Stepping beyond basic coverage, premium insurance offers a world of enhanced protection and benefits. This guide delves into the intricacies of premium insurance, exploring what sets it apart, its associated costs and value, and the advantages it provides to discerning consumers. We’ll examine the nuances of coverage, eligibility, and the market landscape, equipping you with the knowledge to make informed decisions about your insurance needs.

Understanding premium insurance isn’t just about higher premiums; it’s about evaluating the enhanced value proposition against your individual risk profile and financial goals. This exploration will illuminate the key differences between premium and standard plans, highlighting the specific circumstances where the added cost translates to significantly improved protection and peace of mind.

Defining Premium Insurance

Premium insurance represents a higher tier of insurance coverage offering enhanced benefits and services compared to standard plans. It often involves increased premiums in exchange for superior protection and a more personalized experience.

Premium insurance distinguishes itself from standard insurance primarily through the breadth and depth of its coverage. This often includes higher coverage limits, broader definitions of covered events, and access to specialized services not typically available in basic plans. Furthermore, premium plans frequently offer enhanced customer service, such as dedicated account managers and expedited claim processing.

Benefits of Premium Insurance Plans

Premium insurance plans typically provide a range of benefits exceeding those found in standard policies. These advantages contribute to a more comprehensive and secure insurance experience. The specific benefits can vary significantly depending on the insurer and the specific policy, but generally include superior coverage, enhanced services, and greater peace of mind.

- Higher Coverage Limits: Premium plans usually offer significantly higher coverage limits for various events, providing greater financial protection in case of major incidents.

- Broader Coverage: They often include coverage for a wider range of events or circumstances that might be excluded in standard plans. This could include additional coverage for specific types of damage or loss.

- Access to Specialized Services: Premium plans frequently provide access to specialized services such as concierge medical services, 24/7 emergency assistance, or legal consultations.

- Faster Claim Processing: Claims are often processed more quickly and efficiently, minimizing wait times and reducing stress during difficult situations.

- Dedicated Account Manager: Policyholders often have access to a dedicated account manager who provides personalized support and guidance throughout the policy term.

Premium Insurance vs. Basic Insurance Coverage

The key difference between premium and basic insurance lies in the level of coverage, services, and overall value provided. While basic insurance provides fundamental protection against specified risks, premium insurance goes beyond this baseline, offering a more comprehensive and personalized experience. This difference is often reflected in the premium price; premium plans typically cost more but offer a significantly enhanced level of protection and support.

| Feature | Premium Insurance | Basic Insurance |

|---|---|---|

| Coverage Limits | Higher | Lower |

| Coverage Breadth | Wider range of events covered | Limited to specific events |

| Services | Enhanced services (e.g., concierge, 24/7 assistance) | Basic services |

| Claim Processing | Faster | Slower |

| Cost | Higher premiums | Lower premiums |

Cost and Value of Premium Insurance

Premium insurance, while more expensive than standard policies, offers enhanced coverage and benefits. Understanding the cost factors and the resulting value proposition is crucial for consumers making informed decisions. This section will explore the factors influencing the cost of premium insurance, the value it offers, and compare its cost-benefit ratio with standard insurance.

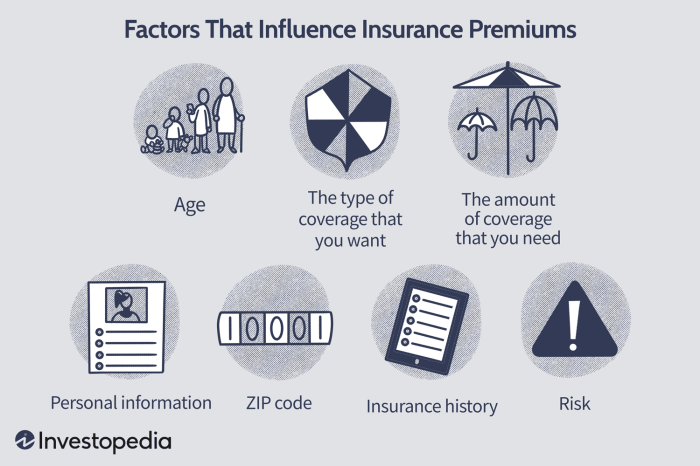

Factors Influencing the Cost of Premium Insurance

Several factors contribute to the higher cost of premium insurance. These include broader coverage limits, access to specialized services, faster claim processing times, and potentially lower deductibles and co-pays. The specific risk profile of the insured individual or property also plays a significant role. Higher-risk individuals or properties will naturally command higher premiums, even within a premium insurance category. Furthermore, the insurer’s administrative overhead and profit margins contribute to the overall cost. Finally, the inclusion of value-added services such as concierge medical services or 24/7 emergency assistance can significantly impact the premium price.

Value Proposition of Premium Insurance for Consumers

Premium insurance offers significant value to consumers seeking enhanced protection and peace of mind. The key benefits include increased coverage limits providing greater financial security in the event of a major loss, access to expedited claim processing, minimizing the time and stress associated with insurance claims. Many premium policies also include access to exclusive services such as concierge medical services, 24/7 emergency assistance, and specialized legal advice. These added benefits enhance the overall value proposition, justifying the higher cost for those who prioritize convenience and comprehensive protection.

Cost-Benefit Ratio Comparison: Premium vs. Standard Insurance

The following table compares the cost-benefit ratio of premium and standard insurance across different coverage types. Note that these are illustrative examples and actual costs and benefits may vary depending on the specific insurer, policy details, and individual circumstances.

| Coverage Type | Premium Insurance: Annual Cost | Standard Insurance: Annual Cost | Benefit Difference |

|---|---|---|---|

| Health Insurance | $12,000 | $6,000 | Enhanced coverage, faster claim processing, concierge services |

| Auto Insurance | $1,500 | $750 | Higher liability limits, rental car reimbursement, expedited repairs |

| Homeowners Insurance | $3,000 | $1,500 | Increased coverage for disasters, faster claim settlements, priority service |

| Travel Insurance | $500 | $250 | Wider range of covered events, 24/7 emergency assistance, higher compensation limits |

Hypothetical Scenario: Financial Advantages of Premium Insurance

Imagine a family with a home valued at $500,000. They choose a standard homeowners insurance policy with a $100,000 coverage limit for a cost of $1,500 annually. A fire causes $200,000 in damage. The family will receive only $100,000 from their standard policy and will be responsible for the remaining $100,000. Had they opted for a premium policy with a $500,000 coverage limit at a cost of $3,000 annually, they would have been fully covered, despite the higher premium. The additional $1,500 spent annually on premium insurance saved them $100,000 in out-of-pocket expenses. This scenario highlights the significant financial protection offered by premium insurance, even though the initial cost is higher.

Premium Insurance Providers and Market Trends

The premium insurance market is a dynamic landscape shaped by a diverse range of providers and evolving consumer demands. Understanding the key players, current trends, and competitive dynamics is crucial for both insurers and consumers seeking high-level coverage. This section will explore these aspects of the premium insurance sector.

Major Premium Insurance Providers

Several large multinational corporations dominate the global premium insurance market, offering a wide array of specialized products and services catering to high-net-worth individuals and businesses. These companies often have a long history, substantial financial reserves, and sophisticated risk management capabilities. Examples include companies like AXA, Allianz, Zurich Insurance Group, and Lloyd’s of London, each with a significant global presence and a portfolio encompassing various premium insurance lines. In addition to these global players, many regional and national insurers also offer premium insurance products, often specializing in specific market niches or geographic areas. The competitive landscape is further diversified by smaller, boutique firms specializing in niche areas like art insurance or high-value jewelry.

Current Market Trends in the Premium Insurance Sector

The premium insurance sector is experiencing several significant shifts. Increasingly sophisticated risk assessment methodologies, driven by advancements in data analytics and artificial intelligence, are enabling more precise pricing and underwriting. This allows for more tailored policies and potentially lower premiums for individuals with demonstrably lower risk profiles. Furthermore, the growing awareness of climate change and its associated risks is driving demand for specialized insurance products covering environmental hazards and related liabilities. The rise of cyber threats is also significantly impacting the market, creating a surge in demand for robust cyber insurance policies to protect against data breaches and other digital risks. Finally, a growing preference for digital interactions is reshaping how premium insurance is sold and serviced, with online platforms and personalized digital experiences becoming increasingly common.

Competitive Landscape of the Premium Insurance Market

Competition in the premium insurance market is fierce, characterized by both price competition and differentiation based on service quality and product innovation. Large, established players leverage their brand recognition, extensive distribution networks, and financial strength to maintain market share. However, smaller, more specialized firms can compete effectively by focusing on niche markets and offering highly personalized service. The competitive landscape is also influenced by regulatory changes, technological advancements, and evolving consumer expectations. Insurers are constantly seeking ways to improve their efficiency, expand their product offerings, and enhance the customer experience to gain a competitive edge.

Innovative Premium Insurance Products and Services

The premium insurance market is witnessing the emergence of innovative products and services designed to meet the evolving needs of high-net-worth clients. For instance, some insurers are offering bespoke insurance solutions tailored to specific high-value assets, such as art collections or private jets, with comprehensive coverage and specialized claims handling. Others are leveraging technology to offer more seamless and efficient claims processes, often incorporating AI-powered tools for faster and more accurate assessments. Furthermore, there’s a growing trend towards bundled insurance solutions, offering comprehensive coverage across multiple areas, such as property, liability, and personal accident insurance, under a single policy. These innovative offerings are aimed at simplifying the insurance process and providing greater convenience for discerning clients.

Final Thoughts

Ultimately, the decision to opt for premium insurance hinges on a careful assessment of individual needs and risk tolerance. While the cost is undeniably higher than standard plans, the enhanced coverage, superior benefits, and often streamlined service can offer significant advantages. By understanding the factors influencing cost, the breadth of coverage, and the eligibility requirements, consumers can confidently navigate the premium insurance market and select a plan that best aligns with their priorities and financial capabilities.

FAQ Corner

What are some hidden costs associated with premium insurance?

While premiums are upfront, hidden costs can include potentially higher deductibles or co-pays, even within premium plans. Carefully review the policy details to understand all potential out-of-pocket expenses.

Can I downgrade my premium insurance plan later?

Most insurers allow plan changes, often with a waiting period or restrictions. Check your policy’s terms and conditions for details on downgrading or modifying coverage.

How does premium insurance impact my tax liability?

The tax implications of premium insurance vary depending on the type of insurance (health, auto, home, etc.) and your location. Consult a tax professional for personalized advice.

What happens if I make a claim and my premium insurance is canceled?

Cancellation typically only occurs due to non-payment or fraudulent activity. A legitimate claim should not directly lead to cancellation. However, future premium rates might be affected.