Securing your family’s future is paramount, and life insurance plays a crucial role. However, navigating the complexities of different policy types can be daunting. This guide delves into the specifics of 20-year return of premium life insurance, a unique product offering a compelling blend of protection and potential financial return. We’ll explore its mechanics, benefits, drawbacks, and suitability, equipping you with the knowledge to make an informed decision.

This policy type offers a distinct advantage: the promise of a full premium refund after 20 years, provided certain conditions are met. This feature significantly alters the traditional life insurance landscape, making it an attractive option for those seeking both comprehensive coverage and a potential long-term financial benefit. We will examine how this differs from other policies and analyze whether it aligns with various financial goals.

Suitability and Target Audience

A 20-year return of premium life insurance policy is a specialized product best suited for specific financial situations and individual profiles. Understanding the ideal candidate and the circumstances where this type of policy offers the most benefit is crucial for effective financial planning. This policy isn’t a one-size-fits-all solution and requires careful consideration of personal circumstances and financial goals.

This type of policy is particularly well-suited for individuals and families who prioritize financial security and have a relatively long-term horizon for their financial planning. The policy’s structure, with its promise of premium return after 20 years, appeals to those who are comfortable with a longer-term investment strategy and are seeking a blend of life insurance coverage and potential return on investment. The relatively high premiums associated with this type of policy mean that it is best suited for those with a comfortable financial situation and a capacity to allocate a significant portion of their disposable income to premiums.

Ideal Policyholders

The ideal individual or family for a 20-year return of premium life insurance policy typically exhibits several key characteristics. They are generally financially stable, with a consistent income stream and a capacity for long-term financial planning. They are also risk-averse, preferring a policy that offers a guaranteed return of premiums after a set period, even if investment returns might be modest compared to some alternative investments. Furthermore, they value the peace of mind that life insurance coverage provides, coupled with the potential for a financial return. For example, a high-income dual-income household with young children might find this policy attractive, balancing the need for life insurance protection with a long-term investment strategy.

Factors to Consider When Determining Suitability

Several factors must be considered to determine the suitability of a 20-year return of premium life insurance policy for an individual or family. These include the individual’s age, health, financial goals, risk tolerance, and existing insurance coverage. The policy’s cost relative to the individual’s overall financial situation needs careful evaluation. For example, a younger individual with a longer life expectancy might find the overall cost-effectiveness less attractive compared to a policy with a lower premium and a longer coverage period. Additionally, individuals with significant existing assets or robust investment portfolios might find alternative investment strategies more appealing than the relatively modest returns offered by this type of policy. A thorough comparison with other financial instruments, such as term life insurance and investment vehicles, is essential.

Suitable Financial Situations

A 20-year return of premium life insurance policy can be a suitable financial tool in various situations. These include:

- Providing long-term life insurance coverage while simultaneously building a modest investment.

- Protecting against unexpected financial burdens, such as funeral expenses and outstanding debts, in the event of death.

- Supplementing retirement savings by receiving a lump sum return of premiums after 20 years.

- Guaranteeing a return of investment for a relatively risk-averse investor.

- Meeting estate planning needs by providing a death benefit to beneficiaries.

Illustrative Examples and Scenarios

Understanding the potential financial outcomes of a 20-year return of premium life insurance policy requires examining various scenarios. These examples illustrate how the policy can perform under different circumstances, highlighting its benefits and potential limitations. We will explore scenarios with varying outcomes to provide a comprehensive understanding.

Scenario 1: A Successful 20-Year Term

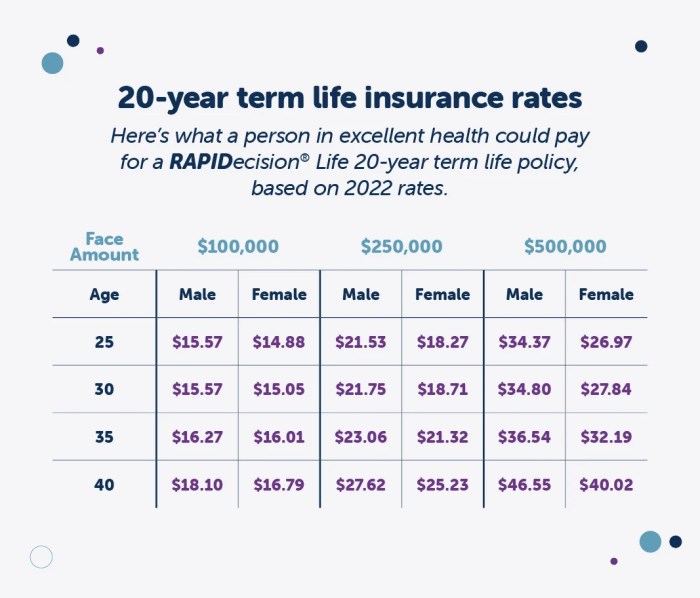

Let’s consider a hypothetical 35-year-old individual purchasing a $500,000 20-year return of premium life insurance policy. Assume an annual premium of $2,500. Over the 20-year term, the total premiums paid would be $50,000. If the insured remains healthy and lives past the 20-year mark, the insurance company will return the full $50,000 in premiums. The insured receives no death benefit during the term but recovers their investment in full. This illustrates a successful, intended outcome of the policy. This scenario showcases the policy’s core benefit: premium return upon policy maturity. The financial outcome is a break-even situation where the individual receives all premiums back without incurring any losses.

Scenario 2: Early Death

Now, let’s consider a different scenario. Suppose the same 35-year-old individual passes away within the 20-year term, say at age 40. In this case, the beneficiary would receive the full $500,000 death benefit, regardless of the premiums paid. While the premiums are not returned, the death benefit significantly outweighs the total premiums paid, providing crucial financial support to the family during a difficult time. This illustrates the policy’s primary function as a life insurance product, offering significant financial protection in the event of untimely death. The financial outcome demonstrates the primary value proposition of life insurance.

Scenario 3: A Family’s Financial Planning

Consider a family with two young children and a mortgage. Both parents, aged 30 and 32, work and are concerned about their family’s financial security. A 20-year return of premium policy could provide a solution. If one parent were to pass away, the death benefit would help cover outstanding mortgage payments, childcare expenses, and other financial obligations, allowing the surviving parent to maintain financial stability. If both parents live beyond the 20-year term, they receive a substantial return of their premiums, which could be used for their children’s education or retirement. This illustrates how the policy can address multiple financial needs simultaneously, offering both protection and potential long-term financial benefits. The policy acts as both insurance and a long-term savings plan, providing flexibility in meeting various financial goals.

Comparison with Alternative Insurance Products

Choosing the right life insurance policy depends heavily on individual needs and financial circumstances. A 20-year return of premium (ROP) policy offers a unique blend of life insurance coverage and a guaranteed return of premiums, but it’s crucial to compare it against other common options to fully understand its value proposition. This section compares ROP policies with term life insurance and whole life insurance, highlighting key differences in benefits, drawbacks, and long-term costs.

ROP vs. Term Life Insurance

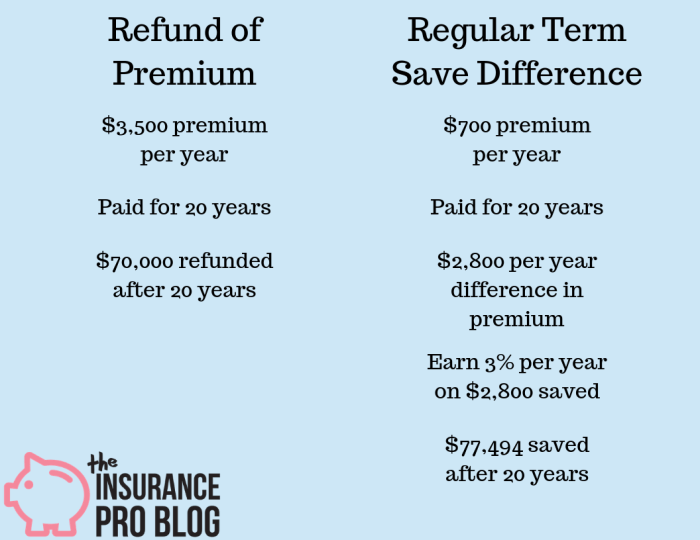

Term life insurance provides coverage for a specific period (the term), typically ranging from 10 to 30 years. It’s generally less expensive than permanent life insurance options like ROP or whole life, making it attractive for those seeking affordable coverage for a defined period, such as paying off a mortgage or providing for children’s education. However, the coverage expires at the end of the term, and premiums often increase significantly or become unavailable upon renewal. In contrast, a 20-year ROP policy offers coverage for 20 years, with the added benefit of premium return upon policy expiration if the insured survives. This offers a financial safety net, but the premiums are usually higher than for a comparable term life policy. The key difference lies in the guaranteed return of premiums in the ROP policy, providing a financial security net not present in a term policy.

ROP vs. Whole Life Insurance

Whole life insurance provides lifelong coverage, accumulating cash value that grows tax-deferred over time. This cash value can be borrowed against or withdrawn, offering flexibility for financial planning. However, whole life insurance premiums are typically much higher than those for term or ROP policies, and the rate of cash value growth may be modest. A 20-year ROP policy offers a defined period of coverage with a premium return, eliminating the lifelong premium payments of whole life. While whole life offers lifelong coverage and cash value accumulation, the ROP policy prioritizes a guaranteed return of premiums within a specific timeframe. The choice depends on whether lifelong coverage or premium return is prioritized.

Hypothetical Cost Comparison

Let’s consider a hypothetical 40-year-old male seeking $500,000 in coverage. A 20-year term life policy might cost $500 annually, totaling $10,000 over 20 years. A 20-year ROP policy with the same coverage might cost $1,500 annually, totaling $30,000 over 20 years. However, the ROP policy would return the $30,000 at the end of the 20-year term, assuming the insured survives. A whole life policy with similar coverage might cost $2,500 annually, resulting in significantly higher lifetime costs. This illustrates that while ROP policies have higher initial premiums than term policies, the return of premiums mitigates the overall cost if the insured survives the policy term. The whole life policy, offering lifelong coverage and cash value accumulation, incurs substantially higher lifetime costs. This simplified example demonstrates that the best option depends on individual priorities – affordability, coverage duration, and the desire for a guaranteed premium return.

Potential Risks and Limitations

While 20-year return of premium life insurance offers attractive features, it’s crucial to understand its inherent limitations and potential risks. This policy, like any financial product, isn’t a guaranteed win, and several factors can influence the ultimate return on investment. A thorough understanding of these factors is essential before committing to such a policy.

Understanding the policy’s terms and conditions is paramount. The return of premium feature is contingent upon specific conditions being met, and failure to meet these conditions could result in a reduced or even zero return. Furthermore, the overall financial performance of the insurance company plays a significant role in the policy’s success.

Limitations on Payout Conditions

The return of premium is not unconditionally guaranteed. The policy typically Artikels specific circumstances under which the premium will be returned. These may include the policyholder’s continued good health, consistent premium payments throughout the policy term, and the absence of specific claims made on the policy. If any of these conditions are not met, the return of premium may be reduced or eliminated entirely. For example, if a policyholder makes a significant claim during the policy term that exhausts the policy’s death benefit, the return of premium might be impacted or forfeited.

Scenarios Where Return Might Not Fully Offset Premiums

Several factors can influence whether the total premiums paid are fully offset by the return of premium. The policy’s underlying investment performance plays a significant role. If the insurance company’s investment portfolio underperforms, the return of premium might be lower than expected. Additionally, high fees and charges associated with the policy can also reduce the net return. For instance, a policy with high annual fees, surrender charges, or other administrative costs might mean that the return of premium, even if fully paid out, might not fully cover the total amount invested over 20 years. This situation is more likely if the policyholder dies before the policy’s maturity date, rendering the return of premium feature irrelevant.

Importance of Policy Fine Print and Limitations

Before purchasing any 20-year return of premium life insurance policy, it is vital to carefully review the policy document in its entirety. Pay close attention to the fine print, which often contains crucial information regarding limitations on payouts, fees, and other conditions. Understanding these limitations is crucial for making an informed decision. Seeking professional financial advice from an independent advisor can also prove invaluable in assessing the suitability of the policy and understanding its potential risks and limitations in the context of your individual financial circumstances. Don’t hesitate to ask questions until you fully comprehend all aspects of the policy. A clear understanding of the policy’s terms and conditions will help ensure that your expectations align with the policy’s actual performance.

Last Point

Ultimately, the decision of whether a 20-year return of premium life insurance policy is right for you hinges on a careful assessment of your individual circumstances, financial objectives, and risk tolerance. While the prospect of receiving your premiums back after two decades is appealing, it’s crucial to weigh this against the potential cost compared to alternative options and understand the conditions that govern premium returns. By carefully considering the factors Artikeld in this guide, you can confidently determine if this policy aligns with your long-term financial strategy.

Common Queries

What happens if I die before the 20-year period?

Your beneficiaries will receive the death benefit, as Artikeld in your policy, regardless of whether the 20-year period has elapsed. The return of premium feature is secondary to the primary death benefit.

Are there any health restrictions that could affect my eligibility?

Yes, as with all life insurance policies, underwriting is involved. Pre-existing health conditions may impact your eligibility or result in higher premiums.

Can I withdraw from the policy before the 20-year mark?

Typically, withdrawing before the 20-year mark will result in a loss of the return of premium benefit and may incur surrender charges. Consult your policy for specific details.

How does the tax treatment of the returned premiums work?

The tax implications vary by jurisdiction. In many cases, the returned premiums are considered taxable income in the year they are received. Consult a tax professional for specific guidance.