Securing a mortgage is a significant financial undertaking, and understanding all associated costs is crucial. Mortgage insurance premiums (MIPs), often overlooked, play a vital role in the mortgage process, impacting both the initial outlay and the overall cost of homeownership. This guide delves into the intricacies of MIPs, clarifying their purpose, calculation, and implications for borrowers throughout the loan lifecycle.

From defining the various types of MIPs available – including private mortgage insurance (PMI) and government-backed options like FHA MIP – to exploring the factors that influence their cost, such as loan-to-value ratio (LTV) and credit score, we aim to provide a comprehensive understanding of this critical aspect of mortgage financing. We will also examine how MIPs behave during refinancing and foreclosure, equipping you with the knowledge to navigate these situations effectively.

What are Mortgage Insurance Premiums (MIPs)?

Mortgage insurance premiums (MIPs) are essentially insurance policies designed to protect lenders from potential losses if a borrower defaults on their mortgage loan. They provide a safety net for the lender, reducing the risk associated with lending large sums of money. The premiums are paid by the borrower and help to mitigate the lender’s risk, potentially leading to more favorable loan terms for the borrower.

Mortgage insurance premiums serve a crucial function in the mortgage market. They allow lenders to offer mortgages to borrowers who may not meet the traditional requirements for a conventional loan, such as those with lower credit scores or smaller down payments. This expands access to homeownership for a wider range of individuals. The premiums also contribute to the stability of the mortgage market by reducing the overall risk of defaults.

Types of Mortgage Insurance Premiums

There are two primary types of MIPs: private mortgage insurance (PMI) and government-backed mortgage insurance. PMI is offered by private companies, while government-backed insurance is provided by agencies such as the Federal Housing Administration (FHA). The specifics of each type, including premium amounts and terms, vary depending on the insurer and the borrower’s circumstances.

Situations Requiring Mortgage Insurance Premiums

MIPs are typically required when a borrower makes a down payment of less than 20% of the home’s purchase price for a conventional loan. This threshold is because lenders generally consider a 20% down payment to be sufficient equity to cover potential losses in case of foreclosure. Borrowers with lower credit scores may also be required to pay MIPs, even with a larger down payment, as their higher risk profile necessitates additional protection for the lender. Government-backed loans, such as FHA loans, always require mortgage insurance, regardless of the down payment amount. This is because these loans are designed to make homeownership more accessible to a broader range of borrowers, including those with lower credit scores and smaller down payments. For example, a first-time homebuyer with a 10% down payment on a conventional loan would typically be required to pay PMI, while a borrower obtaining an FHA loan with a 3.5% down payment would pay FHA MIP.

Comparison of PMI and FHA MIP

| Feature | Private Mortgage Insurance (PMI) | Federal Housing Administration Mortgage Insurance Premium (FHA MIP) | Key Differences Summary |

|---|---|---|---|

| Provider | Private insurance companies | Federal Housing Administration (FHA) | Private vs. Government-backed |

| Eligibility | Conventional loans with less than 20% down payment, or borrowers with lower credit scores. | FHA-insured loans. Typically requires lower down payments and credit scores. | Loan type and borrower profile influence eligibility. |

| Premium Calculation | Based on loan-to-value ratio (LTV), credit score, and other risk factors. | Based on loan amount and loan term. Includes upfront and annual premiums. | Differing calculation methodologies based on risk assessment. |

| Cancellation | Typically cancelled when the borrower reaches 20% equity in the home (through appreciation or principal paydown). | Usually remains in effect for the life of the loan, though options for refinancing may exist. | Cancellation timelines and conditions differ significantly. |

Factors Affecting MIP Costs

Several key factors influence the cost of mortgage insurance premiums (MIPs), ultimately determining the amount a borrower pays. Understanding these factors can help prospective homebuyers better prepare for their mortgage costs. The primary drivers are the loan-to-value ratio, the borrower’s credit score, and prevailing interest rates.

Loan-to-Value Ratio and MIPs

The loan-to-value ratio (LTV) is a crucial determinant of MIP costs. The LTV is calculated by dividing the loan amount by the appraised value of the property. A higher LTV signifies a larger loan relative to the property’s worth, indicating a greater risk for the lender. Consequently, higher LTV ratios result in higher MIPs. For example, a borrower with a 95% LTV (meaning they borrowed 95% of the home’s value) will pay significantly more in MIPs than a borrower with an 80% LTV. The relationship is generally inverse: as the LTV decreases, so do the MIP costs. This reflects the reduced risk to the lender as the borrower has a larger down payment.

Credit Score’s Impact on MIP Premiums

A borrower’s credit score significantly influences the cost of MIPs. Lenders view borrowers with higher credit scores as lower risk. Individuals with excellent credit scores typically qualify for lower MIP premiums because they demonstrate a greater likelihood of timely loan repayment. Conversely, those with lower credit scores may face higher premiums, reflecting the increased risk of default. A difference of even a few points on a credit score can result in a noticeable difference in the MIP rate. For instance, a borrower with a 760 credit score might receive a significantly lower MIP rate than someone with a 660 credit score, even if their LTV ratios are identical.

Interest Rates and the Overall Cost of MIPs

While interest rates don’t directly impact the *rate* of MIPs (which is primarily determined by LTV and credit score), they significantly affect the *overall cost* over the life of the loan. Higher interest rates lead to larger monthly mortgage payments, extending the loan repayment period. Because MIPs are typically paid monthly, this longer repayment period means borrowers with higher interest rates pay more in total MIPs over the loan’s lifespan. For example, a 30-year fixed-rate mortgage with a high interest rate will accumulate substantially more MIP payments compared to a similar mortgage with a lower interest rate, even if the MIP rate itself remains constant. The extended loan term directly increases the total amount paid in MIPs.

MIP Payment Structure and Calculation

Understanding how Mortgage Insurance Premiums (MIPs) are calculated is crucial for budgeting and planning your home purchase. The calculation depends on several factors, primarily the loan amount, the loan-to-value (LTV) ratio, and whether you opt for an upfront or annual payment structure.

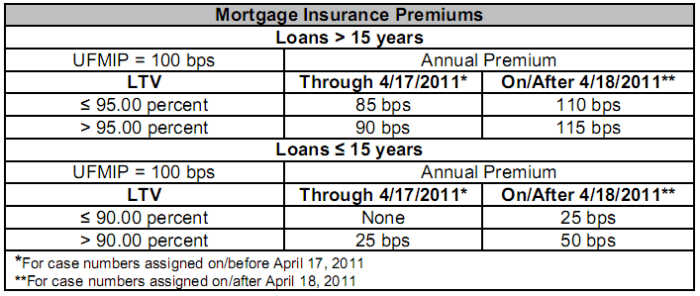

MIP calculations involve applying a specific percentage rate to the loan amount or a portion thereof. This percentage varies depending on the LTV ratio and the type of loan. For example, lower LTV ratios generally correlate with lower MIP rates, reflecting a lower risk to the lender. The payment structure – upfront or annual – also affects the overall cost. An upfront MIP is a one-time payment made at closing, while an annual MIP is paid monthly as part of your mortgage payment.

MIP Payment Methods

There are two primary methods for paying MIPs: upfront and annual. An upfront MIP is a lump-sum payment made at closing, typically ranging from 0.5% to 3.5% of the loan amount, depending on the LTV ratio and loan type. This option reduces the monthly mortgage payment but increases the initial costs. An annual MIP, conversely, is a smaller, recurring payment spread across the life of the loan, typically paid monthly as part of your mortgage payment. This option results in a lower upfront cost but higher overall payments over the life of the loan. The choice depends on individual financial circumstances and preferences.

MIP Calculation Examples

Let’s illustrate MIP calculations with some examples. Assume a standard 30-year fixed-rate mortgage.

Example 1: Upfront MIP

Loan Amount: $300,000

LTV Ratio: 90%

Upfront MIP Rate: 1.75% (This rate is hypothetical and can vary significantly based on lender and market conditions.)

Upfront MIP Calculation: $300,000 x 0.0175 = $5,250

Example 2: Annual MIP

Loan Amount: $250,000

LTV Ratio: 80%

Annual MIP Rate: 0.75% (This rate is hypothetical and can vary significantly based on lender and market conditions.)

Annual MIP Calculation: $250,000 x 0.0075 = $1,875 This is the annual MIP; the monthly payment would be $1,875 / 12 = $156.25.

Step-by-Step MIP Calculation Guide

Calculating MIPs involves these steps:

- Determine the Loan Amount: This is the total amount borrowed to purchase the property.

- Calculate the Loan-to-Value (LTV) Ratio: Divide the loan amount by the property’s appraised value. For example, a $200,000 loan on a $250,000 property has an LTV of 80%.

- Identify the Applicable MIP Rate: This rate depends on the LTV ratio and loan type. Lenders provide this information.

- Calculate the Upfront MIP (if applicable): Multiply the loan amount by the upfront MIP rate.

- Calculate the Annual MIP (if applicable): Multiply the loan amount by the annual MIP rate to find the annual cost. Divide this by 12 to determine the monthly payment.

Note: These calculations are simplified examples. Actual MIP rates and calculations can be more complex and may include additional factors determined by the lender and prevailing market conditions. Always consult your lender for precise figures.

Closing Summary

Navigating the complexities of mortgage insurance premiums requires a clear understanding of their purpose, calculation, and implications across different stages of homeownership. By carefully considering the factors influencing MIP costs and understanding the payment structures, borrowers can make informed decisions, ensuring a smoother and more financially responsible home-buying journey. Remember to compare offers from different lenders and proactively address any questions you may have to secure the most advantageous mortgage terms.

Common Queries

What happens to my MIPs if I pay off my mortgage early?

The rules vary depending on the type of MIP. With some, you may be able to request a refund of a portion of the upfront premium or have future premiums canceled. With others, there might be no refund.

Can I remove PMI if I make extra payments on my mortgage?

While extra payments reduce your loan balance, they don’t automatically eliminate PMI. You’ll typically need to reach a certain LTV (loan-to-value) ratio, usually 80%, before the lender will remove it.

Are MIPs tax deductible?

Generally, no. MIPs are typically not tax deductible, unlike mortgage interest payments.

What if I can’t afford my MIP payments?

Failing to pay MIPs can lead to late payment fees and, ultimately, foreclosure. Contact your lender immediately if you anticipate difficulty making your payments; they may offer options like forbearance or modification.