Navigating the world of car insurance can feel like deciphering a complex code. Premiums vary wildly, influenced by a multitude of factors, leaving many drivers feeling overwhelmed and unsure of how to secure the best possible coverage at the most affordable price. This guide provides a clear and concise overview of the key elements affecting your car insurance costs, empowering you to make informed decisions and save money.

Understanding the interplay between your driving history, vehicle type, location, coverage level, and lifestyle choices is crucial to effectively comparing car insurance premiums. By examining these factors and exploring the offerings of different insurers, you can gain a significant advantage in securing the most suitable and cost-effective policy for your individual needs.

Understanding Discounts and Savings

Securing the best car insurance premium often involves understanding and leveraging available discounts. These discounts can significantly reduce your overall cost, making insurance more affordable. Let’s explore how various factors influence your premium and the potential savings they offer.

Safe Driving Discounts

Safe driving discounts reward drivers with clean driving records. Insurance companies typically assess risk based on your driving history, considering factors such as accidents, traffic violations, and claims filed. The calculation varies by insurer but generally involves a points system. Each accident or violation adds points, increasing your premium. Conversely, a clean record, often defined as no accidents or violations within a specific period (usually 3-5 years), earns you a discount. The discount percentage is usually tiered, with larger discounts for longer periods of accident-free driving. For example, a driver with five years of accident-free driving might receive a 15% discount, while a driver with ten years might receive a 25% discount. This discount is applied directly to your base premium, resulting in a lower overall cost.

Bundling Home and Auto Insurance

Bundling your home and auto insurance with the same provider frequently results in significant savings. Insurance companies incentivize bundling because it simplifies their administration and reduces the risk of losing a customer. The discount percentage offered for bundling can vary considerably, ranging from 5% to 25% or even more depending on the insurer and your specific coverage. For example, if your annual auto insurance premium is $1200 and your home insurance is $600, a 10% bundle discount could save you $180 annually. This is a substantial saving and demonstrates the financial benefit of combining your policies.

Payment Method Discounts

Many insurance companies offer discounts for paying your premium annually rather than monthly. Paying annually eliminates the administrative overhead associated with monthly billing and payment processing. This efficiency translates to cost savings for the insurer, which they often pass on to the customer in the form of a discount. The discount percentage can vary; some insurers might offer a 5-10% discount for annual payments. For instance, a $1000 annual premium could be reduced to $900 with a 10% discount for annual payment. This highlights the value of considering your payment method when comparing insurance quotes.

Other Potential Discounts

Several other factors can influence your car insurance premium and potentially unlock further discounts. These include:

- Good Student Discount: Maintaining a high GPA in school often qualifies you for a discount, rewarding academic achievement and implying a lower risk profile.

- Anti-theft Device Discount: Installing anti-theft devices, such as alarm systems or GPS trackers, can significantly reduce your risk of theft, leading to a discount on your premium.

- Vehicle Safety Features Discount: Cars equipped with advanced safety features like anti-lock brakes, airbags, and electronic stability control often qualify for discounts because these features reduce the likelihood of accidents.

- Defensive Driving Course Discount: Completing a certified defensive driving course can demonstrate your commitment to safe driving and often results in a premium reduction.

- Military Discount: Some insurers offer discounts to active military personnel and veterans, recognizing their service.

Illustrative Discount Types and Potential Savings

The following table provides examples of various discount types and their potential savings, assuming a base annual premium of $1200. These are illustrative examples and actual discounts will vary based on the insurer and individual circumstances.

| Discount Type | Potential Discount Percentage | Potential Savings |

|---|---|---|

| Safe Driving (5 years accident-free) | 10% | $120 |

| Bundling Home and Auto | 15% | $180 |

| Annual Payment | 5% | $60 |

| Good Student | 10% | $120 |

| Anti-theft Device | 5% | $60 |

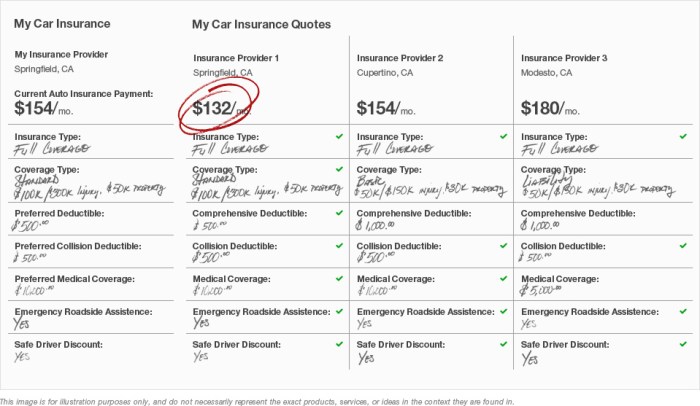

Illustrative Examples of Premium Comparisons

Understanding how various factors influence car insurance premiums can be greatly enhanced by examining specific scenarios. The following examples illustrate how age, vehicle type, and driving history significantly impact the cost of insurance.

Young Driver vs. Older Driver Premium Comparison

This example compares the premiums for two drivers with similar vehicles and coverage, but vastly different ages. Let’s consider Sarah, a 22-year-old with a clean driving record, and John, a 45-year-old with a similar driving history. Both drive a 2020 Honda Civic, with comprehensive and collision coverage. Sarah’s premium is likely to be significantly higher than John’s. This is because insurance companies statistically assess younger drivers as higher risk due to inexperience and a tendency towards more accidents. John’s years of safe driving and established driving history contribute to a lower risk profile, resulting in a lower premium. For instance, Sarah might pay $1500 annually, while John might pay only $800. This difference reflects the statistical risk assessment employed by insurance companies.

Premium Comparison: Different Vehicle Safety Ratings

This scenario compares premiums for two similar vehicles with different safety ratings. Imagine two SUVs, both 2023 models with similar features and engine sizes. However, Vehicle A boasts a top safety rating from the IIHS (Insurance Institute for Highway Safety), while Vehicle B receives a lower rating. Even with identical coverage and driver profiles, the premium for Vehicle B would likely be higher. This is because a higher safety rating suggests a lower probability of accidents and claims, thus leading to lower insurance costs. A potential premium difference could be $100 annually, with Vehicle A costing less due to its superior safety features.

Premium Cost Comparison Over Five Years: Clean Record vs. Multiple Accidents

This visual representation (description only) compares the total premium costs over five years for two drivers with contrasting driving histories. Imagine a bar graph. The horizontal axis represents the five years, and the vertical axis represents the total premium cost. One bar represents a driver with a clean driving record, showing a relatively steady and low cost throughout the five years. The other bar represents a driver with multiple accidents. This bar shows a significantly higher initial cost, followed by potentially even higher costs in subsequent years due to increased risk assessment. The difference in total cost over the five years would be substantial, highlighting the long-term financial impact of accidents on insurance premiums. For example, the clean record driver might pay a total of $4000 over five years, while the driver with multiple accidents might pay $7000 or more. This visual clearly demonstrates the financial benefit of safe driving.

Summary

Ultimately, comparing car insurance premiums is a crucial step in securing affordable and comprehensive coverage. By carefully considering the factors discussed – from your driving record to the type of vehicle you drive and the coverage you select – you can significantly influence your premium costs. Remember to actively compare quotes from multiple insurers, explore available discounts, and leverage a clean driving record to achieve the best possible rates. Armed with this knowledge, you can confidently navigate the insurance market and find a policy that perfectly suits your budget and needs.

Essential FAQs

What is the difference between liability, collision, and comprehensive coverage?

Liability covers damages you cause to others; collision covers damage to your car in an accident, regardless of fault; comprehensive covers damage from events other than collisions (e.g., theft, weather).

How often should I compare car insurance quotes?

Ideally, compare quotes annually or whenever a significant life event occurs (e.g., marriage, new car, moving).

Can I get my car insurance canceled for too many claims?

Yes, insurers may cancel your policy if you file too many claims, especially if they are deemed to be your fault.

What is a usage-based insurance program?

These programs use telematics devices or smartphone apps to track your driving habits, potentially offering discounts for safe driving.