (the maximum amount the insurance company will pay for damages) result in higher premiums, as the insurer assumes greater financial responsibility. Conversely, higher deductibles (the amount the policyholder pays out-of-pocket before the insurance coverage kicks in) generally lead to lower premiums. Choosing a higher deductible signifies a willingness to absorb more risk, thus lowering the insurer’s potential payout and consequently the premium. This balance between coverage level and premium cost allows individuals to customize their insurance policies to their risk tolerance and budget.

Premium Payment Methods and Schedules

Choosing the right payment method for your insurance premiums can significantly impact your budget and potentially even the overall cost of your coverage. Understanding the available options and their associated benefits allows for informed decision-making. Different insurers offer varying payment schedules and methods, so it’s crucial to review your policy documents or contact your insurer directly for specific details.

Different payment schedules and methods offer varying degrees of convenience and cost-effectiveness. Opting for annual payments often results in lower overall costs due to discounts offered by many insurers, while monthly installments provide greater flexibility for budget management. The selection should align with individual financial preferences and capabilities.

Premium Payment Methods

The following table details common methods for paying insurance premiums. The availability of each method may vary depending on the insurer and the type of insurance policy.

| Payment Method | Description |

|---|---|

| Annual Payment | Paying the entire premium in a single lump sum at the beginning of the policy period. This often results in a discount compared to monthly payments. |

| Semi-Annual Payment | Dividing the annual premium into two equal payments, typically due every six months. This offers a balance between convenience and potential cost savings. |

| Quarterly Payment | Dividing the annual premium into four equal payments, typically due every three months. This provides more frequent payment options compared to semi-annual payments. |

| Monthly Payment | Dividing the annual premium into twelve equal monthly payments. This provides the greatest flexibility in terms of budgeting but may come with a slightly higher overall cost due to the lack of discounts. |

| Electronic Funds Transfer (EFT) | Automatic debit from a bank account. This method offers convenience and ensures timely payments, avoiding late fees. Many insurers offer this as a default payment method. |

| Credit Card Payment | Paying via credit card. This method provides convenience but may incur additional fees depending on the insurer and credit card company. |

| Mail Payment (Check or Money Order) | Sending a check or money order through the mail. This is a traditional method, but it’s less convenient and can lead to delays. |

Implications of Different Payment Schedules on Cost

Insurers frequently offer discounts for paying premiums upfront, such as annual payments. These discounts incentivize timely and complete payment, reducing administrative costs for the insurer. For example, an annual payment might receive a 5-10% discount compared to monthly payments, resulting in significant savings over the policy term. Conversely, monthly payments often incur a slightly higher overall cost due to the increased administrative burden on the insurer. The exact discount or surcharge will vary by insurer and policy type. It is always advisable to compare the total cost across different payment schedules before making a decision.

Illustrating Premium Calculations (Hypothetical)

Understanding how insurance premiums are calculated can seem complex, but breaking it down step-by-step reveals a logical process. This example uses a hypothetical homeowner’s insurance policy to illustrate the key factors involved.

Let’s imagine Sarah is purchasing homeowner’s insurance for her newly purchased house, valued at $300,000, located in a low-risk area with a relatively low crime rate. She’s considering different coverage levels and deductibles to find the best balance between cost and protection.

Homeowner’s Insurance Premium Calculation

The following steps Artikel how Sarah’s homeowner’s insurance premium might be calculated. Remember, these are simplified examples and actual calculations can be more intricate, varying significantly between insurance providers.

- Determining the Coverage Amount: Sarah decides on a coverage amount of $250,000, representing 83.33% of her home’s value. This is a common approach, though not a requirement. Higher coverage amounts naturally lead to higher premiums.

- Assessing the Risk: The insurer assesses the risk associated with insuring Sarah’s home. Factors considered include the location (low-risk area in this case), the age and condition of the house, the presence of security systems (let’s assume she has a monitored alarm system), and the building materials. A lower-risk profile generally results in a lower premium.

- Choosing a Deductible: Sarah selects a $1,000 deductible. This means she will be responsible for the first $1,000 of any claim before the insurance coverage kicks in. A higher deductible lowers the premium because the insurer’s potential payout is reduced.

- Applying the Rate: The insurer applies a base rate per $100,000 of coverage. Let’s assume this base rate is $200 annually for a low-risk home in Sarah’s area with a $1,000 deductible. With $250,000 coverage, this equates to a base premium of $500 (2.5 x $200).

- Adding Additional Coverages: Sarah also opts for additional coverages, such as liability protection ($300,000) and flood insurance (optional, and costing an additional $200 per year given the low-risk area). These add-ons increase the overall premium.

- Calculating the Final Premium: Combining the base premium, the cost of additional coverages, and any applicable discounts (e.g., for having a monitored alarm system – let’s assume a 5% discount on the base premium, resulting in a $25 reduction), Sarah’s final annual premium would be approximately $500 + $300 + $200 – $25 = $975.

Impact of Different Factors on Premiums

This table illustrates how changes in coverage and deductible influence the premium.

| Coverage Amount | Deductible | Approximate Annual Premium |

|---|---|---|

| $200,000 | $1,000 | $800 |

| $250,000 | $1,000 | $975 |

| $250,000 | $2,500 | $875 |

As demonstrated, increasing coverage or decreasing the deductible increases the premium, while the opposite reduces it. The specific amounts will vary greatly depending on individual circumstances and the insurance provider.

Last Word

In conclusion, understanding insurance premiums is key to securing adequate financial protection. While the calculations may seem complex, the underlying principle is straightforward: the more risk you present, the higher the premium. By understanding the factors influencing your premiums, you can make informed choices about coverage levels, payment options, and ultimately, the best policy for your circumstances. This knowledge empowers you to be a savvy consumer in the insurance marketplace, ensuring you get the most value for your investment in peace of mind.

FAQ Corner

What happens if I miss a premium payment?

Missing a premium payment can result in your policy being cancelled or suspended, leaving you without coverage. Late payment fees may also apply.

Can I negotiate my insurance premiums?

While you can’t always directly negotiate the base premium, you can often find ways to lower your overall cost by increasing your deductible, bundling policies, or improving your risk profile (e.g., taking a defensive driving course).

How often are premiums reviewed and adjusted?

Premium reviews vary by insurer and policy type. Some policies are reviewed annually, while others might be reviewed less frequently. Changes are typically based on claims history, risk assessments, and market conditions.

What is an actuarial table, and how does it relate to premiums?

An actuarial table is a statistical table used by insurance companies to estimate the probability of certain events, such as death or accidents. This data is crucial in calculating premiums, as it helps predict the likelihood of claims and the associated costs.