Navigating the complexities of tax deductions can be daunting, especially when it comes to healthcare expenses. The question of whether medical insurance premiums are tax deductible is a common one, impacting both employees and the self-employed. This guide unravels the intricacies of this topic, providing clarity on eligibility requirements, documentation needs, and the impact of relevant tax laws. Understanding these nuances can significantly impact your tax liability and financial planning.

This exploration delves into the specifics of deductibility based on employment status, the types of insurance plans covered, and the crucial role of accurate record-keeping. We’ll examine the limitations on deductible amounts, the process of reporting these deductions, and the potential tax savings involved. Through clear examples and practical advice, we aim to equip you with the knowledge necessary to confidently navigate this aspect of tax compliance.

Eligibility for Deduction

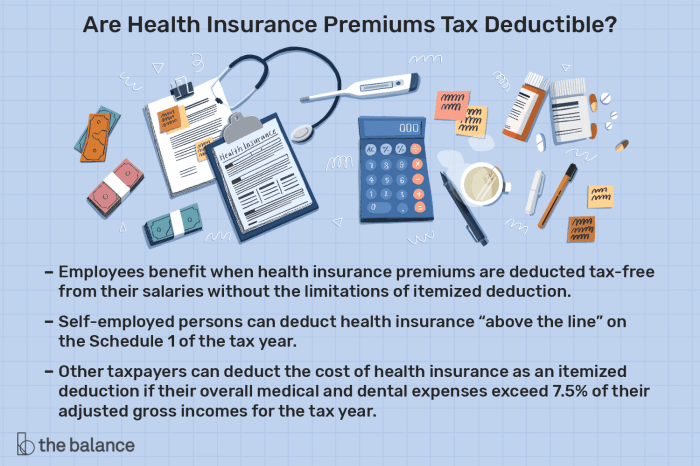

Determining whether your medical insurance premiums are tax-deductible hinges on several factors, primarily your employment status and the type of plan you hold. Understanding these nuances is crucial for accurately filing your taxes and potentially claiming a valuable deduction.

The Internal Revenue Service (IRS) provides specific guidelines regarding the deductibility of medical insurance premiums. Generally, premiums are deductible only if they meet certain criteria. These criteria often depend on whether you are self-employed, employed by a company, or covered under a specific type of health plan.

Types of Medical Insurance Plans and Deductibility

Different medical insurance plans have varying degrees of deductibility. For example, premiums paid for individual health insurance plans purchased through the Health Insurance Marketplace (often subsidized) are generally not deductible, unless you itemize deductions and meet certain income thresholds for the medical expense deduction. However, premiums for employer-sponsored plans are handled differently. Premiums paid for plans offered through your employer are typically not directly deductible by the employee, as the cost is often factored into your compensation. Self-employed individuals, however, have different rules.

Deductibility for Self-Employed Individuals

Self-employed individuals can deduct the amount they pay for health insurance premiums as a business expense. This is a significant difference from employees. This deduction is taken on Schedule C (Profit or Loss from Business) of Form 1040. It’s important to accurately track all premium payments throughout the year to ensure accurate reporting. For example, a freelancer who pays $5,000 annually for health insurance can deduct this full amount, reducing their taxable income.

Deductibility for Employees

Employees generally cannot deduct premiums paid for employer-sponsored health insurance plans. The cost is considered part of their compensation package. However, if an employee pays for supplemental health insurance coverage above and beyond what their employer provides, they may be able to deduct these additional premiums, subject to the same overall medical expense deduction limitations. For example, an employee with an employer-sponsored plan who also pays for a dental plan might be able to deduct the dental premiums if they itemize deductions.

Examples of Deductible and Non-Deductible Premiums

Here are some clear examples:

- Deductible: A self-employed consultant pays $7,000 annually for a comprehensive health insurance plan. They can deduct the full $7,000.

- Non-Deductible: An employee receives health insurance coverage as part of their benefits package from their employer. They cannot deduct the premiums their employer pays.

- Potentially Deductible: An employee with employer-sponsored health insurance purchases a supplemental vision plan for $300 per year. They might be able to deduct this amount if they itemize and meet the medical expense deduction threshold.

Comparison of Eligibility Criteria

| Employment Status | Plan Type | Deductibility | Example |

|---|---|---|---|

| Self-Employed | Individual Health Insurance | Generally Deductible | Freelancer deducting premiums on Schedule C. |

| Employee | Employer-Sponsored Plan | Generally Non-Deductible | Employee’s premiums covered by employer. |

| Employee | Supplemental Insurance (e.g., dental) | Potentially Deductible (if itemizing) | Employee’s additional dental plan premiums. |

| Self-Employed | Employer-Sponsored Plan (if applicable) | Generally Non-Deductible | Self-employed individual with employer-sponsored plan (as an employee). |

Documentation and Record Keeping

Maintaining meticulous records of your medical insurance premium payments is crucial for successfully claiming a tax deduction. Accurate documentation provides irrefutable proof of your expenses to the tax authorities, ensuring a smooth and efficient tax filing process. Failing to keep proper records can lead to delays, complications, and potentially the denial of your deduction.

Types of Necessary Documentation

Supporting your deduction claim requires comprehensive documentation. This ensures the tax authorities can readily verify the legitimacy of your expenses. Incomplete or missing documentation significantly increases the likelihood of your claim being rejected. The following forms of documentation are typically acceptable.

- Premium Payment Receipts: These receipts should clearly show the date of payment, the amount paid, the payer’s name, and the insurance company’s name. Electronic receipts are generally acceptable, provided they contain all the necessary information.

- Insurance Policy Statements: These statements provide an overview of your insurance coverage, including the premium amount and payment schedule. They serve as a valuable corroborating document.

- Bank or Credit Card Statements: These statements act as supporting evidence, demonstrating the payment transactions made to your insurance provider. They should clearly show the date, amount, and recipient of the payment.

- Employer-Provided Documentation (if applicable): If your employer contributes to your health insurance premiums, obtain documentation detailing the employer’s contribution and your portion of the premium. This is essential for accurate calculation of your deductible amount.

Examples of Acceptable Documentation

Imagine you paid your insurance premium on March 15th, 2024, for $500. An acceptable receipt would clearly state “Payment Received: March 15, 2024, Amount: $500, Payer: John Doe, Insurer: Acme Health Insurance.” A bank statement would show a debit transaction on March 15th, 2024, to Acme Health Insurance for $500. Your insurance policy statement would list the monthly premium as $500 and show a payment on March 15th.

Best Practices for Organizing and Storing Documentation

A well-organized system is vital for efficient retrieval and management of your documents. This will save you time and stress during tax season. Consider these best practices:

- Dedicated File: Create a dedicated physical or digital file specifically for medical insurance records. This allows for easy access and prevents documents from getting lost amongst other papers.

- Chronological Ordering: Arrange documents chronologically by date of payment, simplifying the retrieval process.

- Digital Backup: Scan and store digital copies of all documents. This provides an additional layer of security and accessibility.

- Cloud Storage: Consider using cloud storage services for secure and readily accessible backup of your digital records.

Sample Record-Keeping System

A simple spreadsheet can serve as an effective record-keeping system. Columns should include: Date of Payment, Amount Paid, Payment Method (Check, Credit Card, etc.), Description (e.g., “Health Insurance Premium”), and Supporting Document (e.g., “Receipt #123”). Each row would represent a single premium payment. This system allows for easy tracking and aggregation of your medical insurance expenses throughout the year. For example, a row might look like this: “01/15/2024, $400, Credit Card, Health Insurance Premium, Bank Statement January 2024”.

Impact of Tax Laws and Regulations

The deductibility of medical insurance premiums is heavily influenced by the ever-changing landscape of tax laws and regulations. Understanding these changes is crucial for individuals and businesses to accurately calculate their tax liabilities and maximize potential tax savings. Variations exist not only across time but also geographically, creating a complex picture that necessitates careful consideration.

Tax laws governing the deductibility of medical insurance premiums are subject to frequent revisions. These changes can impact the eligibility criteria, the amount deductible, and even the types of insurance plans that qualify for deductions. For example, a government might introduce a new tax credit specifically for individuals purchasing certain types of preventative health insurance, effectively altering the overall tax benefit calculation. Conversely, a change could limit or eliminate the deductibility of premiums for certain high-income earners or specific types of supplemental coverage. Staying informed about these updates is paramount.

Deductibility Rules Across Jurisdictions

Significant differences exist in the deductibility rules for medical insurance premiums across various tax systems globally. In some countries, premiums paid for both employer-sponsored and privately purchased health insurance may be fully deductible, while others may impose limitations based on income levels or the type of coverage. For instance, the United States offers deductions for self-employed individuals and those with certain high-deductible health plans, while Canada’s system focuses on universal healthcare coverage, limiting the deductibility of private insurance premiums. European countries often have their own unique sets of regulations, some with more generous tax benefits than others. These variations highlight the need for tailored advice based on specific geographical location and individual circumstances.

Tax Implications for Various Scenarios

Several scenarios illustrate the potential tax implications. Consider a self-employed individual who pays a substantial amount for health insurance. The deductibility of these premiums can significantly reduce their taxable income, leading to lower tax liability. Conversely, an employee with employer-sponsored insurance might not have the same deduction opportunities, even though they contribute to the premiums. Furthermore, the tax implications differ for those with high-deductible health plans versus those with plans that offer more comprehensive coverage and lower deductibles. High-deductible plans may offer tax advantages through Health Savings Accounts (HSAs), but the tax benefits might be offset by the higher out-of-pocket expenses. Finally, the tax treatment of premiums paid for long-term care insurance can vary significantly depending on the specific policy and applicable regulations.

Comparing Tax Benefits of Different Medical Insurance Plans

Different medical insurance plans offer varying degrees of tax benefits. A comprehensive plan with lower out-of-pocket costs might not offer the same tax advantages as a high-deductible plan coupled with an HSA. The tax benefits should be weighed against the overall cost of the plan and the potential out-of-pocket expenses. A detailed cost-benefit analysis, considering both premiums and potential out-of-pocket expenses, is essential to determine the most tax-efficient plan. For example, a family might find a high-deductible plan with an HSA more beneficial if they rarely incur significant medical expenses, while a family with a history of chronic illness might prefer a comprehensive plan, even with fewer tax advantages.

Calculating Tax Savings from Deductions

The calculation of tax savings resulting from the deduction of medical insurance premiums is straightforward but depends on the individual’s tax bracket and the applicable deduction limits. The formula is:

Tax Savings = (Deductible Premium Amount) x (Tax Rate)

For example, if an individual deducts $5,000 in medical insurance premiums and is in a 25% tax bracket, the tax savings would be $1,250 ($5,000 x 0.25). This calculation demonstrates the significant financial benefit that the deductibility of medical insurance premiums can provide. However, it’s crucial to remember that this calculation is a simplification and may not accurately reflect the tax implications in all situations, particularly when considering other tax deductions or credits. Professional tax advice is always recommended for complex situations.

Closing Summary

Successfully claiming deductions for medical insurance premiums hinges on a thorough understanding of eligibility criteria, meticulous record-keeping, and accurate reporting. While the specifics vary depending on your employment status and the type of insurance plan, careful attention to detail can result in significant tax savings. This guide has provided a framework for navigating these complexities, empowering you to optimize your tax position and maximize the benefits available to you. Remember to consult with a tax professional for personalized guidance based on your individual circumstances.

Questions Often Asked

Can I deduct premiums for my spouse’s health insurance?

Deductibility depends on your filing status and whether your spouse is claimed as a dependent. Generally, if you are jointly filing and your spouse is covered under your plan, the premiums may be deductible under certain circumstances. Consult IRS guidelines for specific details.

What if I overpaid my medical insurance premiums?

Overpaid premiums might be refundable, depending on your insurance provider’s policies. Contact your insurer to determine the process for obtaining a refund. Keep detailed records of the overpayment for your tax records.

Are premiums for short-term medical insurance deductible?

Deductibility of short-term medical insurance premiums varies based on specific plan details and tax laws. It’s advisable to consult tax regulations and potentially seek professional tax advice to determine eligibility.

What happens if I fail to keep proper records of my premium payments?

Failure to maintain adequate documentation can hinder your ability to claim the deduction. The IRS may disallow the deduction if you cannot provide sufficient proof of payment. Thorough record-keeping is crucial for successful tax filing.