Securing your family’s financial future is a paramount concern, and life insurance plays a crucial role in achieving this goal. Among the various types of life insurance available, level premium term life insurance policies offer a straightforward and often cost-effective approach. This guide delves into the intricacies of these policies, exploring their features, benefits, and considerations to help you make an informed decision.

We will examine the core characteristics of level premium term life insurance, comparing it to other types such as whole life and universal life insurance. We’ll explore how factors like age, health, and policy length influence premium costs, and provide illustrative scenarios to demonstrate when this type of policy is most suitable. By the end, you’ll possess a comprehensive understanding of level premium term life insurance and its potential role in your financial planning.

Defining Level Premium Term Life Insurance

Level premium term life insurance offers a straightforward and cost-effective way to secure your loved ones’ financial future. It provides a guaranteed death benefit for a specific period (the term), with premiums remaining consistent throughout the policy’s duration. This predictability makes budgeting for life insurance simpler and more manageable than with other types of policies.

Level premium term life insurance differs significantly from other life insurance options, primarily in its duration and features. Unlike permanent life insurance policies, such as whole life or universal life, level premium term insurance does not build cash value. This means that premiums solely cover the death benefit, resulting in lower costs compared to policies that accumulate cash value. The trade-off is that the coverage expires at the end of the term; renewal may be possible, but usually at a higher rate.

Key Features of Level Premium Term Life Insurance

Level premium term life insurance is characterized by its fixed premiums and specified coverage period. The policyholder pays a consistent premium for a predetermined number of years, receiving a guaranteed death benefit should they pass away within that term. There are no cash value components, and policyholders receive no returns or investment gains. The simplicity of this structure contributes to its affordability. Many policies offer the option to convert to a permanent policy before the term expires, though this typically involves a higher premium.

Differences Between Level Premium Term and Other Life Insurance Types

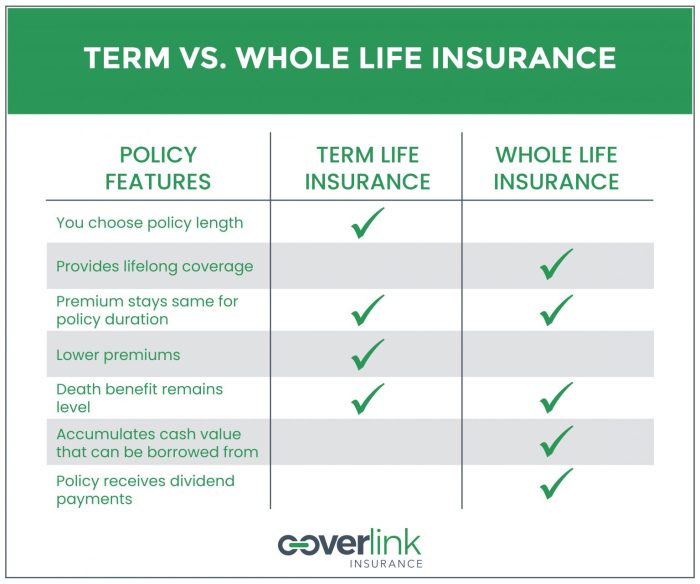

The primary difference lies in the duration of coverage and the presence or absence of cash value. Level premium term insurance provides coverage for a defined period, after which the policy expires. Whole life insurance, on the other hand, offers lifelong coverage and builds cash value that can be borrowed against or withdrawn. Universal life insurance also offers lifelong coverage and builds cash value, but offers more flexibility in premium payments and death benefit adjustments.

Comparison of Life Insurance Policy Types

The following table summarizes the key differences between level premium term, whole life, and universal life insurance:

| Feature | Level Premium Term | Whole Life | Universal Life |

|---|---|---|---|

| Premiums | Fixed, level premiums for the term | Fixed, level premiums for life | Flexible premiums; can be adjusted |

| Death Benefit | Fixed amount paid upon death within the term | Fixed amount paid upon death | Fixed or adjustable amount paid upon death |

| Cash Value | None | Accumulates cash value over time | Accumulates cash value over time |

| Coverage Duration | Specified term (e.g., 10, 20, 30 years) | Lifetime | Lifetime |

Understanding Policy Length and Premiums

Choosing a level premium term life insurance policy involves understanding the interplay between the policy’s length and the associated premiums. The length of coverage directly impacts the cost, reflecting the increased risk the insurer assumes over longer periods. Shorter terms generally mean lower premiums, while longer terms come with higher premiums. This section will clarify this relationship and provide examples to illustrate the variations.

Policy Length and Premium Costs

The typical term lengths available for level premium term life insurance policies range from 10 to 30 years, although some insurers may offer shorter or longer terms. The most common options are 10, 15, 20, 25, and 30-year terms. The premium you pay is calculated based on several factors, including your age, health, gender, and the chosen term length. A longer term represents a greater commitment from the insurer, leading to higher premiums to account for the extended period of risk. Conversely, shorter-term policies involve less risk for the insurer and thus result in lower premiums.

Term Length, Premium Examples, and Influencing Factors

The table below illustrates how premium costs vary based on the chosen term length. Note that these are example premiums only and actual costs will vary based on individual circumstances.

| Term Length (Years) | Premium Example (Monthly, for $500,000 coverage) | Factors Affecting Premium |

|---|---|---|

| 10 | $30 | Lower risk for insurer, shorter coverage period. |

| 15 | $40 | Increased risk compared to 10-year term, longer coverage period. |

| 20 | $55 | Significant increase in risk; longer duration of coverage. |

| 25 | $70 | Higher risk due to extended coverage period; potential for increased mortality risk. |

| 30 | $85 | Highest risk; longest coverage period, significant time commitment from the insurer. |

Epilogue

Level premium term life insurance offers a valuable tool for securing financial protection during a specified period. By carefully considering your individual needs, evaluating the various factors influencing premium costs, and comparing different providers, you can choose a policy that aligns with your financial goals and provides peace of mind. Remember to consult with a qualified financial advisor to determine the best life insurance strategy for your unique circumstances.

Question & Answer Hub

What happens if I die before the term expires?

Your designated beneficiaries will receive the death benefit Artikeld in your policy.

Can I renew my level premium term life insurance policy after the term expires?

Many policies offer a renewal option, but at a higher premium reflecting your increased age.

What are the common reasons for policy denial?

Common reasons include pre-existing health conditions, high-risk occupations, or failure to disclose accurate health information.

Can I change the beneficiary of my policy?

Yes, you can usually change your beneficiary at any time by notifying your insurance provider.

How long does it take to get approved for a policy?

Approval times vary depending on the insurer and the complexity of your application, but it can range from a few days to several weeks.