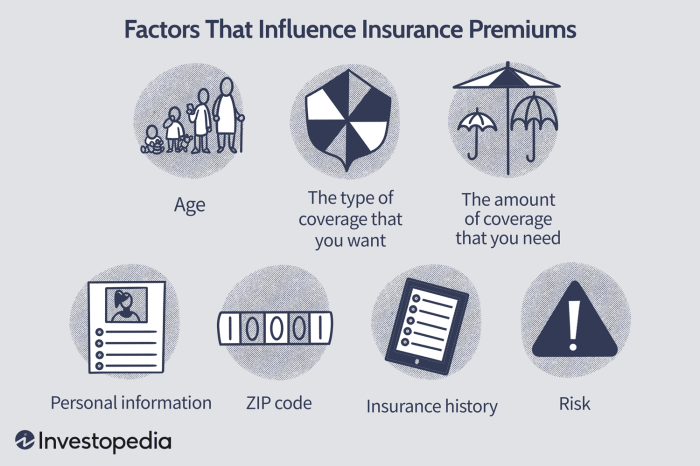

Understanding insurance premiums is crucial for navigating the complexities of financial planning. This guide delves into the multifaceted world of insurance costs, exploring the factors that influence premium calculations, the components that make up your total premium, and strategies to potentially lower your expenses. We’ll examine how various elements, from your age and driving history to lifestyle choices and credit score, contribute to the final cost, offering insights into how the system works and how you can make informed decisions.

From car and health insurance to homeowners’ policies, we’ll uncover the secrets behind premium determination, providing practical advice and illuminating the often-opaque processes involved. This exploration will empower you to become a more savvy consumer, better equipped to negotiate favorable terms and secure the most cost-effective insurance coverage.

Understanding Insurance Premium Components

Insurance premiums, the payments you make for coverage, are not a single, monolithic fee. They are comprised of several key elements, each contributing to the overall cost. Understanding these components allows for a more informed assessment of your insurance policy and its value.

Administrative Costs

Administrative costs represent the expenses incurred by the insurance company in managing the policy lifecycle. These include salaries for employees involved in underwriting, claims processing, customer service, and marketing. Furthermore, significant portions of administrative costs are dedicated to maintaining IT infrastructure, handling regulatory compliance, and operating physical office spaces. The complexity of insurance products and the increasing regulatory burden contribute significantly to the rising administrative costs embedded within premiums. For example, a large insurer might allocate 15-20% of its premium income to cover these overhead expenses. Efficient operational practices and technological advancements can help insurers minimize these costs, ultimately benefiting policyholders.

Claims History

Your individual claims history significantly impacts your future premiums. Insurers use statistical models and historical data to assess risk. A history of frequent or costly claims indicates a higher risk profile, leading to higher premiums. Conversely, a clean claims history reflects lower risk and can result in lower premiums, often through discounts or lower risk classifications. For instance, a driver with multiple at-fault accidents will likely face substantially higher auto insurance premiums compared to a driver with a spotless record. This system incentivizes safe driving and responsible behavior.

Profit Margins

Insurance companies, like any business, aim to generate a profit. Profit margins are incorporated into premium calculations to ensure the insurer’s financial sustainability. This margin represents the percentage of premium income retained by the company after covering all expenses, including claims payouts, administrative costs, and taxes. The precise profit margin varies across insurers and product lines, influenced by factors like competition, investment returns, and regulatory environment. For instance, a company might aim for a 5-10% profit margin on its auto insurance portfolio, which is then factored into the premium calculation to ensure long-term profitability.

Example of Auto Insurance Premium Breakdown

Let’s visualize a typical auto insurance premium breakdown using a text-based representation:

“`

Auto Insurance Premium ($1000)

Claims Costs: $400 (40%)

Administrative Costs: $200 (20%)

Profit Margin: $100 (10%)

Taxes & Fees: $150 (15%)

Reinsurance Costs: $150 (15%)

Total: $1000 (100%)

“`

This example illustrates a simplified breakdown. The actual proportions may vary depending on several factors, including the insurer, the policyholder’s risk profile, and the specific coverage selected. Reinsurance costs, for example, represent the premiums paid by the primary insurer to a reinsurer for transferring a portion of the risk. The insurer’s investment income can also influence the overall premium, though it’s not explicitly shown in this simplified illustration.

Insurance Premium Comparisons Across Providers

Choosing the right homeowner’s insurance can feel overwhelming, given the sheer number of providers and varying premium costs. Understanding how premiums differ across providers is crucial for securing the best value for your money. This section will guide you through comparing premiums and selecting a provider that aligns with your needs and budget.

Direct comparison of insurance premiums requires a structured approach. Simply looking at the headline price isn’t sufficient; a thorough analysis of coverage, deductibles, and other policy features is essential. This allows for an apples-to-apples comparison, preventing the selection of a seemingly cheaper policy that ultimately offers less comprehensive protection.

Average Premiums Across Three Major Providers

Let’s consider three hypothetical major providers – “InsureAll,” “SafeHome,” and “ProtectCo” – and their average annual premiums for a standard homeowner’s insurance policy covering a $300,000 home in a low-risk area. These figures are for illustrative purposes only and do not represent actual quotes from specific companies. Actual premiums will vary based on numerous individual factors.

| Provider | Average Annual Premium |

|---|---|

| InsureAll | $1,200 |

| SafeHome | $1,050 |

| ProtectCo | $1,350 |

Effective Comparison of Insurance Quotes

Comparing insurance quotes effectively involves more than simply comparing the bottom-line price. A detailed analysis of the policy documents is vital. Key factors to compare include coverage limits (dwelling, personal property, liability), deductibles, discounts offered, and the provider’s claims handling reputation. Using a comparison website can streamline this process, but always verify the information independently. For instance, one provider might offer a lower premium but a higher deductible, potentially increasing your out-of-pocket expenses in the event of a claim.

Factors to Consider When Choosing an Insurance Provider Based on Premium Costs

Several factors influence the final premium cost beyond the base rate. These include your credit score, claims history, the age and condition of your home, security features (alarm systems), and even your location. Providers use sophisticated algorithms to assess risk, and these factors directly impact your premium. A good understanding of these factors helps you make informed decisions about how to potentially lower your premiums. For example, installing a security system might qualify you for a significant discount.

Insurance Premium Pricing Models Across Different Insurers

Different insurers employ various pricing models, leading to variations in premium structures.

Understanding these variations is key to informed decision-making. Consider these aspects when comparing premium pricing models:

- Risk Assessment Methodology: Insurers use different algorithms and data points to assess risk, resulting in varying premium calculations.

- Discount Structures: The availability and amount of discounts (e.g., multi-policy discounts, security system discounts, loyalty discounts) differ significantly between providers.

- Coverage Options and Customization: The level of customization and the range of coverage options influence the final premium. A more comprehensive policy will generally cost more.

- Claims Handling Processes: While not directly impacting the premium, the insurer’s claims handling reputation can indirectly influence costs. Efficient claims processing can potentially reduce the long-term cost of insurance.

Closing Notes

Ultimately, mastering the intricacies of insurance premiums empowers you to take control of your financial well-being. By understanding the factors that influence premiums, employing cost-saving strategies, and making informed comparisons between providers, you can secure the best possible coverage at a price that fits your budget. Remember, informed choices lead to significant savings and peace of mind, solidifying your financial security for years to come. This guide serves as a starting point for a lifelong journey of understanding and managing your insurance costs effectively.

Answers to Common Questions

What is a deductible?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in.

How often are insurance premiums reviewed?

Premium reviews vary by insurer and policy type; some are annual, others less frequent.

Can I get insurance even with a poor driving record?

Yes, but you’ll likely pay higher premiums. Some insurers specialize in high-risk drivers.

What is lapse in insurance coverage?

A lapse occurs when your insurance policy expires without renewal, leaving you uninsured.

How does bundling insurance save money?

Insurers often offer discounts for bundling multiple policies (e.g., car and home insurance) together.