Securing your family’s financial future is a paramount concern, and life insurance plays a crucial role in achieving this goal. Among the various life insurance options available, 20-year return of premium (ROP) life insurance stands out for its unique combination of protection and potential financial return. This comprehensive guide delves into the intricacies of 20-year ROP policies, exploring their features, benefits, risks, and suitability for different individuals and families. We’ll examine how these policies work, compare them to traditional options, and provide insights to help you make informed decisions.

We will navigate the complexities of premiums, death benefits, tax implications, and investment potential. Through illustrative examples and case studies, we aim to provide a clear understanding of when a 20-year ROP policy might be a beneficial addition to your financial strategy and when alternative options might be more appropriate. Our goal is to empower you with the knowledge needed to confidently assess whether this type of insurance aligns with your personal circumstances and long-term financial objectives.

Defining “20-Year Return of Premium Life Insurance”

A 20-Year Return of Premium (ROP) life insurance policy offers a unique combination of life insurance coverage and a guaranteed return of premiums. Essentially, it provides a death benefit to your beneficiaries should you pass away within the 20-year policy term, and if you survive the entire 20 years, you receive all the premiums you paid back. This makes it a potentially attractive option for those seeking both life insurance protection and a form of long-term savings.

Core Features of 20-Year Return of Premium Policies

These policies typically feature a level term life insurance component, meaning the death benefit remains constant throughout the 20-year term. The premiums are also usually level, meaning they don’t increase over the life of the policy. The key differentiator is the return of premium feature; all premiums paid are refunded at the end of the 20-year period, provided the policy remains in force. It’s important to note that this return is typically tax-free. However, any accumulated cash value or investment gains (if applicable, depending on the policy type) might be subject to taxation.

Types of 20-Year Return of Premium Policies

While the core concept remains consistent, variations exist in the specific features offered by different insurers. Some policies may offer additional riders, such as accidental death benefits or critical illness coverage, at an added cost. Others might incorporate investment components, although these are less common in pure ROP policies. The key difference lies in the specific terms and conditions, including premium amounts, death benefit levels, and the exact process for receiving the premium refund.

Comparison of 20-Year Return of Premium Policies vs. Traditional Term Life Insurance

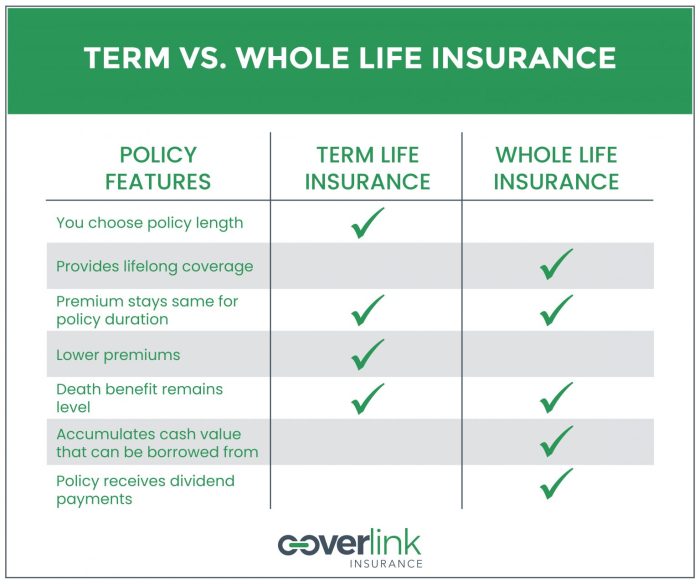

20-Year ROP policies differ significantly from traditional term life insurance. Traditional term life insurance provides coverage for a specified period (e.g., 10, 20, or 30 years), but premiums are not returned at the end of the term. ROP policies, on the other hand, act as both insurance and a form of savings. The cost of a ROP policy will generally be higher than a comparable term life insurance policy due to the return-of-premium feature. The decision of which policy type to choose depends on individual financial goals and risk tolerance. Those prioritizing a guaranteed return of premiums may favor ROP, while those solely focused on affordable life insurance coverage might opt for traditional term life insurance.

Comparison Table of 20-Year Return of Premium Policies

This table provides a hypothetical comparison and should not be taken as a definitive representation of actual policy offerings. Always consult individual insurers for the most up-to-date information.

| Insurer | Annual Premium (Example: 40-year-old male, $500,000 death benefit) | Death Benefit | Return of Premium |

|---|---|---|---|

| Hypothetical Insurer A | $3,000 | $500,000 | $60,000 (20 years x $3,000) |

| Hypothetical Insurer B | $3,200 | $500,000 | $64,000 (20 years x $3,200) |

| Hypothetical Insurer C | $2,800 | $500,000 | $56,000 (20 years x $2,800) |

Financial Aspects and Benefits

Understanding the financial implications of a 20-Year Return of Premium life insurance policy requires careful consideration of tax implications, potential investment growth, and how the policy fits within a broader financial strategy. This policy offers a unique blend of life insurance coverage and a potential return of premiums, making it a complex but potentially rewarding financial instrument.

Tax Implications of Premium Return

The tax treatment of the premium return at the end of the 20-year term is generally favorable. In most jurisdictions, the returned premiums are considered a tax-free return of capital. This means that you won’t owe income tax on the money received, assuming the policy was purchased with after-tax dollars. However, it’s crucial to consult with a qualified tax advisor to understand the specific tax implications in your jurisdiction, as tax laws can vary. This is particularly important for policies with additional features or riders that might affect the taxability of the return. Always keep detailed records of your policy and premium payments for tax purposes.

Potential Investment Growth Opportunities

While the primary benefit is the return of premiums, the underlying investment strategy of the insurance company plays a crucial role in the overall financial outcome. The policy’s cash value grows over the 20-year period, potentially providing a higher return than a simple savings account. The exact investment strategy varies between insurance providers, and the growth is not guaranteed. Some policies might be linked to market indices, offering potential for higher returns but also carrying greater risk. Others may adopt more conservative strategies, leading to more modest growth. Understanding the investment strategy employed by the insurer is key to assessing the potential financial benefits. For example, a policy invested in a diversified portfolio of stocks and bonds might experience higher growth than one invested primarily in low-yield government bonds.

Financial Benefits Under Different Life Circumstances

Scenario 1: Reaching the 20-year mark without needing a death benefit. In this scenario, the policyholder receives the full premium paid back, essentially eliminating the cost of the insurance over two decades. This could be used for retirement planning, a down payment on a house, or any other significant financial goal.

Scenario 2: Death benefit claim within the 20-year term. If the policyholder dies before the 20-year mark, the beneficiaries receive the death benefit, which is usually significantly higher than the total premiums paid. This provides crucial financial security for the family during a difficult time.

Scenario 3: Policy lapse before the 20-year mark. If the policy is lapsed before the 20-year mark, the policyholder will typically receive the cash value accumulated up to that point, which could be less than the premiums paid. However, this still provides some financial return compared to simply losing all premiums.

Hypothetical Financial Plan Incorporating a 20-Year Return of Premium Policy

Let’s assume a 35-year-old individual, Sarah, aims to secure her family’s financial future and save for retirement. She decides to purchase a 20-Year Return of Premium life insurance policy with an annual premium of $5,000. This policy provides a $500,000 death benefit. Over 20 years, Sarah pays a total of $100,000 in premiums. At the end of 20 years, she receives the full $100,000 back. Simultaneously, she contributes to a 401(k) and Roth IRA for retirement savings. The return of premium acts as a significant supplemental retirement fund, effectively reducing the overall cost of her life insurance and enhancing her long-term financial security. This strategy demonstrates how a 20-Year Return of Premium policy can be integrated into a comprehensive financial plan, offering both life insurance protection and long-term financial benefits.

Risk Assessment and Policy Considerations

Choosing a 20-year return of premium life insurance policy requires careful consideration of various factors impacting cost and risk. Understanding these aspects is crucial for making an informed decision aligned with your financial goals and risk tolerance. This section details the key elements involved in assessing the suitability of such a policy.

Factors Influencing Policy Cost

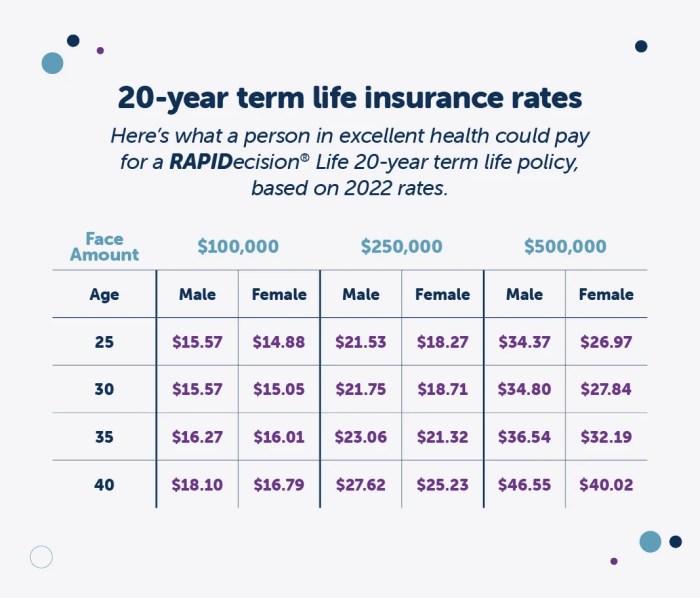

Several factors determine the premium for a 20-year return of premium life insurance policy. These include the applicant’s age, health status, smoking habits, the desired death benefit amount, and the policy’s specific features. Younger, healthier, non-smoking individuals generally qualify for lower premiums. A higher death benefit naturally translates to a higher premium. The policy’s internal rate of return (IRR), a key factor influencing cost, reflects the insurer’s profitability projections and the complexity of the return-of-premium feature. For instance, a 35-year-old non-smoker with excellent health might receive a significantly lower premium than a 55-year-old smoker with pre-existing conditions seeking the same death benefit.

Risk Comparison with Other Insurance Options

20-year return of premium policies offer a unique risk profile compared to traditional term life or whole life insurance. While they provide a death benefit similar to term life insurance, they also guarantee the return of premiums after 20 years, unlike term life which offers no cash value. However, the premiums for return of premium policies are typically higher than those for comparable term life insurance policies. Compared to whole life insurance, which builds cash value over time, return of premium policies offer a more defined timeframe for premium repayment, but may lack the long-term cash value accumulation of whole life. The risk lies in the potential for a lower overall return compared to investing the premium amount elsewhere if the insured lives beyond the 20-year period. The choice depends on individual priorities – guaranteed premium return versus potential higher returns from alternative investments.

Underwriting Process

The underwriting process for a 20-year return of premium policy is similar to other life insurance applications. It typically involves completing an application form providing detailed health information, including medical history, lifestyle habits (smoking, alcohol consumption, etc.), and family medical history. The insurer may require a medical examination, including blood tests and an EKG, to assess the applicant’s health risk. The insurer will use this information to assess the applicant’s risk profile and determine the appropriate premium rate. A thorough review of the applicant’s financial stability may also be conducted to evaluate their ability to sustain premium payments. The approval process can vary in length, depending on the insurer and the complexity of the application.

Potential Downsides and Limitations

While offering attractive features, 20-year return of premium policies have limitations. The most significant is the higher premium compared to standard term life insurance. This means a larger portion of your budget is allocated to insurance premiums, potentially reducing funds available for other investments. The return of premiums after 20 years is only guaranteed if premiums are consistently paid. If the policy lapses due to non-payment, the return of premium benefit is lost. Furthermore, the overall financial return may be lower compared to other investment strategies if the insured lives past the 20-year period. The investment growth potential is limited compared to other actively managed investments. Finally, the policy’s terms and conditions, including specific clauses regarding premium returns, should be carefully reviewed before signing the contract.

Final Conclusion

In conclusion, 20-year return of premium life insurance presents a compelling proposition for those seeking both life insurance protection and the potential for a full premium refund after two decades. While offering a unique blend of security and financial return, careful consideration of individual circumstances, risk tolerance, and financial goals is crucial. By understanding the nuances of policy features, tax implications, and potential downsides, you can make a well-informed decision that best serves your needs. This guide has aimed to provide a thorough exploration of this insurance option, equipping you with the necessary tools to navigate the complexities and make a choice aligned with your long-term financial well-being.

Essential Questionnaire

What happens if I die before the 20-year period?

Your beneficiaries will receive the death benefit, as Artikeld in your policy. The return of premium feature becomes irrelevant in this scenario.

Are there any health requirements to qualify for a 20-year ROP policy?

Yes, insurers will conduct a medical underwriting process to assess your health and risk profile. This process may involve medical questionnaires, exams, or lab tests.

Can I withdraw the premiums before the 20-year mark?

Generally, no. These policies are designed to provide a return of premiums after the full 20-year term. Early withdrawals are usually not permitted.

How does the tax treatment of the returned premium differ from the death benefit?

The returned premium is typically considered taxable income, while the death benefit is generally tax-free to beneficiaries.

What if my health changes significantly after purchasing the policy?

Most policies do not allow for changes to coverage amounts or premium adjustments based on changes in health. It’s essential to carefully consider your health status when applying.