Securing a mortgage is a significant financial undertaking, and understanding all associated costs and protections is crucial. One such element often overlooked is mortgage premium insurance (MPI), a vital component for many borrowers. This comprehensive guide delves into the intricacies of MPI, exploring its purpose, mechanics, costs, benefits, and alternatives, providing a clear understanding of its role in the mortgage process.

From defining MPI and explaining its various types to analyzing its impact on the housing market, we will cover the essential aspects of this insurance. We will also compare it to alternative risk mitigation strategies and examine the legal and regulatory landscape surrounding it. This detailed exploration aims to empower prospective homeowners with the knowledge needed to make informed decisions regarding their mortgage and associated insurance.

Definition and Purpose of Mortgage Premium Insurance

Mortgage premium insurance, often shortened to MPI, is a type of insurance designed to protect lenders against financial losses in the event a borrower defaults on their mortgage loan. It essentially acts as a safety net for the lender, mitigating the risk associated with lending large sums of money for extended periods. This insurance is particularly relevant in situations where the borrower makes a down payment that is less than 20% of the home’s purchase price.

MPI works by transferring the risk of default from the lender to the insurance provider. If the borrower defaults and the lender forecloses on the property, the insurance company compensates the lender for the outstanding loan amount, up to a certain limit. This ensures the lender doesn’t suffer significant financial losses due to the borrower’s inability to repay the loan. The cost of this protection is borne by the borrower through the payment of premiums, typically added to their monthly mortgage payment.

Circumstances Requiring Mortgage Premium Insurance

Mortgage premium insurance is typically required when a borrower’s down payment is less than 20% of the home’s purchase price. This is because a smaller down payment increases the lender’s risk. If the home’s value decreases or the borrower defaults, the lender’s potential loss is significantly higher with a smaller down payment. Lenders often mandate MPI to offset this increased risk. In some cases, even with a down payment of 20% or more, lenders may still require MPI based on factors such as the borrower’s credit score or the overall economic climate.

Types of Mortgage Premium Insurance

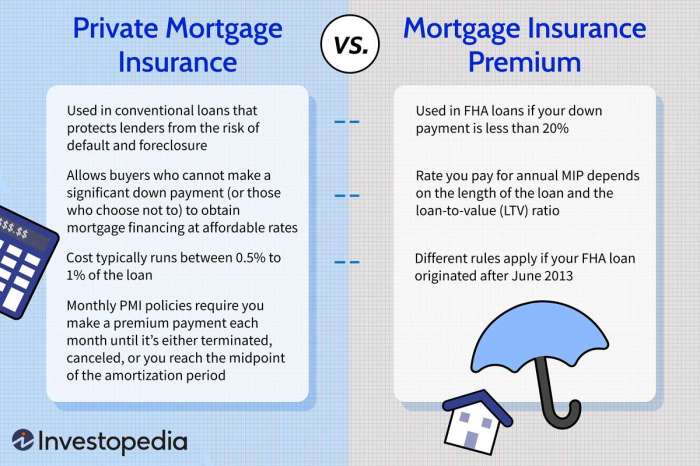

There are several types of mortgage premium insurance, each with its own features and terms. Private Mortgage Insurance (PMI) is the most common type, offered by private insurance companies. It’s typically required for conventional loans with less than 20% down payment. Another type is Mortgage Insurance Premium (MIP), which is required for Federal Housing Administration (FHA) loans, regardless of the down payment amount. MIP is paid upfront or added to the monthly mortgage payment and protects the FHA in case of borrower default. In some cases, lenders may also offer their own proprietary mortgage insurance programs. These programs might offer different terms and conditions compared to PMI or MIP.

Comparison with Other Insurance Types

Mortgage premium insurance differs significantly from other types of insurance, such as homeowner’s insurance or life insurance. Homeowner’s insurance protects the property itself from damage or loss due to events like fire or theft, while life insurance protects the borrower’s family in case of their death. MPI, on the other hand, protects the lender from financial losses due to borrower default. It’s a crucial component of the mortgage process, primarily focused on mitigating risk for the lender, and indirectly, providing access to financing for borrowers with smaller down payments. The key distinction is that the beneficiary of MPI is the lender, not the borrower or the property.

Alternatives to Mortgage Premium Insurance

Securing a mortgage often involves considering mortgage premium insurance (MPI), but several alternative strategies can mitigate the associated risks. Understanding these alternatives allows borrowers to make informed decisions based on their individual financial situations and risk tolerance. This section explores viable alternatives to MPI, comparing their costs, effectiveness, and suitability in different circumstances.

Higher Down Payment

A larger down payment significantly reduces the loan-to-value (LTV) ratio, thereby lowering the risk for lenders and eliminating the need for MPI. A higher down payment demonstrates greater financial commitment and reduces the lender’s exposure to potential losses in case of default. For example, a 20% down payment on a $300,000 home reduces the loan amount to $240,000, substantially decreasing the risk compared to a 5% down payment. This approach, while requiring a larger upfront investment, offers long-term cost savings by avoiding ongoing MPI premiums.

- Pros: Eliminates MPI premiums, reduces interest rates (potentially), demonstrates financial stability to lenders.

- Cons: Requires a substantial upfront investment, may delay homeownership for those with limited savings.

Private Mortgage Insurance (PMI) Alternatives

While similar to MPI, some private lenders offer alternative PMI programs with potentially lower premiums or more flexible terms. These programs might consider factors beyond just the LTV ratio, potentially offering better rates to borrowers with strong credit scores or consistent income history. A thorough comparison of different PMI providers is crucial to finding the most cost-effective option. It’s important to note that while these alternatives might offer some advantages, they are still essentially forms of insurance and will incur costs.

- Pros: Potentially lower premiums than standard MPI, may offer more flexible terms.

- Cons: Still involves ongoing insurance costs, may not be available to all borrowers.

Building Equity Faster

Strategies to accelerate equity building, such as making extra mortgage payments or refinancing to a shorter-term loan, can quickly reduce the LTV ratio. For example, making bi-weekly payments instead of monthly payments effectively makes an extra monthly payment each year, significantly reducing the loan principal faster. This approach reduces the risk for the lender and may allow for the cancellation of MPI sooner. While it requires additional discipline and financial commitment, it provides long-term cost savings.

- Pros: Reduces LTV ratio faster, potentially leads to earlier cancellation of MPI, builds wealth faster.

- Cons: Requires additional financial discipline and commitment, may not be feasible for all borrowers.

Final Conclusion

Navigating the complexities of mortgage premium insurance requires a thorough understanding of its implications. This guide has provided a comprehensive overview, covering everything from the fundamental concepts to the legal and market impacts of MPI. By weighing the costs and benefits, exploring alternatives, and understanding the regulatory framework, borrowers can make informed decisions that best suit their individual financial circumstances and risk tolerance. Ultimately, informed choices lead to greater financial security and peace of mind throughout the homeownership journey.

FAQ Guide

What happens if I pay off my mortgage early and still have MPI?

Most MPI policies allow for cancellation upon reaching a certain loan-to-value ratio (typically 80%), even before the full mortgage term. Contact your lender to understand the specific terms of your policy and any potential refund.

Is mortgage premium insurance tax deductible?

Tax deductibility of MPI varies by location and specific circumstances. Consult a tax professional or refer to your local tax regulations for definitive guidance.

Can I shop around for different MPI providers?

While lenders often work with specific MPI providers, it’s advisable to inquire about options and compare rates. Understanding your options can help you secure the most favorable terms.

What if my circumstances change (e.g., job loss)?

Most MPI policies have provisions for dealing with unforeseen circumstances. Contact your lender or insurance provider immediately to discuss options and explore potential adjustments or hardship programs.