Premium life insurance represents a significant financial commitment, but for many, it’s an investment offering unparalleled peace of mind and robust financial protection. Unlike standard policies, premium life insurance often boasts higher coverage limits, enhanced benefits, and sophisticated features designed to cater to the complex needs of high-net-worth individuals and families. This guide explores the nuances of premium life insurance, examining its cost, benefits, and suitability for various financial situations.

We’ll delve into the key differentiators between premium life insurance and other policy types, analyzing its suitability for different demographics and financial goals. We will also illustrate how premium life insurance can be a powerful tool in estate planning, business continuity, and securing a family’s financial future against unforeseen circumstances. By understanding the intricacies of premium life insurance, you can make informed decisions about securing your financial legacy.

Defining Premium Life Insurance

Premium life insurance represents a higher tier of life insurance coverage, offering enhanced benefits and features compared to standard policies. It’s designed for individuals seeking significant financial protection and often includes more comprehensive coverage and added flexibility. Understanding the key differences between premium and standard policies is crucial for making an informed decision.

Premium life insurance policies are distinguished by their superior coverage amounts, flexible benefit structures, and inclusion of valuable riders and additional features. These policies typically cater to high-net-worth individuals or those with complex financial needs requiring a more robust and tailored insurance solution.

Coverage Amounts and Benefit Structures

Premium life insurance policies typically offer significantly higher coverage amounts than standard policies, often reaching millions of dollars. The benefit structure can be customized to meet specific needs, including options for accelerated death benefits, which allow access to a portion of the death benefit while still alive for critical illnesses. For example, a high-net-worth individual might secure a $5 million policy to ensure their family’s financial security and business continuity in the event of their death. Another example would be a family seeking coverage for estate taxes, potentially requiring a policy with a much larger death benefit than a standard policy would provide. The specific coverage amount and structure will depend on individual needs and underwriting.

Riders and Additional Features

Premium life insurance policies frequently include a wide array of riders and additional features to enhance the core coverage. These add-ons can significantly increase the policy’s value and provide additional protection. Common examples include:

- Long-Term Care Rider: Provides coverage for long-term care expenses, a significant financial burden for many families.

- Disability Waiver of Premium Rider: Waives future premiums if the policyholder becomes disabled.

- Accidental Death Benefit Rider: Pays an additional death benefit if the death is caused by an accident.

- Guaranteed Insurability Rider: Allows the policyholder to increase coverage at specific intervals without further medical underwriting.

These riders provide enhanced protection against various life events and can significantly reduce the financial strain on the policyholder and their family. The availability and cost of riders will vary depending on the insurer and the specific policy.

Comparison of Life Insurance Types

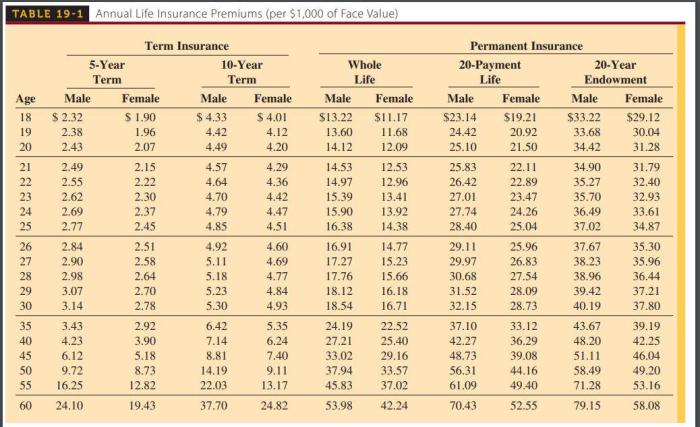

The following table compares premium life insurance to other common types of life insurance:

| Policy Type | Cost | Coverage | Features |

|---|---|---|---|

| Premium Life Insurance | High | High (often millions) | Customizable benefits, numerous riders, potential for cash value growth (depending on the type of policy) |

| Term Life Insurance | Low | Fixed amount, for a specific term | Simple, affordable coverage for a defined period |

| Whole Life Insurance | High | Fixed amount, lifelong coverage | Cash value accumulation, lifelong protection |

It’s important to note that the cost of premium life insurance will vary based on factors such as the age and health of the applicant, the amount of coverage, and the specific features and riders included in the policy. The table provides a general comparison and individual quotes are necessary for accurate cost estimations.

Final Summary

In conclusion, premium life insurance offers a sophisticated approach to financial protection, going beyond the basic coverage provided by standard policies. By carefully considering your individual circumstances, financial goals, and risk tolerance, you can determine if premium life insurance is the right investment for securing your family’s future and mitigating potential financial risks. The comprehensive benefits, customizable features, and potential tax advantages make it a valuable tool for those seeking robust and tailored financial security. Remember to consult with a qualified financial advisor to personalize your strategy.

Answers to Common Questions

What are the common exclusions in premium life insurance policies?

Common exclusions can include pre-existing conditions, high-risk activities (e.g., extreme sports), and suicide within a specified period. The specifics vary by insurer and policy.

How does the cash value component of premium life insurance work?

Many premium life insurance policies build cash value over time, which can be borrowed against or withdrawn. The growth rate and accessibility depend on the specific policy type and insurer.

Can I change my beneficiaries on a premium life insurance policy?

Yes, you can usually change your beneficiaries at any time by notifying your insurance provider and completing the necessary paperwork.

What is the process for filing a claim under a premium life insurance policy?

The claim process involves notifying the insurer of the death, providing necessary documentation (death certificate, policy documents), and completing a claim form. The insurer will then process the claim and disburse the benefits according to the policy terms.